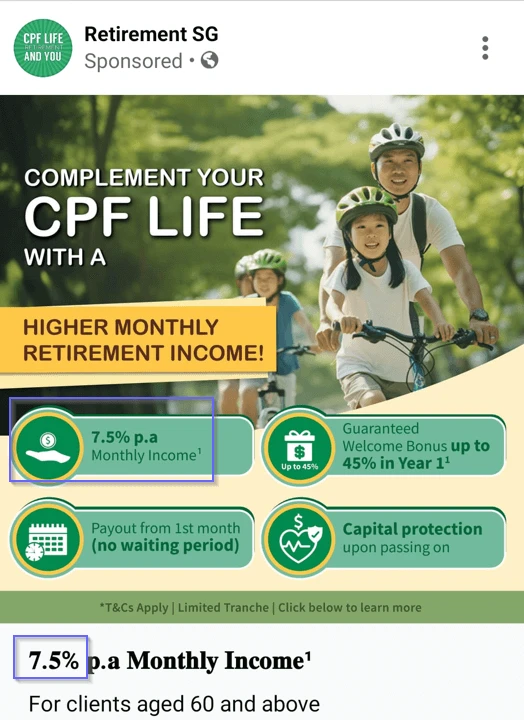

Some of you might have come across a retirement income advertisement on social media platforms such as this:

Not surprisingly, I have readers telling me such retirement plans exist and what I think about such an attractive retirement income strategy.

Investors with an income goal, such as retirement income, or looking for some long-term income are most interested in this.

If I asked the investors to explain more about what they know about “this strategy”, they struggled to explain. The most common response is: “I don’t remember much, but that 8% p.a. income seems guaranteed.“

Look… it is a big ask for any financial institution to promise an 8% p.a. income guaranteed. I am quite sure the person who came across this must have misinterpreted things.

But why?

I think many investors have this income requirement that is so important to them that they wish for a solution to be so true.

So they went in to see the planner, sales representatives and was eventually convinced and got invested.

I think many who came across the ad will have their perception skewed by the attractive sales copy but I feel that your capital set aside for your retirement is important enough that it is better you understand more about the plan.

In this article, I will try my best to explain the features and certain challenging aspect about it that should make you consider deeper before you decide to buy this retirement strategy.

Here is the full sales copy:

For clients aged 60 and above

In less than 5 year’s time, your CPF Life will start paying out.

However, the $1000-$1200 may not be enough for the current standard of living due to current rising inflation.

This is the best time to create a Retirement Portfolio to supplement your CPF Life and receive a monthly Income for Life!

Find out how a Retirement Portfolio can help to provide you with a Retirement Monthly Income for Life:

- 8% p.a. Monthly Income1

- Payout from 1st month (No waiting period)

- Complements your CPF Life by providing you a higher monthly Retirement Income

- Up to 45% Guaranteed Welcome Bonus in Year 11

- Capital Protection upon passing on/terminal illness

by using a Retirement Portfolio to complement your CPF Life, you’ll be able to get a higher payout and receive your Monthly Retirement Income earlier.

Don’t wait any longer. Click below and find out more on how to Complement your CPF Life now!

*T&Cs apply

Please see our T&Cs here: http://bit.ly/3WYnRBx

The T&Cs provide enough details to tell us what about it, but I feel that the group that the advertisement target (quite successfully!) have trouble figuring it out.

Let us start by figuring out what this retirement income plan is about.

What This Retirement Portfolio Is

This retirement portfolio is a unit trust that is structured within a 101 Investment-Linked Plan (ILP) from Manulife called Manulife InvestReady (III).

The unit trust used is Allianz Income & Growth (H2-SGD) Dis.

In the past, I wrote a comprehensive article to explain about the Allianz Income & Growth unit trust: Tearing Down the 8.6% Dividend Yielding Allianz GI Income and Growth Fund.

I will talk more about the fund in relation to income planning later.

While this is the unit trust used in the advertisement, the investor/client and adviser have the discretion to change the unit trust in the ILP.

The goal of the policy is to provide both insurance coverage and investment opportunities. The insurance coverage is limited to death and terminal illness coverage.

With that, let me try to shed light on the features listed in the advertisement.

The 8.0% p.a. Monthly Income1 which Payout from 1st Month (no waiting period)

There is a monthly income because the underlying unit trust (Allianz Income & Growth) distributes a monthly dividend.

The fund was incepted in Feb 2017 and has been paying out dividends.

The ILP allows the investor to receive the payout from the underlying unit trust.

Here is lifted from the product summary:

This explains the payout from the 1st month. The investor also has the opportunity to reinvest the dividend should he/she so chooses.

Could you get 8% p.a. Monthly Income?

Many investors are curious about this, but herein lies the problem. There is a more profound question:

What were you expecting when you see 8% p.a. Monthly Income?

- Were you expecting a consistent 8% of the volatile portfolio value?

- OR were you expecting a consistent income equivalent of 8% of the first-year portfolio value? (e.g. on a $1 million portfolio, you are expecting an annual $80,000, $80,000, $80,000 in income)

- OR were you expecting #2 but with an inflation-adjustment?

This is the problem when discussing income strategies: Everyone has their own income preferences but they are unsure if the product/solution/investment is able to provide that.

Before looking at this product, you need to be clear about the characteristics of your income requirement:

- How long do you need the income to last?

- Can your income be volatile or is there a minimum amount that is required?

- Do you need the income to adjust or keep up with inflation?

Most people want an income stream that lasts forever, that provides a minimum amount and for the income to adjust for inflation. Not just that, the income, relative to their investment capital is high!

I am going to tell you… if you want everything that is not possible (especially if you include the last one).

Many people spend their whole life searching for a product, that they didn’t realize financial institutions will not dare to promise them.

The underlying income is not guaranteed.

Investors tried to read all four features of the advertisement together and had the impression the income is guaranteed.

The nature of income for most financial products comes from whether the underlying financial securities are able to provide that. In this case, the first question is whether Allianz Income & Growth fund can provide it.

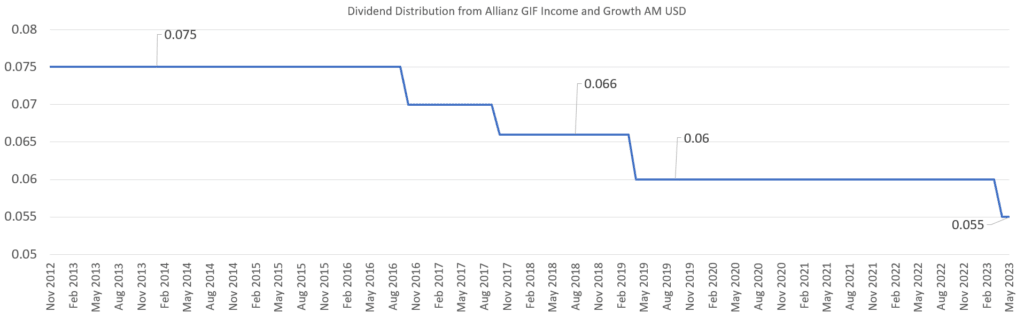

While the H2-SGD class has a short history (incepted in 2017), we can take a look at the dividend history of the AM USD distribution class of the fund which is incepted since 2012.

I shared this in my Allianz Income & Growth article:

This chart shows the dividend distribution for the AM USD share class.

What you will notice is that if you are a retiree that invested in this fund, under perhaps a similar ILP structure in 2012, you will enjoy stable dividends, before the dividends go down over time (from 7.5 cents to 7 cents to 6.6 cents to 6 cents to 5.5 cents recently)

This may give you an idea that the income payout may start at 8%, but based on history your income is not going to be stable, with its history showing the income getting lesser and lesser.

Based on the distribution history, we know the income characteristics:

- There is no disclosure of whether there are any empirical studies as to whether such a portfolio (33% US equities, 33% US convertible bonds, 33% US high yield bonds) can last for how long, and with what type of payout.

- Historical evidence shows that the dividend payout is going to be volatile. Investors may need to sell units and do partial withdrawals to keep the income consistent. This may/may not impact how long the income will last.

- Historical evidence shows the dividend payout goes down during periods when inflation goes higher.

The evidence do not bode well if an investor were to implement this product as a retirement income plan.

If we need further prove of how variable is the income, here is how the advertisement look like recently:

Notice that it is no longer 8% p.a. but 7.5% p.a.

Allianz Income & Growth announced recently a reduction of the Dividend Distribution of the H2-SGD Distribution share class from $0.052 to $0.045.

With such variability, how would you formulate your income strategy?

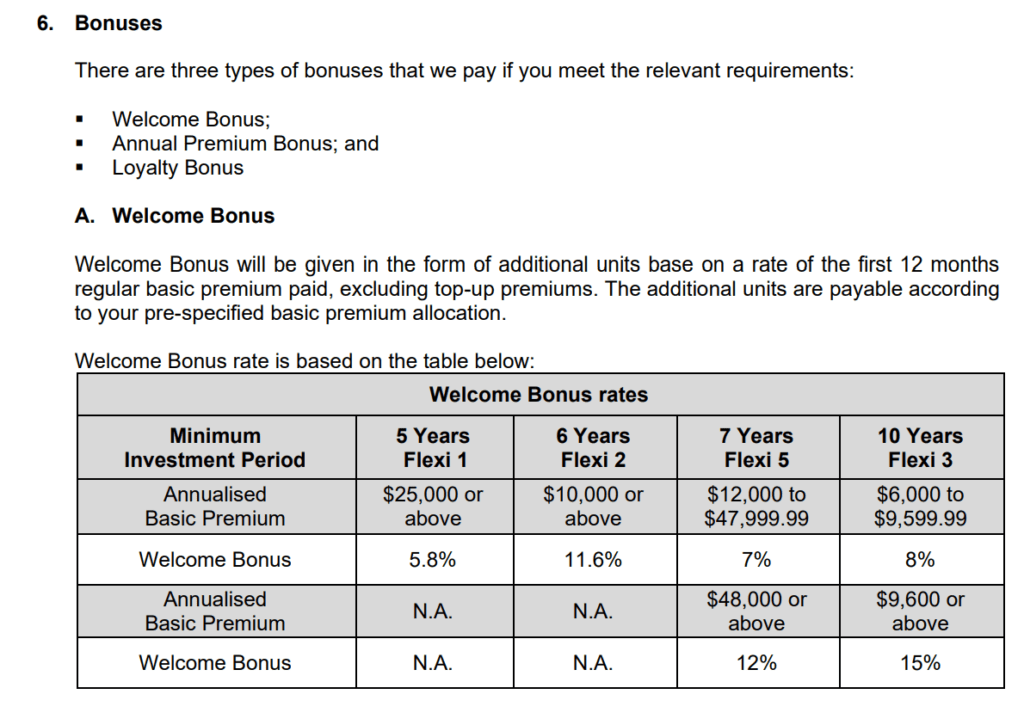

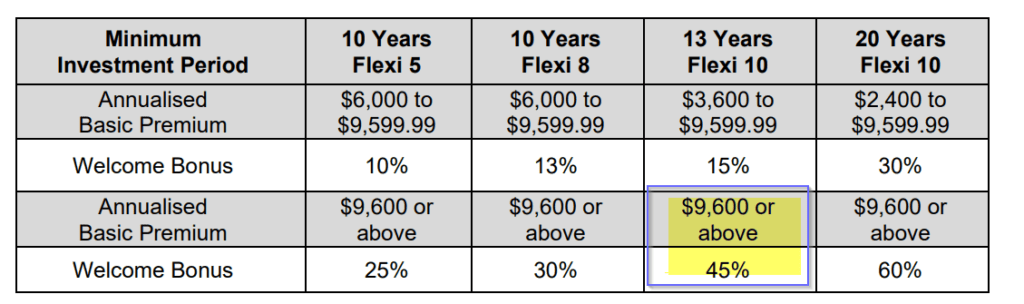

Guaranteed Welcome Bonus up to 45% in Year 11

Many 101 ILPs in the market reward the investors with bonus units, which are additional unit trust units during the first year or first period of investment, and at subsequent points.

The only guarantee in the advertisement refers to the welcome bonus.

Giving 45% bonus units of year 1 sounds big until you realize you can only get 45% if you:

- Invest in a 13 Years Flexi 10 payment structure and

- Invest $9,600 and above.

Here is taken from the Product Summary:

If you invest less annually or can only do it under a different structure, you may not get that high guaranteed welcome bonus.

Here is the Potential Misdirection

These 101 ILPs are meant for people with less capital.

You may realize that these plans are structured by default for an investor to contribute their capital over a period of time instead of a big lump sum at the start.

I took a look at the product summary and cannot find much said about the structure if I were to contribute a single-premium as most are like the table you observe above, contribution over different periods.

Which is quite weird that if I have an income goal, and I want to get income payment from my investment immediately to fulfil my income needs, I have to contribute over a period of time instead of putting it all in as one lump sum.

For example, instead of putting in $1 million to get $80,000 p.a. in income, I had to divide it over five years. Five years is the fastest I can get invested, to get the income which I need.

I enjoy the lowest welcome bonus.

As an income planner trying to allocate my existing financial resources to gain income, this structure by default is weird and likely, it is not meant for the high net worth with capital and a pressing need.

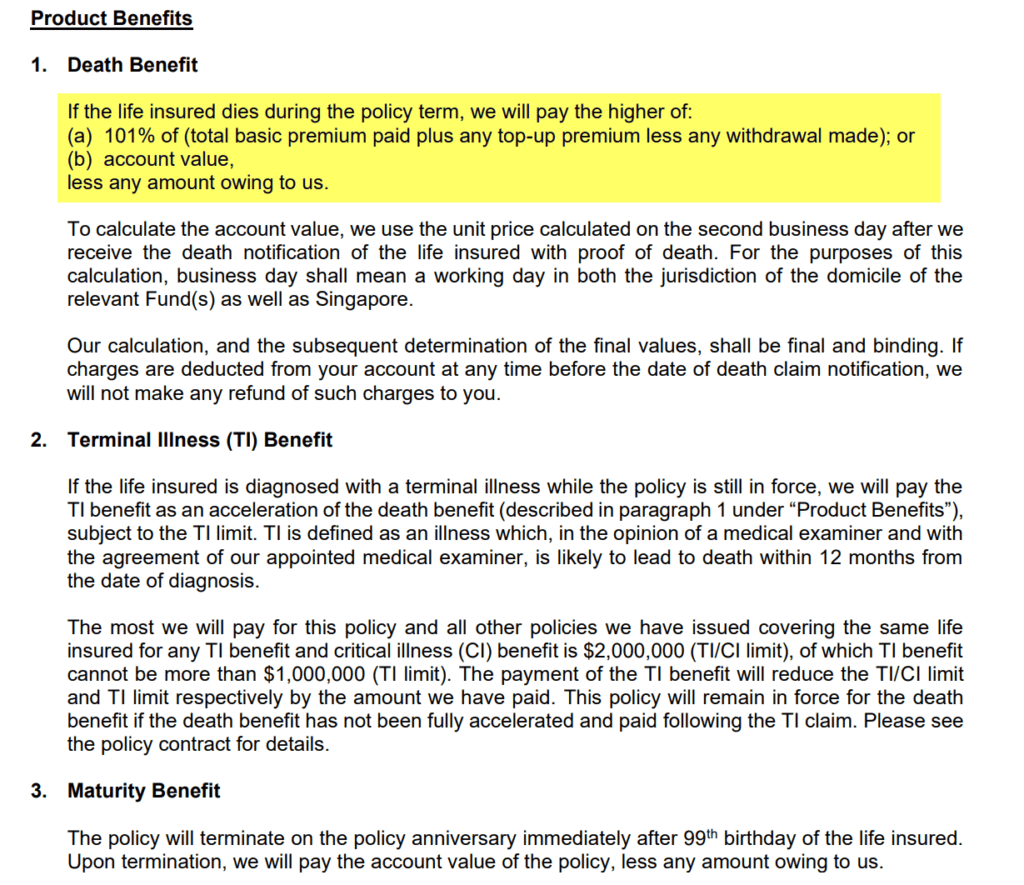

Capital Protection Upon Passing On

The last feature relates to capital protection and investors have to be clear on what this means.

The capital protection is an insurance benefit upon death.

Here is what is stated in the product summary:

If the life insured dies, the death benefit will be 101% of the total basic premiums paid plus any top-up premium less withdrawal made or the account value if it is higher.

So this protects your capital in the event of death. This is beneficial if the fund does not perform well, and after payout the value of the policy is low. In the death event, your beneficiary will at least get the total basic premiums paid.

Investors should note that not all 101 ILP death benefits are similar to this.

Some just protect the basic premium, not the top-up, while some are based on prevailing portfolio value.

The death benefit of Invest Ready is better, but you are paying for the cost of insurance if the investment do not perform well. This is because the cost of insurance is on the net amount at risk (NAAR).

So suppose if the policy value is $200,000 and the total cumulative premiums paid was $300,000, there is a cost of insurance charged on the policy (by cancelling units from your fund) for the $100,000 difference in insurance coverage.

When the retiree is young, the cost of insurance is low.

But how young would a retiree be?

The Retirement Portfolio Structure Has Enough Challenges for You to Think About

I would tell a lot of people:

An income investment product, especially an off-the-shelf one, is not equal to an income strategy.

This is because:

- The product must ensure it can fulfil certain investment or product promises.

- The financial markets are just so uncertain that the returns of the underlying investments are uncertain in reality.

- Combine #1 and #2 means any contractual promises will tend to be very, very conservative to the point it will not interest you. Hence, there are not many contractual promises.

- This means most features are filled with caveats.

Most products by themselves cannot be an income strategy because they have flaws. But that doesn’t mean the flaws cannot be alleviated.

You need to be savvy enough or you need someone to provide a strategy to incorporate the product.

If we review the advertised features:

- The 8% p.a. income is more volatile than you perceive and there is a question of how long the income can last.

- If you wish to implement immediately, with significant capital, you won’t enjoy such a high welcome bonus. The implementation is inefficient.

- The protection through death benefit is fluid based on the performance of the unit trust, but do note that if you are a retiree, the cost of insurance at your age may not be cheap (due to your age). You may not need that protection anymore (unless you have a very strong legacy wish)

There are also other areas to think about that are not stated:

- There is a partial withdrawal charge that coincides with the premium payment period. This means that if the dividend income is volatile and you wish to spend more, you are restricted.

- There are also surrender charges if you surrender during the premium payment period.

- Some may have reservations about having all their money in 100% equities during their retirement. You may wish to be aware that based on how the Allianz Income & Growth fund is set up, equities, convertible bonds and high-yield bonds are affected by the same market conditions.

Even if you have an affinity towards the Allianz Income & Growth fund, perhaps you can consider investing outside of this ILP structure. The fund is available in unit trust platforms such as Fundsupermarket or POEMS.

- You forgo the insurance component, which some of you might not need, especially when you don’t have many dependents.

- You save on the policy and ongoing ILP charges.

- You have much more flexibility to sell units to stabilise the income.

- If needed, you can easily reallocate your capital to other financial goals.

Having a headline yield of 7.5% or 8% income yield would grab attention, but if it sounds too attractive, always remember that the devil is in the details.

Too many times, products disappoint people because we:

- Yearn for an income ideal that is impossible for products to deliver.

- Trusted the wrong financial representative, who is less experienced, strategically omits details about the plan that would otherwise have stopped you from signing it.

- We rationalize our decisions too much when pressed by a representative to a corner.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

lim

Sunday 13th of August 2023

"The T&Cs provide enough details to tell us what about it, but I feel that the group that the advertisement target (quite successfully!) have trouble figuring it out." Unfortunately this is too true.

Worse still is the 'verbal' selling by agents where they don't even mention the T&C but later just because you sign the policy document you are taken to have read it.

Kyith

Sunday 13th of August 2023

I guess that is true in some cases.