One of my Telegram group members wishes to know whether the income will last and how he envisions it if he has a bond-heavy portfolio during his 50-year retirement.

We discussed that it might be a better idea to keep the equity allocation in a stock-bond portfolio in retirement to about 40-75/80% allocation and he was curious about how things will work out in certain parameters.

So here is the Safe Withdrawal Rate simulation.

We are going to simulate the portfolio with:

- 0.50% p.a. all-in cost.

- Equity: S&P 500

- Bond: 50% 5-year Treasury bill and 50% long-term corporate. This allocation should create a mix with a duration closer to Bloomberg global aggregate and a credit profile that is less Treasury-like.

- Retirement duration: 50 years

- Allocation: 50%, 60% and 70% bond

- Inflation parameters: 3%, 3%, 3% constant inflation rate.

Before we do the simulation, I think this inflation parameter will kill the 50-year simulation that started in 1929 and 1937. It will make the simulation of those periods that start in 1960s to be much better.

For the readers, who do not have an idea what I am talking about, the safe withdrawal rate is a way to answer three linked questions about retirement:

- How much do you need to retire for a given duration of retirement?

- How much can you spend, so that you do not run out of money prematurely?

- What will be your allocation?

I did a video to roughly explain this and you might be interested to watch it:

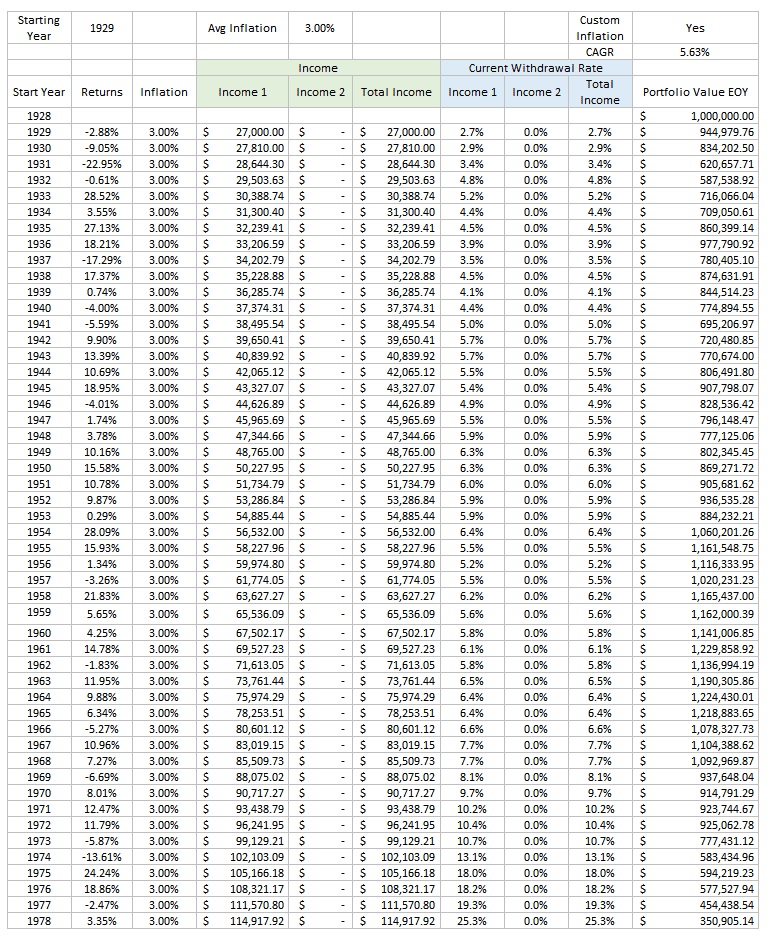

50% Bond and 50% Equity Allocation – $1 million portfolio

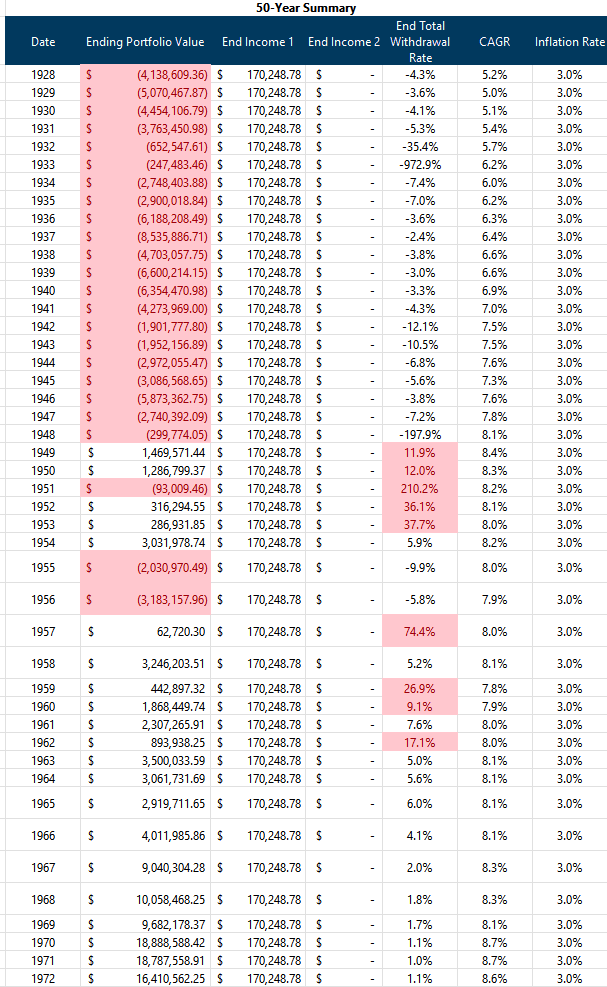

The table below shows the 45 fifty-year period we have simulated:

The highest income we can spend so that all fifty year sequence last was starting with $27,000 a year, then adjusting for inflation.

The fifty-year period starting in 1929 is so challenging that, the amount left is so much less, relative to the other periods.

We can see the 50-year CAGR of each of those periods.

Ending Total Withdrawal Rate shows at the end of year 50, what is the income divide by the portfolio value. A very low value shows that the income can go on for much longer.

You will observe that for most sequences, we should have income that goes on for at least 10 more years except for that 1929 sequence.

Here is that 1929 sequence in detail:

I am not sure how you feel about spending so little just to buffer for another scenario like the great depression. I told the Telegram member that if he is willing to cut his spending instead of adjusting his spending up 3% a year in a deflationary phase, he may be able to take a higher income.

If I have the choice, I would want to buffer for really challenging events like this for some of my spending but not all my spending.

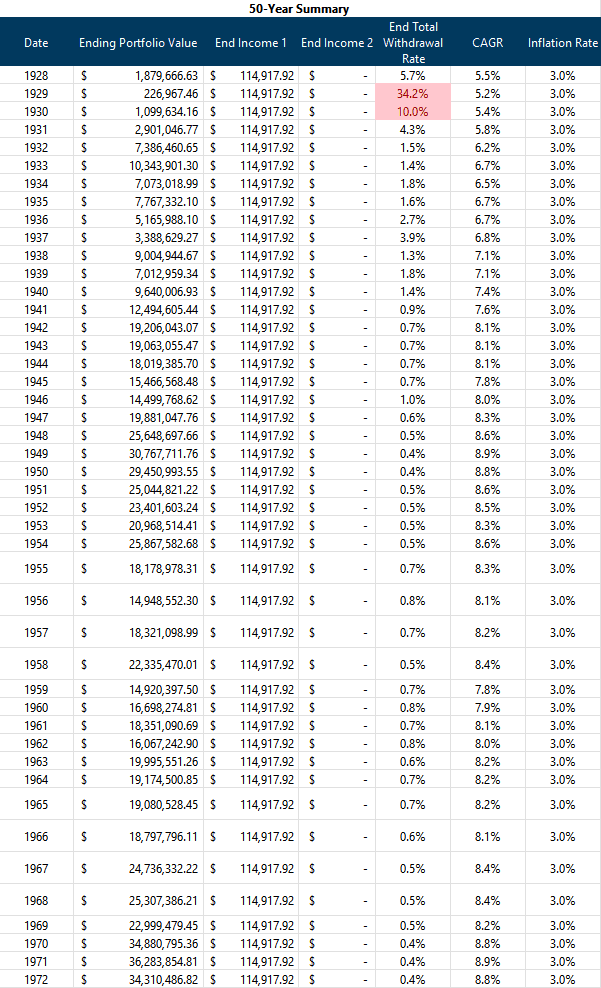

60% Bond and 40% Equity Allocation – $1 million portfolio

If we change the bond allocation to 60% instead of 50%, the outcome is still the same:

We can only start with an income of $27,000 a year on a $1 million dollar portfolio.

If we increase the income to $27,500, that 1929 sequence would fail.

We cannot exactly tell if increasing the bond allocation reduces the ending portfolio value. The ending portfolio value varies from sequence to sequence. In some sequences, having more bonds is conducive and in others, it is not. In those sequences where the market was pretty reasonable in volatility and great in returns, the portfolio with more equities does better naturally.

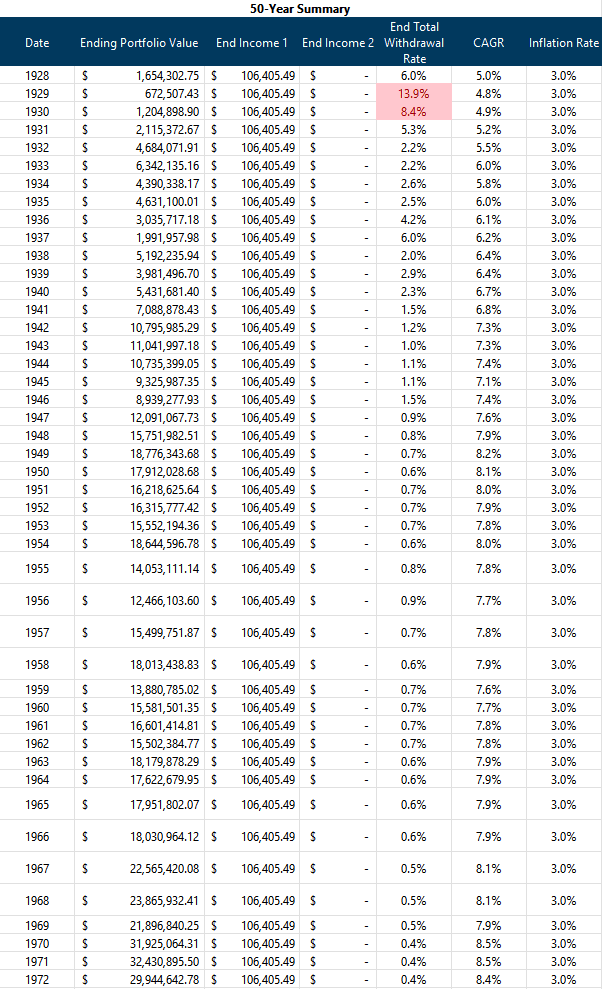

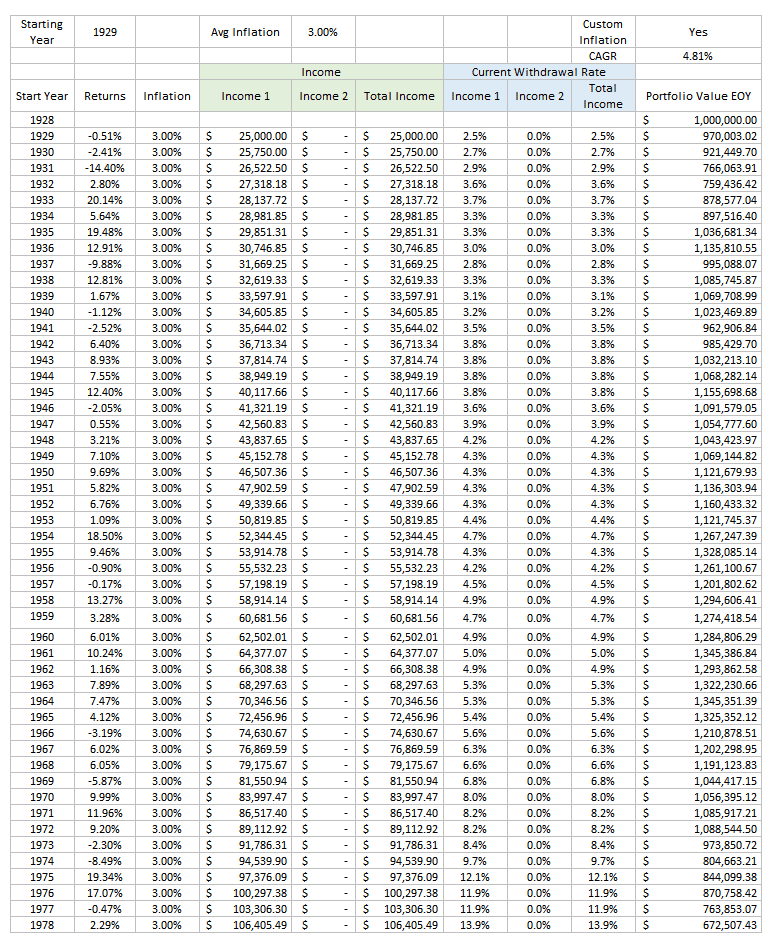

70% Bond and 30% Equity Allocation – $1 million portfolio

If we increase the bond allocation to 70%, the highest income that we can spend DECREASES to $25,000 a year:

How come the results got worse with more bond allocation?

Equities tend to keep up with inflation better. A reduction of equities for very long retirement periods such as 50 years becomes more challenging.

- If you need the income to last, the portfolio volatility cannot be too large. This means you need to keep your equities or risk-assets to a manageable allocation.

- But if you want your income to last for long retirement, you need enough equities.

Both statements look like contradict each other but it just means that either you keep your initial safe withdrawal rate low, or you need to reduce your equities allocation and then step up your equities allocation over time.

Here is how that 1929 sequence look like:

I hope you note that the starting income is $25,000 instead of $27,000.

The All-In Cost Matters in Retirement

One of the reason my SWR simulation is lower than the simulations you may read in other places is because some of them factor in all-in costs.

In this case, I am assuming a 50 basis points cost. Some of our funds cost 20 basis points and I leave enough room if you wish to use slightly higher cost funds from Dimensional or that you have some wrapper fees.

But what if I reduce the cost from 0.5% p.a. to 0.3% p.a.?

Suppose we use the last simulation of a 70% bond and 30% equity allocation, still starting with $25,000 a year.

The difference in portfolio value left in that challenging 1929 to 1978 sequence is:

- 50 basis points cost per year: $672,502

- 30 basis points cost per year: $1,145,149

Whoa a mere 20 basis points cost matters.

I also tested if we can start with an income of $27,000 instead if we have lower fee and the outcome doesn’t change much but you would survive that 1929 sequence but the money likely will run out within 3 more years.

Spend $40,000 on a $1 million portfolio for 50 years with a 70% bond allocation if we are okay with Ignoring the worst sequence.

While we are on this, I wanted to see if we can spend 4% of the initial value of our portfolio if we have a higher bond allocation for a longer retirement and if we are okay with accepting the risk of running out of money in such an outlier like the Great Depression.

I am keeping the cost at 30 basis points yearly.

Pure bullshit.

If we live through the periods before 1950s, we be fxxked.

Even if I reduced the bond allocation to 50%, we have 6 failed 50-year periods as well.

Last Words

It might be quite challenging for some to make out what all this means. Especially for the readers that did not pay attention to my previous posts or videos on the safe withdrawal rate.

So here are some reflections:

- The simulation above is NOT the traditional safe withdrawal rate done by William Bengen or in the Trinity Study. This one uses a fix 3% constant inflation at the request of my Telegram group member. The outcome can be different if we run the same thing with different parameters.

- Tweaking the equity and bond allocation makes less of a difference if we encounter challenging retirement sequences. What matters more is the ratio of your initial income to your portfolio value. The lower the ratio is, the better the portfolio survives. That ratio is also known as the initial safe withdrawal rate.

- Asset allocation to more equity definitely matters if we need the income to not run out prematurely for rather long periods (50, 60 years or for the income to be perpetual)

- If we want a good SWR to work around, usually it ends up closer to 2.7% to 3.2%. If you want the income to be safely more perpetual, the SWR figure is closer to 2.5%.

- Cost does matter in spending down your money. Think about it. If the SWR without cost is 3.2% and your portfolio cost is 1%, what will be your SWR? Should be closer to 2.2% right?

Okay now to Taiwan. Will be in Taiwan for two weeks.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Sinkie

Sunday 21st of January 2024

High bond allocation mainly helps in the first 5 years of retirement if there's a big bear market, financial crisis etc.

To have inflation-adjusted retirement income last for a loooong time, need to have 50++% in equities.

Increasing equity allocation while decreasing bond allocation as you pass the 5th, 7th, 10th, 15th year of retirement can be seen as the long-term coming down from the Bond Tent method, and a high equities allocation will eventually help to generate legacy-lasting inheritance for your grandchildren & great-grandchildren (if you're inclined in this route).

Kyith

Saturday 27th of January 2024

Hi Sinkie, yes the bond tent method or something similar may be something applicable.

lim

Wednesday 17th of January 2024

Is your assumption that you have to liquidate the bonds at mark to market prices in the years when bond prices are distressed?

If you construct a proper bond ladder (with individual bonds or iShares iBONDS), you will get a steady cashflow not only from interest payments but from bonds/bond ETFs that mature at face value (rather than looking a distressed MTM bond prices).

Kyith

Saturday 27th of January 2024

Bond prices are usually not distressed. The volatility usually are lower. What killed the plan is the equity side during the deflation periods and also for longer retirement periods like 50 years, the bonds find it hard to keep up.

Revhappy

Monday 15th of January 2024

Early retirement now, also came to the same conclusion and my plan as well is to employ rising equity glide path and keep high equity allocation in my retirement.