Some how the balloting results of Prime US REIT (analysis here) gives me the eerie feeling of the IPO of HPH Trust.

Here are the balloting results released yesterday night:

Basically if you have applied for any amount that is 99,900 units and below, you get what you applied for.

There is one person who applied from between 500,00 to 999,900 units. He got 325,000 units. There is another person who applied above 1 million units, and he got 625,700 units.

They were initially only catering 16 mil units for the public offer with the rest for placement but in the end allocated 41 mil units for this.

I always have an idea within my portfolio how big a stock or a financial asset will make up my portfolio. If it is too big, how I would reflect upon it and what are the decisions that I would take on it.

I do not know how well things will go, or how poorly it will go. However, over time, I realize that if I do not have a good handle of things, I will usually keep within the rules that I set, which tend to be fundamentally sound. For things I know less about, control the portfolio allocation of it.

Suntec REIT’s acquisition of 55 Currie Street

Suntec REIT is expanding its portfolio in Australia.

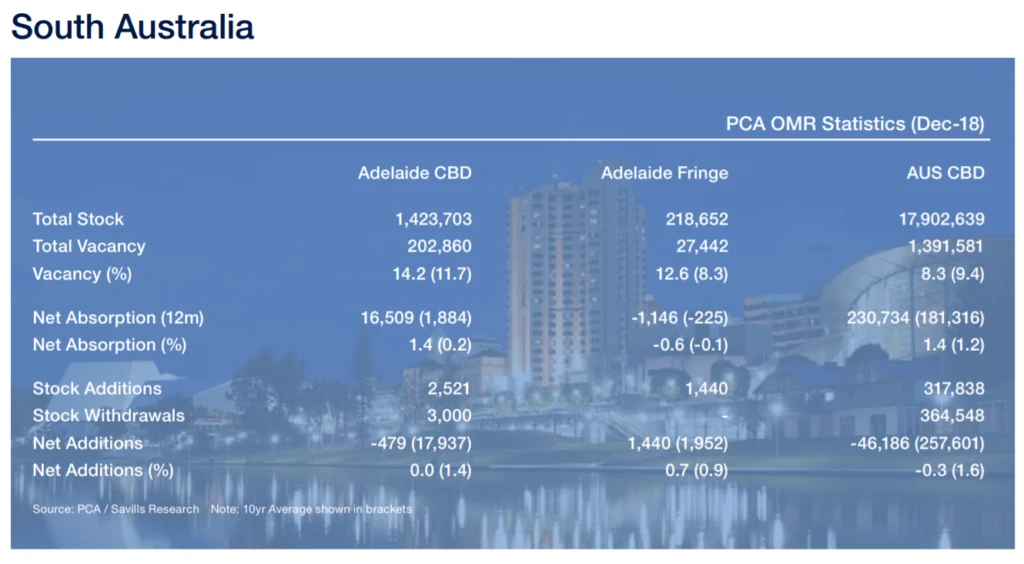

In the latest announcement, they are acquiring a 100% stake in 55 Currie Street, in Adelaide for A$148 mil.

This building is located in the core CBD and it is a 12 story, freehold, Grade A office built in 1988. There was a major asset enhancement in 2018.

The WALE is 4.4 years, with a 91% commitment by reputed tenants such as:

- Allianz

- South Australian Government and Commonwealth Government

The net property income yield they announced is 8%. This looked really good, but they factored in 100% occupancy and a 27 month rental guarantee for vacant spaces. The current occupancy is only 91.6%. It might be that they are quite confident of fully renting out all the spaces.

The lease comes with a 3.5% to 3.75% rental escalation.

This acquisition will add 0.8% to the pro-forma dividend per unit.

It is funded by their recent $200 mil placement.

The NPI yield they announced is higher than market rent in the area.

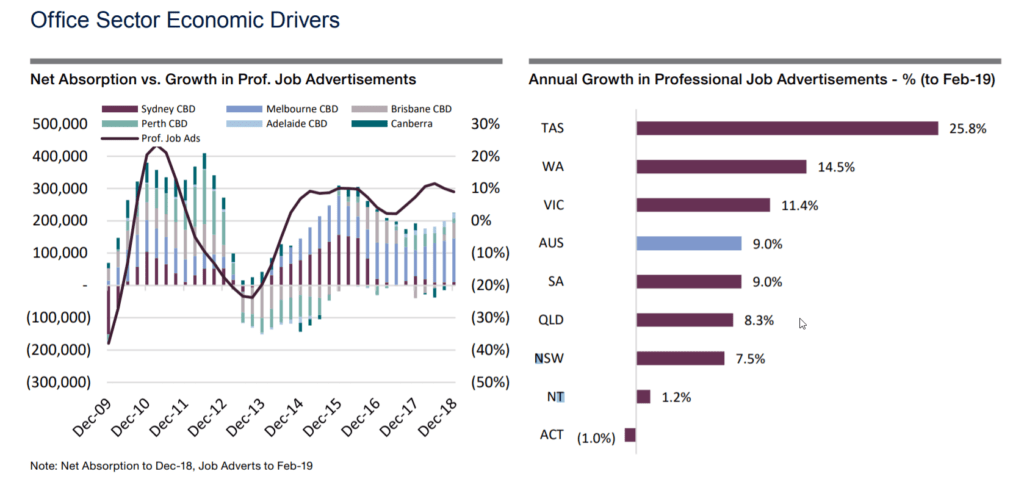

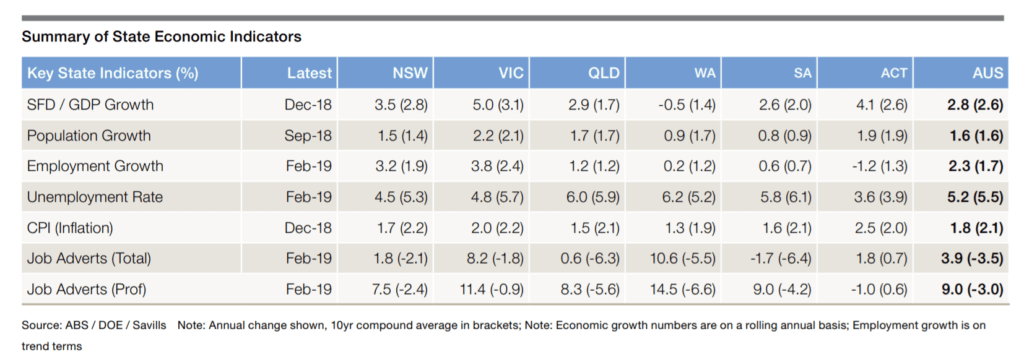

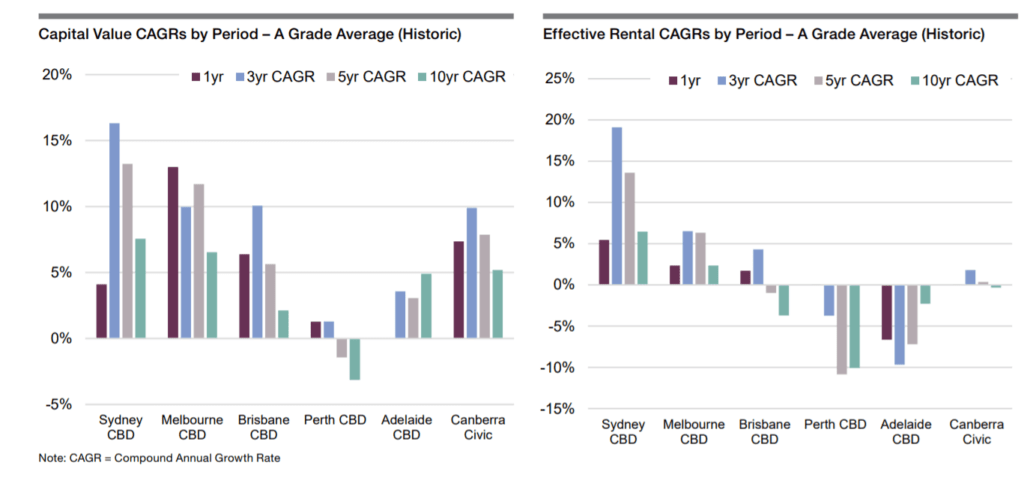

Adelaide, according to my friend is a sleepy town, and from my news flow it seems we should bet on greater developments in Brisbane (other than Melbourne and Sydney) as a possible growth area.

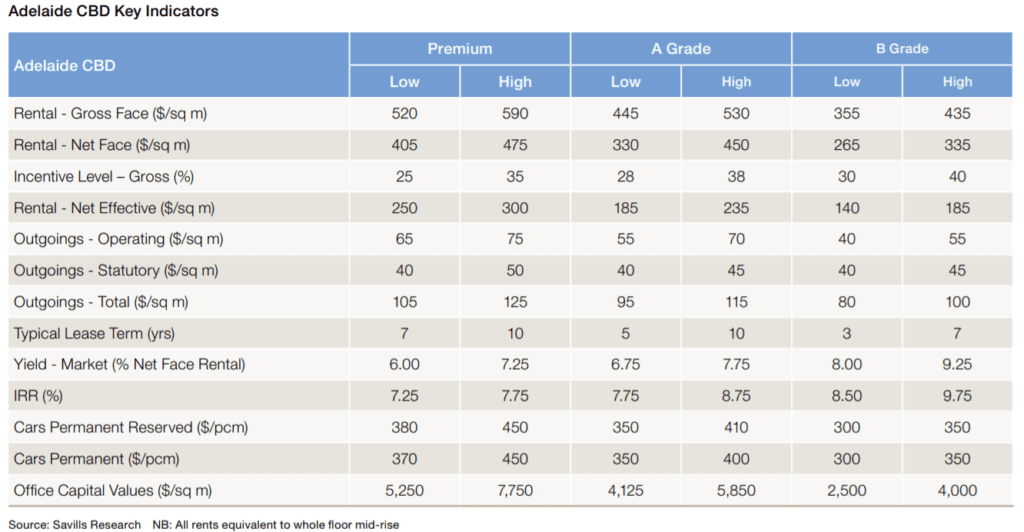

So here are some of the 2019 Q1 data that I gathered.

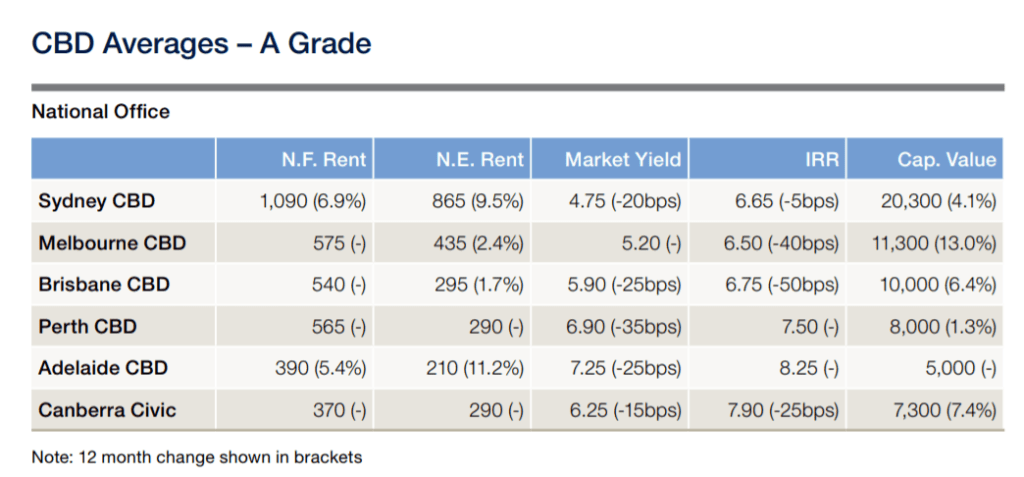

If we observe the market yield, this acquisition looks to be above the market yield of 7.25%. This definitely is one of the highest yielding area and why it will be yield accretive for office REITs looking for yield accretive acquisition. The question is how many quality, yet yield accretive ones can we find?

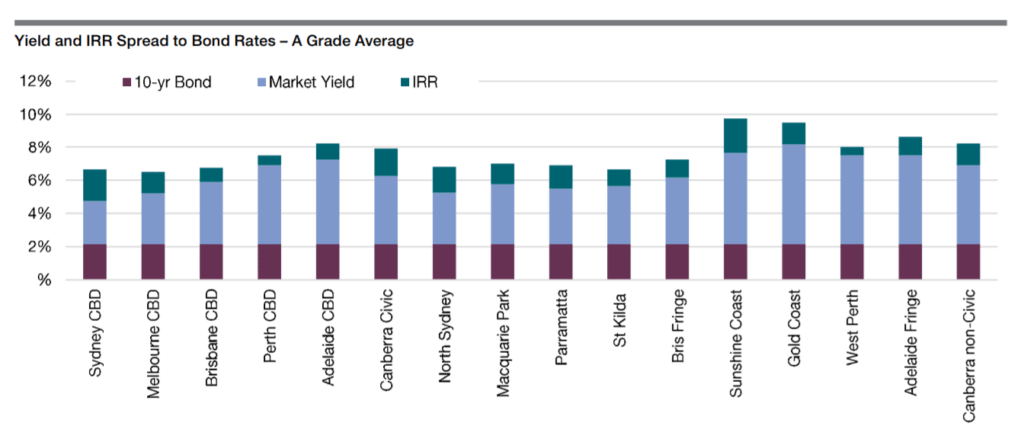

Focus on the South Australia (SA) data versus the rest.

I write more about investing in REITs in the link below

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.