I have a reader, who first contacted me to ascertain whether the amount she requires to attain the status of Financial Security is correct.

So she has a follow up question, after I helped her with that figure:

I have decided on buying the exchange traded funds (ETF) but I am not sure what’s the process of buying it and which one I should go for. I am thinking of putting one lump sum first before investing a fixed monthly sum. Can you advise me how I should go about doing it? I read some articles online but seem to be very complex and was confused. It seems I also have to sit through some kind of test as well?

This seem to be a common question, judging that it seems to be repeated a lot in other discussion forum, so I thought I will try to address it today.

Her question can be broken up into a few parts:

- How to go about setting up to buy and sell exchange traded funds (ETF)?

- Which ETF should she purchase?

- How should she start of building her ETF portfolio?

Accumulating wealth through ETF is one of the most passive approach to building wealth. Compare to many others, which I find lean closer to active management then passive management.

There are some positives of this method:

- Your portfolio is diversified. This guards against the blow up of one specific stock or bonds

- Retail investors can readily form a portfolio with the ETFs available in Singapore, Hong Kong and London Stock Exchanges

- We do not know whether the future will be the same as the past, but the components that you use to form your portfolio can have a positive expected return. This is important because if you put in an asset A and historically at different rolling periods, the compounded average growth is negative, then why do we invest in something like that?

- Exchange traded funds are lower in expense cost then unit trust, investment linked policy (and cost matters a lot in investment)

- Exchange traded funds that tracked traditional benchmark indices are not actively managed, and you do not run into the problem of your unit trust fund manager under-performing the benchmark index (because you are buying the index!) and charging you an exorbitant management fee for that

- An ETF portfolio is low effort. You need to put in upfront effort to learn how to manage an ETF portfolio, and after that your recurring maintenance effort is to inject capital, re-balance your portfolio and then continue to read up on index investing, behavioral aspect of finance

Like all investments, there are always negatives.

Some of them are:

- In terms of available ETF that you can form the core of your portfolio, there isn’t a lot in Singapore. This means that you need to venture to overseas stock exchange such as London Stock Exchange, Hong Kong stock exchange, USA stock exchange, to find these more robust, low cost ETF. Fortunately, your local stock brokers allow you to invest in them

- When you venture overseas, you have to contend with dividend withholding taxes. This could shave your returns. You may also have to contend with estate duty or death taxes. For example, if a non-US citizen passes away, there run a likelihood that 50% of his assets will go to the USA government as estate tax (excluding US$60,000). There are inheritance tax in UK as well. There are non in Hong Kong

- Future conditions could change. Historical returns in the future may not mirror that in the past

- In the short run, the value of your assets can be volatile. And you might not be ready for how volatile it is. So much so that it makes the investor make stupid decisions

1. How to go about setting up to buy and sell exchange traded funds (ETF)?

I have written a very comprehensive article in the past titled Beginner’s Guide – How to Buy and Sell Stocks, Bonds, REITs and ETFs in Singapore

It explains what is a brokerage account, what are stock exchanges and step by step how to go about purchasing and selling stocks, REITs, exchange traded funds.

Let me share with you: The first step is always frightening, but after a while it should get better.

So go through the process:

- Open a brokerage account with a broker

- Open a local custodian account, the CDP account with your first broker

- Take a MAS Customer Knowledge Assessment

- Fill in W8Ben tax declaration form if you wish to trade in USA

- Wait for your account to be processed

- Upon receiving your account ID, password, pin, 2FA token, you can start trading, or buying and selling securities

She mentioned that there is some test that needs to be carried out. That would be the MAS Customer Knowledge Assessment. I have talked about that in the article as well.

Basically, MAS would like to guard novice investors from gaining access to derivatives and sophisticated products. They are afraid that you will burn yourself.

Unfortunately, buying ETF overseas, falls under this category. So the solution is for you to take and pass this test.

Don’t worry, as long as you study the materials you should be able to pass. There is no fee for the quiz. To make you feel better, I failed a few times in the past as well.

Which broker should you use?

The thing about broker is that go for one that is relatively low cost yet provides a good sustainable platform. Most of the brokers are almost the same.

If you are buying ETF from overseas, I suggest Standard Chartered Online Trading (SCB). It is the one that I use, there are no dividend handling charges, and custodian charges for holding your overseas stocks. The minimum is $10 for most currencies and commission at 0.25%. The downside for Standard Chartered is that if you are to purchase the ETF from London Stock Exchange and you need to convert the SGD to GBP, the rates of Standard Chartered is not fantastic.

I am not sure if you can outright create a SCB account. They may ask whether you have make 6 transactions in another broker.

You might need to set up with a local broker. Contact me personally to link up with some of the brokers I know (that provide good service)

You can make your initial Singapore ETF allocation through the local broker, before using SCB for your overseas ETF.

2. Which ETF should she purchase?

This is a tough one because I have no idea about her appetite and goal.

I suppose the goal is to build wealth, but with minimal effort.

The usual component to build wealth is to do it with a stock/equity and bond/debt allocation.

Stock/equity tends to be risky, but because it is risky, more volatile, you hope that the returns are high enough to compensate for it. To grow your wealth, you have to take some form of risk.

Bond/debt tends to be lower return, less volatile.

If you hold a basket of stocks in a ETF, there is diversification, and it guards against a group of stocks blowing up and for you to lose all your money.

If you hold a basket of bonds in an ETF, there is diversification, and guard against a few bonds defaulting on their payments, and these bonds losing their value.

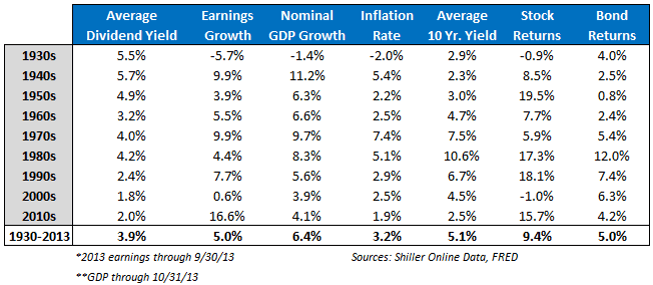

Both stocks and bonds, in the past, have shown positive expected return. If they are not showing positive expected return, or having the potential to have positive expected return in the next 20 years, why would we invest in them?

We combine stocks and bonds because one is higher return but more volatile, one is lower return and less volatile. When one performs well, the other might not perform well and vice versa.

What you will get is that the overall volatility of your portfolio is reduced.

Why is this important?

Traditionally, when you see that you are losing money, or potentially going to lose money, you tend to do stupid things. Thus, if we can reduce the overall volatility of the portfolio, it guards us from doing stupid things to our portfolio.

It is the time in the market that builds wealth. And to keep you in the market, lower volatility increases the probability that you will stick this out.

Unless you understands this concept so well and you can live with volatility. In that case you can have a 100% equity allocation.

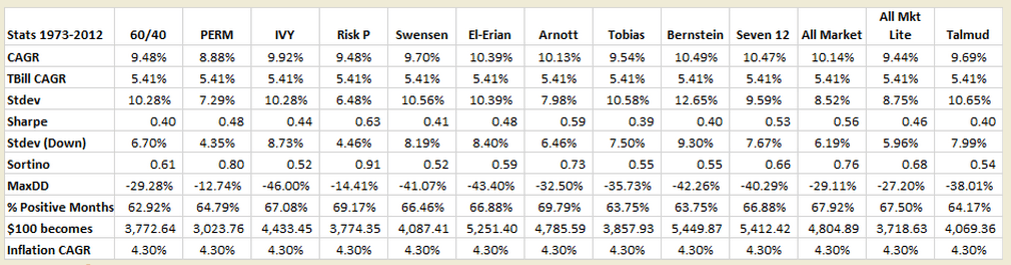

Before we go into which ETF to buy, the table above shows some stats on various academic portfolios created by the thought leaders in the field. These could combine stocks, bonds, real estate, commodities, gold, cash and different asset class.

They are measured against a 60/40 portfolio, which is a portfolio of 60% stocks and 40% bonds.

The data is taken from 1973 to 2012.

You will notice the compounded average growth rate (CAGR) is around 8.88% to 10.49% for the various portfolio. These are pretty good returns all round. Even the weakest, is enviable. Are we going to get something like that in the past? Might not be.

What this shows us is that to a certain extend, different percentage of allocation to different assets in a portfolio might not bring outsize out performance over other strategies.

If you observe MaxDD, which stands for the maximum draw down or the drop of your portfolio from peak downwards, they can be horrendous at-30%, -45% in the past.

This is the negative volatility you have to contend with (if you get +30%, +45%, I don’t think you will complain). Notice that the PERM which stands for permanent portfolio, and Risk P which stands for Risk Parity portfolio have a MaxDD of -12.7% and -14% respectively.

So which ETF to choose?

Generally, if you wish for your ETF portfolio to be low effort, it is recommended to choose ETFs that are fundamentally sound, low cost, broadly diversified. This allows you to capture the majority of the market that you wish to cover.

Around the world many folks advocate very simple lazy portfolios.

Andrew Hallam – Millionaire Teacher

Andrew Hallam was an international school teacher, who taught in Singapore. He wrote the book Millionaire Teacher, which I strongly recommend you read because it is simple, explains the personal finance and passive indexing portion of investing.

He advocates:

- A world equity ETF

- A home country equity ETF

- A home country bond ETF

Here is an article he has written in 2010.

His idea is to create it with:

- 30% Equity – Vanguard FTSE Global All Cap ex Canada Index ETF (VXC) listed on the Toronto Stock Exchange

- 30% Equity – SPDR Straits Times Index ETF (ES3) listed on the Singapore SGX Exchange

- 40% Bond – ABF Singapore Bond Index Fund (A35) listed on the Singapore SGX Exchange

This was 8 years ago.

So if you have $10,000, you can have

- $3,000 in VXC

- $3,000 in ES3

- $4,000 in A35

So every half a year, or quarterly, or annual, you can contribute in equal percentage to this allocation.

Joshua Giersch – Shiny Things in HardwareZone Money Mind

Joshua was born in Australia, but lived in Singapore for 5 years before he went over to USA to work. He worked for 10 years as a quantitative analyst and currency options trader.

And he has been writing and helping new investors in HardwareZone Money Mind, sharing his thoughts on passive index investing for a long time.

Given his background as a quant analyst and FX options trader, his ad-vocation of a simple passive index portfolio versus what he is good at is interesting.

You can go find and read his 83 page book Rich by Retirement. (It includes much personal finance elements, debunking some other financial assets hearsay as well).

This book is important because it is applicable for Singaporeans, whereas other books discuss more on the ETF and indexing aspect of building wealth but in the USA context.

Joshua’s idea is:

- 40% Equity – iShares Core MSCI World ETF USD Acc (IWDA) listed on the London Stock Exchange

- 40% Equity – SPDR Straits Times Index ETF (ES3) listed on the Singapore SGX Exchange

- 20% Bond – ABF Singapore Bond Index Fund (A35) listed on the Singapore SGX Exchange

The change is slight but Joshua really like IWDA as it covers stocks in every developed market in the world, and the expense ratio is very low (0.20%). Also, it reinvests its dividends automatically instead of paying them out.

Other Lazy Portfolios

I have given you 2 examples but in truth there are a lot of resources on this so called Lazy Portfolio.

The key is to read, and understand how these folks came up with these allocations, what is their motivations, the pros and cons.

If you read more, you will see the benefits being repeated again and and again.

- The Escape Artist posted on JL Collins on an International ETF Portfolio. He listed down a UK, USA, Canada and Australia implementation (Interestingly, JL Collins have written a book on passive index investing with a focus on Financial Independence. The book is called The Simple Path to Wealth. Highly recommended read)

- Canadian Couch Potato Model ETF Portfolio. He started off as a Canadian Money Blogger, who eventually pivoted to be a financial adviser. His ETF portfolio is also based on three ETF, a All World Equity ETF, a Canadian Equity ETF and a Canadian Bond ETF

- 8 Different Lazy Portfolios listed down the lazy portfolio of a few renowned investors.

3. How should she start of building her ETF portfolio?

This will depend on her capital.

I would suggest to her to learn the ropes of investing by investing in only 1 ETF. This will allow her to be comfortable with the purchase and sale process of the broker.

So if she has $10,000, she can contribute to the STI ETF (ES3) in 2 batches, and get comfortable with it.

There is this pervasive idea in investing that you have to contribute an equal amount every time.

In my opinion you do not need to.

Suppose your ideal allocation is a 40% World Equity ETF, 40% Singapore Equity ETF, and 20% Singapore Bond ETF.

You can contribute 100% of your lump sum to Singapore equity, or 50% to Singapore equity, 50% Singapore bond.

Then you accumulate your cash until it becomes sizable and cost effect based on commission for you to invest again.

So if you build up $6,000, you could then put them in the World Equity ETF.

Be cognizant that your ideal allocation is 40/40/20 and whenever you have the capital try get to that stage.

Once you have formed that 40/40/20 allocation, then perhaps you can invest in equal amounts.

Do not be worried that your capital is too small to invest monthly. Just accumulate them so that you can invest half yearly, or annually.

In the grand scheme of things, the performance difference of dollar cost averaging monthly versus annually is not going to be a lot.

The key here is to invest in a cost effective manner.

4. Spend your Time to Increase Your Competency in Index Investing

You won’t buy into what I said fully unless you understand investing in this kind of Wealth Machine fully.

A lot of the times, you invest this way, because the thought leaders or experts say so.

You have to figure out why this wealth machine make sense. Or doesn’t make sense.

The way to build up your conviction, is to read enough on the subject.

Don’t worry about missing out and wanting to invest fast. If you missed out on 1 year of 100% gains, its not going to matter much.

It means that next year, you are going to average in and buy at a twice as expensive price. Your eventual goal might be $200,000 to $500,000.

Missing out on a $20,000 gain is not a catastrophe compare to not knowing what you are doing, freaking out every time there is an increase in volatility in the market, always second guessing whether is this the right way to build wealth, should you put in your money now that the market is “expensive”

There are many free resources on the subject.

You can read online. You can borrow books to read and build up competency.

Here are some things to read. You can either purchase them or borrow from the library. I suggest you try the library first:

- Millionaire Teacher by Andrew Hallam. Personal finance and Indexing. Should be an easy read to ease in. Available in National Library

- Rich by Retirement by Joshua Giersch. You need to buy this. Higher ranked by virtue of it being for the Singapore Context

- The Bogleheads’ guide to investing. Written by a bunch of John Bogle fans who are also practitioners investing in index funds. Available in National Library

- A random walk down Wall Street : the time-tested strategy for successful investing by Burton G. Malkiel. Available in National Library

- The simple path to wealth : your road map to financial independence and a rich, free life by JL Collins. Available in National Library. This is part personal finance, part financial independence. I like this book for it deals a lot with the behavioral aspect, explanation how to frame your brain to not do stupid investing stuff

- The little book of common sense investing : the only way to guarantee your fair share of stock market returns by John C. Bogle. Available in National Library

- 4 Pillars of Investing by William Bernstein. Available in National Library

There are some blogs that I like to read up in these area.

These are not strictly passive index investing blogs. However, these writers tackle the subject of equity and other asset classes over time, or they debunk recent market discussions through critical thinking.

This helps a lot to help you stay the course on index investing a lot.

The first person is Ben Carlson‘s blog A Wealth of Common Sense. This blog is his masters project (imagine what would happen if he didn’t decide to take his masters). He used to manage institution money and now works in Ritholtz Wealth Management.

Ben’s articles are short, but very data focus, and is able to keep your attention.

Nowadays he doesn’t write so much on the data stuff, because he wrote so much about it in the past (like 1 per day) that perhaps there are less things to write.

If you want to see returns, losses, volatility across various asset classes, over various time frame, binge read the following (start all the way from the start):

- http://awealthofcommonsense.com/category/markets/

- http://awealthofcommonsense.com/category/investments/

You will get short articles talking about data like this.

You will either be very convinced or get out of investing totally.

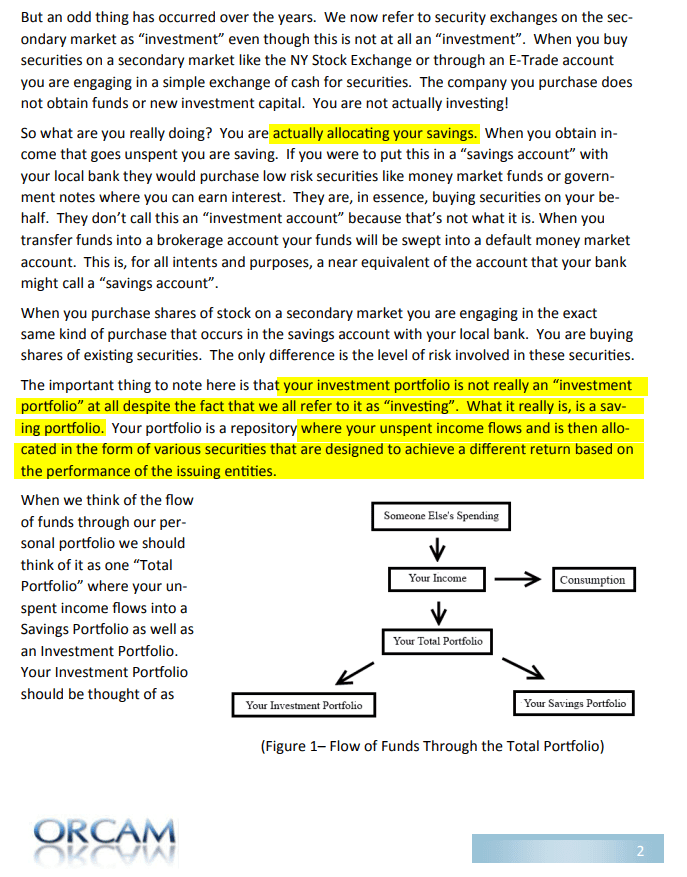

The second person is Cullen Roche over at Pragmatic Capitalism. He is not an indexing guy but does countercyclical indexing with low cost funds as a way to make money with lower volatility.

He is probably the one that re-frame the way I look at investment as a long term 20 year savings. If you look at it as a savings with a positive expected return, that is volatile before maturity, your conviction level might change a fair bit.

Not just that, the good thing about Cullen is his content is short, to the point, but makes you understand the world better.

So some of his latest content include:

- Putting the Rise in Yields in Perspective

- The Difference Between Asset Price Inflation & Consumer Price Inflation

- Are Individual Bonds Safer than Bond Funds?

- The Best Investment Strategy: DISCIPLINE

Finally some of my own content related to Indexing:

- The Global Stocks Index Fund in Singapore–Infinity Global Stock Index Fund

- Why you should build wealth passively with POSB Invest-Saver

- Your Returns if You Dollar Cost Average into the STI ETF

- Will you lose money on a bond ETF in a rising interest rate environment?

If Your Money is Important Enough to You….

To the best of my abilities, I will answer as much as I can about this topic.

You can get to where I am currently. What I learn is nothing new:

- I was interested in unit trust. I do not know how they work, so I went to the library as an undergraduate and read up on them

- I chance upon these blogs that seem to provide good information. So I read all their content overtime

- I read as much as I can of the Shiny Things thread in Hardwarezone MoneyMind

Why do I do this? Because I think it is the most fundamentally sound way, yet low effort way to invest for the average folks.

And I been trying to find such a method for some time.

It is still a little complex.

You will still get questions about the markets, fear, uncertainty, losing money, re-balancing. The reality is that you can read these up, get equipped and work through them better than active stock investing.

Do not worry about missing out on a 50% gain in 1 year, losing to inflation.

Spend 1 year learning about it. If you do not know what you are putting your money into, it is NOT a wealth machine. You are a mere speculator.

To build conviction, know what you are doing.

Let me know your thoughts.

To get started with dividend investing, start by bookmarking my Dividend Stock Tracker which shows the prevailing yields of blue chip dividend stocks, utilities, REITs updated nightly.

Make use of the free Stock Portfolio Tracker to track your dividend stock by transactions to show your total returns.

For my best articles on investing, growing money check out the resources section.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

Zhenghao

Sunday 27th of May 2018

Great post! You summarized almost all of what i would advise to my friends who are not prepared to invest the time required for active investing. I also recommend standard chartered at the moment. Well done and keep these great posts coming!

Kyith

Tuesday 29th of May 2018

Thanks. Really glad it helps

Financial Horse

Wednesday 23rd of May 2018

Oh, this is a great post. One of my readers was asking how should he start investing in ETFs (he wants 80-20 equity bond split becaues he is young and has a high risk appetitte), and I realised I should refer him to your post.

I've always wondered, do you invest primarily through ETFs, or do you stock pick? Personally I pick for the Singapore market (because I don't like the REIT ETFs, and not a huge fan of the STI), but for US/global markets I usually just ETF and buy one or two stocks I really like.

Cheers.

Kyith

Wednesday 23rd of May 2018

I mainly do active stock investing. one of the reasons I am aware of these other stuff is because firstly i was trying to find solutions for the general folk who wishes to spend less effort, and secondly i came from an unit trust environment