The portfolio that allows you to stay rich or preserve your wealth, may have to be very different from the one that helps you accumulate your wealth.

This is because you have to balance between taking money out periodically for your needs, while not taking out too much to “harm” your portfolio.

Cambria Investment’s Founder and Chief Investment Officer Meb Faber shared his research on how to construct a portfolio that allows you to stay rich in the depths of the Covid Pandemic.

You can read his thoughts here.

Here are my notes on his research here.

What does staying rich mean?

Every one of us wishes to stay rich but mathematically, what does staying rich mean?

Technically, Meb means preserving our future purchasing power in the best way possible. In math-speak, over the long term, you should be earning a REAL return that is positive.

If we wish to buy what we want, inflation is the big bad monster to beat.

Real return is the nominal return that you see fund managers published, deducting the headline inflation rate we see.

If we get a positive real return, then at the very least, our purchasing power is preserved.

The secondary objective is to be able to live with our portfolio.

To many, that equates to sleeping well at night.

This equals lower volatility and maximum drawdowns.

So the goal is to get the most optimum real return versus volatility.

Treasury Bills will not allow you to stay rich

Many people think the treasury bill is the most risk-free investment and therefore should be a big portion of the portfolio if you wish to remain rich.

From 1926 to 2020, treasury bills returned 3.4% a year with no drawdown on your capital.

But if we factor in inflation, the biggest drawdown that treasury bills experienced was -49%.

This basically means in a moderate inflationary environment, treasury bills are ok, but you cannot passively preserve your wealth if you need to adjust your portfolio tactically.

Almost every securitized asset has disastrous drawdowns

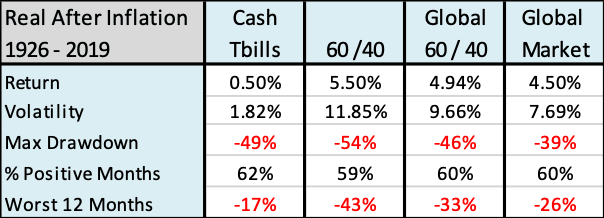

Meb provided the real return of each securitized asset class, the degree of volatility, maximum drawdowns and the number of months the asset class remain positive.

Almost everything has a deadlier max drawdown.

Cash Treasury bills keep up with inflation, while cash under the mattress earns you nothing and you lose badly. US stocks and foreign stocks are pretty similar but US stocks have a greater real return.

Long term bonds have pretty big drawdowns after inflation as well.

A Good Solution: The Global Asset Allocation Portfolio

Meb thinks that a diversified 40% equity, 10% commodities and 50% bond portfolio is able to allow you to stay rich better. This is his Global Asset Allocation or GAA portfolio.

If equities have positive real returns, then why not just put 100% in US stocks? Because the drawdown can make it hard for you to stomach unless you have great fortitude to sit through the vast amount of your wealth going through deep drawdowns.

From a perpetual income perspective, the volatility drag affects your portfolio’s ability to generate income perpetually.

Meb layers in from the 60/40 portfolio made up of US stocks and bonds to a global 60/40 before the Global Market (GAA) portfolio.

If you add anything to a 100% US equity portfolio it brings down the returns but the volatility drops. In this case, the real return drops from 7% to 4.5% but the volatility is equivalent to US 10-year bonds with lower maximum real drawdown than US 10-year bonds.

The difference between Global 60/40 and GAA is the gold and commodities and we can see the drop in long term returns but also volatility and drawdown.

There is also a hard reality: There is going to be some big drawdown.

No matter how we cut, there is still gonna be a 39% drawdown.

A Conservative Solution: GAA with Treasury Bills

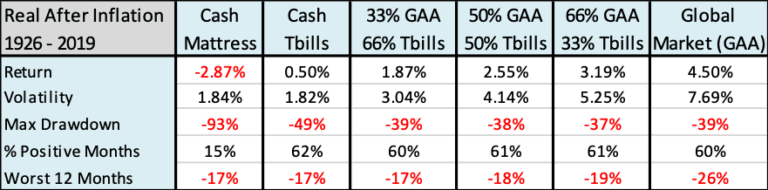

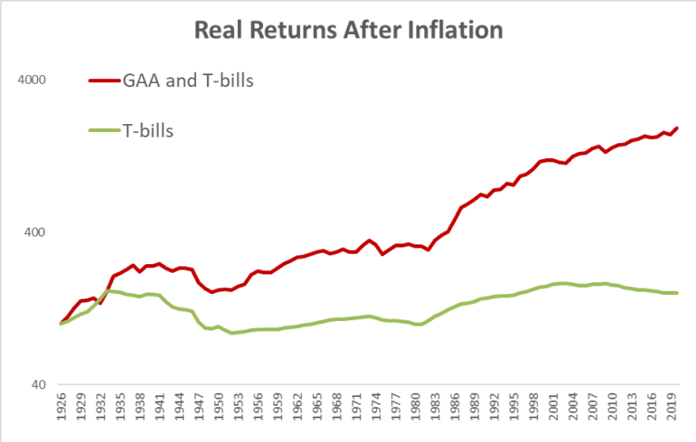

If the goal is to balance preserving our purchasing power versus the volatility, then Meb presents an alternative allocation where he combines Treasury bills with the GAA.

The goal is to have treasury bills profile but better real returns.

In the table above, Mab provided three different GAA and Treasury Bill allocations.

What we get is similar worst 12 months returns as cash Treasury Bills, but better maximum drawdown, higher volatility and about 2% better real returns.

If we compare the three portfolios against the GAA the volatility is lower but that is about it.

The real returns over the long term are better (as long as it is not flat it is good). The biggest drawdown probably occurred in the 1944 to 1947 period.

The Data Sheds Light On What Could be Viable Long Term Spending Rates to Keep Your Capital Intact Perpetually

A lot of wealth builders have this fascination of

- Preserving portfolio longevity to hedge longevity risks

- Ensuring that there is a perpetual income stream for themselves AND generations after

- Withstand against various economic regimes

- In a passive manner

This can be termed perpetual income.

Previously, I consolidated the research behind what is the safe percentage of capital to spend so as to preserve the wealth for perpetual income in these two articles:

- Generating Perpetual Passive Income – Contrasting the American and British Way of Measuring Wealth

- Could we Model Our Retirement Spending like Endowment Funds?

If you wish to create a university endowment kind of everlasting fund, the intersecting initial spending rate is about 2% to 3% of your initial capital, based on all this work.

The key is also to reduce the volatility drag and if we look at the expected return based on the combination of the GAA and Treasury Bills, it is between 1.87% to 3.20% a year.

This kind of coincides with the rough rule of thumb to have a perpetual income fund with a volatility profile of a Treasury portfolio.

A Global 60/40 portfolio and GAA portfolio will have a higher return (4.5 to 4.9% a year) but with higher volatility (7.7% to 10%) but it is still better than that if we have pure stocks (15 to 18.7%).

That should give you some handle on how much you can spend so that you wish to increase the chances of your money lasting forever and how the portfolio is setup.

Conclusion

Real returns are often confused with nominal returns by people. Some would think how come the returns are so low which in fact, is not low at all.

I think in recent months, there are greater conversations around the topic of inflation. If inflation is not part of the conversation, treasury bills is king.

I would say that these portfolios Meb presented beat inflation.

They don’t hedge inflation. Hedging means if inflation goes up in the next 6 months, what you are considering is also doing that within this time frame.

Beating inflation means over a longer period, your purchasing power is preserved.

The data shows that cash treasury bills do preserve purchasing power, but perhaps over the very long run, after a few market regimes.

But that is not how we live.

We need to spend money to pay for what we need and it wouldn’t help us if we just look at the returns over the long run and not how the portfolio performs in a shorter timeframe.

It will be interesting to see the data for real estate.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Henry

Wednesday 1st of June 2022

Hi Kyith,

I am planning to purchase a property with full cash. While looking for that property, I plan to put in Singapore Saving Bonds. However, SSB is limited to $200,000. I do not wish to put in bond or stocks to avoid all those volatility. Do you have any suggestion? Thanks.

Kyith

Friday 3rd of June 2022

Hi Henry, if you need 100% liquidity, then just put in cash or fixed deposit like instruments. Try to find the best or money market funds like Fullerton Cash Fund. The rates are lower but the principal is protected. that is what you want.

Revhappy

Friday 13th of May 2022

Hi Kyith,

Looking at your portfolio, your unrealised losses is similar to Mar 2020 levels and your networth is lower than what it was in Jan 2021, inspite of S&P500 being much higher, what is the reason for this deviation? Your ETFs seem to have multifactor overweight so it should do better that the cap weighted index performance. So I am a bit surprised. My networth is also down significantly on year to date basis, but compared to Jan 2021, I am still up.

Kyith

Saturday 14th of May 2022

I didnt actually look at my networth relative to mar 2020. the market is down and almost everything will go down accordingly. multifactor means over the long term we hope to capture the premiums or the rewards of risk associated with smaller, cheaper and higher quality companies with better momentum but it does not mean that in the short run it will do better. perhaps in certain time periods like in the 2000 to 2010 it shows meaningful deviation from the main markets because based on the selection, it significantly underweight growth stocks so the outperformance was more meaningful.