The Ministry of Finance announce almost at midnight a 35% Additional Buyer’s Stamp Duty (ABSD) will now apply for any transfer of residential property into a living trust from 9th May 2022 onwards.

This change primarily affects those living trusts set up with no identifiable beneficial owner at the time of transfer into a trust. Previously, the Buyer’s Stamp Duty was payable for the transfer but depending on the profile of the beneficiary, ABSD may also be payable.

The change means that if a trust has no identifiable beneficial owner at the time of the transfer of the residential property, the trustee will have to pay the ABSD called ABSD (Trust).

The trustee is able to apply to the IRAS for a refund of ABSD (Trust) if the following conditions are met:

- All beneficial owners of the residential property are identifiable individuals;

- Beneficial ownership of the residential property has vested in all of these beneficial owners at the time of property transfer into the trust; and

- The beneficial ownership cannot be varied or revoked, or be subject to any condition subsequent, under the terms of the trust.

A living trust is a trust created in the lifetime of the person who owns the asset, and who decides to put the assets into the trust. This person is called the settlor. A living trust differs from other types of trusts in that it is a live entity when the settlor is alive. Other trusts include a Standby Trust, which is a trust where assets can be transferred to the trust at a later date and only activated in defined events such as death or mental incapacity. There is also a testamentary trust, which is a trust that comes into effect after the settlor’s death.

Given the way the refund is worded, it seems that the trust cannot be a revocable trust, which is a trust where the settlor can terminate or change the terms of the trust. I find that those trusts that are not subjected to future gift or estate tax tend to need to be irrevocable.

The question in our mind is what is an identifiable beneficial owner and IRAS defines who are not identifiable beneficial owners:

Basically, if the beneficial owners can be easily changed, are very transient or someone will only become beneficiary when conditions are met, these are not identifiable and you cannot get a refund.

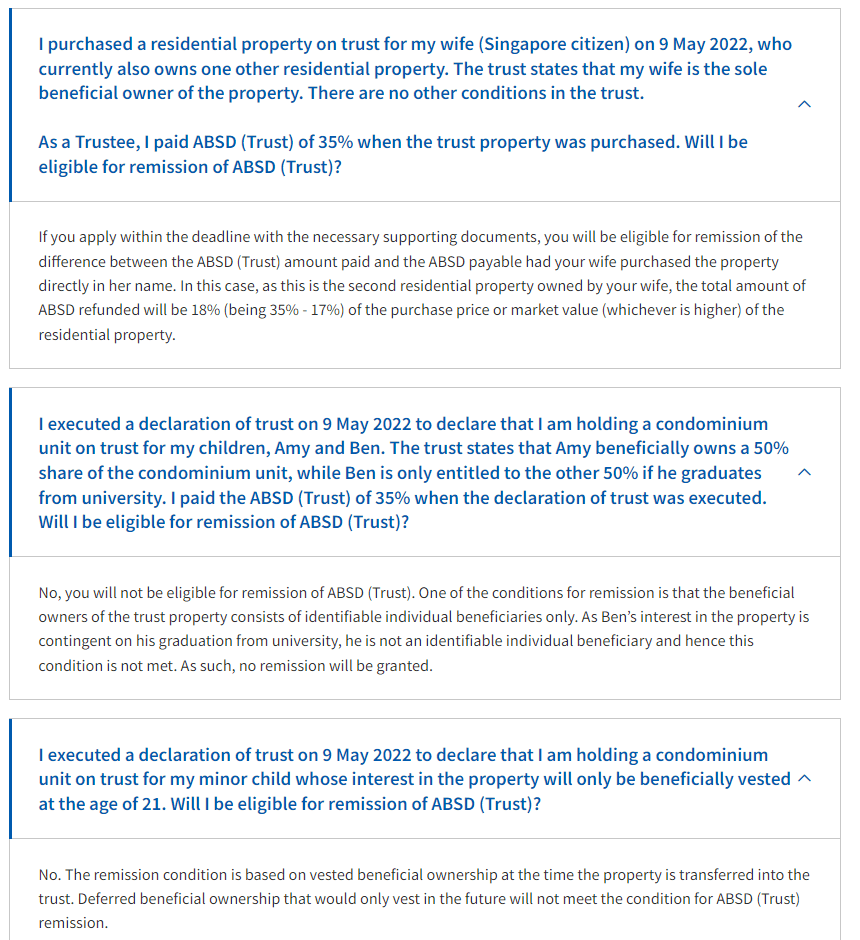

IRAS gave some examples in their FAQ:

The last two examples give us a better colour.

I think the government observed that many richer people who like property but do not wish to pay ABSD would buy the property with 100% cash (if not, it cannot be purchased as trust property) and put in a trust and set one or more of their children as beneficiary of the trust when certain conditions were met.

So this ABSD (Trust) tightens that.

I think if you look at the percentage of ABSD levied on the living trust, I feel that it is less to deter people from doing it but to earn tax on it. If they see this as a speculative problem that plagues a large group of Singaporeans, they would just have a 20% tax and it would send the message. Setting a high 35% feels more like a wealth tax on the rich.

Another possibility is that they observe that the recent property sales were done mainly by rich foreigners and Singaporeans using this method and because they do not need to pay ABSD, they would snap up the properties at an even higher price point and that would gradually raise property prices. Setting a high ABSD will nerf property speculation by lengthening the holding duration, thus bringing down the internal rate of return of the property.

The number of people that could do it is limited (paying 100% for a property is already kinda tough except for the rich), so this one does not affect things so much, which makes this look more like executing a wealth tax.

Now people are wondering if the government will do something about de-coupling. That is the final frontier. Most likely they will not.

Business Times have a good article where they provided quick takes from property analysts. It is worth a read.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024