About 10 years ago, I went to someone’s house on another person’s recommendation.

I have lived with a skin problem for 15 years of my life since then. Since I was economically OK, I treated this as a medical project to try and solve it. If you have a problem like mine, perhaps you have also gone through the paces of going around and trying much shit and see whether it works.

This acquaintance of mine told me that this person is coming from Malaysia that has helped others with “frustrating problems” similar to mine. You might be wondering why Kyith can be so trusting of what an acquaintance said.

If you have something that you wish to solve (be it health or something else), your brain can be very accepting of things that may not make a lot of sense. Even if you are a very rational person, there are points where a switch in your brain will be a trigger to be more accepting. (If the salesperson finds that switch and triggers it, there goes your money.)

The family that house this Malaysian person lives in a landed property in the North. Throughout the whole day, they showed me how I should carry myself if I ever become rich. I could detect a genuine concern and willingness to help to solve my problem.

At the end of the day, I had a chat with the husband of the home who wishes to provide a different perspective. He explained a bunch of stuff about wealth and life to me. Before I went off, he passed me a book. According to him, this book has a profound impact on how he built his wealth.

Naturally, if someone tells you that this book has a profound impact on his wealth building, you freaking read it.

Judging from how much I shared with you about the book and what he shared in the conversation, you may detect that it didn’t have a profound impact on how I built my wealth.

If You Can Ponder About the Meaning of Money, Perhaps You are In an Enviable Position

Every time I clean up my stuff and came across the book (unfortunately I did not return to him. I kept it well hoping due to some stroke of luck, I bumped into him again.) I wonder whether what he said was not useful for me.

Or whether I am too dumb to comprehend.

Ok, maybe not too dumb but that with what was on my plate then, my brain was not prioritizing what the message the book was trying to tell me. There is some book that is less on application but a lot on very high-level philosophical stuff.

At a certain stage of your life, that philosophical stuff will not sound useful to you.

A middle-aged guy who has built up his family and his wealth and have everything well set up was trying to explain to a 30-year old, single guy who was starting to get his shit together.

In recent years, incidents like this led me to believe that some of my best materials on Investment Moats do not apply to some.

They are wealthy and valuable to perhaps those who have an excess surplus from their income.

But for those who do not have a surplus, I wonder if the materials I have written are useful at all.

This week, I came across this very splendid article by Lawrence Yeo called Money is the Megaphone of Identity.

When I think about the title, I was thinking it is going to say if you are a fxxker, more money just makes you a bigger fxxker. If you are nice, more money will make use a very rich, pleasant person.

The article is more than that and in a way it sort of explains how we react when we are at different stages of wealth.

You Have a Different Challenge at Different Phase of Money and Life

The article is long and I will just highlight the points that I resonated with the most.

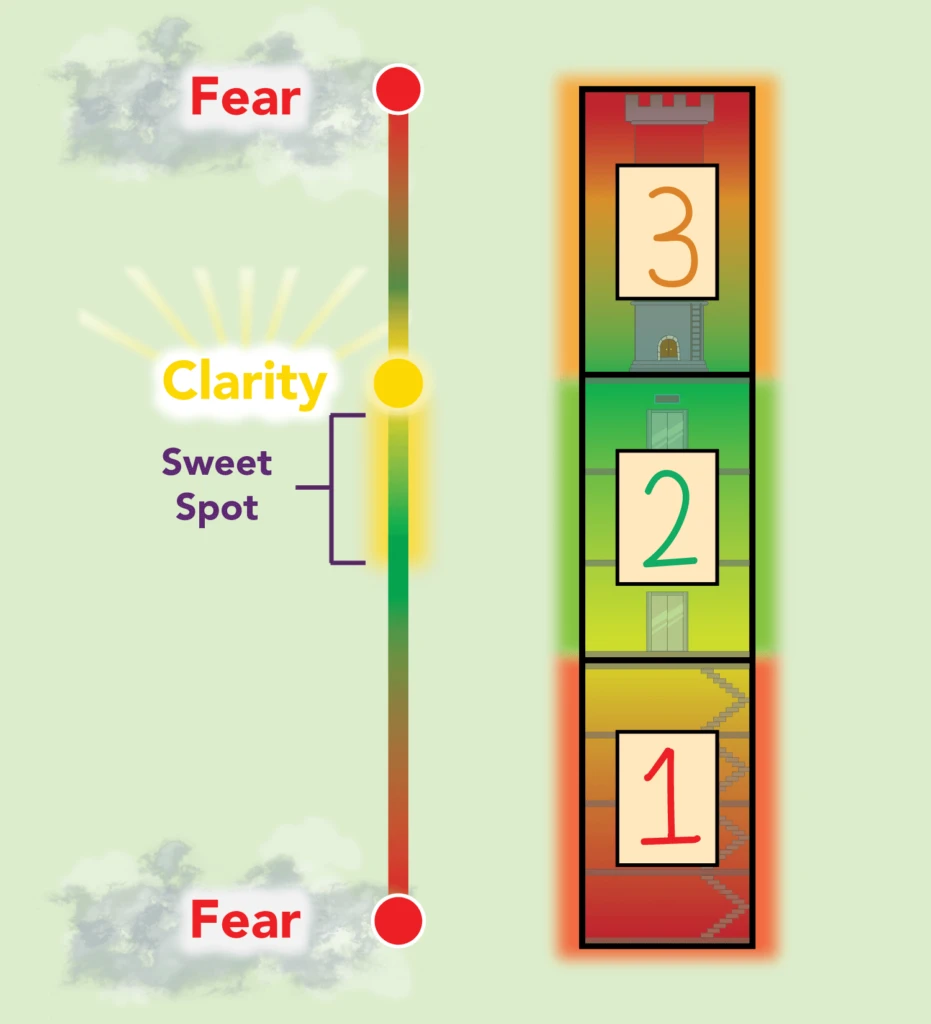

I have a similar idea as Lawrence that we should view life as a spectrum. There are the different stage of life. Some stages can be a real struggle that you must try to move out of.

There are also some stages where you can choose not to venture into.

Perhaps a similar illustration would be my 11 Stages of Wealth. At most stages, your money can have a useful function. However, if you demand more function, you might need a larger sum of money.

I like the way Lawrence was able to bundle life and money by dividing into three phases: survival, freedom and power.

The ease segregates these in the mode of life. Survival is the toughest mode of life. Freedom is where life is not so tough. Power is when seemingly, we will not associate with a tough life.

But things are not so simple, as Lawrence will explain.

Survival: Running As Far As We Can From Our Fear

This is the phase a lot of us started off identifying with. For our richer peers, they might not know this pretty well (but some of them may eventually learn about this)

We are basically fighting to make sure we have the minimal semblance of health. All the money that we have used up to make sure that the health and wellness of our family stay intact.

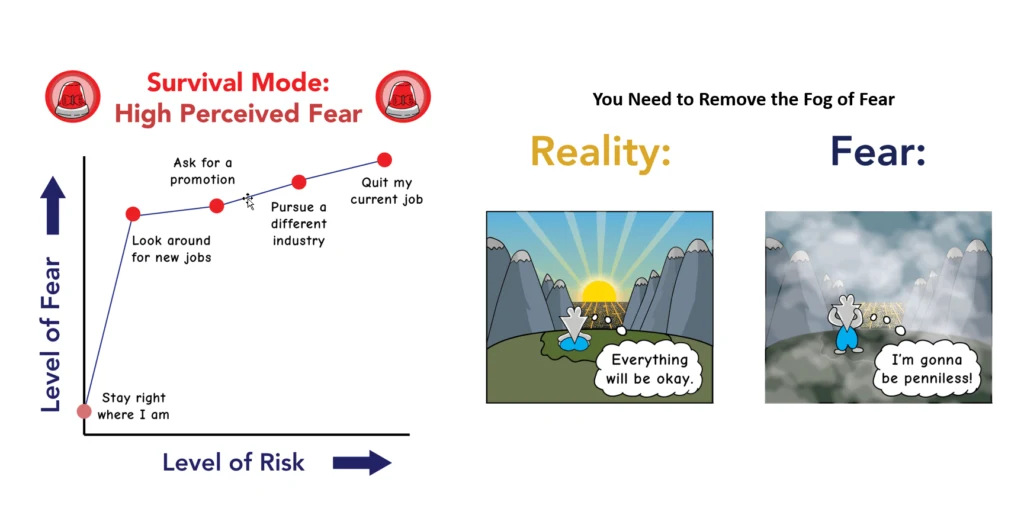

However, the concept of survival means different things to different people. What is considered as survival expenses are defined differently by different people. Even though you earn $10,000 a month, you would still be in survival mode.

You will feel that if you lose your job, you will lose your basic survival standard of living.

This is a phase Lawrence articulate quite well because in order to get out of the survival phase, you need to figure out that you have enough.

Figure out that you have excess surpluses above your basic survival. This requires you to know how much is your basic survival. For some, basic survival could be $500, or $5,000 a month.)

If we cannot get out of this mode, we will forever be in that accumulation phase and think we are in danger and cannot stop working. Others will look at us wondering if we lost our mind when we say that earning $15,000 a month is inadequate.

If you are at some of this stage, you would not take in some of my materials because a lot will require that you have surplus from your income.

If your life has this failed condition, it is likely you failed to listen to what I have to tell you, even though it is good.

A Different Financial Independence Scale

Lawrence has a good take on the next phase that you will move to. When you have a surplus, your brain is more receptive to progress through this phase.

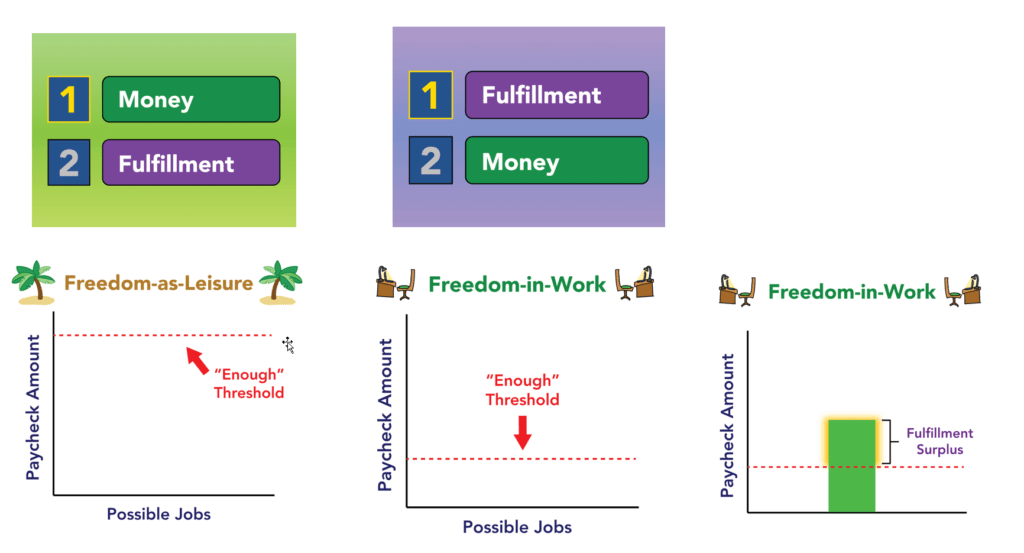

He explains that in our pursuit to accumulate wealth, we priortize money over fulfillment. Enjoyment is like a reward and a pastime.

The challenge with enjoyment as a past-time is that we have to work a lot so that we get to enjoy more of it. We work hard, we get exhausted, the reward feels more appealing. The reward felt like a necessity and we want more.

We fall into the trap to think that we had to save 25 to 33 times our annual expense in order to have that reward. In other word’s our “Enough” threshold is extremely high.

We should progress to a place where our work or business is rewarding. If our work is rewarding, we will only need a smaller “Enough” threshold because the money needed is just for survival.

In other words, have a profession and job that you like and have a life you do not need to retire from.

Lawrence explains that because your Enough threshold is much lower, the amount you makeover that will give you fulfilment. In a way, I think it boosts your morale that you have “excess”

To others, you might have less than them. But for the life scheme you live, that is more than enough.

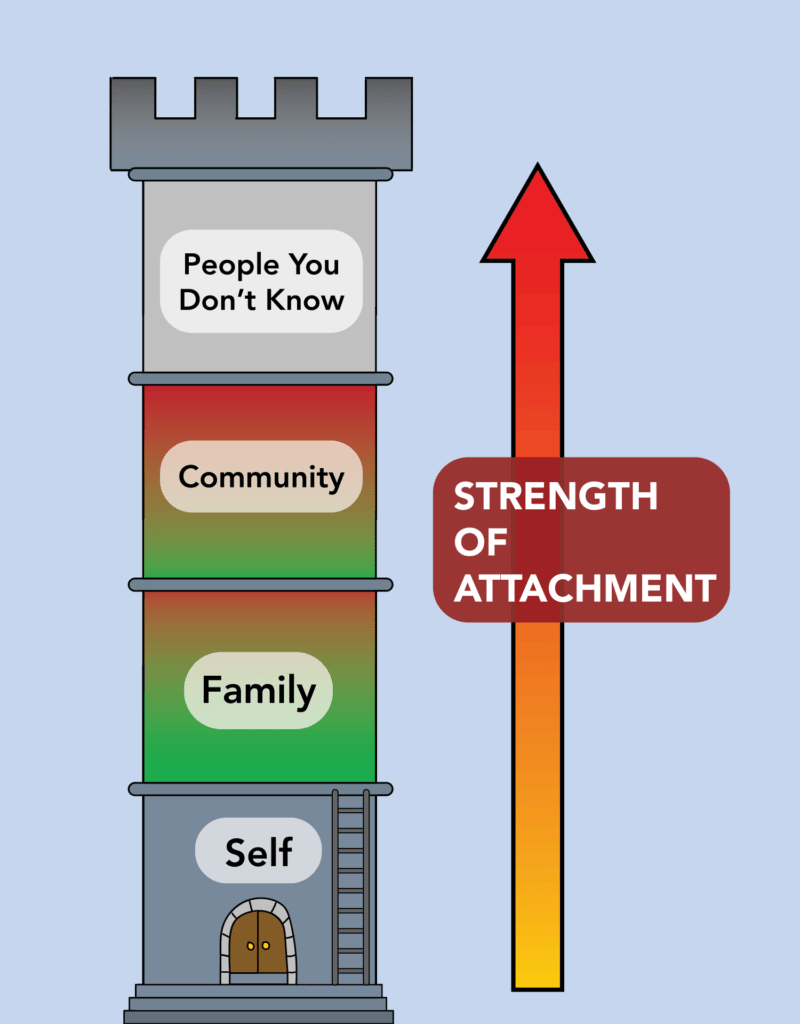

The ultimate stage of the second phase is Freedom-In-Attention.

This is something new to me but it is very true. This is a phase where what used to bother me, that I think matters enough, is less important. This could be people concerned about the price of their HDB flat, gripes about government not giving enough subsidies, a certain employer not doing right by their employee.

If you are in a different stage (perhaps Freedom-as-leisure), this would be your concern. You will know you have level up if you find yourself complaining about this less.

The Power Phase

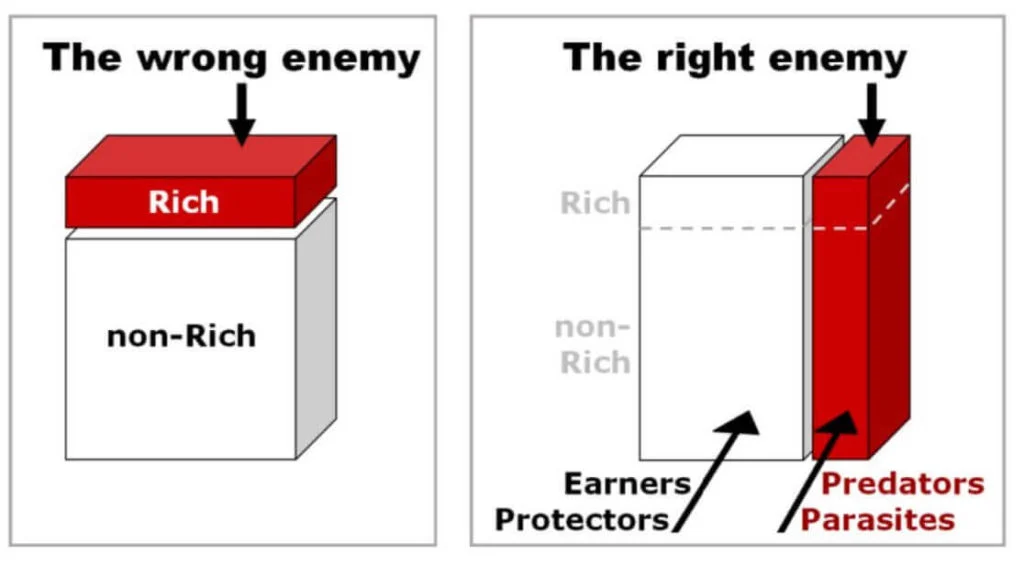

The last phase is an interesting one. If you have more money, naturally, you may have more power.

Power have always been viewed in an evil manner. Lawrence describes that power means that you first hold power-over-the-self.

Power-over-the-self is a big shit for many of us because many of us always felt people dragging us by the nose all over and we are not in control.

I cannot say that I am independent if I am always held prison by circumstances and other people.

Money allows you to have this power but money alone might not be enough.

A higher progression of this phase is Power-over-family and Power-over-Community. There are positive ways and negative ways to exert influence.

If you do it positively, your family members and peers around see you as a role model and create improvements as a result.

The danger Lawrence cited is that your money has influence over unknown people.

That might seem ok but for some, they fall into the trap that money becomes part of their identity:

I mentioned earlier that financial freedom is obtained by the elimination of attention, but the reverse is also true. Financial freedom is diminished by the constant receipt of attention as well.

I mentioned earlier that financial freedom is obtained by the elimination of attention, but the reverse is also true. Financial freedom is diminished by the constant receipt of attention as well.

The more you are viewed through the lens of money, the less you are able to break free from the identity of money. For some, that may not necessarily be a bad thing. Perhaps you’re a financial advisor, and your personal wealth has to be a reliable signal to others that you know what you’re doing.

The more influence you have over others, money changes its utility. The danger is that you moved from attachment of money to less attached to money and then back to being attached to money.

This may be the reason there are well-off people unhappy that they lost millions of dollars but objectively that may be 3-4% of their net wealth.

Money have meshed closely into our personal identity. Losing a small part of money also means losing yourself.

Summary

Given all this, what should we do?

Pick your spot. There should be a stage on one phase where you would have more clarity over life than other stages.

It may be ok to stay there.

I can facilitate to describe how much money is required to be at that stage. But I would not be able to tell you which stage suits you the most. Different persons may have different amount for the same stage in the phase.

I guess the host of the house tried to explain to me from the lens when he has power. During that time, I could not comprehend what he was saying.

If I am being honest, I do not comprehend even today because… I have not moved much past the later stages of Phase 3. Perhaps if I ever get there, it might make more sense.

Lawrence’s Money Is the Megaphone of Identity is a long but good read to recommend. Let me know which part of the article you most identify with.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Sharon

Monday 14th of December 2020

Wow, you found More To That. Welcome to the club! Lawrence is an excellent writer. Love reading his articles. He goes very in-depth.

Kyith

Monday 14th of December 2020

yes!