Back in my stock-picking days, many of us eventually pivoted to finding companies that have more economic moats, in the hopes of holding on to stocks that can grow their earnings over time, but are not too expensive.

A fund manager who eventually got on our radar was Terry Smith of Fundsmith.

Terry Smith talked a good game by our standards. What he says validates a few things we wonder if it is really true initially and the nuance around some of his sharing opens our eyes to the importance or perhaps, the degree of unimportance of starting valuation in the eventual performance of quality businesses.

I am careful about outcome bias but the good results of Terry Smith do play a role in us paying some attention to what he has to say. But to us, Fundsmith has always been a unit trust that is great but not an investment vehicle we have access to.

Until recent years when more people were asking about what I think about the fund. Turns out, more and more retail investors can get access to Fundsmith through various investment-linked policy structures.

In my mind, there was no dispute whether the fund performed well or not. I know its performance is good by layman’s standards. In an ILP structure, the returns may be affected. There is not too much dispute there. If you are an accredited investor (AI), you should get it through a platform such as FSMOne.

But if we know how Fundsmith invest, how would the fund measure up against Smart Beta equivalents?

I went down this rabbit hole a while ago and in this article, I shared the results of the fund performance through my factor investing lenses.

This post is more about me putting out the work for a dear friend of mine who is invested in one of these ILPs with Fundsmith.

Long story short, you may be able to achieve equivalent performance, through other funds that are less costly. But we also have to give credit to Fundsmith for their credit implementation as well.

Fundsmith Communicate Clearly About their Investment Strategy

What separates Fundsmith from other mutual funds is their communication of how they invest.

For example, Fundsmith created an Owner’s Manual, which explains what they are trying to do and their approach.

I think clear communication is important because:

- It gives people like myself, yourself or someone you ask a basis to evaluate what they are trying to do, their strategies, so that you know if they are living up to the standards they set for themselves, and your own standards.

- It shows that at least they have a strategy and not flipping about!

There is a problem with the actively-managed unit trust in Singapore in general.

I get this often from readers, chat-group members or advisers. This XXXX fund, is it good or not.

Firstly, you just scour the internet and you won’t find anything regarding what the fund is trying to do. If that is the case how do I tell you, other than the results whether the fund is good or not good? I can only judge through my lenses.

Unit trusts have a bad reputation in the past (perhaps still is) that you can publish something on a factsheet but we have no idea how frequent the manager trades the position.

For Fundsmith, they stick their neck out and says this is their investment philosophy:

- We aim to buy and hold

- We aim to invest in high-quality businesses. Not high short-term return but sustainably high rate of return.

- We seek to invest in businesses whose assets are intangible and difficult to replicate

- We never engage in “Greater fool theory”

- We avoid companies that need leverage

- The businesses we seek must have growth potential

- We seek to invest in resilient businesses

- We only invest when we believe the valuation is attractive

- We do not attempt market timing

- We are not fixated on benchmarks

- We are global investors

- We don’t over diversify

- Currency hedging, or the lack of it

If there is a position that you feel that does not meet this investment philosophy, you can question them on it.

It also allows us to decide how to compare the performance.

How I Evaluate Funds Performance

Aside from the qualitative and implementation details, such as how cheap or expensive the fund is, here is how I compare funds.

Typically, a human manager, or a team of human managers, have an investment strategy. They are either a value, momentum, quality or low volatility manager. They target a certain region be it US, Global, Asia or emerging market. They either like to be concentrated or diversified.

The question is whether they tell you.

If I can find information out there, or am able to talk to them, then I can figure out what to compare them against.

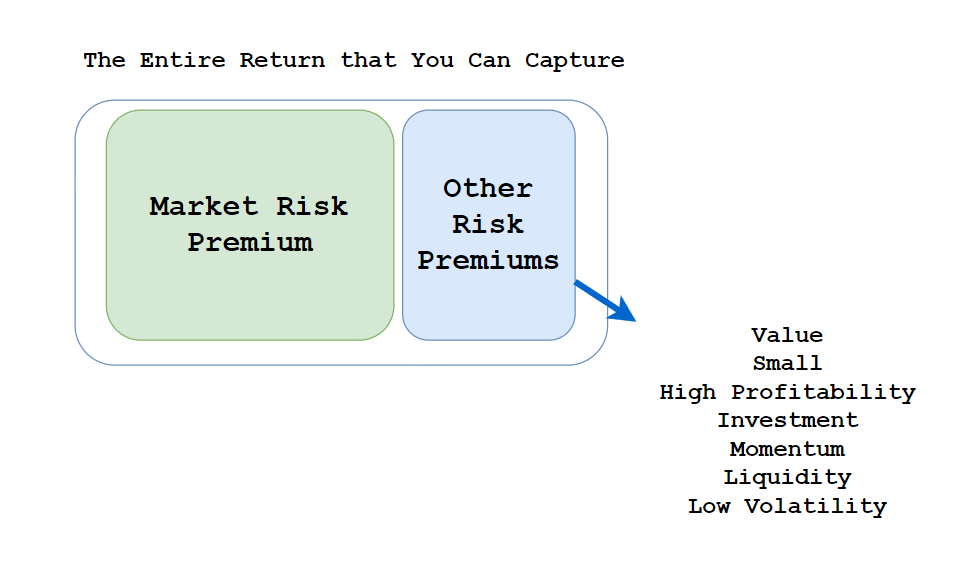

Professor Eugene Fama and Kenneth French told the world that aside from capturing the risks that is above risk-free rate, there are other risk factors such as smaller companies over larger companies, cheaper companies over more expensive companies that explains asset returns. Since their initial work, a few other risk factors were discovered such as high profitability, momentum etc.

These factors are areas of risk that are independent enough, and have enough empirical evidence that show you can be compensated for taking the risks with additional returns, if you invest for the long run.

Why is this important?

Most active managers want to earn a return over the market risk premium, and attempt to expose themselves to these risks so that their returns look better than the index (market risk premium only).

So if we know what the manager is trying to do, be it targeting momentum, low volatility, we can form a better basis to see if they are doing similar things and their returns.

If there is no information out there, I will either measure them against a regional index, or look at the allocation and craft a composite index to measure them against (see my Allianz Income and Growth analysis)

If there is nothing out there… there is nothing to analyse really.

Are People Comparing Performance in the Right Currency?

This is a question I have in mind.

The coffee talk is always this fund is doing much better than this other fund that I own, but my experience is that many might not be comparing in a like-for-like fashion.

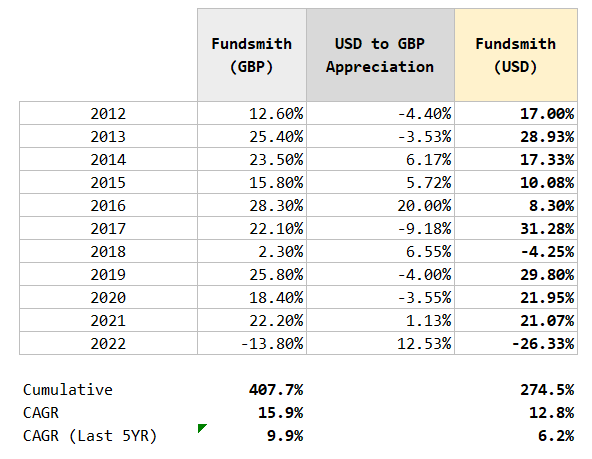

The longest-running fund performance usually is quoted in GBP, which is generally not the de facto standard in the Singapore context.

So let us convert the fund performance to USD:

This is probably not going to be similar to how the fund will do it, but it does give us a good enough idea.

After the conversion, we realize the CAGR is more muted.

If we want to compare against other funds or index, it would be more sensible to compare performance in the same currency.

Quality as a Factor has Performed Well

Terry Smith has given his investors and prospective investors a very clear idea about their investment strategy. Invest in quality companies that are not too expensive and hold for the long term.

This allowed us to figure out which factors they were trying to target and that would be a mixture of quality and value. Since we know what are the factors, it allows us to take a look at how Fundsmith measure up against a comparable index that systematically targets the quality factor,

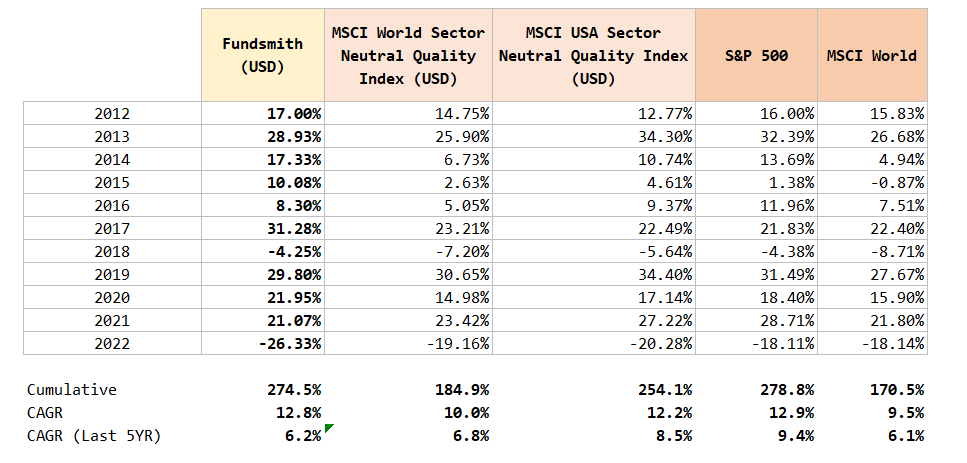

MSCI has a series of index-based around the quality factor and since Fundsmith’s holdings are so US dominant, we can take a look at how the fund has performed over the time it was incepted.

The MSCI USA Sector Neutral Quality Index systematically captures the top stocks that matches certain fundamental quality scores such as high return on equity, low leverage and low earnings variability. The World Sector Neutral Quality Index does the same thing but on a global basis. Terry Smith’s fundamental metrics used is likely to be more than this and that would result in differences in the companies the MSCI quality index own compared to Fundsmiths.

This Quality index is more systematic (read robotic), than a group of human beings behind.

But how far apart are the performances?

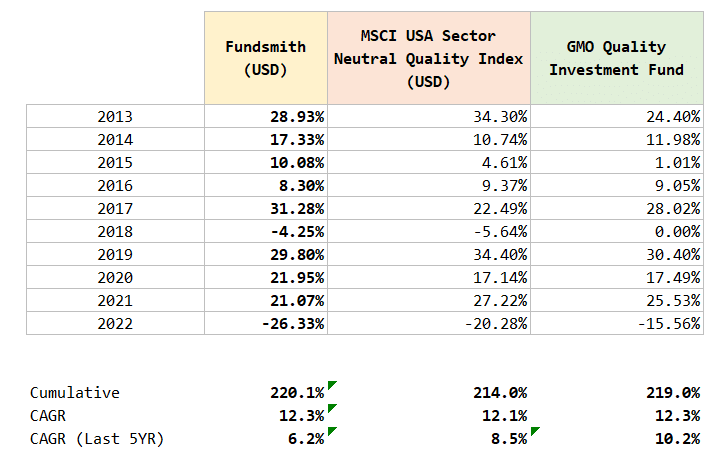

The S&P 500 have done better than Fundsmith in the past 11 years. It has also done better than Fundsmith in the past 5 years. Fundsmith have done better than the MSCI World in the past 11 years but in the past 5 years, the performance is pretty similar.

If you run a concentrated fund with a high active share, your annual performance will look different from the index and true enough, there are years where the performance is quite unlike the indexes (see 2014, 2017, 2020 as an example). Fundsmith typically holds less than 30 stocks while the Sector Neutral Quality Index holds 125 stocks.

Fundsmith’s performance is not too far off the MSCI USA Sector Neutral Quality Index but has done much better than the MSCI World Sector Neutral Quality Index. The MSCI USA and World Sector Neutral Quality Index has done better in the past 5 years but in my opinion five years is a short time to judge performance.

Perhaps the reason for recent poorer performance is due their decision to weigh more to non-US developed market stocks.

The big takeaway is that we can systematically determine the risks a fund manager is targeting, in this case USA region, and quality, and then see if the manager is adding value.

If the performance is not too dissimilar from a robotic index by MSCI, should we pay a higher fee for it?

A good question to think about.

Could You Invest in The MSCI USA and World Quality Index?

You can invest in the performance through Smart Beta ETF funds. I wrote about factor funds and smart beta funds more in this article.

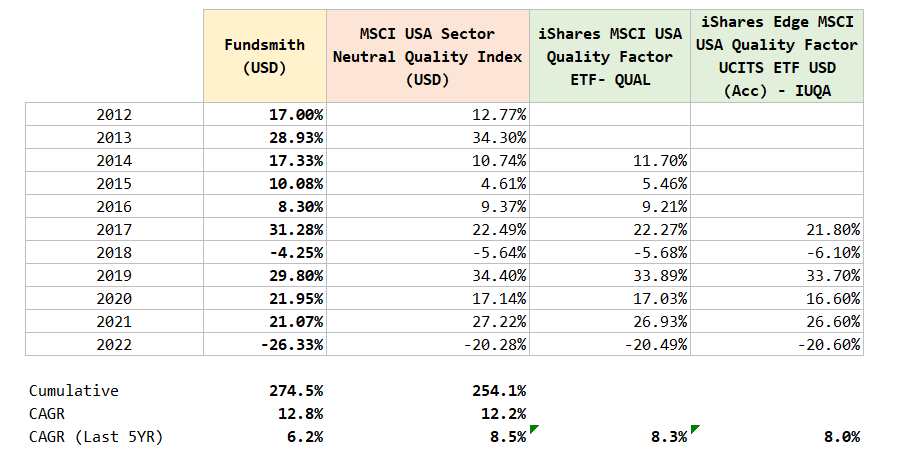

There are two ETFs that you can consider that tries to mirror the performance of the MSCI USA Sector Neutral Quality Index (USD)

- iShares MSCI USA Quality Factor ETF (Ticker: QUAL)

- iShares MSCI Edge MSCI USA Quality Factor UCITS ETF USD (Accumulating) (Ticker: IUQA)

The first one is a US-incorporated ETF and the second is an Irish-domiciled ETF, which should be more withholding and estate tax efficient for Singaporeans.

You can invest in them through a low-cost broker such as Interactive Brokers.

Here is the year by year performances of the actual ETF against the index, and Fundsmith USD performance:

This means that if you like to invest in USA quality companies, you do not have to invest through an ILP structure.

FYI: There are quality factor ETFs targeting the MSCI World instead of USA only as well. Look for the ticker IWQU or MSCI World Quality Factor UCITS ETF.

Fundsmith vs. GMO Quality Investment Fund

I have another friend who told me about this great actively-managed fund.

This fund is called the Phillip Global Quality Fund. It is from Phillip securities and they fed into the GMO Quality Investment Fund.

GMO, is made famous by their very charismatic and value-focus chief investment officer Jeremy Grantham . Phillip is smart to identify a good fund and feed into it and not take the risk of finding managers that perform well and also the risk if they found a good manager but decide to leave them.

The total fxxking expense ratio is 2.4% for the unhedged and 2.45% for the hedged.

For context, the Quality Investment Fund lists a management fee of only 0.48%.

Phillips is really milking this one.

We can compare the performance of Fundsmith against the performance of the GMO Quality Investment Fund (not through the Phillps Global Quality fund wrapper)

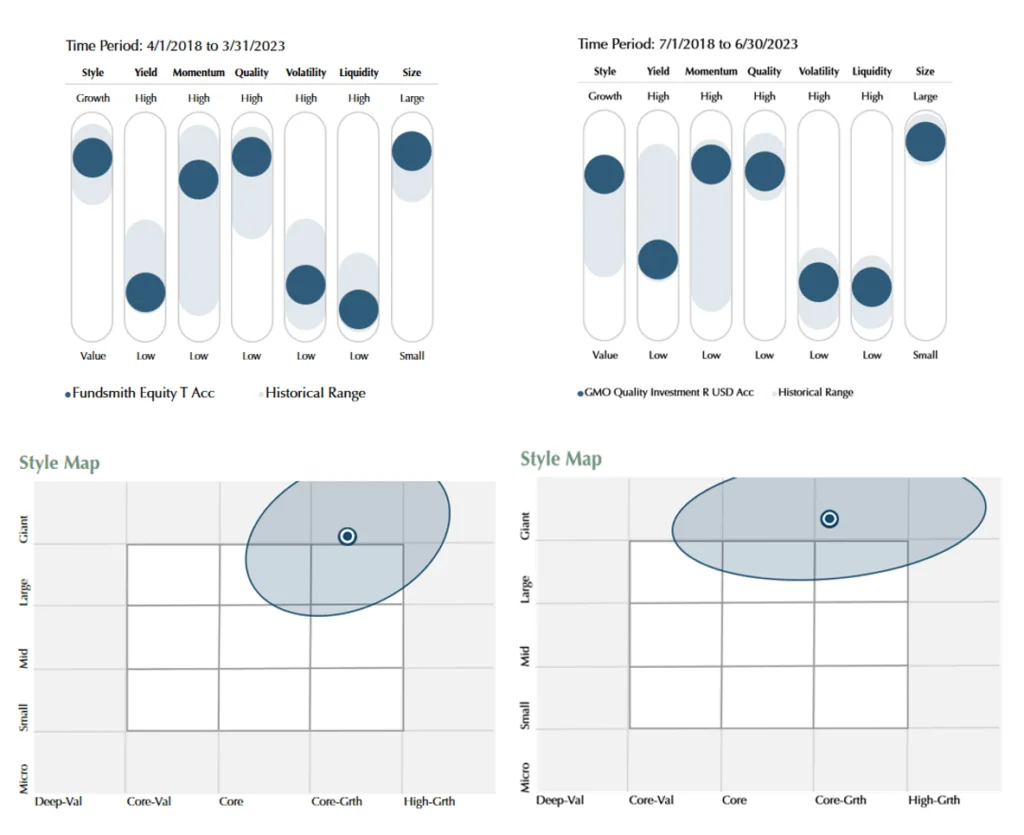

The above diagram is taken from Morningstar’s factor profiling of Fundsmith (left) and GMO Quality Investment (right). If we know what is the stocks that make up each fund, we can profile the characteristics of each stock, then aggregate them to provide the factor profile of the funds.

What you will realize is that the two funds are pretty similar. Large stocks, that are more growth, low dividend + buyback yield, high momentum and quality, and low volatility and liquidity.

Two different active managers, with systematic investment approaches, having a DIFFERENT sets of stocks, but reaching the same portfolio profile.

Here are the returns:

There are some interesting things you may realize: Managers can do well but only to a certain extent.

To have different returns, you have to hold different things.

For example, in 2018, most equity funds heavy on USA stocks didn’t do well, so the Quality index, Fundsmith and GMO Quality Investment fund didn’t do well.

In 2021, most funds do well but Fundsmith did not do as well, relative to the other two. In 2022, GMO Quality investment fund did better.

Some investors think managers have some superpower that helps their clients avoid losses. They don’t have superpowers. There are limitations to what the managers can do.

On a ten year basis, all three had the same performance but GMO Quality have done much better than the index and Fundsmith itself.

That would mean that GMO Quality did not do as well in the first five years.

This is a good time to highlight that… even in a year, or two years, you might not be able to capture the quality premium, or know if the manager is worth it.

Dimensional’s High Profitability Factor Index against Fundsmith

Dimensional added profitability to their multi-factor portfolios in the 2010s. The work of Professor Robert Novy-Marx on gross profitability had a big influence on the decision. Professor Novy-Marx discovered that more profitable firms generate significantly higher average returns than unprofitable firms, despite them being more expensive relatively.

The quality of a business to drive better profitability is essentially what Warren Buffett prioritised in his later years managing Berkshire Hathaway. Professor Novy-Marx also explains that profitability has a high relationship to value and is also complementary.

Thus, in their multi-factor funds (those available under Endowus or Providend), there is the elimination of small, low-profitability firms and also consider firms with higher operating income before depreciation and amortization minus interest expense.

Profitability is very related to Quality, but not essentially the same because different companies assess quality differently. Dimensional is very specific.

I always wonder how a systematic strategy that targets a company with high profitability will do against quality managers like Fundsmith.

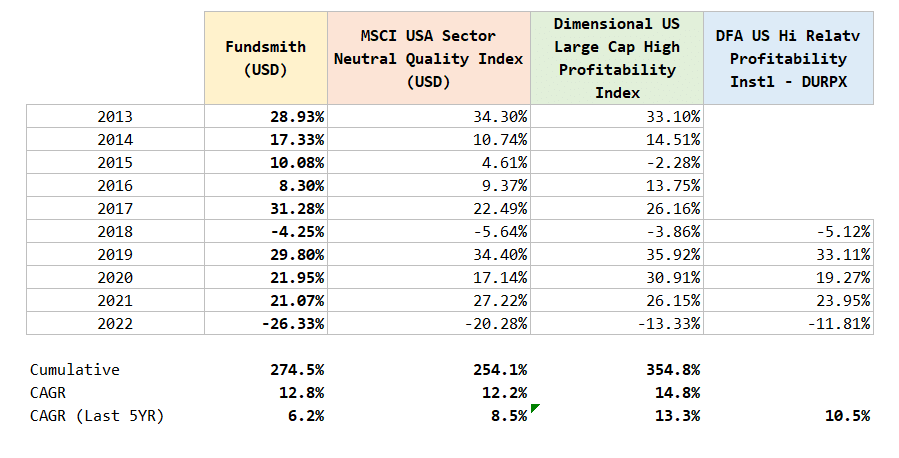

Fortunately, Dimensional crafted a US high profitability index, so we can profile its performance against Fundsmith. Dimensional US Large Cap High Profitability Index consist of large-cap US companies whose profitability is in the top 35% of all large-cap companies.

The chart above shows the performance of Fundsmith against the MSCI Quality index, and also against the Dimensional US Large Cap High Profitability Index and also an actual Dimensional US mutual fund (unit trust) that invests in high relative profitability.

The performance of the US high profitability index have been great, but as a research index, it’s performance does differ from the high relative profitability institutional unit trust. Research index, such as the Large Cap High Profitability Index, tries to go back in history and simulate what are the stocks the index will buy and sell as if we live through the actual period. The results of the actual fund will differ from the research index. Dimensional is not an index-based strategy. They are systematic in their process (the same can be said of GMO or Fundsmith as well).

Still, the actual DFA funds do deliver returns that are also better than the USA Sector Neutral Quality Index.

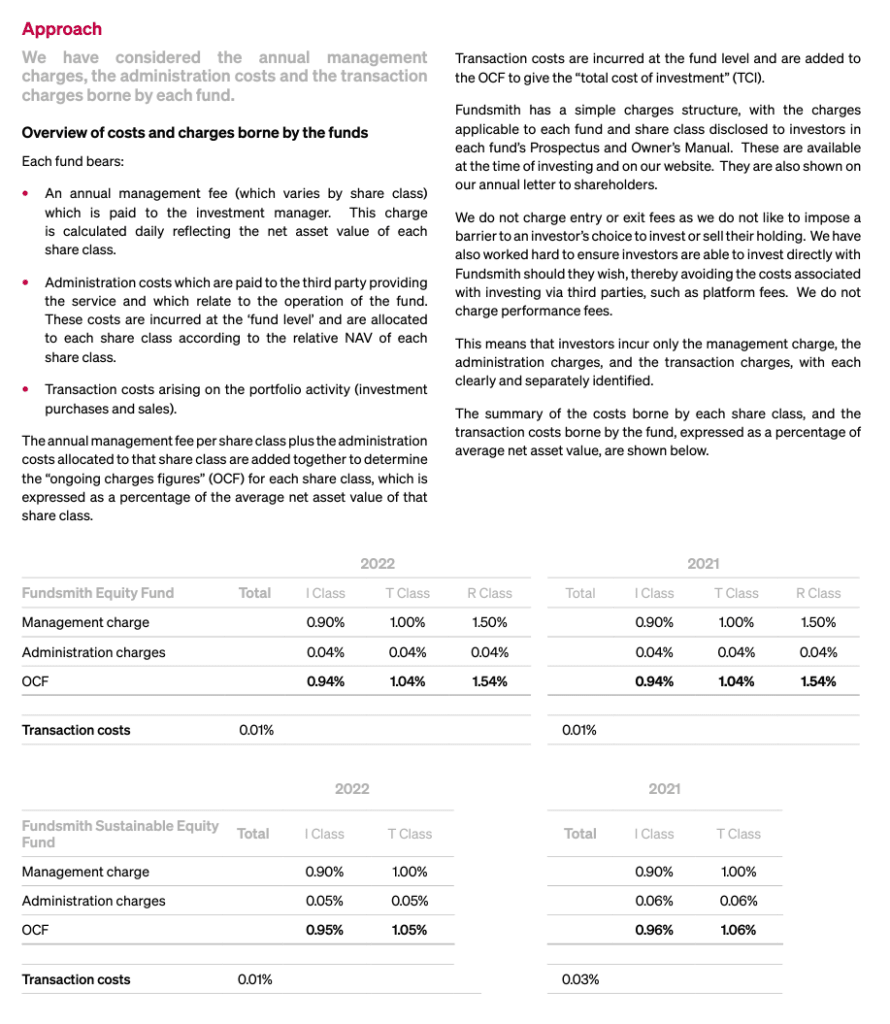

Fundsmith’s Transparency Over Their Costs

Some investors may be concerned about the cost of an actively managed fund like Fundsmith. I already made a small comment about the high wrapper cost around the GMO Quality Investment Fund if you purchase it through the Phillip Global Quality Fund.

Whether the expense ratio is on top or includes the management fee of GMO Quality Investment Fund, it looks too high.

Local investors of Fundsmith usually buy it through an Investment-linked policy structure (ILP). If you are an Accredited Investor (AI) you can get access to Fundsmith at the fund class charges.

If you get it through an ILP structure, there is a set of fees and bonus units that would be too confusing for me to explain. I am not super against an ILP structure. I don’t think it is helpful for you but I do think a lot of people misunderstood it because they don’t know how to compare the structure against equivalent advisory structures (I do think the ILP is a fee structure to remunerate the advisers and you should see if your adviser adds enough recurring value for you to pay that fee). You can read Don’t Buy Investment-Linked Policies (ILP) for the Right Reasons for my thoughts.

I am going to leave ILP costs aside because it is not helpful to review them with it. There are readers who can buy Fundsmith through AI means wondering if the fund is a good investment.

And Fundsmith is very transparent with their fee disclosure.

In their assessment of value, they went to lengths to talk about their costs.

Fundsmith Assessment of Value 2022 >>

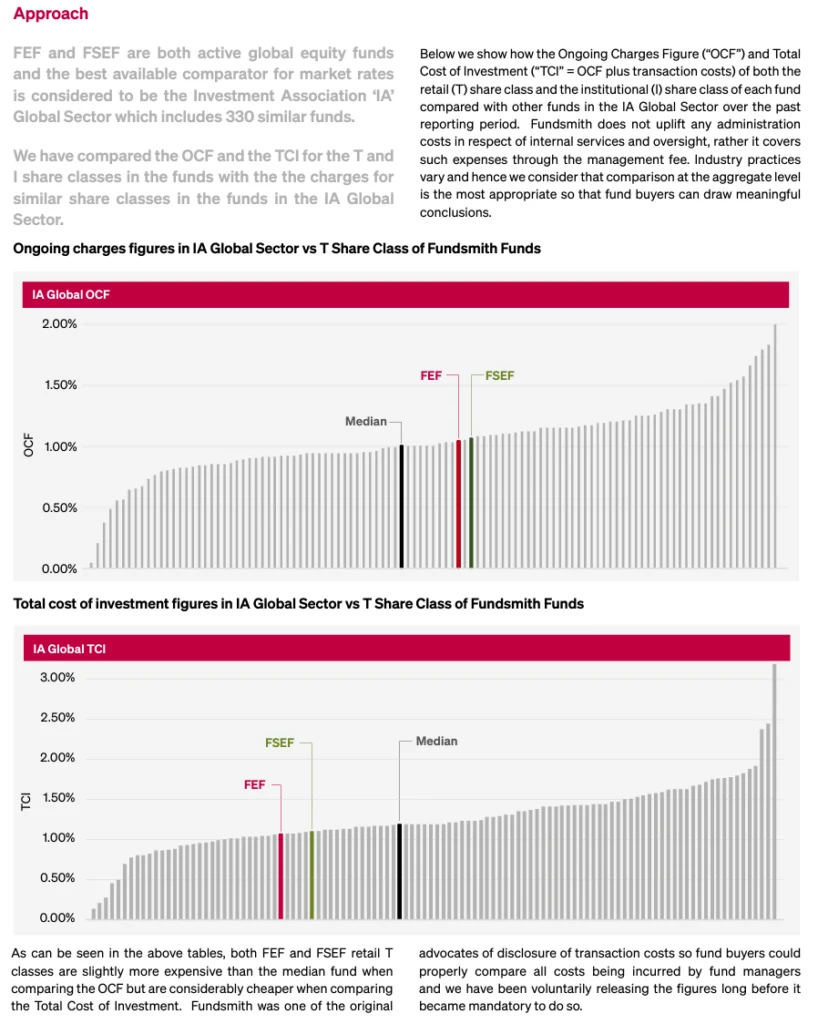

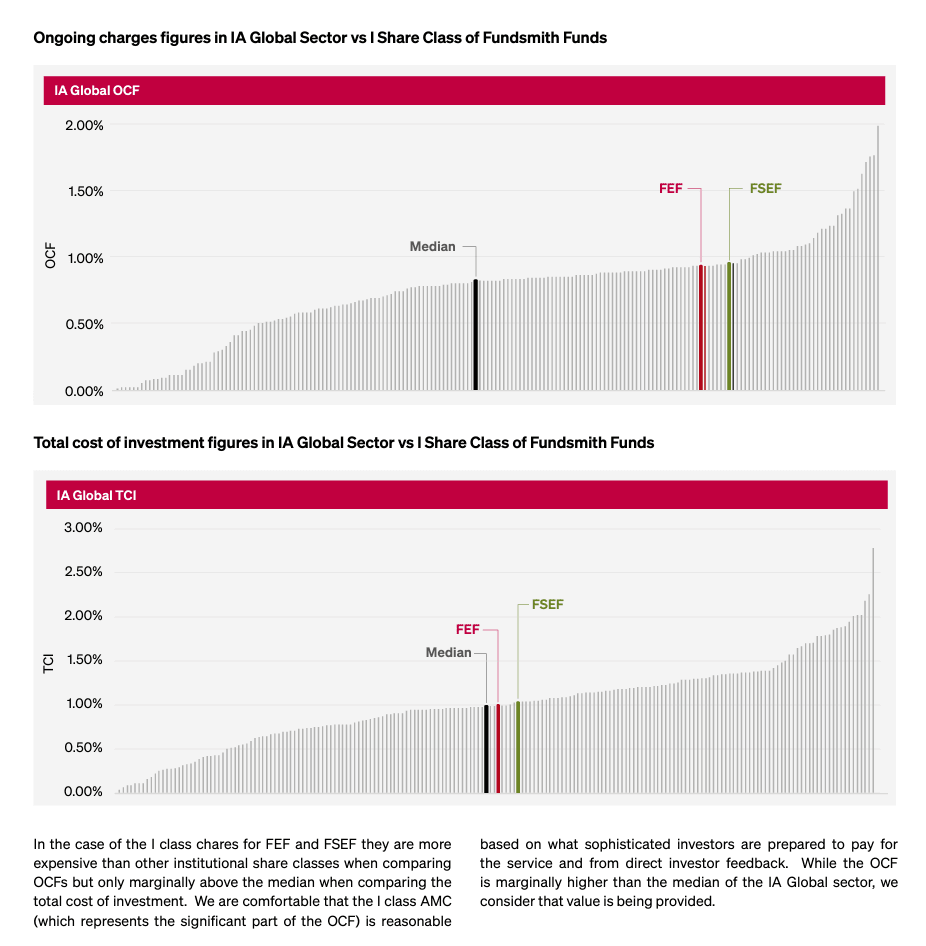

The above page gives a breakdown of different fund class costs.

Local ILPs listed the R class as the fund they will use so the ongoing cost figures come up to 1.54%.

Fundsmiths show the comparison of the total ongoing cost and the cost if we include transactional costs against comparable funds. Do note that this is comparing the T Share class but not the R share class. They want to point out that transactional costs can be a big part of the cost and if we include that, more funds will look more costly.

Fundsmith were able to achieve their return despite costs but I do think cost is more glaring over the long run.

You do have to ask if it is worthwhile to pay for the fee if the performance can be attributed to certain quality metrics to which you have cheaper ETF alternatives.

Conclusion

Since 2012, Fundsmith have shown that they have a coherent investment strategy around curating companies with good moats, and growth drivers and investing in them with a buy-and-hold strategy. They have implemented well, resulting in a performance better than the MSCI World.

However, if we put on our factor lenses, then the result is less surprising. There are smart beta etf alternatives that may be able to achieve similar results if you have a similar quality or high profitability investment philosophy.

Despite that, Fundsmith has shown a willingness to not care about hugging the index, to be concentrated and tilt towards certain regions. If we measure them against the MSCI World Quality Index, they have objectively done well in the early years (but not the latter years). A longer time will let us know if the managers at Fundsmith will do better than a smart beta index.

Fundsmith sits in the unique position of a fund that performs up to expectations, with the right ethos and clear communication. I have fewer problems with the fund than many other funds.

Other Areas of Transparency

There are a few documents from Fundsmith’s document repository that I thought is a good read, whether you are a prospective investor of the fund or a stock picker.

One of them is the Fund Stewardship Report.

- Their purpose, culture and values

- Investment beliefs and strategies

- Fundsmith ownership structure and governance

- Incentives of the people in Fundsmith

- Their thoughts on Systematic and potential market-wide risks

- Their communication with the companies they invest in, in order to maintain or enhance the value of assets

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.