On Thursday, the Monetary Authority of Singapore (MAS) said it has received feedback on misleading insurance sales practices relating to the fresh changes on critical illness coverage as outlined by the Life Insurance Association (LIA) Singapore.

MAS said that there are some financial advisory representatives, as part of their advisory process, have conveyed to customers that the scope of CI coverage is narrower under the new set of CI definitions.

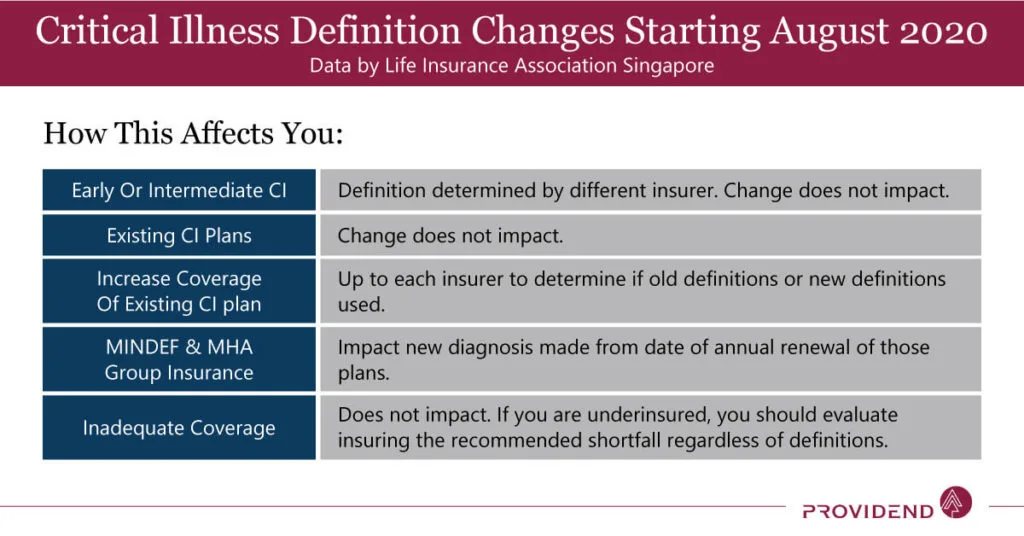

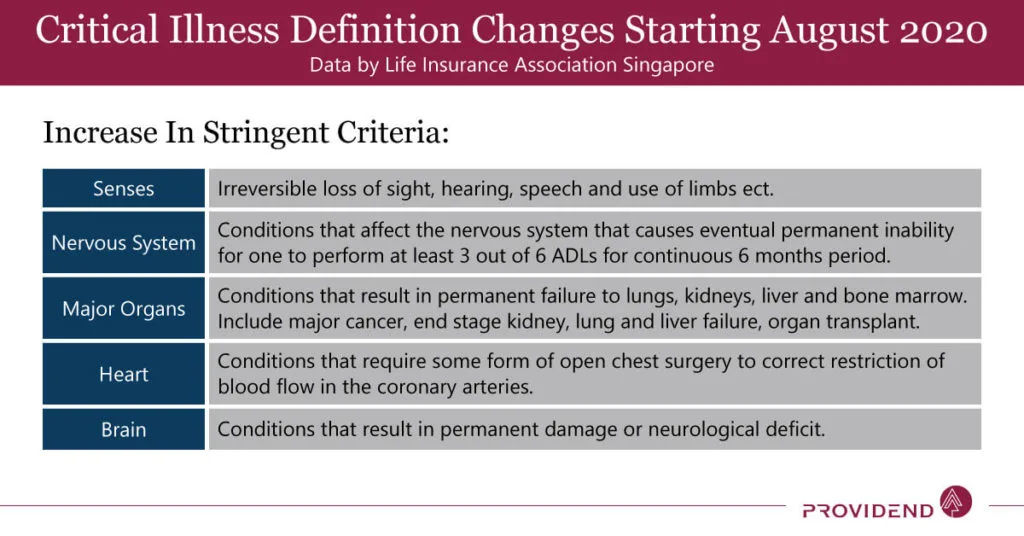

If you would like to learn more about the changes to the CI definitions, you can read this article by MoneyOwl.(I have also attached some company infographics at the end of this article) LIA emphasize that this change is to provide greater clarity, so that customer does not misunderstand what is covered and not covered.

MAS said that these financial advisers were found to use the change in CI definition as reasons to pressure customers to purchase insurance policies before the August 26 deadline.

MAS wishes to reiterate that FA representatives should provide proper advice to consumers and not use aggressive sales tactics to rush consumers into purchasing insurance policies or other investment products.

When I got to know that there is this revision to the critical illness definition, I thought the most natural posture of advisers is to use this opportunity to pressure existing clients from tightening up their coverage by getting additional coverage.

This can be to sign up for a late-stage critical illness plan under the old CI definition, before the change in definition, and to sign up for a multipay critical illness, or early critical illness plan.

Since the standard CI definition is “more stringent”, then you should err on the safe side by getting a multi-pay critical illness plan to cover your bases in the event that you cannot claim under the standard late-stage critical illness plan.

Financial advisers are banking on your vulnerability to err on the safe side to purchase more coverage from them.

However, are they wrong to ask you to up the coverage?

I managed to catch a webinar where a doctor tries to explain these changes to a group of advisers.

The general feeling that I get is that the change made things less ambiguous. Perhaps they closed previous loopholes. If you are on an existing CI plan, you may be able to abuse these loopholes.

These loopholes would be covered in the new definitions.

In a way, with the current definition, there is room for dispute. In the new definitions, there is less room for dispute.

If you suffer from something that you will definitely be rejected in the new definition, under the current definition, you might be rejected due to the ambiguity.

For those critical illnesses that cannot be covered by a late-stage critical illness plan, financial advisers would strongly advise you to get a standalone multi-pay critical illness plan.

I grew very skeptical about multi-pay critical illness plan when I see almost every adviser shooting YouTube and Facebook video talking about it.

It is either many of us are so under-insured in a high probable area or that the commission is rather lucrative that it is worth the effort to do a video.

Be more vigilant when you discuss it with a FA representative. Do not be misdirected such that you get lured into the mindset that to resolve critical illness, you can only depend on a critical illness plan.

Ensure that you are covered adequately in the right areas before covering a less important area. Here is a good rule-of-thumb to follow:

- Your hospital and surgical plan, or your shield plan are important to take care of the inpatient and certain outpatient treatment cost.

- The late-stage critical illness provides you with the cash flow to replace your income, in the event that you have to quit and focus on tackling your health problem

- Early critical illness is good to have after #1 and #2.

Take care of 1 and then take care of 2. If you still have funds, then maybe devote to 3.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

GERARD LIM

Sunday 23rd of August 2020

CI coverage in my opinion is not really worth it. To get a 300K coverage for Early CI, its likely that your premium will cost at least 3k per annum. So the "returns" is only around a 100 times. Can consider FWD cancer insurance, which cover early stage of cancer too, at around $300 per annum for a payout of 250K.

Kyith

Tuesday 25th of August 2020

Hi Gerard, thanks for bringing my attention to FWD cancer insurance. Off the top of my head that looks like a good deal. Looks like I got to reach out to my FWD contact.

divvy

Saturday 22nd of August 2020

hi Kyith thanks for your balanced sharing ( as usual!). Just wanted to share some perspective on this subject. Actually, I got a ( new ) multi-pay CI insurance tagged to term insurance for my son when news of the change in definitions was announced ( with no prompting from my FA). As someone who is in the medical line myself and also someone who has in recent years claimed CI successfully, the new ( more restrictive) definitions ( 21 of them!) will likely affect ease ( ? success) in claiming for some current " grey zone" conditions. I sort of look at it this way: with the old definitions, there is still a probability of claim in grey zone cases, depending on how strongly the medical information supports your claim. But with these newer guidelines, this probability has reduced significantly.

Kyith

Saturday 22nd of August 2020

Hi divvy, thanks for sharing. I think that the old definition there are room for recourse while now... maybe totally no room. Can you share the thought process behind the multi-pay?

SPR

Saturday 22nd of August 2020

Hi Kyith,

I recently signed a term insurance with 300k coverage. When recommending the CI rider, my agent advised for the same coverage amount for CI.

As a 29 YO with no dependents, I wanted to get a second opinion on the CI - is it excessive or standard for a 1:1 match?

Thanks!

Kyith

Saturday 22nd of August 2020

HI SPR, BRC give a very good response. That should be a pretty good second opinion. $300,000 is not overly excessive or conservative. You have to see with respect to your annual income. Usually we measure by 3 to 5 times your annual expense. if your annual expense is eventually 150k a year and you wish to cover 4 years, then 300k may not be enough. You can scale up accordingly.

SEcondly, typically we buy a life term and add CI riders to it. We may think that by paying for 1 total cost we covered two areas. The right way to think about this is that, if you suffer from something and claim CI, and you spend all the CI money, you may still need to leave money for your dependents to take care of them. Thus, the fundamentally sound way is to calculate your life and CI insurance sum seperately.

BRC

Saturday 22nd of August 2020

Hi SPR,

If you absolutely have no dependents and don't have a particular goal to leave a gift to non-dependent loved ones or, say, a charity or welfare organization, you may not need the term life coverage at all. Of course, there is a small advantage of having some coverage now so that if you eventually become uninsurable and do have future dependents that it is already in place.

That said, to get CI rider coverage you usually need the term life coverage to be above or equal to the desired CI coverage. However, it is more important to view CI coverage in terms of it's own ability to replace your income for you if you are struck by a critical illness rather than as a ratio to the life coverage. Typically, it is good to have about 2-5x your annual income in CI coverage to help to bridge the potential income gap during the years when you may not be able to continue working. By that logic, you should not need more than this even if your life coverage is higher than that.

I'm not sure how much you make and won't ask here, but $300k sounds reasonable. Do take the time work this out yourself based on the principles above.

Hope this helps!