About a couple of years ago, my colleague and I conducted an internal webinar open to clients’ children. We wanted to do something like this because their parents most likely want them to start their adult life journey with a solid foundation.

In preparation for the webinar, we surveyed the millennials aged 19 to 34 on a few things. One of the questions we asked was their motivation to pick up this kind of financial stuff.

Here are the results:

There were a couple of things from the survey that was surprising.

The first one was how much they wished to be “independent” from the grips of financial advisers. I was surprised by the level of distrust they had for financial advisers.

The second was the number who wished to attain financial freedom. Times seem to have changed. If this was ten years ago, I can confirm that not many of us would know this financial freedom concept so well.

But I think this financial concept has been bandied around in the media enough such that more people are interested.

Why We Should Aim for Smaller Milestones instead of Trying to Get to the Ultimate Goal

Depending on where you are, financial freedom may be something that is very far out of reach, especially if you have just started climbing the corporate ladder. When your income is lower, it might be difficult to envision where your income would climb.

There is a reason why many are not motivated to save for retirement. The goal is so far away, and the sum of money required is so extensive that you wonder why would you save for something so far away when you can give yourself a better life by spending the money today.

To reach financial freedom, perhaps it is better if we can reach each challenging but achievable milestone first. Slowly but surely, we can get ourselves to a better position.

Our Money can be Very Useful to Us Even if We Fail to Attain Financial Freedom.

Money can be very helpful to your life, even if the amount of money you have is not able to create a recurring passive income.

For example, if you have accumulated five years of annual expenses, that gives you a lot of optionalities.

While this amount of wealth does not last you forever, if you are trapped in an industry that you do not like, that is enough money for you to risk a career transition into another industry.

Presenting The 11 Stages of Wealth

I first created these 11 stages of wealth to present a ladder so that you can measure the wealth-building journey that will be useful for you.

You can also look at where you are compared to others in a way that takes out the absolute dollar figure.

Someone can achieve financial security with less than a million, while someone who is vastly richer might not even have ten years of his annual expenses saved.

Where you are on this ladder and your struggles with it will stir a different conversation between your peers.

Each stage of wealth on this ladder either:

- It gives you some degree of psychological freedom

- Your level of wealth provides a certain level of immediate use

You should aim to level up to a further stage.

The higher you go, the more useful your wealth would be.

Let us go through these stages one by one.

Stage 0: Financial Dependent

A financially dependent person simply has a lot of baggage.

Firstly, he or she has to depend on others for survival, for extravagant things, or to take care of daily expenses.

A Financially Dependent person has a negative net worth, meaning his assets are less than the liabilities.

Let me explain briefly what is net worth. The following is how you calculate net worth:

Net Worth (Equity) = Assets – Liabilities

Net Worth is usually used to determine if a person or entity is in good financial shape.

The Assets are the stuff that:

- Produces current cash flow or potential to produce future cash flow. You as human capital, investments, savings, insurance savings, investment bonds, and properties are some examples.

- Have a value that you can sell off in exchange for money. The value will depend on how much people are willing to pay for it now. This can be whatever value that is left of the car, the home, your stamp collection, your collectables, or your gold and silver coins.

The Liabilities are

- Outstanding mortgage Debts you took on your home

- Mortgage Debts that are outstanding that you took on your investment properties

- Debts that you borrowed as part of a leveraged insurance savings plan

- Credit Card Debts that you have outstanding

- Unsecured Debts that you borrow from a money lending agency (legal or not legal)

- Debts that you borrow from family members, friends, and relatives

- Debts on the purchase of your car

A Financially Dependent person has to borrow consistently from banks, institutions, friends, and family for the lifestyle that he or she lives.

You might see him always driving the newest cars, switching from an HDB flat to a condo, and bringing his family on European holidays for three years.

If you assess his net worth, it might be a different story.

Secondly, a financially dependent person cannot keep his cash outflows below his cash inflows. In other words, a financially dependent person has a negative net cash flow.

Net cash flow is calculated as:

Net Cash Flow = Cash Inflow – Cash Outflow

Cash Inflow is:

- Disposable Income

- Dividend Income from Dividend Stocks

- Business Income from Side Businesses

- Interest Income from bank savings, deposits

- Cash Payout from insurance savings endowments

- Systematic annual selling of investment assets

Cash Outflow is:

- Basic Survival Expenses. These are the expenses that, without them, you and your family can’t survive well

- Rich Living Expenses. These are the expenses that you do not need to survive but they make your life feel RICH

- Repayments for Liabilities

A Financially Dependent person is likely to have a negative net cash flow.

How can a person spend more than he or she earns?

You can do that by borrowing from others.

You can get your family to pay for your house or give you an allowance. The latter is a good situation to be in.

They are dependent on friends and family members.

When you depend on others, the person has some hold over you.

In this case, they are your friends, boss, company, and the banks. If they are not happy about something, they can push that situation on you to create stress in your life.

Can a person be having a positive net worth yet net cash flow negative?

Yes. The person may have assets that are of value, but his family members are servicing his assets.

He may also have lost his job, move on to a lower-paying position, but still kept his cars and big house, but having a very problematic time servicing his home.

Can a person have a negative net worth yet net cash flow positive?

Yes. The person owes some debt, but he is keeping within payment which is a good thing. The person may be conscious of paying down the debt or building up the assets.

He could be taking on debt for studies to earn more in the future.

These are good debts.

But is the person dependent on banks or family members at this point? Likely yes.

Financially Dependent can be good or can be bad; we are not demonizing people at this stage. It depends very much on what the person builds up in his assets.

Related: Read my Comprehensive Guide to Your Personal Net Worth Statement and Your Personal Cash Flow Statement

Stage 1: Financial Solvency

If a financially dependent person proceeds to improve how he or she manages the wealth, they or becomes Financially Solvent.

When they achieve Financial Solvency:

- Their net worth can still be negative, but they stop taking on more money from unsecured lending, friends and relatives, or parents

- They are not behind on their liabilities payments. This means their net cash flow is positive.

A financially dependent person and progress to this stage show either higher motivation, a change in their money beliefs and values, or a more conducive environment that assists them to realize they need to be more responsible.

The main benefit a financial solvent person gets is the freedom from the anxiety that comes from being behind on his or her bill payments. This is a psychological benefit.

If you owe people money, yet do not have the cash flow to pay, you may have to exercise extra discretion to avoid certain people to that you owe money. It might be okay for a while, but as time passes, this will become taxing on your family and you.

As their net cash flow is positive, they can start investing money to build wealth, paying down more debts, or saving for some goals.

Stage 2: Financial Stability

A person proceeds to achieve Financial Stability when they manage to build up some emergency funds.

A person’s emergency fund is more important than paying off all his or her debts.

Without the emergency fund, a financially solvent person would be paying off his debts with all his net cash flows and one hospital emergency, and he would have to turn to his credit card or other family members for help.

An emergency fund of $3000 helps a lot, even if it is not the full amount we usually recommend.

You can read this comprehensive guide that I wrote to find out how an emergency fund works and how to build it up.

A person that achieves Financial Stability tends to have achieved Financial Solvency as well.

Stage 3: Debt Freedom

Debt Freedom is achieved when a person can pay off all his or her debts.

That seems drastic because, for most people, their mortgage is 25 to 30 years, which means it will take a long time to be free from debt.

However, we tend to consider Debt Freedom to be achieved when the person paid off all their high-interest debt EXCEPT mortgage debt.

So if you have a sensible residential mortgage, you can consider that you have attained debt freedom. A sensible residential mortgage is one where you can comfortably pay the mortgage from your income without compromising your life too much.

Freedom from debt is important because debt is money owed for what you spent last time. The more debt you have, you will be spending on paying off your spending last time, which leaves you with less money for your spending today and in the future.

A person who achieves Debt Freedom tends to have achieved the previous two stages.

Stage 4: Accumulated 1 Year’s Worth of Annual Expenses

You have cleared most of your outstanding debt that is high interest, leaving you with low-interest mortgage debt.

It is time to start accumulating wealth.

You can follow my Wealthy Formula. This is the formula for how most people build wealth. The gurus you encountered will say the same thing.

The first milestone in wealth accumulation is to accumulate one year of annual expenses.

It is popular in the urban culture to have $X so that you can fire your boss and tell your company off.

Basically, you have more control over your situation versus when you are a slave to debt and your job.

Suppose last year, you spend about $25,000/yr in expenses.

The first wealth accumulation is to build up this $25,000.

Once you attain this, you have a little optionality. Suppose you think there is much more to your capacity if you leave this job and focus on a separate work domain.

You can make this fork because you are alright for one year.

Stage 5: Accumulated 5 Years’ Worth of Annual Expenses

This is similar to Stage 4, but you have built up five years’ annual expenses.

Suppose your annual expenses still hover around $25,000/yr. If you achieve $125,000, you might be able to take that sabbatical for two years and then come back to work.

Alternatively, it can be viewed as you got a 5-year extension to make some life or work projects work.

Stage 6: Accumulated 10 Years’ Worth of Annual Expenses

Stage 6 builds upon the work of stages 4 and 5.

At stage 6, you would have accumulated a larger sum than in the previous stages. You will try to build up ten years of your annual expenses.

Suppose your annual expenses hover around $25,000/yr. If you build up to $250,000, you have ample financial room to manoeuvre.

The difference between this stage 6 and the next stage (stage 7) is that stage 7 requires your wealth machine to provide cash flow while leaving the capital intact.

Stage 6 looks as though you will spend down your principal capital.

Ten years of annual expenses are synonymous with a couple building up money so that one spouse can be a stay-at-home mom for ten years.

Stage 7: Financial Security

As you accumulate wealth, your wealth can be put into financial assets that you can manage competently.

We call this your Wealth Machines.

When the person develops these Wealth Machines, their wealth fund would grow and be able to distribute wealth cash flow either by selling off assets systematically or in the form of interest income, dividend income, and business income.

Financial Security is reached when your Wealth Machine(s) can provide a wealth cash flow greater than your annual essential expenses.

Your essential expenses are not all your current expenses. Your essential expenses are the minimum goods and services you need for your family to function at the bare minimum level. There are usually fewer luxuries or items for the rich living here.

You can learn more about what is considered essential and less essential in this survival expenses guide.

Here is an example that you can use to guide you in calculating the amount you need to be financially secure:

- Your total annual expenses are $25,000/yr.

- However, out of this $25,000, your essential expenses are only $14,000/yr. This is the amount that your family needs to provide an okay but not great lifestyle.

- If your wealth machine can provide a rate of return of 7% a year, you can take a wealth cash flow of 4% a year. You will need to accumulate $14,000/0.04 = $350,000.

With $350,000, you reach some sort of financial security. You keep your capital relatively intact, while you can conservatively cover your annual survival expenses.

Financial Security is a very attractive stage to me because it gives a person optionality.

Security with wealth enables the person to make a riskier career move without worrying too much about the repercussions, taking a break from work, or pivoting to semi-employment.

The person does not have to give a crap about how the boss thinks when his basic survival is not determined by the moods of his or her boss.

In the Financial Independence space, Financial Security is very similar to a type of financial independence known as LEAN FIRE.

LEAN FIRE stands for Lean Financial Independence Retire Early.

Instead of aiming for the wealth assets to be able to provide a wealth cash flow that covers all your annual expenses (stage 8 later), LEAN FIRE aims to achieve this by covering their basic necessary expenses with less money.

Related: How much wealth do you need to achieve financial security, financial independence, and retirement?

Here are some expectations about your wealth machine:

- The long-term annual rate of return of your wealth machine should be reasonable. The rate of return should be conservative enough based on what the average wealth builder can achieve, and we should not push the rate of return just to fit the target and duration we want

- The wealth cash flow, distributed from your wealth machine, should be less than the annual growth of your wealth machine (which grows at the annual rate of return). This is because the wealth machine needs to distribute cash flow and have enough assets to keep up with inflation. If all is paid out and spent, the wealth machine will get smaller and smaller.

Stage 8: Financial Independence

Stage 8 is a progression from Stage 7.

Financial Independence happens when your Wealth Machine(s) is able to provide a wealth cash flow that is greater than your annual current expenses. (Your current expenses should more than include just your essential expenses and contains your discretionary spending).

The wealth cash flow distributed from your wealth machine should be conservative enough before you can declare that you have attained financial independence.

Building on the previous example, suppose:

- Your annual expenses are currently $25,000/yr

- If you believe you can maintain your annual expenses at around $30,000/yr plus inflation, you can calculate how much you need.

- The formula is the same as my article above on how much you need to achieve financial security, independence, or retirement.

- If your wealth machine can provide a rate of return of 7%, you can take a wealth cash flow of 4%. You will need to accumulate $30,000/0.04 = $750,000.

We can rate a person having an Audi as rich, but to me, if a person has an investment property and a portfolio that provides a wealth cash flow covering what he and his family need now, that is truly a position to be enviable.

Again, the expectations about your wealth machine are similar to when you estimate Financial Security:

- The long-term annual rate of return of your wealth machine should be reasonable. The rate of return should be conservative enough based on what the average wealth builder can achieve, and we should not push the rate of return just to fit the target and duration we want

- The wealth cash flow distributed from your wealth machine should be less than the annual growth of your wealth machine (which grows at the annual rate of return). This is because the wealth machine needs to distribute cash flow and have enough assets to keep up with inflation. If all is paid out and spent, the wealth machine will get smaller and smaller.

Stage 9: Financial Freedom

Once you are past stage 7, the rest is the stuff of fairy tales.

Financial Freedom happens when your stable Wealth Machine(s) can provide more than your annual expenses and one or two extravagant things previously not considered.

What is life if you slog so hard and do not get to enjoy it?

When a person reaches financial freedom, he can throw in a few things that they have denied their family for the longest time, be it the premium car that they wanted, or one more holiday for the year.

The difference is that these new spending goals weren’t considered before this stage of their lives.

Stage 10: Financial Abundance

The last stage of the list is Financial Abundance.

A person and his family are really rich when his net worth is very positive, and his wealth machine(s) provide a level of cash flow that expenses accountability can take a back seat.

This is to say that the cash flow is so strong that they can provide for the family and other goals that money doesn’t run out easily, while at Financial Freedom, careful considerations still have to take place.

When your friends or yourself have reached this stage, you are probably at the top 1% of the place where you live.

You will likely not have an issue sending your niece to an overseas education out of goodwill, throwing an extravagant birthday bash for your daughter’s 21-year-old birthday, or helping fund that poor family that got into a trouble whose story was all over the newspapers.

Expanding the Stages: Explaining some of the slightly Ambiguous Stuff

I have had this stage of wealth for some time already, and many readers love it because they can see where they are and what the next rung is.

Many folks ask me some questions about it, and I feel there is some stuff I can spend some time explaining.

There are also a few stages that I was debating hard on whether to include.

And as of now, I did not include them.

However, I will explain them here and see if it fits something you can identify with. If it does, you include it.

Stage: Freedom from Employer

This stage is interesting. It is a milestone we reach when we feel we are not afraid to fire our company and go to work with another one.

Is wealth an important determinant?

I believe it is.

A young working adult would think money matters less. That is because she could be at Stage 0: Financial Dependent. If she quits, her parents will still provide her with an allowance. She can still maintain a rather good standard of living.

However, when you have a family, leaving a job when you do not have another one planned can create a lot of anxiety. You do not know if you can find a job that pays well to cover many of the essential needs.

Thus Freedom from the Employer could become a valid stage.

So how much do you need?

This is very subjective because our boldness to leave our employer would vary for each of us.

One way of computing is perhaps a percentage of your future financial independence amount. Perhaps 10%.

Essentially Stage 4 to 6, different levels of F-U Money, is to address your confidence to have freedom from the employer.

This stage can be equated to your ability to take a sabbatical.

Stage: Quarter and Half Financial Independence

Between the stage of 1 year of annual expenses and Financial Independence, you could probably squeeze in 3 more stages.

This is to let you know where you are on the journey and serves as motivation.

However, I did not include them because I would rather include more novel stages, whose names tell us how functional they can be. I have already violated this by having three stages of accumulated annual expenses.

There is also the problem of sequencing.

For some, Half financial independence might be earlier than Financial Security, and for some, it might be later.

I would rather treat most of their essential survival expenses as about half or three-quarters of the total annual expenses they need.

So financial security is good enough.

There is one advantage of tracking Half Financial Independence, and that is it means one spouse is essentially financially independent!

Stage: Flexible Financial Independence

This is one possible stage that might rest between Financial Security and Financial Independence.

Essentially, we articulate the stage of financial independence as the wealth machine can provide a reasonable rate of return over time. Out of this rate of return, we decide to take the distribution of a conservative amount as wealth cash flow.

In this way, we can have a high degree of confidence our Wealth Machine can Grow, and still distribute Wealth Cash Flow for a long time, instead of running out.

Flexible Financial Independence is when you haven’t reached this sum for your wealth machine, but your wealth allows you to take risks to live off, should you need it.

For example, your aim is to have $600,000 to be fully financially independent, based on withdrawing 5% of your portfolio.

You have not reached this sum yet. You only have $480,000.

But you deem this enough for you to be flexibly and financially independent.

This means you can withdraw 6.1% of $480,000 and get nearly the $30,000/yr you need.

Is this conservative? Probably not. You might run the risk of running out of money earlier than expected.

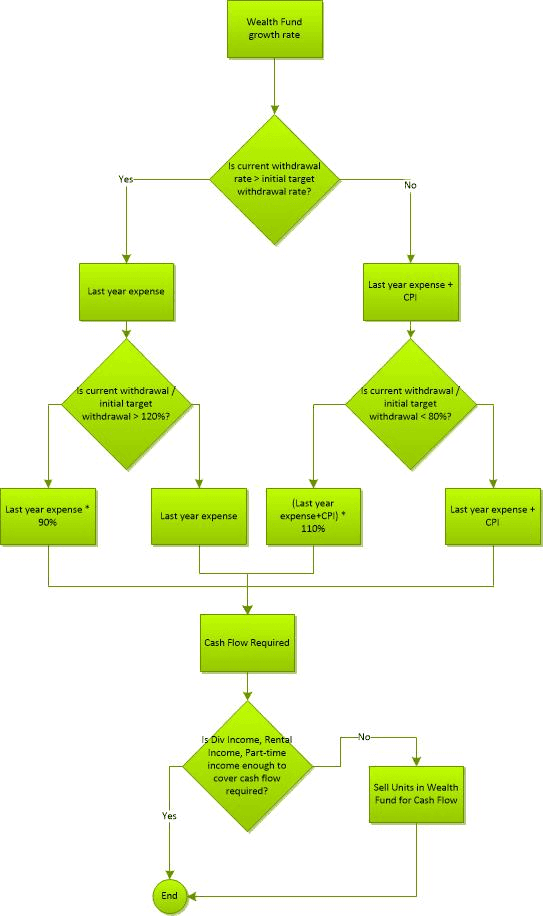

However, you can implement a variable spending plan.

For example,

- When there is a recession => Be conservative, cut my annual expenses by 10%, activate my part-time job to supplement

- When time is good => increase the allowance that I can spend by the inflation amount

We call this a variable withdrawal system. I have written how a variable withdrawal system would make $500,000 adequate for me if my expenses are $24,000/yr. You can read it here.

As in my article, you could have a workflow like this to make things systematic.

Why don’t I include flexible FI?

I think it’s difficult to see where it resides.

For me, Financial Security is Flexible Financial Independence. For some, Half Financial Independence is Flexible Financial Independence.

For some, they can never be flexible!

If this works for you, you can include this.

You should enjoy the Process of Accumulating Money as much as the End Goal

I am not sure where each of you would reach.

Your earnings potential and your situation may mean that you may reach financial abundance or that you can only accumulate five years of annual expenses.

Just treat the process of accumulating money as a real-life computer game, where the rewards are real.

Instead of playing a virtual game where you can hit the reset button, in this game, you cannot reset easily, and you may be penalised for making stupid moves.

However, as you level up to a further stage of wealth, it comes along with certain “life upgrades” similar to your experience when you play a game.

Summary: What Can You Do Next?

You can start with my FREE Building your Wealth Foundation series of articles, where I explain in detail the simple steps you can take to put yourself in a strong foundation and then move up the stages.

On an individual level, how do you measure in these 11 stages, has anyone achieved some sort of financial stability, debt freedom, or financial security yet?

Let me know.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Goldilocks

Tuesday 19th of July 2022

Have in all likelihood finally hit Level 10, but in reality it does not really make much change from Level 9, and I live as like Level 8. Also still working as a PMET. Yes, am in all likelihood in the Top 1% and annual passive covers 2x annual FAT Fire. Lesson learnt is that it does not really make much difference, once you cross Level 8. If you do not hunger after an ostentatious lifestyle, having much more does not mean you have to spend much more. Still have not reach the CPF withdrawal age yet, and wondering what to do once that comes. Cheers.

Tcs

Monday 18th of July 2022

I am probably at stage 6.5 working towards stage 7. I am 42 and hopefully can reach and stay at Stage 8 ard age of 55. If lady luck is on my side, hopefully able to achieve this by Age of 50.

Tcs

Wednesday 20th of July 2022

@Kyith,

Agreed. It is also the stage which taking off most pressures for most people which will help to live longer and happier too.

Kyith

Monday 18th of July 2022

Good to hear that you are near stage 7. Stage 7 to me feels the most important. The rest is a bonus. Covering your essential expenses... with enough conservativeness opens up a lot of options.

Scott

Monday 9th of November 2020

I am curious what expenses you include to get to $14,000/yr survival level and $25,00/yr annual expenses? When I strip off all the fluff I end up at 50,000/yr. If I really stretch and say I paid off my house and have no car loans I can get to 38,000/yr. Can you share what categories and how much in each to get to 25,000/yr annual expenses?

Kyith

Friday 13th of November 2020

Hi Scott, thanks for your question. That $14,000 is used as an example but if you are curious I can list out what I considered essential. Basically, I do not separate entertainment and say that it is not essential. I take everything and break them into two piles. for example my entertainment could be $300 but the bare essentials is $60. the rest of the $240 is less essential.

A hypothetical one for me is the following:

Food - $500/m $6000/y Transport - $80/m $960/y Utilities (home, mobile, broadband) - $200/m $2400/y Household - $200/m $2,400/y Insurance - $200/m $2,400/y Entertainment - $200/m, 2,400/y Medical - $50/m, $600/y That works out to be about $17,160/yr. I did add some buffer for a few things like household and food but i think it is sensible. For each of us, we could have more categories and your mileage may vary.

Harry

Thursday 14th of December 2017

Kyith, long time investmentmoats supporter here! Thanks for all your great writeups. Can I check with you on Stage 7. You wrote:

"For example, your annual expenses is $25,000/yr. However, out of this $25,000, your survival expenses is $14,000/yr.

If your wealth machine can provide a rate of return of 7%, out of this, you can take a wealth cash flow of 5%.

You will need to accumulate $14,000/0.05 = $280,000."

Confused on the "rate of return of 7%" statement. Where does it fit into the equation?

Jason

Sunday 3rd of December 2017

We are at stage 7 or 8, but most likely 7 as things are evolving as we live on. Our parents will grow older and they will need our support in terms of medical fees. Our children will grow up and they will need education fees.

I read your latest post and thinking of a coasting FI, doing more investment related stuff, reading more books and attending AGMs.

Kyith

Tuesday 5th of December 2017

Hi Jason,

Thanks for updating. You look like you are in a good situation. I think most of us do not have a Fat sum of wealth such that we can safely tell ourselves we are at stage 8. Until then, usually we are at stage 7.

Things can be made more certain by deliberately exploring the future costs. I urge you to do that to empower yourselves.

Best Regards,

Kyith