The US dollar weakens.

This is because a vast sums of money is pumped into the main street and financial markets to prevent a financial calamity.

There are some possible repercussions. These are possibilities and not definite:

- There are evidence to suggest the weakness in the US dollar is gonna last longer

- Whether there is inflation or weakness in the currency would depend on each country’s central bank’s response

- Equity markets remains more attractive than bonds

- Ex US markets looked more attractive than US

- Cyclical stocks, value, and small caps look to do better in this climate based on past data.

Market Sentiments Remain Surprisingly Bearish

Even after the run-up in market indexes, according to the widely followed AAII survey, sentiments are pretty bearish still.

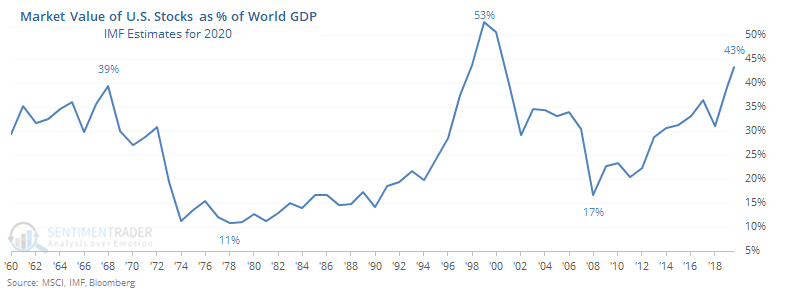

Market Value of US Stocks versus the World GDP Provides some Clues to Performance

With the stunning rise in big American tech stocks, the U.S. portion of this global equity market capitalization is nearing all-time highs.

The chart above shows that the market value of US stocks as a percentage of world GDP are at an all time high. In the 1960s, the US stocks have started to underperform stocks in other parts of the world by the time this index peaked.

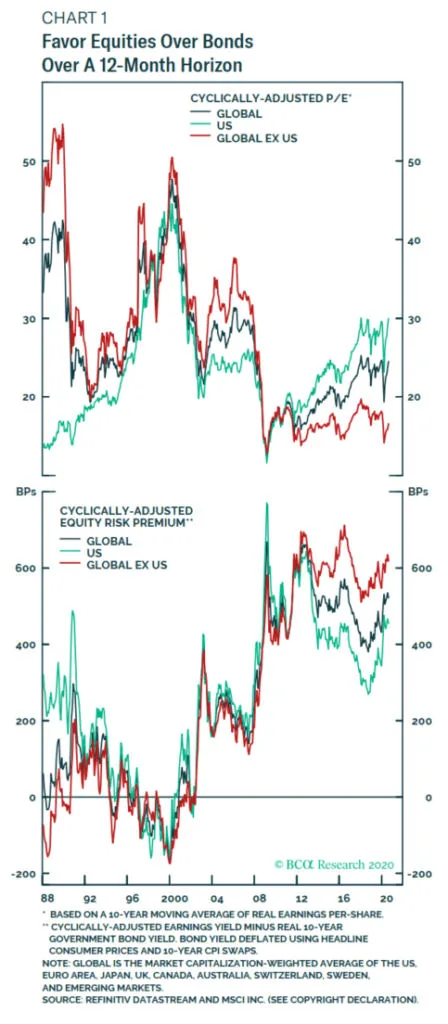

CAPE Indicates the Valuation of US and Ex-US Markets

I was still wondering a few days ago how I could get my hands on the latest cyclical adjusted price earnings (CAPE) ratio of different countries. Lo and behold I found it in this BCA research.

The CAPE ratio provides a slow moving snapshot of the valuation of different countries. We can then compare to the CAPE for the countries/regions in it’s past history.

From the top chart, it seems US is more expensive then global valuation. The theme for the past 10 years is growth, what is more expensive will get more expensive.

While US, global and global ex US valuation have gone up, the valuation in the rest of the world is less excessive.

In fact based on the 32 year sample, the valution for rest of the world is rather cheap.

The bottom chart shows the cyclical-adjusted equity risk premium or the risk in the market over the risk-free rate. The equity risk premium tells a similar story in those countries other than the US, as a collective is still risky and therefore may command a higher return going forward compare to the US.

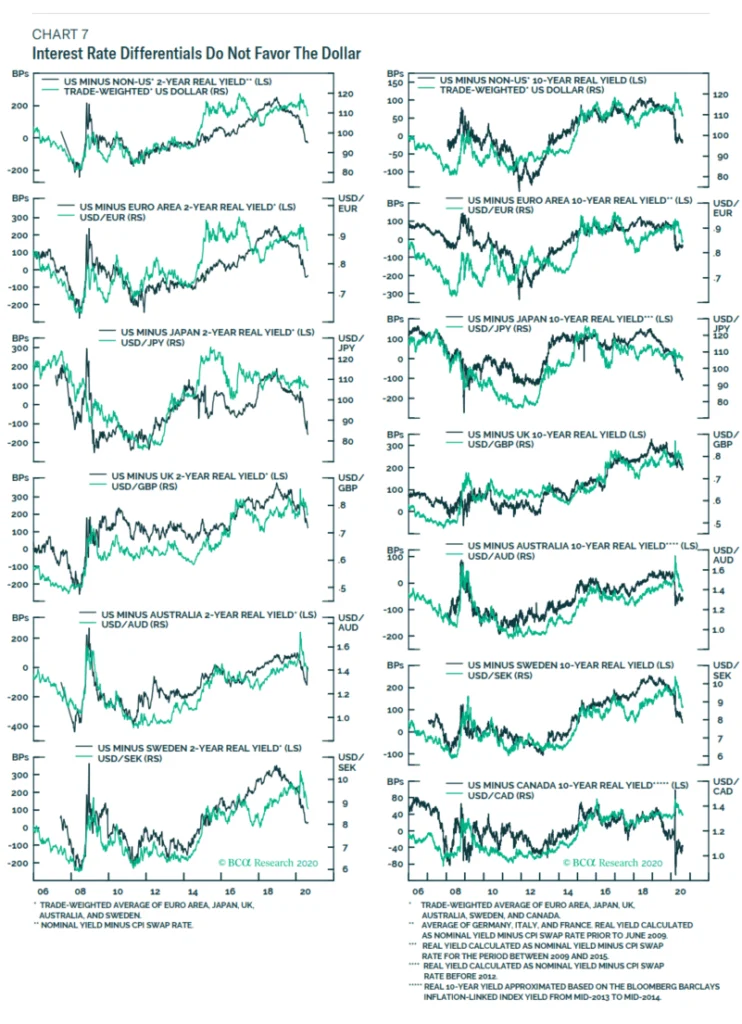

The Dance Between Fiscal Deficit, Inflation, Currency and Interest Rates

The charts above shows the interest rate differential and its affect on the value of the USD versus each country’s currency pair.

For example, the Euro area 2-year real rates were 2.21% below the comparable US real rates. Today, they are 0.19% higher than the US real rates. The relative higher EURO area interest rates have an effect on the demand for Euro vs dollars, in favor of selling dollars into Euro.

What we are seeing across various currency is that the real yield spread between US and other country rates is weakening in favor of the foreign currency. The effect might be a weakening of the USD.

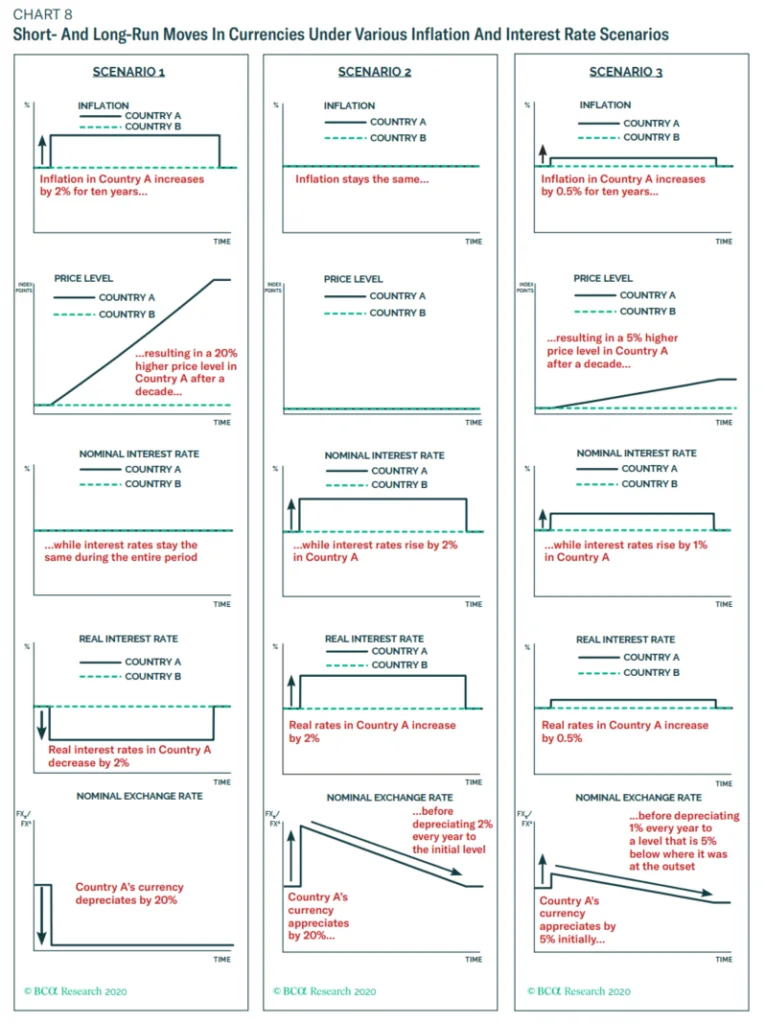

One thing most facinating about this report was the education that I get on the dance between interest rate, inflation and the currency exchange rate.

This is probably something that I should revisit often.

Suppose the interest rate and inflation are initially the same in Country A and B but A suddenly and unexpectedly decides to run a larger budget deficit for the next 10 years.

What will happen to the value of A’s currency? It is not so straight forward. The result will depend on how A’s central bank reacts.

Scenario 1 shows that A’s central bank will not hike the interest rates at all in response to the larger budget deficit.

- Annual inflation will rise by 2% over the 10 years due to additional aggregate demand from easier fiscal policy.

- The price level in A will end up 20% higher than previously at the end of the 10 years

- The currency of A will fall immediately by 20%. The fall is immediate rather than 2% fall a year is that we are assuming A and B’s interest rate remains equal

Scenario 2 differs from scenario 1 in that a immediately move to neutralize the stimulative impact of a larger deficit by hiking interest rates by 2%.

- No net impact on aggregate demand, therefore inflation expecations in A do not change

- A’s currency immediately appreciate by 20%. Appreciation is necessary to create the expectation of a subsequent 2% a year depreciation in A’s exchange rate

- The slow currency depreciation in A offsets the 2% rise in interest that A’s bonds pay over B’s bonds

Scenario 3 shows what will happen if all else being equal we do it half way.

This is for one country with a lot of assumptions. If we have multiple countries, and a lot of assumptions, you wonder what is the net effect. This would explain why we need not always see high inflation.

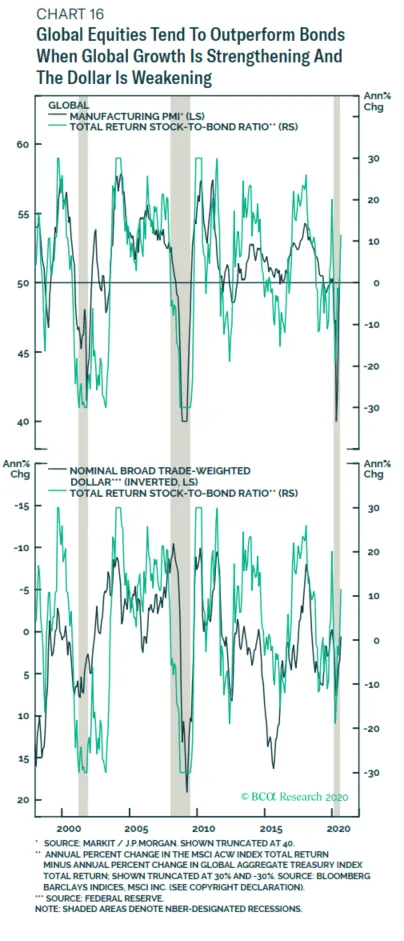

Stocks over Bonds When Dollar is Weakening and Global Growth is Strong

Global equities have generally outperformed bonds when global growth is strengthening and the US dollar is weakening.

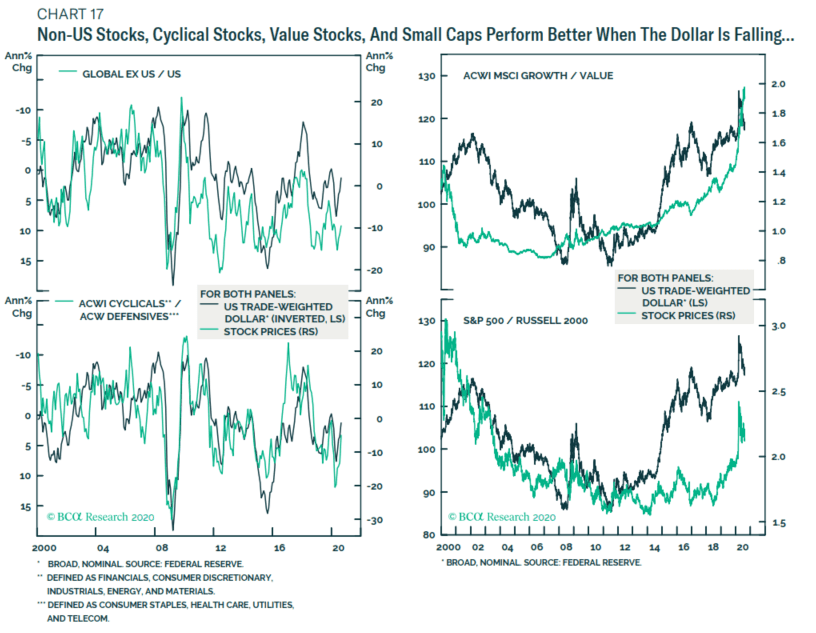

The Strong Correlation of Dollar and Certain Specific Factor Performance

For the long suffering non-US stocks, stocks that are more cyclical, value stocks and small caps, they tend to do better in a weaker US dollar environment.

While the sample is small, notice the tight correlation with the US dollar.

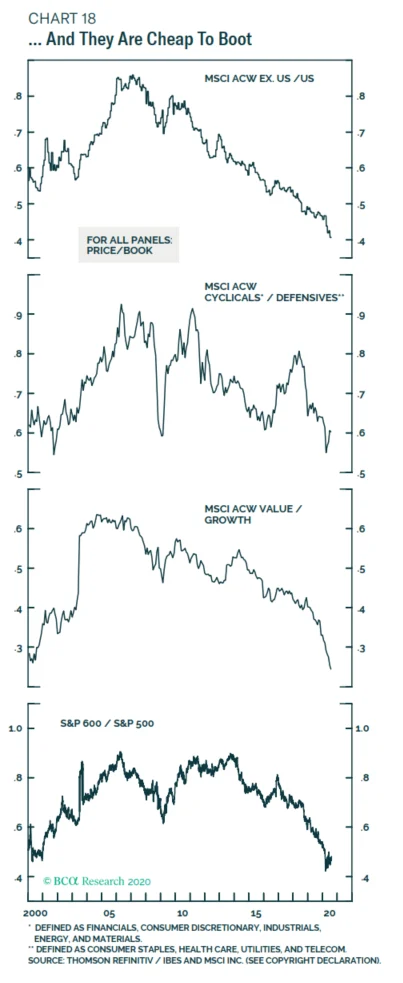

The interesting thing I did not realize that other than value and small factors, there is a disturbing trend between cyclical and defensives. Relatively speaking, the value of cyclical companies, value, smaller companies looks cheaper.

Conclusion

In the years where US dollar is weak, foreign stocks have advanced 85% of the time, emerging market stocks have advanced 65% of the time.

Gold on the other hand is up only 42% of the time.

Can the cheap get cheaper? Possible.

It would be interesting to revisit this post 3 years from now to see whether this time is really different. Not just value vs growth, there is a narrative of small versus large and cyclical versus defensive which is lesser in the news.

Based on what we have discuss today, taking a concentrate bet in a narrow slice of the market is a form of speculation and I would hope that you are able to do deep research if you are thinking of computing large amount of your net wealth.

The alternate way to hedge against possible inflation is perhaps equities in emerging counties. They produce commodities and if there is a demand for the commodities, these countries are likely beneficiary as well.

The problem is…. they look poor for a good 10 years and it is hard to put money in something that looks ugly.

I think the investment crowd will turn when it is time to turn.

You cannot fight human nature. The retail investors, and the institution investors cannot afford to missed out on where the potential outperformance is.

Not investing in Ex-USA is a bet that things will continue like it is now. Investing exclusively in Ex-USA is to take a contrarian view.

The alternative is to have both to capture the returns of an expensive market and a cheap market.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

lim

Saturday 15th of August 2020

With a global ETF like IWDA and VWRD, investors can be on 'autopilot' since it holds both US and ex-US stocks.

Emerging markets ETF hold a lot of China, and there has been quite a big rally in China stocks so I am not so whether EM ETF are currently considered 'cheap' though I am still vested and accumulating as I am generally still positive on China. (the US elections will come and go)

Europe seems to be doing a better job at managing COVID19 than USA so it can re-open its economies earlier. US seems to be hinging everything on a vaccine. They also seem to be able to pass stimulus packages and relief measures without much political drama.

Kyith

Saturday 22nd of August 2020

Hi Lim, sorry for the late reply. With regards to Europe, I wonder if the longterm returns is going to track the population and productivity dynamics of the region.