I had a discussion with a member of my Telegram group about something Dan Egan, VP of Behavioral Finance & Investing at Betterment, shared in the past. Dan’s post was the basis of my advanced personal cash flow management post yesterday.

Dan shared that his emergency money is entirely fungible in that the money can be used for different types of emergencies. And he invests the emergency funds, which grow over time if the emergency never comes up.

Dan took this route due to his money philosophy.

He dislikes inflation, so he would rather hedge his long-term purchasing power than risk deflation in the short term.

I think you will fall into either the camp of “emergency funds should only be put in very safe cash-like securities” or the camp of “how should I invest my emergency funds?”.

I used to wack my friend Mr 15 Hour Work Week for his funky emergency fund strategy because I think we should not be so risk-seeking when it comes to our emergency fund.

Today, I had some years thinking through this and the experience of listening to more people to give me a different take on emergency funds.

My recommendation for your emergency fund is:

- If you do not have so much money in your emergency fund, don’t invest the money. Have most of the money in securities you can access in the time frame you need, with almost all the value intact.

- If your emergency fund is larger, you could invest in a balanced fund at most, but you should treat it the same way as #1.

I will explain to you my thoughts in this article.

If you would like to learn more about an emergency fund, how one should frame the fund and learn different aspects of emergency funds, and the sequence of emergency fund accumulation, you should read my comprehensive emergency fund guide here.

The Objectives of an Emergency Fund

Emergencies are events that you least expected. If you expected something to happen and you have not set aside money, then it’s less of an emergency but more of a failure to plan for.

Thus, we are planning for events that:

- Not sure when it will happen

- When it happens, how much we need

- How many times we will access it and the interval

There is uncertainty in time and magnitude.

Why Do We Want to Invest in our Emergency Fund

Typically, we are most afraid that if the emergency does not happen, the money will sit idle and not earn a return. Many of us don’t like the idea of our money not being deployed well.

Our emergency fund has an opportunity cost if it is stored in cash.

The Size of Our Emergency Fund is Different

The size of our emergency fund depends on:

- Our situation. Some of us are new to personal finance and will encounter more emergencies, and some of us have to take care of more people’s affairs.

- Our risk-averse nature.

- What we have

After COVID, I think having an emergency fund that comes up to twelve months of your expenses is reasonable. For some with more to fend for, twenty-four months is possible.

For those with more money, the fear that they need to invest their money is greater.

Emergency Fund Should Encourage You to Be More Risk Seeking With the Rest of Your Wealth

Suppose we know that we have adequately set aside money meant for unknown situations that may hit us. In that case, we should be able to safely invest the rest of our money, according to our risk tolerance, in better-optimized portfolios.

Thus, the more recommended stance is to have an extremely safe emergency fund and invest in riskier stuff for your other goals.

Is Investing Our Emergency Fund Unsound?

His philosophy drives Dan Egan to prioritise not losing to inflation over having enough money.

I think that goes against the purpose of an emergency fund, but our thinking can be very different, so there is no one size fits all solution.

To make the plan work here is what we can do:

- Have an idea of how much you need to have when emergencies of different magnitude occur. For example, you should always have six months of expenses.

- Overfund your emergency fund based on the worst historical drawdown for such a portfolio. When a drawdown of that magnitude happens, you will still satisfy your original goal: access to the amount of money you were thinking of.

The problem for many is that:

- They don’t know the portfolios that they deploy the money to can be volatile.

- They don’t know how volatile the portfolio is.

This would result in an emergency fund solution that is less sound.

The Main Problem With Investing Your Emergency Fund in Riskier Assets

In many minds, we might think that if we take out a portion of our emergency fund, the emergency fund can still recover.

It may be possible if we take out less than 6-8% of the fund in a once-in-a-blue-moon frequency.

However, if the amount is larger, we have to top the fund up most of the time. We will likely have to top up the fund whether we invest in riskier or safer assets.

If you invest your money and the worst return occurs, you may lose twice the amount you plan.

For example, suppose in your mind, you want to ensure that the maximum single event risk you wish to protect against is $25,000.

The maximum historical volatility that has occurred is 45% in six months.

So your plan will be to set aside $25,000/0.45 = $55,555 in your emergency fund.

In the worst-case scenario, this will happen:

- $55,555 goes down to $25,000.

- You spend $25,000.

- Your emergency fund is zero.

So in the worst case, Your riskier emergency fund gets wiped out.

If the drawdown is smaller:

- $55,555 goes down 10% to $50,000

- You spend $25,000

- Your emergency fund is left with $25,000

Volatility drag will stop your portfolio from growing and investing in returning to original value because too much was taken out, causing permanent “damage”.

Thus, the riskier emergency fund will still have to be funded by topping up.

How the Traditional Emergency Fund Strategy Will Play Out in a Grave Market Downturn

The alternative is to keep the $55,555 separately:

- $25,000 in no volatility securities like cash, fixed deposits, and Singapore savings bonds as the emergency fund.

- Assign the $30,555 in a riskier 100% equity portfolio to a specific financial goal you wish to pursue.

When a six-month 45% drawdown happens:

- Tap the emergency fund for the $25,000.

- The $30,555 will fall to $16,805 but will likely recover in the next 5-8 years back to $30,555.

You will still have $30,555 in this traditional emergency fund strategy.

What This Means: Emergency Fund Needs a Less Volatile Portfolio

If based on the numbers in the example, it works out to a 55% equity and 45% cash portfolio.

We could begrudgingly use a 40% equity and 60% bond portfolio to achieve roughly the same result. Bonds are riskier than cash, so we must compensate for that.

This means there is a cap to the volatility of the ideal portfolio for an emergency fund.

The Larger the Emergency Fund, the More Volatile the Portfolio

If your emergency fund is like five years of your expenses, in theory, the equity allocation can be greater.

The Six-Month Volatility of Different Emergency Fund Portfolio Solutions

How volatile can your emergency fund solution get?

We look at three different portfolios:

- 100% equity based on an MSCI World Index.

- 100% bond based on five year US treasury bond. When a crisis happens, investors flock to US treasury bonds, so it is the best in terms of credit quality and how they react to the crisis. But it is still volatile.

- A 50% MSCI World and 50% five-year US treasury bond portfolio.

We have data from 1970 to Jun 2022, and we will chart the six-month returns because we should need the money rather fast, so we cannot tolerate large volatilities. You could even contend I should do three-month instead of six months, but I will not do that.

Here is the six-month rolling return of the MSCI World portfolio:

There is some crazy appreciation that you would get. Stocks tend to go up over time. But if you need to extract money from the portfolio, high volatility portfolios may not be a good idea.

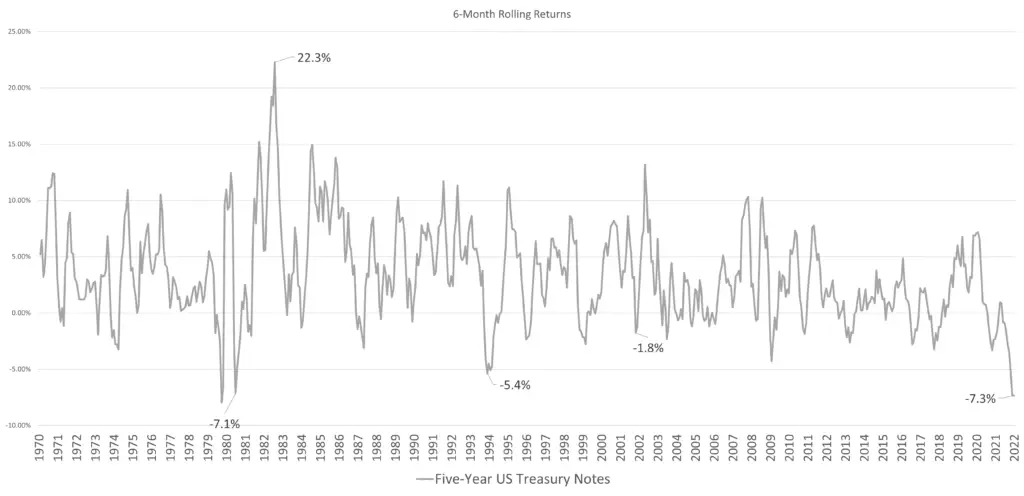

Here is the six-month rolling return of the Five Year US Treasury portfolio:

Even if the credit quality is high, there are duration and interest rate risks. The largest drawdown that you will get in the portfolio… is right about now!

Your portfolio will still go down 7.3%.

7.3% in the grand scheme of things… is still very manageable and not too bad of a solution but I think many people were surprised that their cash management portfolios with Robo-advisors can have negative unrealised losses.

Most likely, they are less guided when they deploy their money.

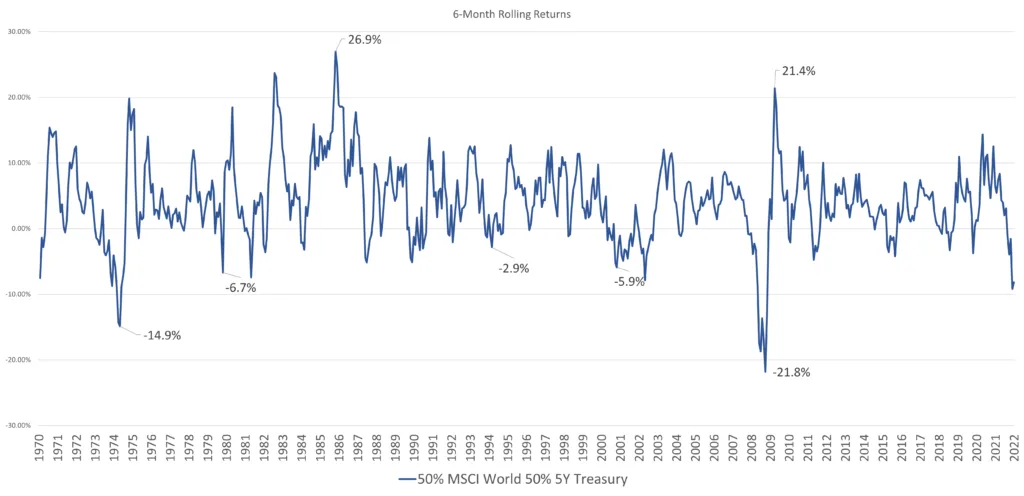

Here is the six-month rolling return of the more balanced portfolio:

This probably fits what you are looking for if your emergency fund is very large.

Remember the Problem That You are Addressing

Usually, our circumstances are very different and there are no fixed solutions.

But the important thing is that you need to know very clearly the problem you are attempting to solve. Some financial problems are tougher.

It might make sense to split the financial problem into some problems instead of looking at them in one big chunk.

Cash, in a way, has this comforting ability to give people peace of mind.

When shit happens, that is something that you might appreciate more.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Sinkie

Saturday 23rd of July 2022

Investing your emergency funds, even if it's just a 10% allocation to a stock index, should only be attempted by those who have experienced multiple bear markets & eaten plenty of salt along the way.

Keeping it simple & using only cash-like has psychological benefits that can outweigh whatever potential extra returns or "beat inflation".

E.g. Having a more optimised allocation for your actual main investment portfolio, & not doing stupid things with it when SHTF.

Kyith

Saturday 23rd of July 2022

yup

createwealth8888

Saturday 23rd of July 2022

COVID crisis has taught me that even free lance and adhoc job can also be affected and lost for awhile!

Kyith

Saturday 23rd of July 2022

Hello uncle create wealth!!!!