A CPF (Amendment) Bill was passed yesterday.

There were some changes made to simplify certain aspects of the CPF. For most working adults in the higher income bracket, the simplification of the CPF may work in your favour or against you.

Here are the changes.

Monies from CPF OA and SA Automatically Flows to CPF Retirement Account if Depleted for those under retirement Sum Scheme (RSS)

This first one affects the older CPF members who are under the Retirement Sum Scheme (RSS). So it will concern less of those younger members.

But you should be interested if you are helping your parents plan their finances.

Currently, if members on RSS depleted their CPF Retirement Account (RA) savings, they can only continue to receive a payout if they apply to transfer the remaining monies from their CPF Ordinary Accounts and Special Accounts to their Retirement Account.

With this change, if the members have used up their RA savings, CPF will automatically disburse OA and SA savings to the members.

So it is not a manual trigger but an automatic process.

For those who are currently receiving CPF LIFE payouts, they need to apply to add any inflows to their Retirement Account to their LIFE payout. This inflow from RA to their CPF LIFE will be automated in November 2021.

If you are currently on CPF LIFE and have also started getting additional monthly payout (AMP) from your CPF RA, this change will not affect your AMP.

It will however affect the new monies that are injected into your CPF RA, which will flow directly to CPF LIFE Premiums. You can read directly on CPF FAQ here.

The justification given is that there were many members who do not know this and therefore do not get that uninterrupted income.

The group that will benefit most will be the group whose money in OA and SA is less than the full retirement sum (FRS), or the basic retirement sum (BRS). The money is stuck there and they could not get it out unless the money is added to the Retirement Account and they get the money through increase payout.

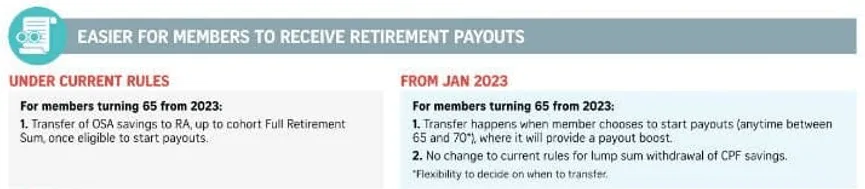

Second Transfer to CPF RA Only happens when You Start CPF LIFE Payout

This one is a bit weird.

Our monies in CPF gets automatically transferred to our CPF RA during two pivotal milestones. When you hit 55-years-old and 65-years-old.

Currently, on the second milestone, upon hitting 65 and when you are eligible to receive CPF LIFE payout, the money, equivalent to your full retirement sum will be transferred to your RA.

With this change, money will only be transferred over to your RA, depending on when you wanna receive the payout. That will be between 65-years-old to 70-years-old.

This is a timing shift.

I think those with ample CPF, would have fulfilled the full retirement sum at the first milestone (55-years-old).

The interest rate on OA, SA are rather similar to that of RA (except for that extra 1-2% that you can earn on the first $60,000)

If the money stayed in OA and SA longer, you could potentially compound your money in your investments at a higher rate of return.

This is the only benefit I see.

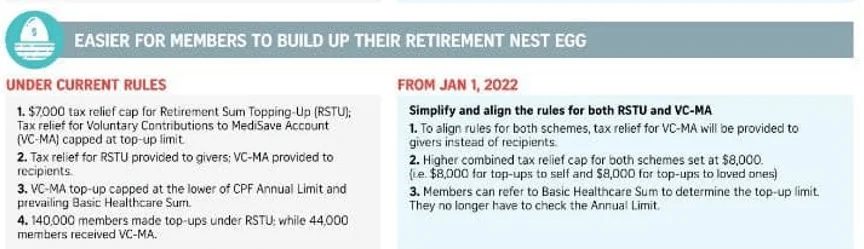

CPF Retirement Sum Top-up and Medisave Voluntary Top-up to be Combined with a Higher $8,000 Limit for Tax Relief

This is a big one that concerns more working adults in the higher tax bracket. It concerns the topping up of your loved ones and your CPF SA/RA and your CPF Medisave.

A member can enjoy tax relief by topping up SA/RA under the Retirement Sum Top-up Scheme (RSTU) and by voluntarily top-up their CPF Medisave account (VCMA).

Currently, only those who receive top-up money in their Medisave get the tax relief. This is why I wrote a very indirect method you could to gain tax relief by topping up your parents CPF Medisave.

With this change, tax relief is given to the Medisave giver instead of the Medisave receiver. This means if you top-up your loved ones’ CPF Medisave, you gain tax relief.

With this change, they are combining the maximum amount that you can top-up to a single party and enjoy tax relief. The amount is bumped up to $8,000 each.

This means you gain tax relief for:

- $8,000 top-up to your CPF SA/RA and CPF MA

- $8,000 top-up to your parents, parents-in-law, grandparents, grandparents-in-law, spouse, siblings CPF SA/RA and CPF MA

Another big thing is also that your VCMA or Medisave top-up amount is no longer limited by your CPF Annual Limit (about $37,000).

So your VCMA and RSTU is independent of that $37,000 limit.

The impact is that you have much more variation in practising tax relief.

For example, if you have reached full retirement sum, you have a small window at the start of the year to top up your CPF Medisave and enjoy tax relief, up to the Basic Healthcare Sum (BHS).

You could then top-up your spouse’s CPF SA if your spouse has been a full-time homemaker for a while.

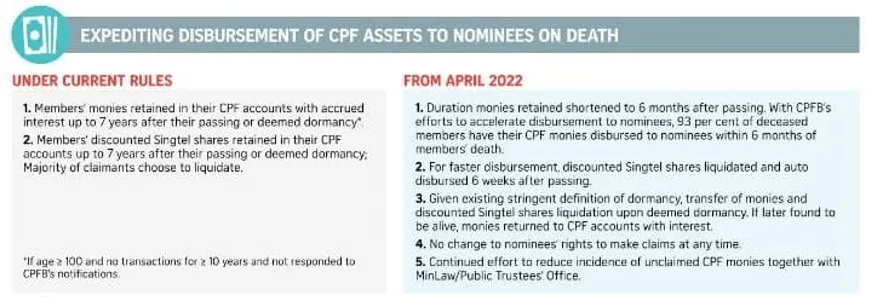

Expediting Disbursement of CPF Assets to Nominees on Death

CPF is also streamlining the administration of how unnominated CPF funds that is less than S$10,000 are disbursed.

Currently, all eligible beneficiaries must submit their information and supporting documents to the Public Trustee’s Office (PTO) under the Ministry of Law.

Ministry of Law feedbacked that many said the process takes significant time and effort and can be streamlined if the amount is not too big.

In the latest update, a representative may be appointed to represent all eligible beneficiaries and make a consolidated claim for the deceased CPF member’s unnominated CPF monies.

If there is a dispute over the nomination, the PTO will not proceed until a consensus has been reached. So an agreement between the surviving heirs is important. If die die there is no agreement, then the family will need to submit the application under the normal administration.

With all these changes, it means that there is no longer a need for CPF to retain unclaimed CPF monies over a long period (up to 7 years). CPF will shorten this duration to six months after CPF is notified of the member’s death.

Should a nominee not make a claim in 6 months, the money will be transferred out of the deceased CPF account. no interest will be payable from then.

However, nominees continue to have the claim to the nominated monies at any time. If CPF finds a dormant member alive, CPF will restore the monies to the member’s original accounts with interest.

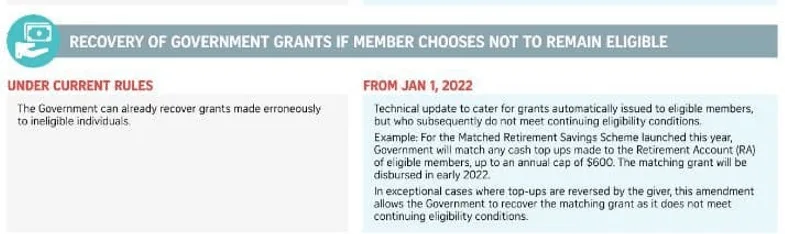

Claw Back of Government Grants if You Try to Game the System

The last change is more to close any loopholes if people try to game the system to obtain Government grants. If you are no longer eligible to receive the government grant, this amendment allows the government to claw back the grant.

Overall, these changes should not be too deep of an impact on most of our lives.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Should I Take Less Risk in My Fixed Income Allocation by Moving Away from a Global Aggregate Bond ETF? - May 5, 2024

- Singapore Savings Bonds SSB June 2024 Yield Climbs to 3.33% (SBJUN24 GX24060A) - May 3, 2024

- New 6-Month Singapore T-Bill Yield in Early-May 2024 to Stay at 3.75% (for the Singaporean Savers) - May 2, 2024

kola

Friday 5th of November 2021

for the top-up/voluntary contribution: currently there is SA top-up 7k + MA top-up 3k(or the annual increase in BHS, if done at beginning of year). total tax relief = 10k

with the change, is the tax relief now cap at 8k? ie. lower? (assuming top-up can only be for self)

Kyith

Friday 5th of November 2021

I think you can consider it lowered. To be fair thanks for reminding me. I also forgot there is that 3k limit.

Lee Jackie

Wednesday 3rd of November 2021

May be on the time shifting part. It could be the fact that housing is becoming more expensive and loans might take longer to pay off and members might want to keep more in OA for that purpose as they work longer.

Kyith

Wednesday 3rd of November 2021

Hi Jackie, very good point. could be due to this. I know if you have shifted to SA, you can approach them and tell them you wish to set aside more in your OA to pay off the mortgage. I am less sure about setting aside for CPF Retirement Account.

Kenny Goh

Wednesday 3rd of November 2021

“ If the money stayed in OA and SA longer, you could potentially compound your money in your investments at a higher rate of return.”

I was thinking that keeping money in OA & SA would result in lesser compounding interest as the interest rate is lower than RA due to the additional 1-2% for the first $60k?

Kyith

Wednesday 3rd of November 2021

Hi Kenny, you are right. But keeping it in OA and SA allows you to invest at a higher rate. I was thinking its due to this but we cannot be 100% sure what they are thinking.