The financial industry is currently experiencing big changes.

Digitally savvy millennials and digital natives are now prominently featured in the wealth management market and becoming a principal target of wealth management firms. They are born in the digital age; as such, they have different expectations and needs for financial services from their forebearers.

- They rely more on mobile devices. More of them grew up alongside the Internet and mobile phones.

- They put their trust in technology first, then in licenses. They grew up with technology companies and witnessed the great changes and impacts of technology on our community.

- They pursue faster and smoother experiences. Unlike previous generations who focus solely on metrics like returns, investment horizons, or investment risks, the younger investors focus more on the consultation process, ease of purchase, and after-sales interactions.

Technology’s influence is not limited to the younger wealth builders. The digital-savvy natives are influencing how their parents and older peers consume their financial services.

Established financial service providers, such as OCBC, recognize this, and they have begun delivering wealth solutions that closely matches what we’ve been looking for.

In the past 4 years, we have seen a few digital-first advisory platforms sprout up on our shores, namely Smartly, AutoWealth, Stashaway, Endowus, Syfe and MoneyOwl. We have seen established players like Kim Eng, CIMB CGS and DBS making a greater push to revamp their offerings to cater more to our changing needs.

OCBC recognizes that there is a need to shift their wealth management delivery to be more digitally-focused in order to provide a seamless experience.

Today, I will share with you OCBC’s RoboInvest platform and the portfolios you can invest in to build your wealth.

How does OCBC RoboInvest Work?

OCBC understands that we have our investment leanings. Thus, they collaborated with a few of their trusted partners to design RoboInvest as a platform that allows us to easily execute our investment.

Through RoboInvest, you will be able to invest in different types of portfolios curated by their investment team to capture the portfolio returns. If you are an existing OCBC client, you can immediately access OCBC RoboInvest now via the OCBC app or internet banking and explore the portfolios put out by the investment team:

Once you log in to your OCBC Mobile Banking App, you can navigate based on my directions above. You should not have a problem getting to the RoboInvest screen. You can also access RoboInvest through the web on your desktop.

If you are currently not an OCBC customer, it is time to sign up with them to try out the assortment of banking and investment services they offer.

I would categorize OCBC’s Robo implementation to the group which is more investment-focused. Some Robo platforms allow you to cover different aspects of your financial life, and the option of a human adviser should you require. There are also Robo platforms that prefer to offer you more investment products based upon their sophisticated investment philosophy and deliver the investments through a Robo experience.

OCBC RoboInvest falls closer to the latter.

OCBC does not just offer funds and insurance plans. Their RoboInvest platform allows you to invest in various portfolios curated by their investment team. Let me introduce some of these portfolios. I will break them up into two groups: the Core Portfolios and the Thematic portfolios.

Core Portfolios to form your Foundation

A buy-and-hold investor would need a set of core holdings in their portfolio. These core holdings are the foundation of your wealth. Your core strategic allocation should reflect your risk appetite and your risk capacity. Your risk capacity is determined by the health of your financial situation and how long until you need to harvest your portfolio for your financial goal.

The strategic allocation will direct a large percentage of your long-term returns. A higher equity allocation will give your portfolio a higher probability of higher returns, but also higher volatility. A lower equity allocation will mean more stability but at the expense of higher returns. For some with lower risk tolerance, this lower equity allocation would make your investing experience more liveable and allow you to stay invested.

OCBC’s investment team has adopted a quantitative approach in their investment strategy. OCBC RoboInvest uses well-tested algorithms to create and manage a variety of portfolios. Their quant algorithms process over 60 different factors across quality, value, momentum, growth, and volatility. The algorithm constantly assesses the factor premiums, weights of the portfolio, candidates to add to the portfolio and candidates to be removed from the portfolio. The portfolio is reconstituted during the periodic rebalancing (quarterly/ semi-annually) based on these algorithms.

Currently, there are 36 different portfolios available for you to choose from. Out of the 36 curated portfolios, there are 6 portfolios suited to form your core strategic allocation.

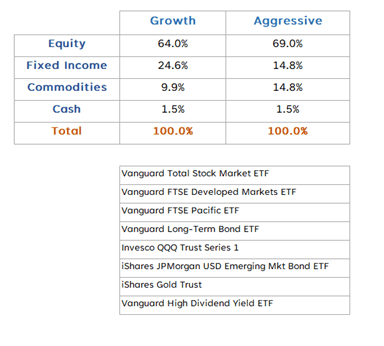

The table below shows two of the six strategic portfolios:

“Growth” and “Aggressive” portfolios are more suitable for investors with higher risk tolerance and a longer time horizon. The portfolios are made up of low-cost ETFs that are listed in the United States.

The two portfolios differ in terms of their equity, fixed income and commodities allocation.

The Growth portfolio has a higher allocation of fixed income compared to the Aggressive portfolio. Otherwise, both portfolios have the same ETFs.

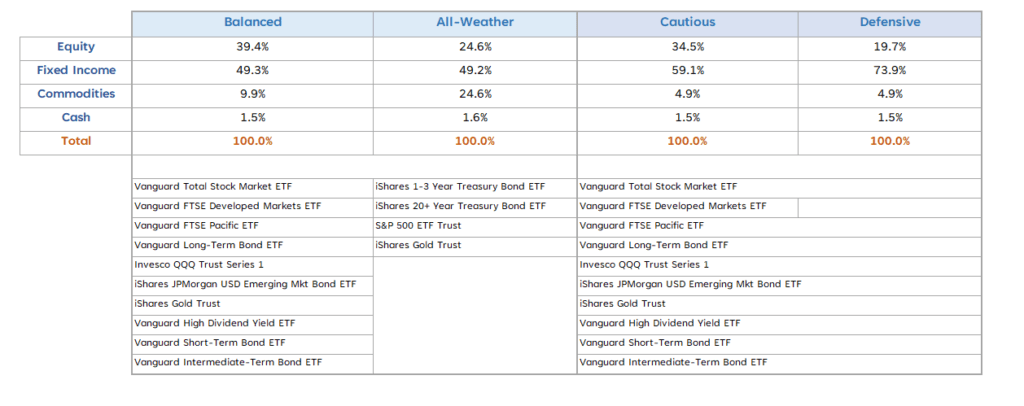

Here are the rest of the 4 portfolios that might be suitable to form your strategic allocation:

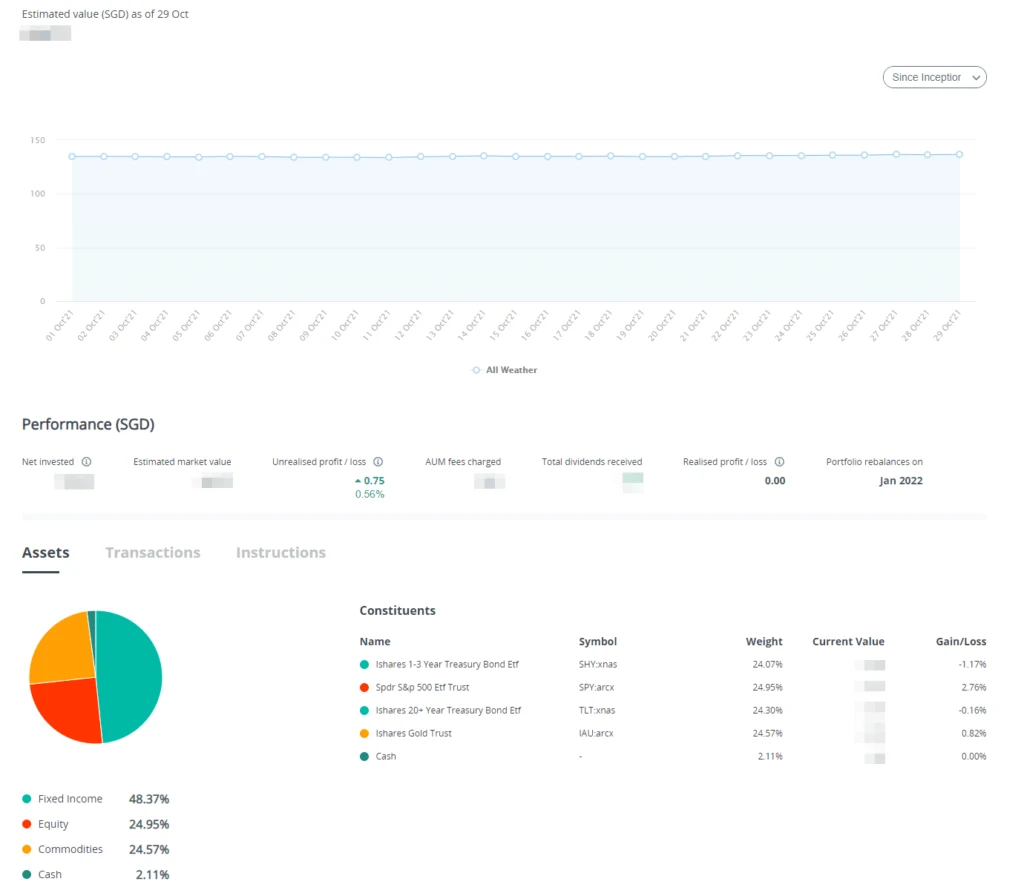

The “Balanced” and “All-weather” portfolios are suitable for investors with a moderate risk appetite. The All-Weather portfolio is OCBC’s risk parity implementation. The portfolio should result in lower volatility, at the expense of lower expected returns.

The “Cautious” and “Defensive” portfolios are more suitable for those who are more risk-averse and conservative. They may also be suitable for investors who have a more cautious view of the market and would like to be more defensive.

In terms of the ETFs used, the Balanced, Cautious and Defensive portfolios use the same ETFs as the Growth and Aggressive portfolios. The All-Weather portfolio uses a different set of ETFs.

These portfolios are automatically rebalanced on a semi-annual basis.

You may notice that for all portfolios, there is a cash allocation. If I am right, that cash allocation is to ensure that there are enough monies to pay for the annual management fee. If there is not enough cash, OCBC will sell some of the ETF units to pay the management fee. But given OCBC’s auto-rebalancing system, there should always be an allocation to pay for the management fee.

Thematic Portfolios to Express Your Personal Investment Opinions

The investment team’s investment philosophy and factor screen across different geographical regions and sectors result in a range of thematic portfolios for you to choose from. It allows you to capture the upside (as well as the downside) of companies that you think may do well. Many of these portfolios revolve around themes that are in the news today. Let me give you some examples.

Some of you may have different views of the world, but most of you think that technology is going to be the future. In the future, many aspects of our lives will be tech-enabled, but it does not mean that every technology sector will do well at the same time.

For example, companies involved with delivering software-as-a-service, in general, did well year-to-date. However, companies involved with solar energy and electric vehicles, in general, have stalled out.

While software-as-a-service in the United States have done well, China technology has undergone some massive correction after a massive run-up at the start of the year.

You may feel that some of these sub-themes is going to do well in the future and it would be the right time to invest now.

RoboInvest has a few curated portfolios that allow you to capture the returns of these themes.

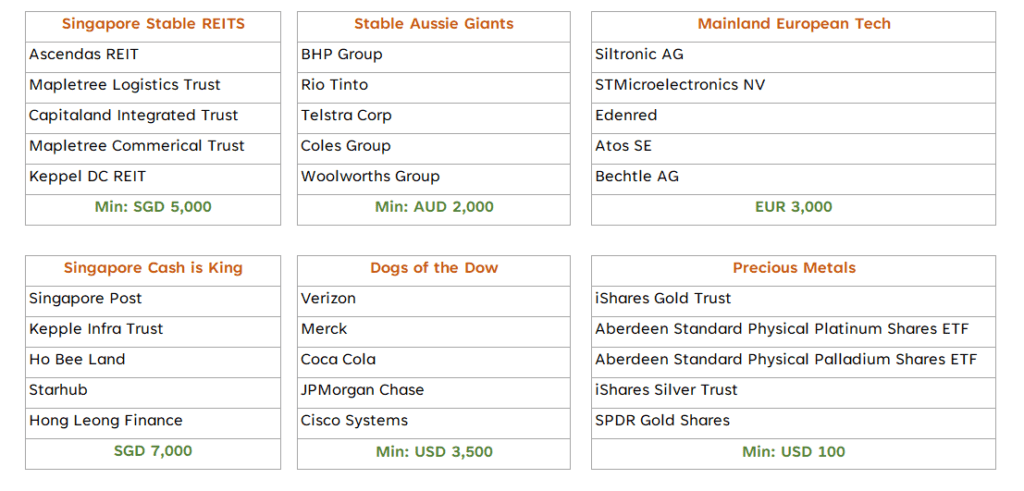

Here are 6 of the 36 portfolios available on RoboInvest today. I have listed the top holdings of the portfolio and the minimum amount to be invested in the portfolio. These few portfolios are related to one another by their association with the technology theme. But each of them is focused on different areas.

One thing you may notice is that 5 out of the 6 portfolios mentioned above are invested in individual securities. Thus, it is important to note that when you invest in these portfolios, you are not investing in a portfolio of ETFs or unit trusts.

OCBC is actively managing these securities as a portfolio. The holdings of the portfolio reflect the investment philosophy of the manager. If you invest in these portfolios, you will be exposed to the sectorial returns and the risks, but your returns would not mirror that of the sector index. Your returns will be determined by the securities selection of the manager.

In addition to tech, OCBC RoboInvest has other portfolios curated around themes and some of them have very interesting names such as “Singapore Cash is King”, “Dogs of the Dow” etc.

Some may wish to own REITs but do not wish to manage them and would like to delegate that job. There is a portfolio for that.

Dogs of the Dow is a very popular value investment strategy where we rank the United States DOW component stocks by the highest dividend and buy those higher dividends yielding stocks. Some of you believe picking stocks this way over time may yield a value premium.

With RoboInvest, you can implement something like this without having to screen, invest and rebalance on a frequent basis yourself.

You can review the rest of the portfolios available here.

Deciding Your Overall Portfolio Allocation

Now that we have discussed both core and thematic portfolios, how do we put them together? Here are some suggestions from my experience.

Generally, most of us can just make do with core portfolios. If you wish to capture market returns, you will need to set up a suitable core portfolio allocation. The ideal core portfolio is one that matches your risk tolerance and your risk capacity.

For example, my risk tolerance is moderate (believe it or not) and for my goal, my time horizon is greater than 15 years. Thus, my risk capacity is on the high side.

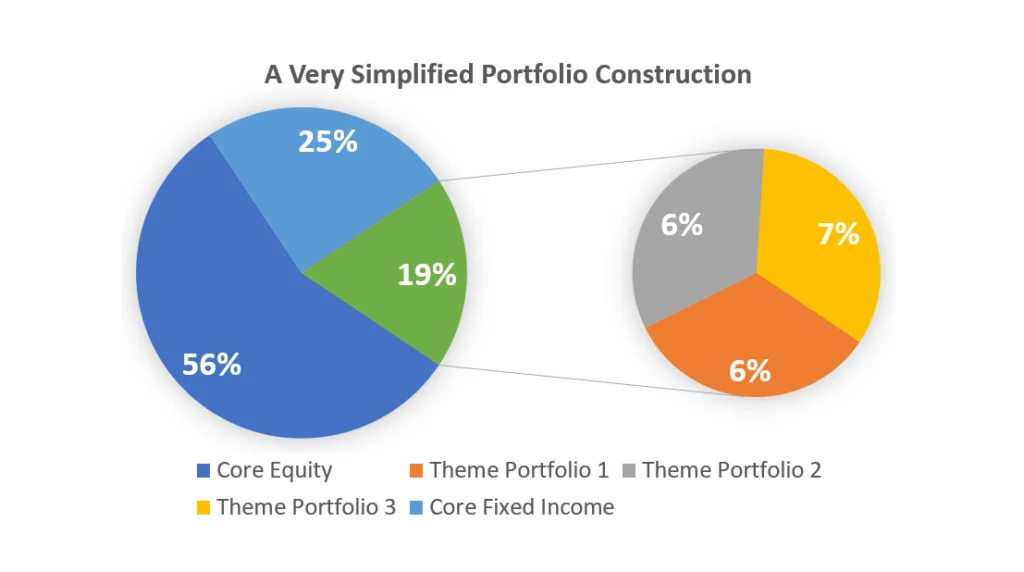

An ideal portfolio that matches this risk tolerance and risk capacity is a Growth portfolio. 75% of the allocation is made up of equity and commodities and 25% make up of fixed income.

I could implement this with:

- 1 x balanced portfolio

- 3 x thematic portfolios

This would be enough to give us a portfolio allocation roughly like this.

The portfolio allocation respects your risk tolerance and allows you to express some of your investment opinions, but not let it dictate a large portion of the returns.

If you have less capital, perhaps stick with a core portfolio allocation or just one or two thematic portfolios. What is suitable for me may not be suitable for you. Thus, you would need to come up with your ideal portfolio allocation so that your wealth is balanced with your needs.

Under the Hood of OCBC RoboInvest

OCBC works with a couple of partners for their RoboInvest platform.

To ensure that you have a good experience with OCBC RoboInvest, they work with a local fintech company, WeInvest, to give you a user-friendly, goal-based onboarding experience.

When you have decided to invest, you will be prompted to perform certain onboarding actions, such as assessing your risk tolerance and recording your goals. After the onboarding, it is important that you are able to check the performance of your portfolio, the past transactions and seamlessly approve any rebalancing instructions.

WeInvest is the partner that makes it possible.

OCBC also works with Saxo Markets to execute the trades for your investments. Saxo is also the custodian of your investments. An omnibus main account is opened by OCBC with Saxo. OCBC will designate a sub-account with a unique identifier for your securities under this main account. The overall name in the main account is OCBC. By signing the agreements to invest with OCBC RoboInvest, you will have to agree to designate the right to purchase, sell, and hold securities to OCBC.

How to Invest with OCBC RoboInvest

I went through the onboarding process as an existing OCBC client and must say the process is rather smooth.

Before I invest, I had to go through the Customer Account Review (CAR) process.

I decided to invest in the All-Weather portfolio because I am always intrigued about the return versus risk profile of an all-weather portfolio.

There is adequate historical research that shows a portfolio with balance allocation to short-term bonds, long-term bonds, equities and commodities creates a portfolio of much lower volatility (in terms of standard deviation). The portfolio gives up some returns, but the investing experience may be much more liveable for some investors.

My portfolio was good a couple of days later after I initiated the All-Weather portfolio transaction. The portfolio is funded directly by CASA. The actual trade execution of the portfolio component takes place when the market is open.

The great thing is that the amount you need to start can be very small. If you have at least USD 100 (SGD 136) in your bank account, you can invest in the core portfolios. However, to invest in the thematic portfolios, you may need a larger initial investment sum (you can refer to the minimum sum provided in the selected portfolio above in my thematic section).

RoboInvest also automates the process to dollar cost average into different portfolios with their Monthly Investment Plan (MIP). Typically, investors find that brokerage platforms do not have a process that allows them to dollar cost average into a particular group of stocks automatically without them being aware of it.

If you are able to remove yourself from the decision making, it would reduce the tendency for you to deliberate on buying when the portfolio goes down over time. With MIP, investors will be able to invest systematically.

Unlike insurance endowment plans and investment-linked policies, there is no lock-in period or surrender charges. You will have the flexibility to sell some of your investments or all your investment as and when you want to.

What are the fee charges like?

OCBC charges a service fee of 0.88% a year on the total value of your investments held with OCBC RoboInvest. This fee does not include clearing, exchange and stamp duty/fees that are levied by the individual exchanges where the underlying stocks trade on. If there is a need for currency conversion, those charges are not included as well.

Learn more about OCBC RoboInvest today

Whether you are a new investor or an experienced investor, you may be able to find a few portfolios that match what you are looking for.

OCBC understands that to engage investors who demand a certain level of digital quality of service, they need to improve the way we connect with our investments. Working with partners like WeInvest and Saxo show their willingness to work with partners specialising in their field.

You can explore RoboInvest with as little as USD 100 today.

This article is sponsored by OCBC but the views belong to the author. It should not be taken as investment advice.

Important information

This advertisement has not been reviewed by the Monetary Authority of Singapore.

- Any opinions or views of third parties expressed in this document are those of the third parties identified and do not represent views of Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”).

- This information is intended for general circulation and / or discussion purposes only. It does not consider the specific investment objectives, financial situation or needs of any particular person.

- Before you make an investment, please seek advice from your Relationship Manager regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs.

- If you choose not to do so, you should consider if the investment product is suitable for you, and conduct your own assessments and due diligence on the investment product.

- We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participating in any trading or investment strategy with you through this document. Nothing in this document shall be deemed as an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy.

- No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake any obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice.

- OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

- Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- The information in and contents of this document may not be reproduced or disseminated in whole or in part without the Bank’s written consent.

- OCBC Bank, its related companies, and their respective directors and/or employees (collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

- You must read the Offer Document/Indicative Term Sheet/Product Highlight Sheet before deciding whether or not to purchase the investment product, copies of which may be obtained from your relationship manager.

- Any hyperlink to any third-party article or other website or webpage (including any websites or webpages owned, operated and maintained by third parties) is for informational purposes only and for your convenience only and is not an endorsement or verification of any such article, website or webpage by OCBC Bank and should only be accessed at your own risk. OCBC Bank does not review the contents of any such articles, website or webpage, and shall not be liable to any person for the same.

- There are links or hyperlinks which link you to websites of other third parties (the “Third Parties”). OCBC Bank hereby disclaims liability for any information, materials, products or services posted or offered on the website of the Third Parties.

Collective Investment Schemes

- A copy of the prospectus of each fund is available and may be obtained from the fund manager or any of its approved distributors. Potential investors should read the prospectus for details on the relevant fund before deciding whether to subscribe for or purchase units in the fund.

- The value of the units in the funds and the income accruing to the units, if any, may fall or rise. Please refer to the prospectus of the relevant fund for the name of the fund manager and the investment objectives of the fund.

- Investment involves risks. Past performance figures do not reflect future performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

For funds that are listed on an approved exchange, investors cannot redeem their units of those funds with the manager, or may only redeem units with the manager under certain specified conditions. The listing of the units of those funds on any approved exchange does not guarantee a liquid market for the units.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024