Both Straits Times and Business Times ran the update that DBS will be launching their Exchange Traded Funds (ETF) portfolio for the investors.

And it got me thinking about a few things.

Firstly, the product.

A Human-Robot Managed ETF Portfolio

There will be 2 portfolios that are launched:

- The Asia Portfolio: Gives you Singapore listed ETF exposure to countries in Singapore, China and India

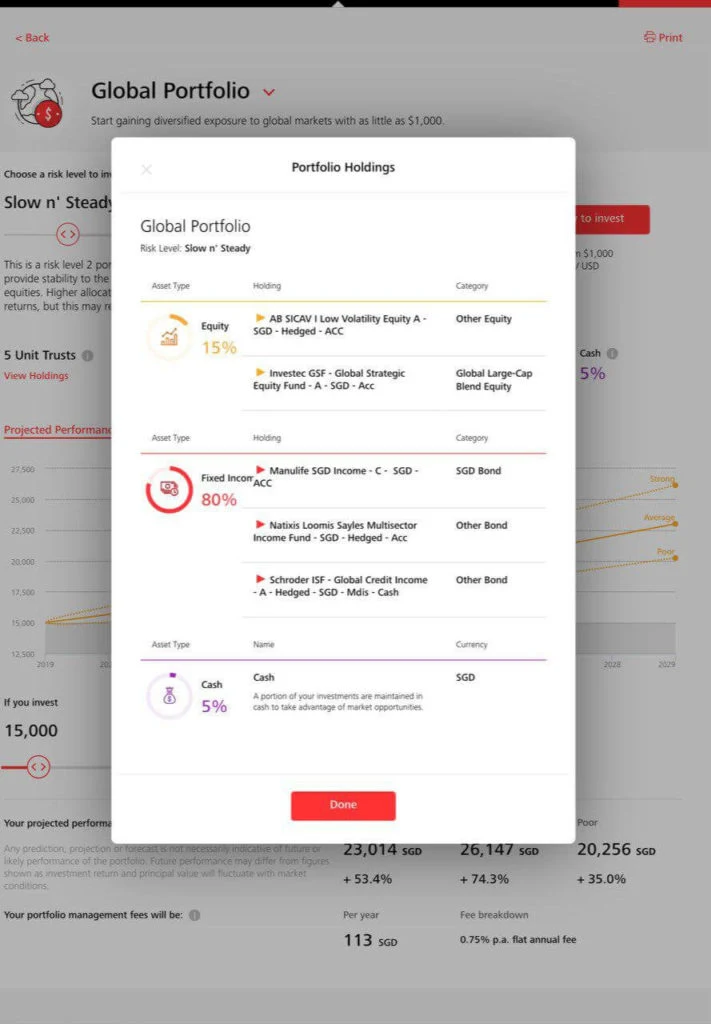

- The Global Portfolio: Offers UK-listed ETFs

You can invest with a minimum sum of $1,000.

The investor will be charged an AUM fee of 0.75% per year. You can look at this as the company wrap fee.

There will be no more sales charges, locked in period or platform fees. More on this later.

The portfolio is actively managed.

A team of portfolio managers led by Mr Christophe Marciano, head of discretionary portfolio management, will review the portfolios on a quarterly basis to ensure that they remain resilient to market volatility, provide optimal returns, and remain aligned to DBS Chief Investment Office’s views.

So if we understand from this, this portfolio will be “actively re-balanced”, or “strategically allocated”.

Lower Cost than Unit Trust

Using exchange traded funds is great. But I do have to be clear. Using them is good because they are relatively low cost enough, versus the past competition such as unit trust.

Unit trust on average would have 1% to 2% in annual expense ratios, which are recurring costs. ETF listed in Singapore at least have below 0.75% at least. (this is not including commission, the AUM fees)

Cost is an important component because it eats into your return. If we go by past history, it is very difficult to make out-sized out-performance versus the indexes these ETF and funds are measured against. Thus, usually the best they can do is to keep up with the index they are suppose to outperform.

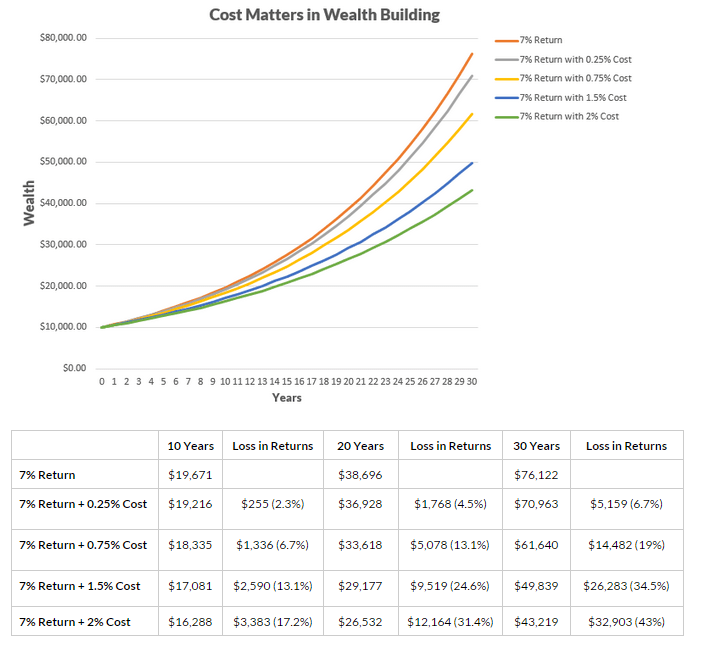

The above illustration is a favorite of mine to show that over time, the costs do eat into the returns, if the strategy does not generate an edge. Each of the lines is 7% returns plus different cost. You can think of them as your expense ratio and sales charges.

Your returns are uncertain, but your costs is always incurred, whether the fund does well or not.

It is not only ETF that can be lower cost than traditional unit trusts. Some unit trusts can be lower cost than the traditional unit trust. The Lion Global Infinity Series of Unit trust is a wrapper around Vanguard low cost unit trusts. Not super low cost by Vanguard standards but still lower cost enough. You can read my review of the Infinity Global Fund, which is one of the fund that tracks the MSCI World Index.

I written about the Dimensional funds in the past. That is also a low cost unit trust, but you can only buy it through an AUM structure. The Vanguard funds, available to accredited investors in Singapore, are also unit trust that is low cost.

I am not sure if the Active Management can Deliver Outperformance

DBS’s digiPortfolio is not the first that came up with the human + robo tilt. MoneyOwl brands themselves as bionic, which is roughly the same thing.

The difference is that there is a manager tilting the allocation of the ETFs in the digiPortfolio so that they give you optimal returns (what is optimal returns?) and controlled volatility.

MoneyOwl implements Dimensional funds, which are not passive as well. They rely on Dimensional’s deep research over the years, and currently, on what are the factors that gives pervasive and persistent out performance.

So the DBS manager is going up against a team that have been doing it for close to 40 years.

The harsh reality is that in the past 7 to 8 years every one’s returns pales to the S&P 500 or NASDAQ.

A lot of the value, size, momentum tilts was not working for a long time. If you are not in growth, you are rather screwed. What this means is that most of these manager’s tilt should under perform.

Since I track these things at work, I can safely tell you that Dimensional funds have been under performing the index they compared against. Not just that the funds such as Aggregate, Inclusif, Lumiere Capital, Lighthouse Advisers as well.

Perhaps the best way to think about this is in this way. Since they are actively managed, let us look at the performance of their unit trust portfolios for their higher net worth clients under DBS Treasuries (more on that later)

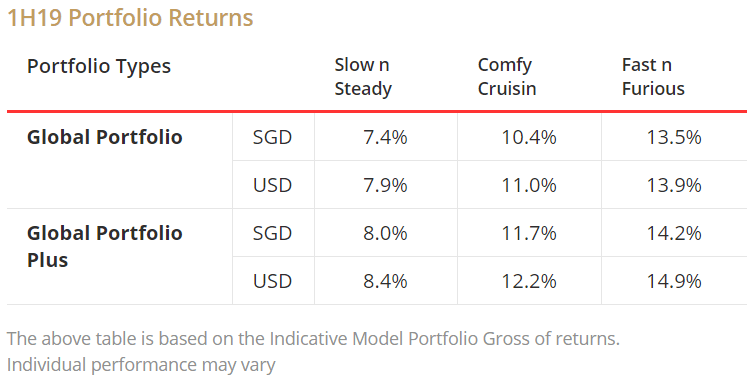

Slow n Steady, Comfy Cruisin and Fast n Furious should be 3 different allocations ranging from conservative, balanced to aggressive.

That half year 2019 returns look great. However, the market have recovered much from last year.

The best way is to measure against a model portfolio. It is strange that is not published but perhaps we can take reference from some of my model index portfolios at work.

These model index portfolios are made up of MSCI World, MSCI Emerging Markets, Bloomberg Barclays aggregate bond index. They are not what the clients invest in but what the funds are measured against.

2019 YTD up till June index benchmark model portfolio results are as follows:

- Conservative (USD): 9.96%

- Conservative (SGD): 9.15%

- Balanced (USD): 12.20%

- Balanced (SGD): 13.08%

- Equity (USD): 15.42%

- Equity (SGD): 15.49%

You be the judge. Do note that DBS did not put out a model index portfolio they benchmark against. If they do, please let me know.

The DBS unit trust portfolio actually did better than some of the boutique funds this year.

The Global Portfolio

I will not say much about the Asia portfolio because it feels… like another actively managed unit trust. There is a home region bias sometimes and for those who feels more at home in Asia, this may be up to your consideration.

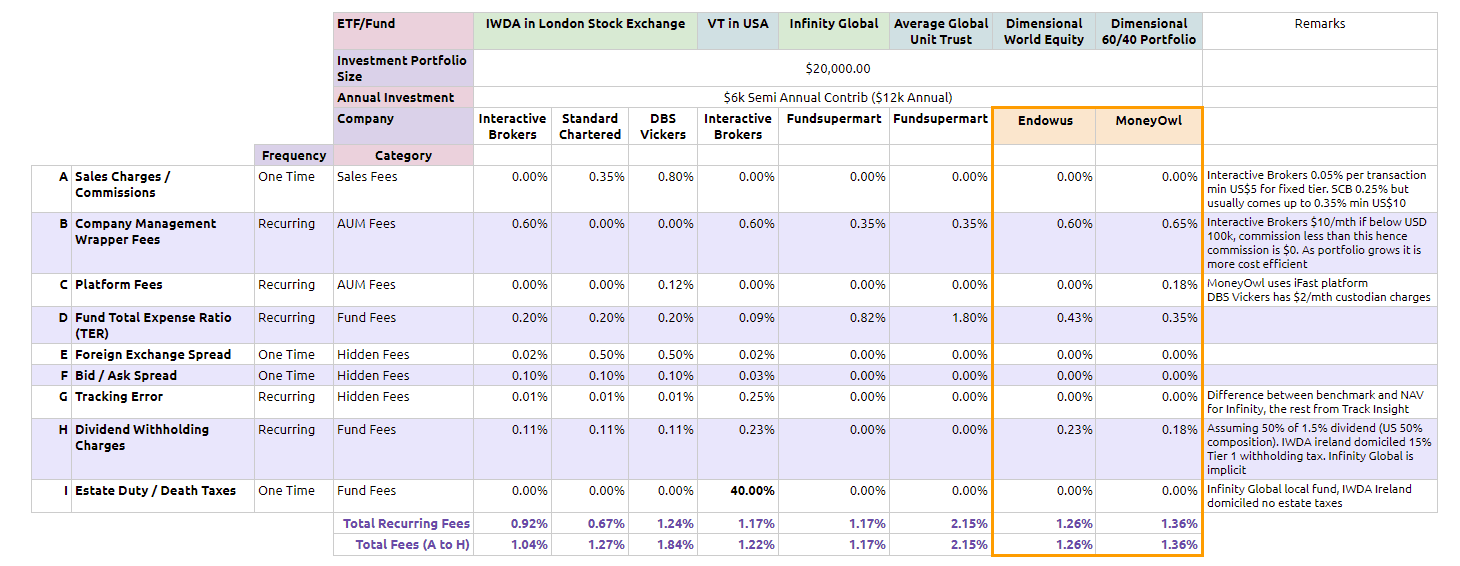

The Global Portfolio is interesting in that they make use of UK Listed ETF. These ETF’s tend to be domiciled in Ireland, and for the international investors, there are some tax advantages. (I talked about these tax differences more in my Dimensional article and withholding tax article here). It has to be said, not all ETF listed in UK are domiciled in Ireland.

It shows that DBS is also paying attention to what the smarter local investors are doing here and what they are doing on DBS Vickers platform.

DBS have the opportunity to give investors a easier access to some of these low cost iShares or Vanguard ETFs.

What the more cost conscious investors will look to are

- What are the underlying ETFs

- How is the active strategic management carried out

I think we will know the fund details next time. So there are not much we can comment here.

The competition for sophisticated investors is not each of the robo invest firms but against the Gold Standard DIY Option.

The Gold Standard DIY Option is to invest in certain low cost, Ireland Domiciled, UK Listed ETF through Interactive Brokers.

The advantage of digiPortfolio is a much more stream lined interface. I do think for some very bochup investors, if the manager does a good job, there are certain advantages for them to manage their money through an active manager.

You would have to see if that is worth it over the cost difference of 0.75% per year AUM versus 0.05% per transaction cost. (for investors with lower sums than US$100,000, the cost difference might be lower. Refer to my dimensional article)

Could you RSP or GIRO into an ETF digiPortfolio?

Even till today, I do think why Insurance Endowments, Investment Linked Policies and Unit Trust sell well is because you can initiate a regular savings plan (RSP).

Once setup, the money will funnel from your bank account, to the unit trusts, ILP and endowment.

ETF transactions at Robo is still very clunky, perhaps with the exception of MoneyOwl and Endowus since they use unit trusts.

With RSP, the wealth building can be more passive.

When it is more passive, there is less behavioral tendency to act more rashly.

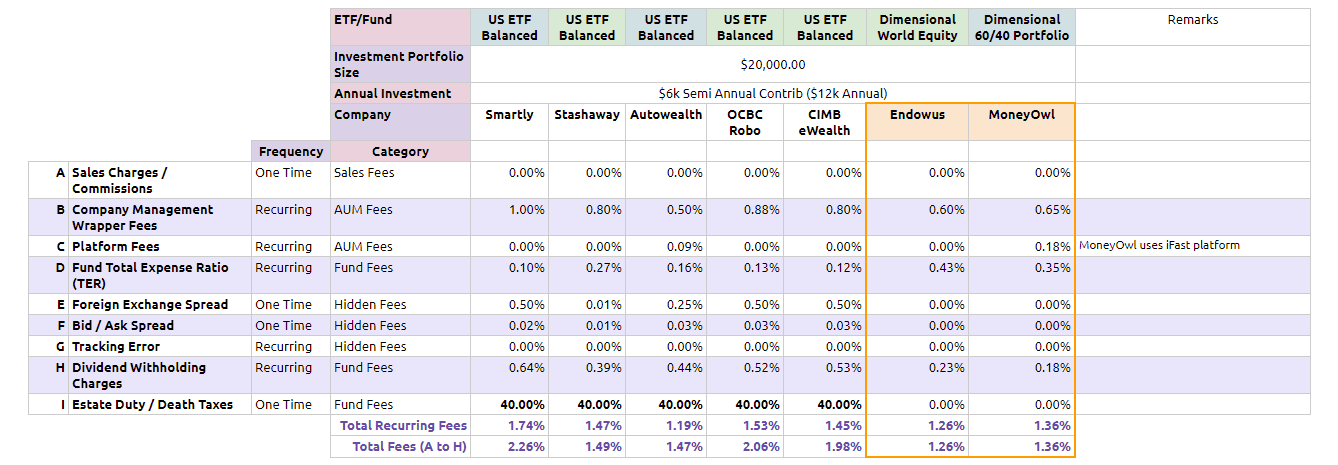

The Cost Comparison

I am not going to do a deep cost comparison because, frankly I am not in the mood to do that.

You can however take a look at some of my past comparison.

Note that the 0.75% AUM fee is equivalent to the Company Management Wrapper Fee line item.

DBS likely is not absorbing the underlying expense ratio. This is the difference between DBS and OCBC’s All Seasons Fund (not listed up there). In that All Seasons fund, there is a company management wrapper fee of 0.50% but from what I understand, you are not charged the underlying fund expense for the Lion Global funds. You are for the non Lion Global fund.

The DigiPortfolio have an advantage over some DIY solutions because they have custodian fees, which is equivalent to platform fees. DigiPortfolio do not have platform fees.

For that they have an advantage over MoneyOwl as well because of iFast’s 0.18% platform fees.

Given that, if digiPortfolio give you a IWDA or VWRD, you can get invested at 1.05% in total all in cost (around 0.30% expense ratio + 0.75% AUM fee)

I think that is close to the Infinity Global’s cost, which is not too bad.

The Positioning of These 2 Portfolios versus The Global Portfolios

DBS have already rolled out 2 portfolios for the DBS Treasuries Clients. These are the clients with AUM of $350,000 (actually it can be lower because some of my friends with less money are inside)

These 2 portfolios, The Global Portfolio and Global Portfolio Plus, use actively managed unit trusts. For each there are 3 different bond and equity allocations.

The ETF portfolio are positioned as more suitable for investors with no prior experience.

So I wonder what happens when the investor becomes more experienced. Should they switch to a Global Portfolio and Global Portfolio Plus?

The Robos have a certain philosophy and they implement it in their portfolio. Then they market one portfolio.

The banks have too many products.

Experience tell me different products suit different wealth builders of different nature. However, I find it hard to make out the distinct differences that a portfolio of higher cost unit trust suit you more than a low cost ETF portfolio (both are marketed by the same firm)

Personally, I think they just make those who know less even more confuse. Then they get on Seedly to ask XX, YY, ZZ which is better.

The Distribution Channel

The existing Robos have to burn a lot of money on advertising because they do not have an existing distribution channel. And still they would struggle with getting the sizable AUM to be profitable.

The banks and brokerage platforms have the distribution channel with their banks and customer service people. Not to mention the financial muscle. And it is this distribution channel that will make them gather AUM much faster than the Robos could.

The idea of investing has to be sold most of the time. Folks seldom wake up and have this idea that they need to invest.

But I do wonder, with Manulife’s 15 year bancassurance partnership with DBS, given the choice, which would their people push more for the every day people.

Perhaps after the initial spurt, interest would die down.

The Death of the Traditional Stock Broker Platform

At that time, it moved a number of its employees from DBS Vickers into the bank in an effort to cater to demand for a more holistic wealth proposition.

A few months ago, I started hearing the rumors of movements within DBS Vickers. It seems that DBS may have realized that they need to rationalize the brokerage business.

This digitization of investments may be it.

I have not received any notices whether my brokers are still around. Usually, I will email her via email. So I shot her an email just to test 2 months ago. Usually she will reply me with a call in the day.

No response.

Then last week, I received this Whatsapp message:

Hi XXX,

I’m YYY, your remisier from DBS Vickers (DBSV). I tried calling you and WhatsApp you since Aug 23 but could not reach you.

I enclose specimen letter and Transfer Request Form, in case you have not received them.

I shall be grateful if you will complete, sign and return the Transfer Request Form to me at my email address:

Apparently, UOB Kay Hian took the Remisers in.

UOB Kay Hian, the largest securities brokerage in Singapore, has emerged as a keen suitor for the 150-odd remisiers and retail equity trading representatives at DBS Vickers, the broking arm of Singapore government-linked DBS Bank.

Business Times

However, my confusion was what should I do?

Is DBS Vickers not going to be around anymore or not going to serve me? No sound at all.

Conclusion

I think at this stage, the UK Listed Global Portfolios look promising to what I advocate wealth builders with less time to do. But you should evaluate if you wish to go with Interactive Brokers as well.

It is not the most straight forward to use and I can see why people would go with a Robo despite costing more. The hassle of the onboarding and transaction process matters to some people.

We have to wait and see what is in the portfolios.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Kenny

Monday 9th of September 2019

If Dimensional Funds have been underperforming its index, would it be advisable to still invest via MoneyOwl/Endowus ?

Kyith

Tuesday 10th of September 2019

What is your perspective on it?