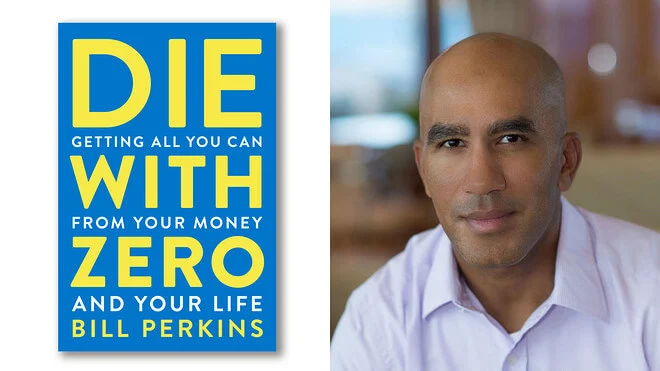

Chris recently talk up this book Die with Zero as the anti-FIRE book that those pursuing financial independence should read.

I have not read the book but have heard the author Bill Perkins share about his idea in a recent podcast interview. (If you would like to know more about his book you can Google Bill Perkins and you should get a fair number of YouTube videos of him talking about his book.

The guy was a trader and a poker player. Now, some of these traders might have a different mindset but I do think folks like them are made up a little differently.

And this may affect their outlook on life and how much wealth one has.

You see whether you are trading this or that, trading becomes a skillset that people pay you well to do it for a living. For these folks, they can get into the “zone”, be hyper-focused, and eventually figure out how to be profitable.

If you are in that caliber, as long as you have some capital, you have a chance to turn it around. This gives you a different perspective on the question of how much do you need?

By the looks of things, I think we should be reading it, even though you would likely find it incredulous that you would die with zero.

We May Never Be Able to Buyback Some Experiences

My friend Nick always tell us: “The last cheque must bounce.“

He means that if the money is not spent, it is not your money. So keeping so much money means you probably wasted your life and time on it. (Interestingly, Nick also has that competency with capital markets. Give him some capital and he will be Ok. I do think that if you wanna feel safer develop that skillset to compound capital.)

I think Bill has a point that you should smoothed out consumption over your lifetime.

One thing that I caught from him is that…. you changed as a person over time. As you grow older, maybe 10 years later, everything about you changes.

While you may have the money, time to go out to club, your whole person just changed to such an extent that the feeling if you go is totally different.

This is so real.

It means we cannot turn back the clock. You cannot go back to a period where all your friends are more carefree, more energetic, clueless about what is to come. You need a lot of money but even then, you cannot buy your friends’ carefreeness.

When Enough is Not Really Enough

I think we all over-accumulate wealth based on the following reasons:

- the addiction to accumulate for dunno what

- not knowing that they had enough

Both of these are a mixture of life issues and also a financial planning issue.

Particularly for #2, we keep accumulating because we think we don’t have enough. Sometimes, your adviser might explain to you that if you reached $X,XXX,XXX, you should be good to go.

However, if you do not trust your adviser, you will still continue to accumulate (we will leave those who still really like their work and continue to work aside.)

Getting that how much is enough for my family? question correct is crucial. There is a fine line between what is adequate and inadequate to be financially independent.

A few months ago, one of our advisers seeks my opinion on a case he was working on.

The client has this idea that based on his net wealth of $15,000,000 and how much income he requires, he would be in a very good position. After all, $15,000,000 is a lot of money**.

He is confident that the amount will last bacause he believed that his estimation is conservative.

We have a systematic way the advisers determine whether you will have the income you need. But at times, our advisers also go out of their way to triangulate with others whether there is another perspective to how we look at specific client’s situation.

My assessment of the case was that in an average scenario, $15,000,000 should last for him. However, I do disagree with his plan being conservative.

One reason is that not all the net wealth is in investible assets that efficiently provide income. The second reason is that he requires about $45,000 a month.

There are enough scenarios I can think of that he would literally have zero before death.

One of the big value we can give is to validate how safe is the safe plan in your head.

We tend to err on the safe side because the prospect of having zero scares us more than having too much. If you have too much you can still passed the wealth to the next generation. If you love your children and their children, leaving some monetary legacy is not such a bad thing.

Die by Zero would probably be very helpful for the financial independence crowd. However, this may lead some others down a path that might be rather destructive for themselves because they missed the essence of the book.

Whether if you wish to die with zero or do not with to die with zero, it is always good to know how much net wealth is adequate for you, and how much net wealth is conservatively adequate for you.

That amount, together with the assumptions, will help you decide how to die with near-zero or how much bequests you could leave for the next generation.

** The case study is for education purposes. The identity of the client is withheld from others in the firm other than the client adviser. Actual financial figures are withheld.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Xavier

Sunday 16th of August 2020

I fully agree with Alan’s comment! Really interesting especially about the part of leaving a legacy for the kids and letting them know only when they have matured in character!

Alan Lok

Sunday 16th of August 2020

3 comments -

1. Not sure if most of you notice this subtle pattern - the skill to ace in poker is quite similar to that for day trading. It involved a tinge of making decision based on probability in a relatively short time span. For value investing, or for crisis investing (which i personally always touted), that time span can be much longer. So while it is not critical, still quite nice to acquire that "poker" instinct skill set for value investing.

2. All of us have to die one day and hopefully (or hopelessly) your pool of "money" will not be depleted the day before that happen. Health insurance, gold bar, properties, successes in value investing e.t.c.... only serve to provide that mental buffer for us to pursue those true meanings in life. I personally do not live a luxurious lifestyle; on the contrary, I enjoy more of the simple things in life, Kopitiam Tea O, Ba Cho Mee, - but that does not mean I have no hunger for more "money". For me, the size of that mental support behind is crucial as well. It keeps me rational when i am playing my game of poker, day trade or any kind of investing, knowing that i am doing it with money i can lose in full. Of course, i always keep a delicate balance between being too focused on getting more money versus enjoying the precious moments in life (such as changing my babies' diapers).

3. Don't let your kids know that you will have a legacy for them after you passed away. Raise them up and convinced them that they will have to fence for themselves after JC (and yes i absolutely meant it, if they don't have what it takes to get that Bachelor degree from NUS or NTU through scholarship, go borrow from OCBC!). Let them take ownership of their own life, while you live out your own. But of course, right before you passed away, let them know, that LEGACY is still there. By then, your kids have grown up with a matured character, matured and independent enough to optimize your legacy instead of letting it ruin their life.

Pete

Thursday 27th of August 2020

My kids are 26 (already started working) and 21 (still in army) were told since young their father will NEVER send them overseas for their university educations. My eldest child earned a local law degree and the younger one will soon attend another local U as well.

I had also started telling them not to expect money from me to buy their first home or to sponsor their weddings. The reason is simple, I did that all by myself and they should too.

Naturally, they also know I am leaving nothing behind for them.

Sounded cold but to motivate them, they need to know they had to work hard for what they wanted. The only thing I wish my wife and I had done is to get them to do housework and iron their own clothes :)

Kyith

Friday 21st of August 2020

Hi Alan, hope you take care of yourself over there. Thanks for sharing your thoughts. I appreciate someone who understands both the value investing side of things and the trading side of things. I agree with point 3. But the conversation would be different if they know that their dad is a finance guy later in life haha.

You are right to say about the mental buffer. I would contend that Bill Perkins have some sort of mental buffer as well.