There is this unit trust that people have been mentioning to us, or myself for the longest time: Allianz Income and Growth Fund.

I don’t know what is the fascination over this fund.

Those people investing in funds talked about it. Prospects and clients talked about it.

Even lead generation companies who help advisory firms generate leads use it to be part of it’s “8% P.A. Retirement Plan”!

On the first cut, here is the appeal:

- It pays out monthly dividend income, which appeals to people looking for income such as retirees a lot.

- The dividend income based on the unit price is above 8%.

- It is a five-star Morningstar Rated fund since April 2020.

- Their friends or you-know-who says it is good.

I took a quick look at the fund, then I was puzzled. I seen my fair share of high-yield bond-based income unit trust and this one looked just as risky.

Do people really know what they are getting themselves into?

So here is how I look at the fund from my perspective.

What is the Allianz Income and Growth Fund?

The fund is a Luxembourg-domiciled unit trust that seeks long term capital growth and income by investing in corporate debt securities, equities of US/Canada and bonds.

This fund was formally managed by an Allianz manager but recently Allianz Global Investors and asset management firm Voya Investment Management entered into a long-term strategic partnership and the investment team was transferred to Voya Investment Management.

There are some constraints set on the fund:

- I think in general, the fund cannot invest more than 70% in either equities, convertible bonds or high-yield bonds at any one time.

- Cannot invest more than 30% of fund in emerging markets.

- Cannot invest more than 20% in ABS or MBS.

- Cannot invest more than 25% in deposits in money market instruments and cannot be more than 10% in money market funds.

- Cannot be more than 20% in non-USD Currency Exposure.

The Income and Growth fund is an actively-managed fund.

The main market is in United States Securities.

Since the fund is domiciled in Luxembourg, it will follow the inheritance and withholding tax laws of the country. You will need to assess where you are a tax-resident of, and whether you are liable to these taxes.

What Will Drive the Fund’s Returns?

I have this philosophy built up after looking at funds over the years:

There are not a lot of good managers. Managers of funds also have investment constraints that will prevent them from doing dramatically different things with their funds, such as holding 30-40% cash when they feel “the time is right”. Even if the manager is good, don’t expect him or her to do miracles like getting a good return when the underlying regions, sectors, and style factor they are targeting is not doing well.

What does this mean?

If you invest over a long time, the returns you get are going to revolve either better or worse than their underlying tilts towards specific asset class, regions, sectors, and style factors.

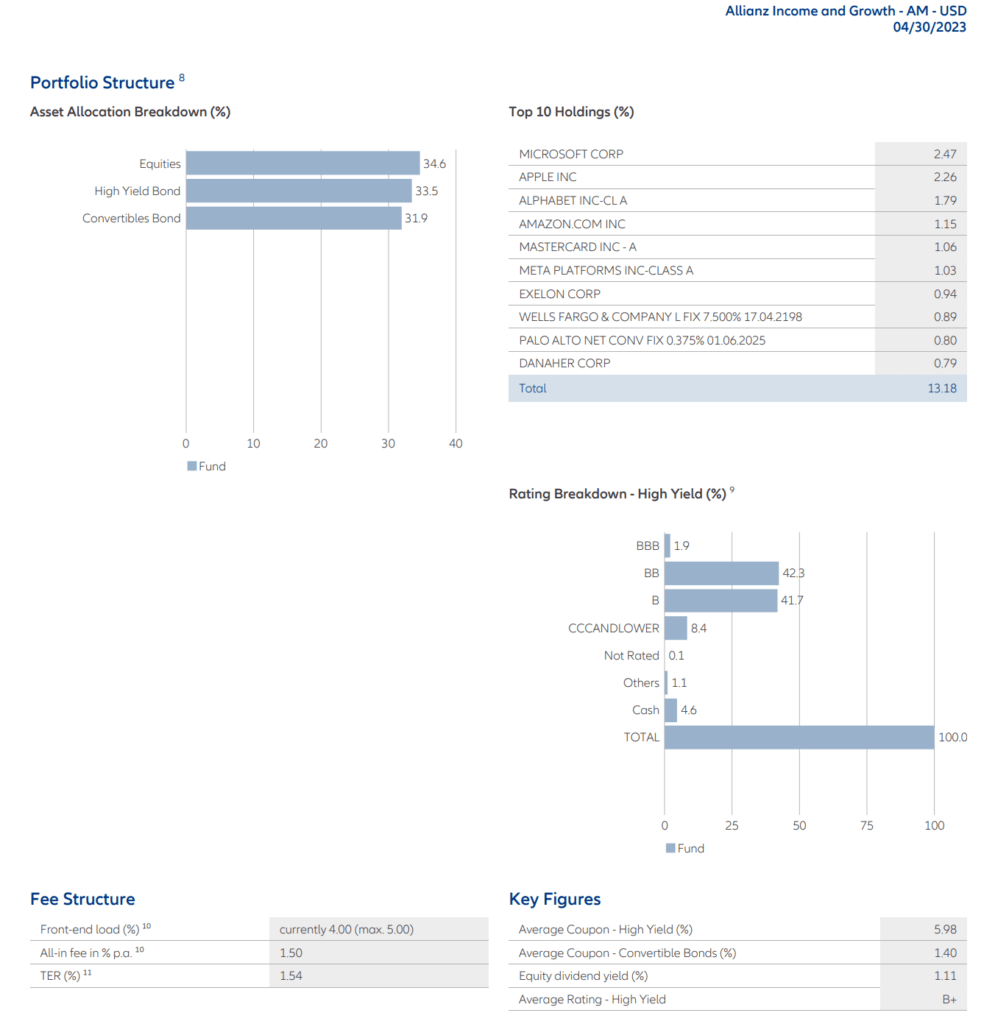

I took a look at Allianz Income & Growth factsheet:

The fund has almost equal weighting to :

- US Equities

- US High Yield Bonds

- US Convertibles Bond

Holy shit.

I wonder if the people invest in the fund understand what they are investing in. Like any unit trust, you can get it at Fundsupermart, DollarDex, Poems, Endowus, through some Investment-linked policies.

Depending on the platform, you may have to pay a sales charge but there are no performance and exit fees (but do note that in Investment-linked policy structure, you would incur surrender charges if you exit early).

The total expense ratio of the fund is close to 1.50%.

The Whole Fund Is Levered Towards Equities

Investors looking to retire prefer not to take too many risks for their retirement money.

This means they prefer fixed income-based solutions then equities.

But they still need income.

Traditional bonds didn’t give a lot of income not too long ago!

So they look towards income funds or look for promising bonds that can give them more income.

Or income products such as Allianz Income & Growth.

If you look at what makes up the fund, all three components are levered towards equities.

What does that mean?

Convertible bonds and high-yield bonds do well when equities do well and do not do so well when equities don’t do so well.

While they have the word “bonds” in their name, both are closer to being equities than bonds.

Convertible bonds have very low coupons. But if the issuer’s share price increases, the bondholder can convert the bonds to equity stakes at a specific strike price. This means that if the equity price move towards the strike price, the value of the convertible bond also rises.

Convertible bonds are issued instead of rights or placement to prevent dilution. It can also be looked as cheap debt, which remains as cheap debt if the business transformation or initiative does not work out. The existing equity holders won’t be diluted when the convertible bonds are converted because the share price would have risen a fair bit at a well-priced strike price.

Thus, convertible bonds do well when equities do well. The downside of convertible bonds is greyer. I think they are not issue by distressed companies because if your company is distressed, bond holders would demand a higher yield, which means not many will eat your convertible bonds.

High-yield bonds are also sometimes known as junk bonds. The yield is high because the issuer are risky business. The bonds carry a higher risk of default. The yield of the bonds typically get compressed when markets do well, which means the bond prices go up. The opposite is true as well.

Equities typically don’t do so well during recession and during recession the issuer of high yield bonds are the most at risk.

Convertible and high yield bonds are not the safe bonds that investors have in mind.

I do think that novice investors placed a lot of hope that these bonds exhibit Treasury-like characteristics during times of distress.

They can be in for a shock.

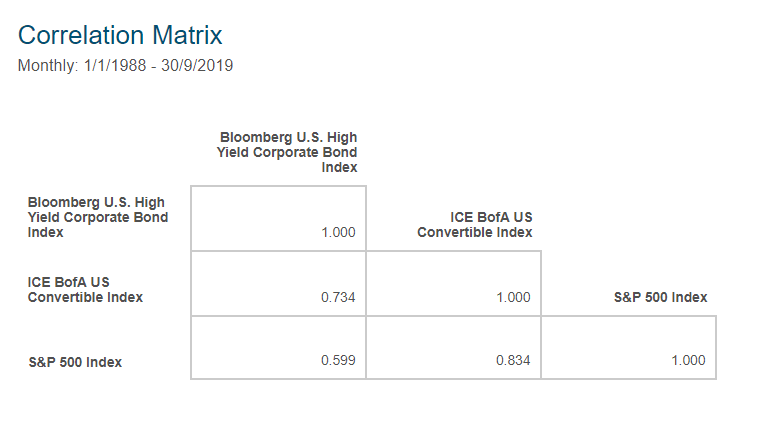

Here is the correlation of the three different groups of securities:

- Bloomberg US High Yield Corporate Bond Index represents US high-yield bonds

- ICE BofA US Convertible Index represents US convertible bonds

- S&P 500 index represents US equities

The correlation of Convertible bonds to High yield bonds and equities is 0.73 and 0.83, respectively. A correlation closer to 1 means the two groups are significantly correlated from the index data from 1988 to 2019 (32 years).

The correlation of High yield bonds to Convertible bonds and equities is 0.73 and 0.60, respectively.

The correlation of US Equities to High yield bonds and convertible bonds is 0.60 and 0.83, respectively.

The correlation of the three is high with high yield bonds having the least correlation to equities.

I wonder if a retiree or an investor looking for income is happy with a 100% equity portfolio generating income for him or her.

My experience tells me most will HAVE RESERVATIONS if 100% or 80% of their income sources are from equities.

But their preference for the Allianz Income & Growth fund for income befuddles me. If you are ok with this fund, what then is your issue with a high equity income solution? If you are not ok with a high equity income solution, then you should not be ok with Allianz Income & Growth fund.

The Historical Performance is Objectively Not Good

If you subscribe to my philosophy that the nature of the components drives the returns of the fund, then the returns of Allianz Income & Growth are driven by US equities, US convertible bonds and US high-yield bonds.

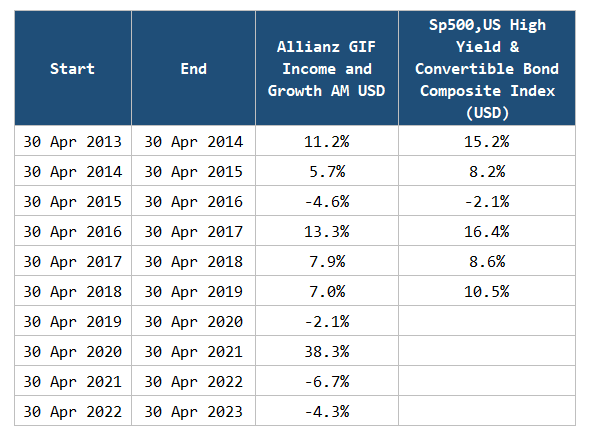

I decided to create a reference index made up of:

- 34% S&P 500 Index.

- 33% Bloomberg US High Yield Corporate Bond Index

- 33% ICE BofA US Convertible Index

The alternative to Allianz’s income and growth would be to invest in an ETF portfolio of these three indexes.

Allianz publishes some historical fund returns in their fund factsheets.

I decide to compare the historical fund return against this reference index I created:

We have about six years of data which we can compare.

You would notice that the reference index performance meanders like Allianz GIF Income and Growth AM fund. When the performance is good, the reference index performance is also good, and when the fund performance is not good, so is the performance of the reference index fund.

Almost every year, the reference index did better than the Allianz GIF Income and Growth AM fund. No doubt, the index does not include fees and the expense ratio of the fund is a hefty 1.5% p.a.

I think without the hefty fee the performance of the fund will be closer to the reference index.

But even if fees are lower, what are you buying the Allianz fund for? To keep up with the index? Perhaps that strips away much of the sophistication you are paying to the manager.

What determines the performance you enjoy are due to the underlying equities, high-yield bonds and convertible bonds.

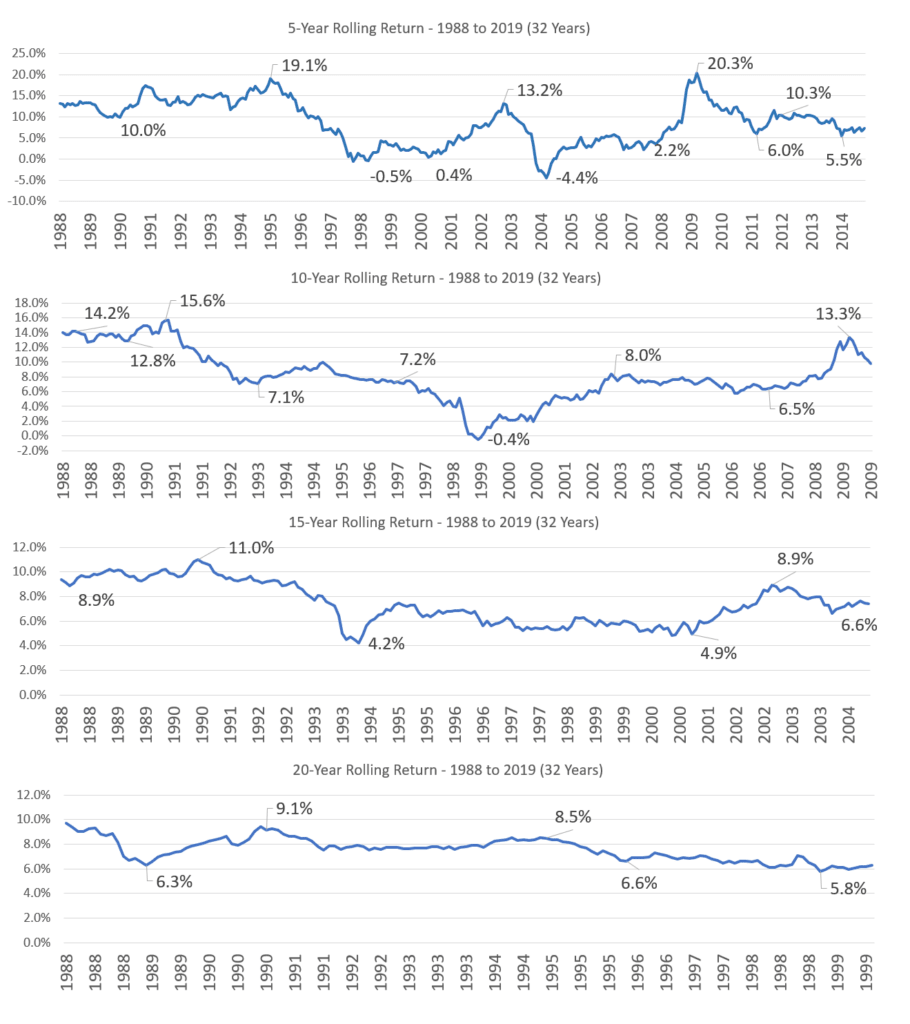

32 Years of Reference Index Returns

If the nature of the Allianz Income & Growth drives the returns, what does 32 years of US equities, US high yield bonds and US convertible bonds tell us about the possible returns nature?

In the charts below, I laid out the 5-year, 10-year, 15-year and 20-year rolling returns of the reference index from 1988 to 2019:

Each point on the chart represents a 5-year, or 10-year, or 15-year, or 20-year period.

We see a very common pattern readers of Investment Moats usually observe: when the investing period is short, you can get a wider range of outcome.

The lucky investor will get 19% a year for five years while an unlucky investor will get -4.4% a year for five years.

But if you invest longer, the range of returns narrows.

One thing I notice is that, the US equity, convertible bond and high-yield reference index have the tightest 20-year annualized return range. It is basically between 5.8% a year and 9.1% a year.

I think this may be appealing for some investors who felt that such a return is decent during their retirement or for capital preservation.

But is this really impressive?

A 60% S&P 500 and 40% 5-year US Treasury will have a range between 5.4% and 10% a year.

So no, it is not so special versus the typical 60/40 portfolio.

Overall, the fund’s return is quite close to a 60/40 portfolio.

We do have to acknowledge that while 32 years is long, it will be great to see the performance of this reference index over different economic regimes. The 60/40 is “battle tested” over 200 years of historical performance and we hope to see the same for such a portfolio.

Allianz Income & Growth’s Falling Dividend Distribution

Financial advisory firms tout the Income & Growth fund as the basis of their passive income solution.

So let us talk about income.

The main selling point of Allianz Income & Growth is its MONTHLY dividend distribution which currently yields close to 8.6%.

How consistent is the dividend?

Investors need to know that the portfolio manager of an unit trust fund like Income & Growth wears both the investment manager hat as well as the financial adviser hat.

The fund sets a high dividend distribution, but that distribution can change over time.

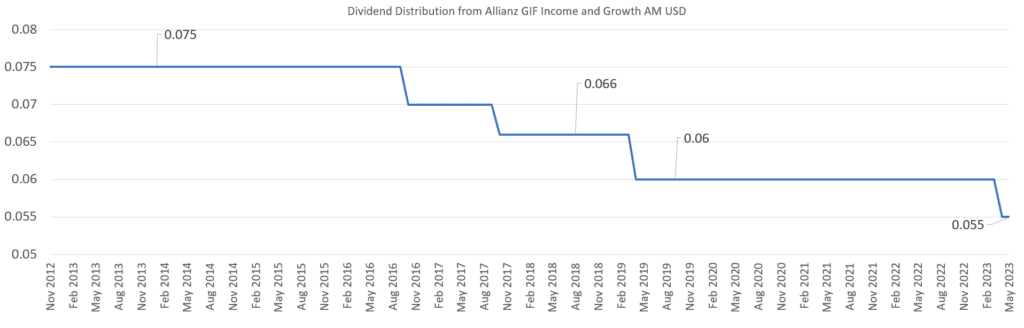

The chart below shows the dividend distribution history of the AM class of the fund:

The monthly dividend used to be $0.075 a month. The dividend payment dropped to $0.07 a month, which is a 6% reduction in Oct 2016. The dividend payment dropped to $0.066, which is a 5.7% reduction. Then in Apr 2019, that dropped a further 9% to $0.06 before recently dropping to $0.055.

If your idea for the fund is to provide inflation-adjusted income or income that goes up over time, and NOT spend the capital because you think that will preserve your capital, the fund’s dividend history should shed more light.

The Fund is Likely Paying its Dividend Out of its Capital Appreciation or Capital in General

I am a total returns guy so I can view returns as a combination of dividends and capital appreciation.

But many income investors wish to keep their capital intact because they equate keeping their capital intact as a way to prolong their income stream or to ensure their income stream last perpetually.

I got news for investors with this mindset:

Just because you are spending only the dividend income from your unit trust does not mean you are not spending your capital. The fund manager may be liquidating your capital sometimes, or all the time, to pay your dividend income.

We know the current dividend yield of the Allianz Income & Growth AM class fund yields 8.6%.

Here is the following:

- S&P 500 Dividend Yield: 1.66% (from YCharts)

- iShares Convertible Bond ETF Average Yield to Maturity: 4.97%

- Bloomberg High YIeld Bond ETF Yield to Worst: 9.06%

Only 1 out of 3 hits 8.6%.

How the F*** do you expect the fund to keep generating an income that keeps up with an 8.6% yield?

There is enough evidence that the income has to come from some capital appreciation returns, which is something that may be uncomfortable for some income investors.

Convertible bonds, by their nature, is low yielding and much of the high income will have to come with systematic harvesting of capital appreciation returns.

Can a Combination of S&P 500, US High Yield Bonds and US Convertible Bonds Give You an Income of $80,000 on a $1 Million Portfolio?

I am curious about the 8% income advisory firms put in their advertisements.

Can you get an 8% income in your retirement?

Seasoned Investment Moats readers will know that your initial income to your portfolio ratio dramatically determines the success of whether your income streams last through your retirement.

Many expect an income of $80,000, $80,000, $80,000, and $80,000 from their income solution but they don’t realize that the income from such a fund such as Allianz Income & Growth is not consistent (see the Falling Distribution section above).

The income is also not adjusted for inflation.

Spending 8% of your portfolio is wildly optimistic. It requires the retiree to live through a lucky sequence. During unlucky sequence, the money will run out in less than 10 years.

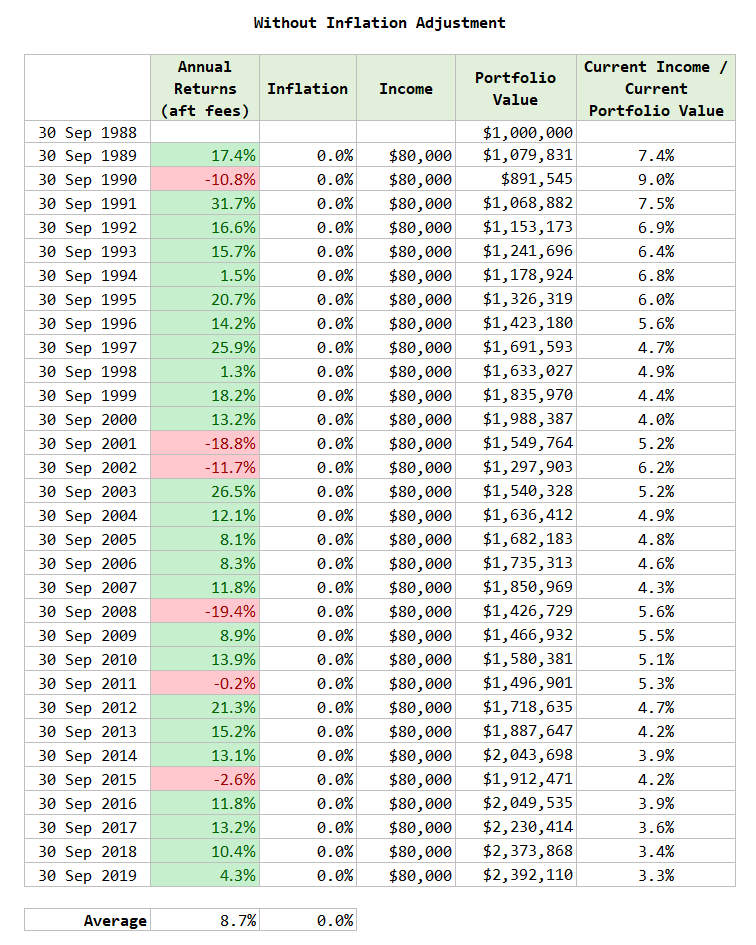

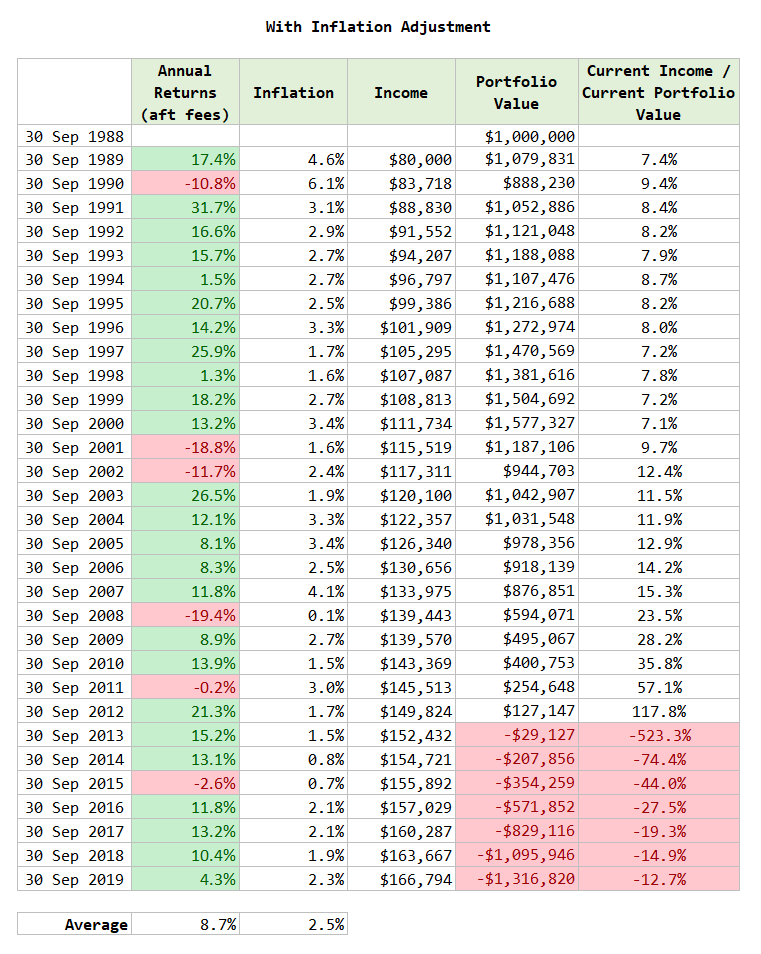

Since we have return data of the reference index spanning from 1988 to 2019, we can see whether a retiree retiring in 1988 can last till 2019 or 31 years:

Observe that the income of $80,000 does not go up with inflation.

The worst drawdown for this reference index is -19.4% during the GFC which is very, very good.

As you can see, the portfolio last but also grew from $1 mil to $2.3 mil.

You are able to get 31 years of income and preserve your capital.

The compounded return during this period is 8.7% a year.

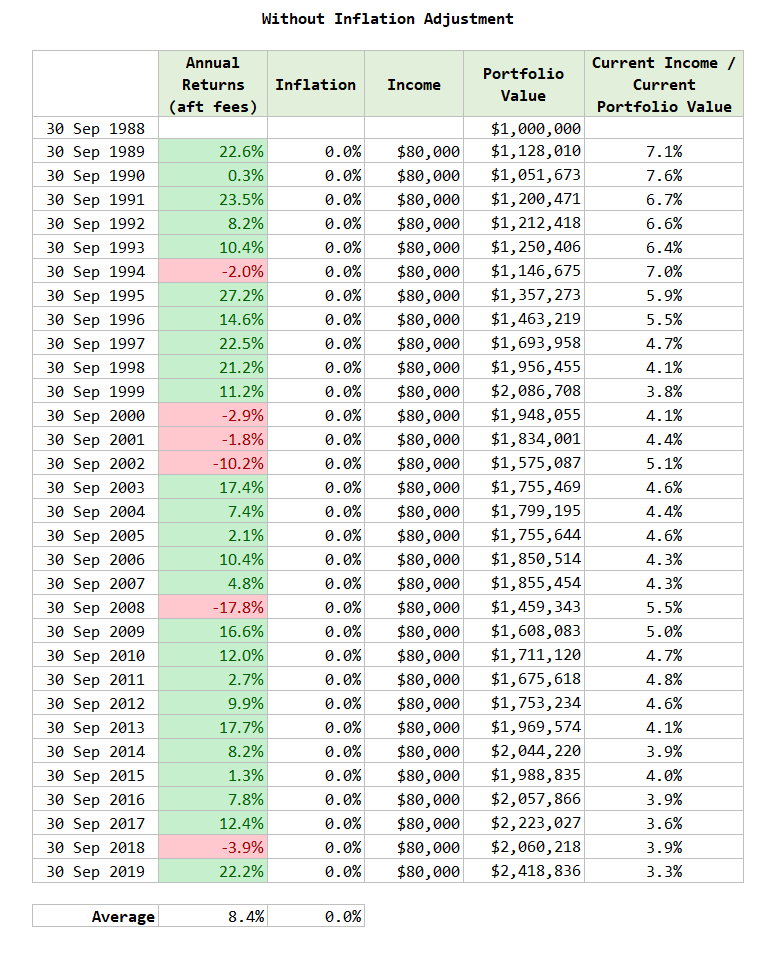

This looks very, very impressive, until we take a look at a 60% S&P 500 and 40% US Treasury Bond portfolio:

A 60/40 portfolio in the same time period will also last and the portfolio value also end up at the same spot.

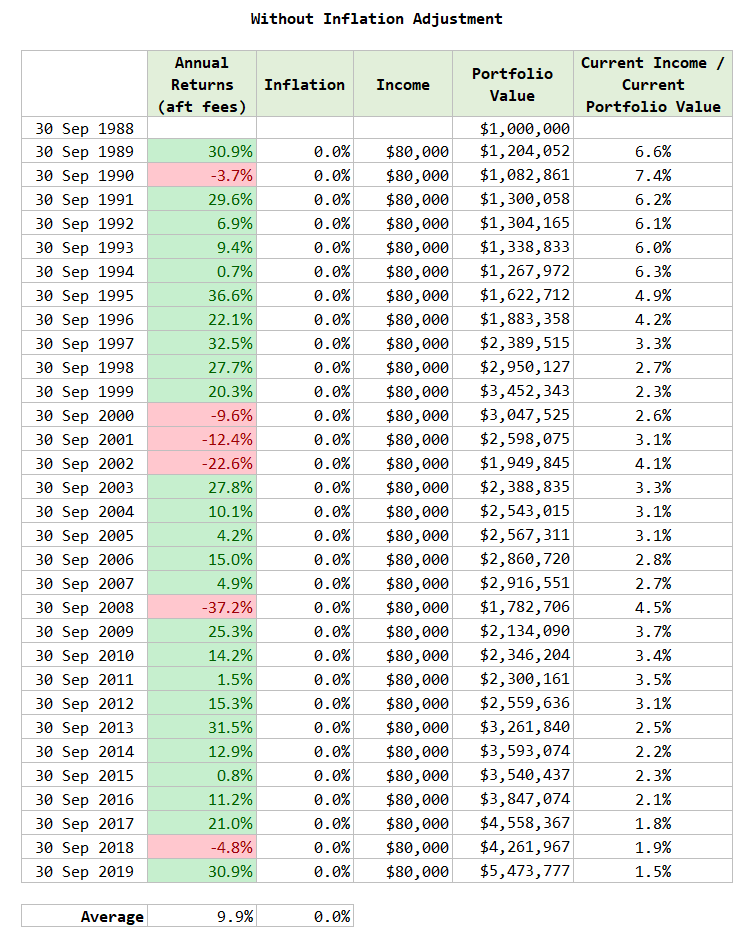

How about a 100% S&P 500 portfolio?

Remember, this is the lowest yielding portfolio. The portfolio not just last but grew to $5.4 million!

So what does this proof?

It is not that a combination of S&P 500, US High YIeld bonds, US Convertible bonds is a good retirement solution.

It is just that 1988 to 2019 is not such an unlucky sequence to live through.

In fact, it is a pretty good sequence to live through.

That is why even a 100% equity portfolio work well, despite such a high initial income withdrawn.

The Income Stream Dies with Inflation Adjustment

Now what if we tries to adjust the $80,000 first year income by last year’s inflation?

The inflation during this period is rather mild at 2.5% a year during this 31 year period.

But the portfolio ran out of money prematurely.

Spending an initial 8% of the portfolio is too optimistic and a retiree runs a risk of income not lasting long enough.

Even if the compounded growth is 8.7% a year, which is more than 8%, it does not mean you can spend so much.

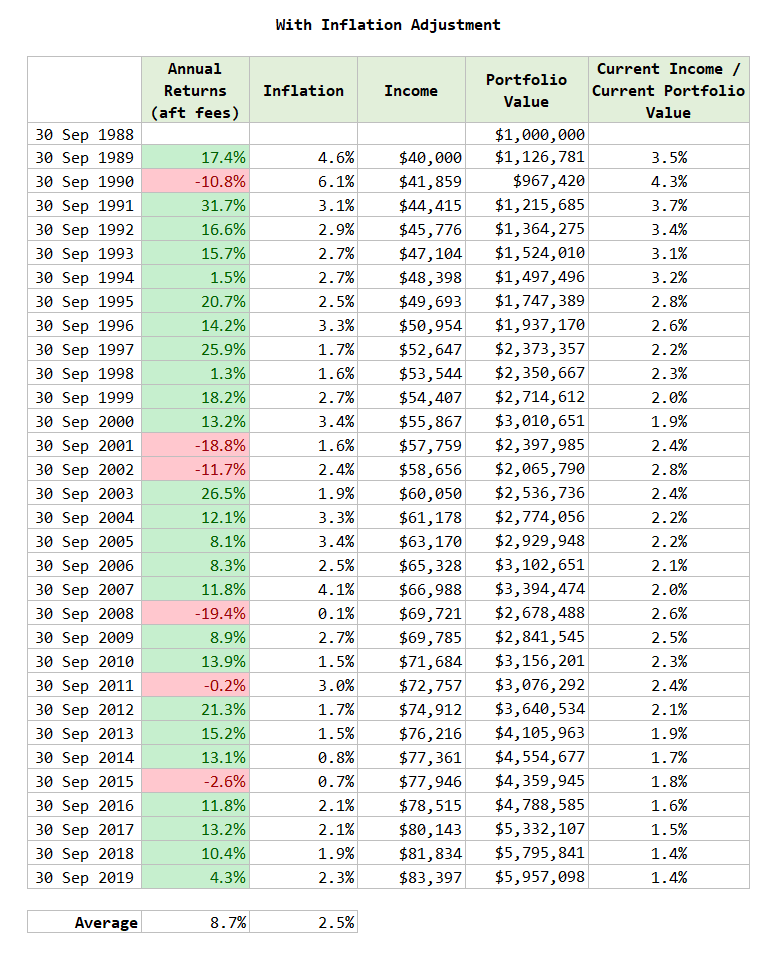

But if you reduce your first year income from $80,000 to a sensible $40,000 or an initial 4% of the portfolio the wealth portfolio will last and thrive:

This string of tests drives home the following point:

- The sequence you live through is more important than your asset allocation.

- Even though your return is high, it does not mean you can spend a high income.

- A lower income-to-portfolio ratio improves the odds that your portfolio last throughout your retirement.

Conclusion

Here are some of my thoughts after deep diving into it:

- The future returns likely will be driven by the performance of US equities, convertible and high-yield bonds.

- We have peeled away any investment sophistication of the investment manager. I don’t think there is much alpha driven in the past to warrant such an “appealing status”

- Be aware that convertible and high-yield bonds are more equities-like than safe bond-like. Don’t be shocked about its volatility during distress periods.

- The one-year worst performance of the reference index is better than a 60/40 portfolio but not by too much.

- I don’t see the appeal of such allocation when pitted against a 60/40 portfolio to warrant its “appealing status”

- The low cash flow yields of convertible bonds and US equities likely mean that part of your high 8% distribution will come from selling capital appreciation proceeds or in our terms, selling capital.

- The dividend distribution shows a decline over its ten-year history. If you expect the payout to hold steady, history does not show that.

- In terms of income planning, be it for retirement or some other reason, it does not have much difference compare to a 60/40 portfolio or for the matter an 100% equity portfolio. What is critical to whether you will run out of money pre-maturely is the starting income, relative to your portfolio value. Spending an initial 8% and keeping constant may look good in this 30-year 1988 to 2019 retirement sequence, but this is a “lucky” 30-year period. If the fund performance is so similar to equities, such a high initial payout would likely mean you run out of income pre-maturely if you live through a more “unlucky” 30-year period such as the 1937 to 1966 period.

- If we adjust the 8% initial payout by inflation (you can do this by selling some units), so that you preserve your real-spending power, the simulation show that you would run out of money pre-maturely.

- I show that if you start with a lower initial income payout, relative to your portfolio value ($40,000 on a $1 million portfolio, or 4%), you can preserve your wealth. It illustrates again that the critical factor of sustainable income is less asset allocation, short-term investment performance.

Personally, I think the fund does not deserve such a great reputation for underperforming the reference index. Whether it works for you is another matter.

If you are still interested in the fund, you can invest through Endowus and hopefully through my Endowus Referral Code here. You get $20 off your Endowus Fee if you sign up through it.

Endowus will rebate 0.63% of the 1.54% Allianz Income and Growth fund-level fees, leaving you with 0.92% in fees.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Siew

Saturday 2nd of December 2023

Hi Kyith,

Thanks for the post, I have also been hearing about this fund recently. Can I get your insights on some things?

For the table where you could only compare 6 years worth of data between the fund and your reference index. Does it include the dividends paid out from the fund?

Also, the fund is yielding positive annualised returns although dividends have dropped over the years. Compared to decumulating from your portfolio, it also means your capital is still growing and you still at least get a 7-8% p.a. dividend?

Thank you!

Kyith

Monday 4th of December 2023

The returns of the fund are taken from Allianz Income and Growth factsheet and usually these are total returns, which means it includes the dividends. i am not sure if the second question is regarding my proposed decumulationg strategy or pertaining to Alliance income and growth.

In general, your capital can still grow when you are spending down provided the following:

1. you are living through a sequence where inflation is quite in controlled or that the starting period of retirement is not too depressive. In short, you are living through a rather favorable sequence of return. 2. you control or take care of the initial income (not the annual, but the initial income) you decide to extract, relative to the portfolio value

both of these are commonly referred to as the safe withdrawal rate (SWR).

if you don't take care of the ratio, even if your portfolio has a compounded average return of 14-15%, you can still run out of money prematurely.

in Allianz income and growth case, a starting extraction of 8% of the portfolio based on the data is shown to be more risky.

Chai

Tuesday 12th of September 2023

Hi Kyith Great effort in analysing the Allianz Income and Growth Fund. Is it possible that part of the monthly distribution come from derivative trading e.g. stock options instead of selling capital like you mentioned? Thank you for the insight.

Kyith

Saturday 16th of September 2023

Hi Chai, that is possible. I have anedoctal comments that they are doing options writing. But i cannot confirm.

Alex

Sunday 28th of May 2023

Thanks Kyith for another excellent write up. Sorry not sure if I am asking too much. Would you mind to share your view on iShares Asia Pacific Dividend UCITS ETF (IDAP)? I suppose that is more legit. Thanks in advance and no worries if you have no time for this.

Kyith

Saturday 3rd of June 2023

Hi Alex, first time coming across that name but it sounds like an interesting fund. Let me take a look.

Blade Knight

Saturday 27th of May 2023

Thanks Kyith for taking the time to research and also sharing your analysis and thoughts on such high dividend yield fund. Very interesting points.

I recalled seeing a 11% dividend yield product from an investment fund being marketed on FB advertisement recently. Apparently, such "high income yield" products are popular these days.

Kyith

Saturday 3rd of June 2023

Wow 11%. That is even more bold!

M

Friday 26th of May 2023

False/misleading information skewed to advisor's view. So many wrong/false information that was mentioned. I would recommend the author to review/take down post to avoid legal issues containing false information.

Guru

Tuesday 12th of December 2023

@kyith this joker write a long post and didn’t never even verified ,giving false informatioz. Dividend was paid out since 2013 August till date 2023 November without missing a month of declaration . Technically clients who invested since 2013 have already clock more than 100% their capital just dividend alone. AUM of this fund is currently @ 42,332+ millions till date. Guess the numbers of investors in this funds. If this is not a good funds , why is there such a high aum? Are millions or thousands of investor a idiots who does not do their research before investing. Young boy there is still much things for you to learn before commenting such posts online.

M

Sunday 28th of May 2023

@Kyith,

For AM class, dividends were declared and paid throughout 2014-2018. Kindly verify, thank you.

Kyith

Friday 26th of May 2023

Hi M, which part do you think is false, and misleading?