“My wife and I earned a combined of $150,000 last year. We have $110,000 left to pay off on our 4-room HDB flat’s mortgage. We have combined $250,000 in our CPF and $200,000 in cash saved up. How well are we doing?”

I would like to ask my readers: How often do your close friends ever confided this question to you? (let me know in the comments for this post below)

As well as I can remember things, none of my friends ever told me this sensitive part of their family life. Our personal finances are a secretive part of our lives that our friends, relatives, and colleagues should never know of.

But because of that, at the back of our mind, we have that same lingering question as the opening paragraph. For some, they believe they still have time to procrastinate and push this question to the depth of their mind. For others, they realize they need to find an answer.

They think their current financial situation is OK. But how could they verify that?

If you wish to know your current health situation, you signed up for a comprehensive health checkup. A health professional will explain your health checkup results.

Could you have something similar to help you assess your financial health and let you know whether you could reach your financial goals?

Today, I am going to introduce you to MoneyOwl’s Comprehensive Financial Plan service. It is currently FREE.

But before you sign up for it, I want to explain the value that you will get from this service and why it is important.

How Often Does This Financial Ponder Enter Your Head?

I work in a firm where prospects come to us seeking financial planning solutions. Outside of work at Investment Moats, I have readers asking whether I can help them with their unique financial problems.

I would like to think that I know a little bit about what occupies some of your money concerns.

Generally, what I came to realize is that people do not seek for a financial plan.

They seek someone or some organization to help them figure out

- How they are doing currently?

- Could they or when they can retire?

- What are the steps to get there?

What I observe at Investment Moats is that I have to validate #2 for people a lot. Different readers have some idea how to do #3 (if they do not have an idea, then I am not sure what they are reading here at Investment Moats.)

Those three questions usually hit you after 35 years old. You got through the hectic 25 to 35-year-old period where your partner and yourself are busy with getting the career on track, getting married, messing with your home and taking care of the baby.

After 35, for some, it is when the couple has slightly more bandwidth to catch a break and think. It is also the period where you might be facing more volatility or stagnation in your partner or your career. You start thinking about the future.

Finance wise, after 35 is also the time where you have dabbled in enough punts, investments you came across.

When you are in your late 20s, early 30s or even late 30s, you could brush off these questions.

As you get ever closer to the standard retirement age, the anxiety in both of you will build-up as you felt that you may not have enough time.

One thing I would tell those who contacted me is… let us figure out how you are doing now. Some folks scare the shit out of themselves thinking they are in such a poor state when their situation is much better than their peers. For some, they genuinely needed help because their situation is a mess.

What we observe at my workplace is that by their 40s, the prospects would have build-up a mixture of financial products/ assets/ plans that they do not have an idea (1) how they should categorize them and (2) whether they still need them going forward.

Why Knowing Your Current True Wealth Position is Important

If you do not have a good idea if you are doing OK, it will be difficult to move forward.

If your finances are in a mess, currently you would not be in a good position to take on more risk in investments. We have to take a step back and arrange your financial house in order.

Building wealth for financial independence is not just about getting the best product. You could get the best product, but if you are in debt, you might gain better performance by paying off the debt. You could also review your policies, cash and other products you have purchased to see if you can re-allocate them to investments that fit your wealth-building better.

For some of you, you might be doing pretty OK.

Knowing that you are more or less on track can is part of the value of engaging a financial planner. The freedom from worry allows you to focus on your work and family better.

Having clarity from knowing how you are, what are the steps to take going forward allow you to focus on executing the steps that take you there.

If you are unsure whether you are doing the right thing, it will be hard to push 100% in one direction. We need help to validate if what we wish to do is the best course of action.

What Should You Find in Your Comprehensive Financial Plan?

To gain clarity on how you are doing, a lot of times you need a professional to help you. They should help come up with a comprehensive financial plan.

MoneyOwl’s 4th Bionic Service With a Robo Platform helps you make sense of your current financial situation. It provides you with a Comprehensive Financial Plan.

The financial plan encapsulates

- How you are doing now (Your current true wealth position)

- What are your financial goals

- The level of income in financial independence (FI) they estimate you would have at the FI age you wish for

- The financial commitment that you need to make in order to get there

- A human adviser will sit with you to interpret the report with you (if you wish to). This would usually last about 2 hours.

In order to come up with this plan, MoneyOwl would need to know your full financial life. You would have to carry out a fact-finding process where you will be asked about your goals, your income & expenses, your assets & liabilities, your investments, your CPF.

And you have to create an account with them. (If they prompt you for the Promo code after you have created an account, the Promo code likely is sent to your email. The email might end up in your Spam folder so do check that!)

That is it.

There may be apprehension in providing so much of your financial life. Some consumers do not give the info of all your assets to their advisers because they are afraid that if they reveal more of what they have, their advisers will force them into an uncomfortable position to commit all of their money to financial products the advisers have for them (more on this perhaps in another post.)

So here is the opportunity to have a comprehensive plan.

- You pay for a diagnosis of your current financial situation.

- In return, no product is pushed to you. You will have the freedom to implement on your own, if not MoneyOwl can help with their portfolio solutions.

The kicker is that for a limited time, this comprehensive financial planning is FREE.

Normally, I would show you the process. But this time I thought of just showing you the end product that you will get.

So here are some selected parts of the report.

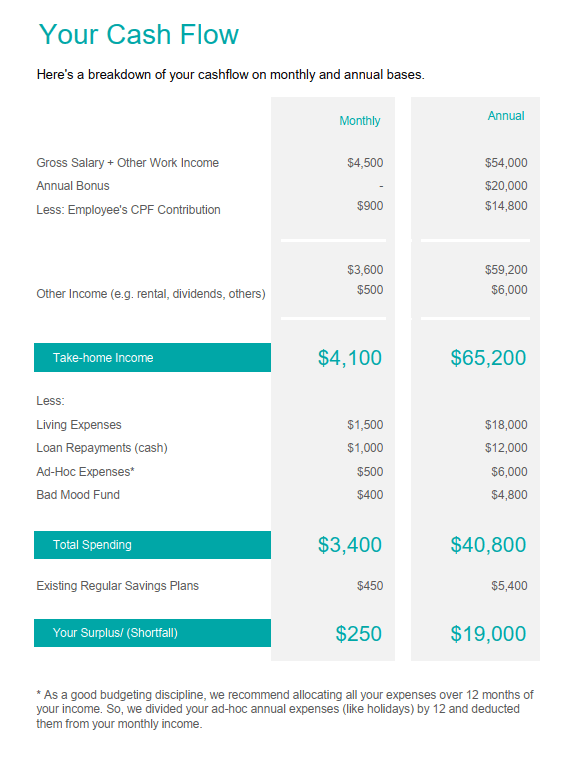

1. A Summary of Your Income and Expenses

It astounds me how many people do not know in total, how much they earn annually. I think it might be a by-product of auto income tax filling.

If you fill in the information truthfully, the report will show your income & expenses broken down into a few key categories. CPF is separated out, your loan repayments as well.

The objective here is to come up with your Surplus or Shortfall. This is your excess cash flow or free cash flow that you could use to channel into your education or FI goals.

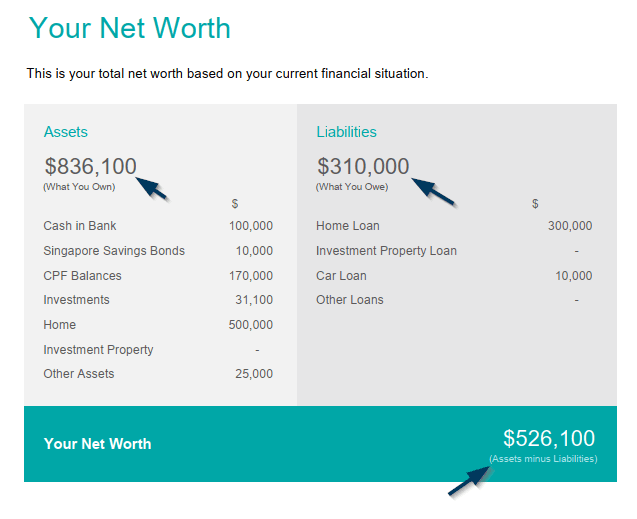

2. Your Net Worth

The net worth is “your financial report card” up to this point. If your financial life is in order, your net worth should be progressing well. If not, we need to find out why…

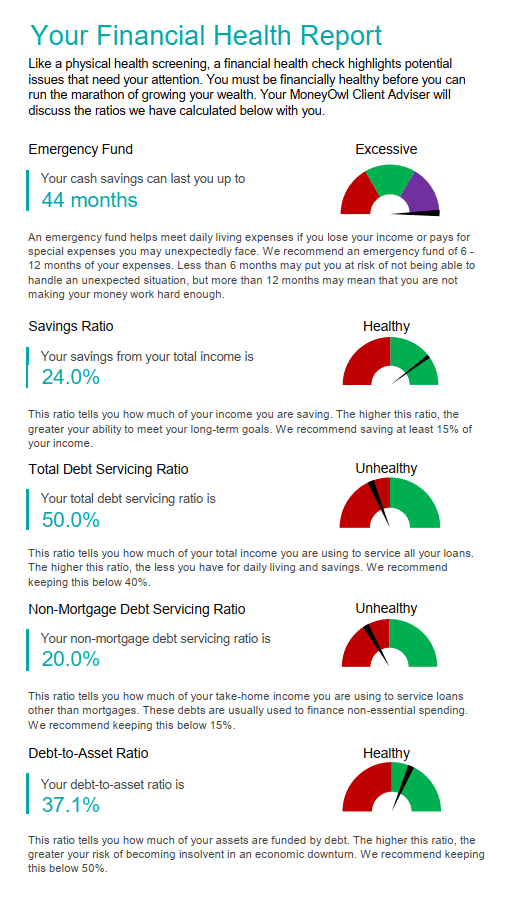

3. Critical Ratio Analysis

MoneyOwl analyses a few critical ratios that help determine your overall financial wealth. The emergency fund computes how many months of cash you have in the event of an emergency. This guy has 44 months which is about nearly 4 years. My own report shows that I reached 300 months (25 years).

The savings ratio tells you a lot of whether you could be FI. A high one is good. It also means your expenses as a percentage of your income is in control.

The next 3 ratios shows your ability to service your debt and whether you are overleveraged.

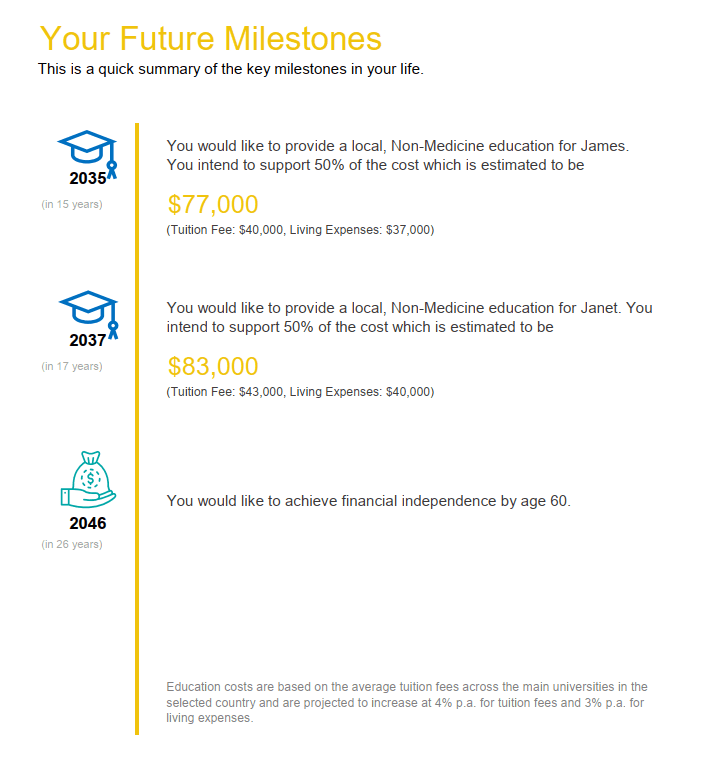

4. Where do you wish to get to?

MoneyOwl’s report shows you the financial milestones when they happen and how much you will need.

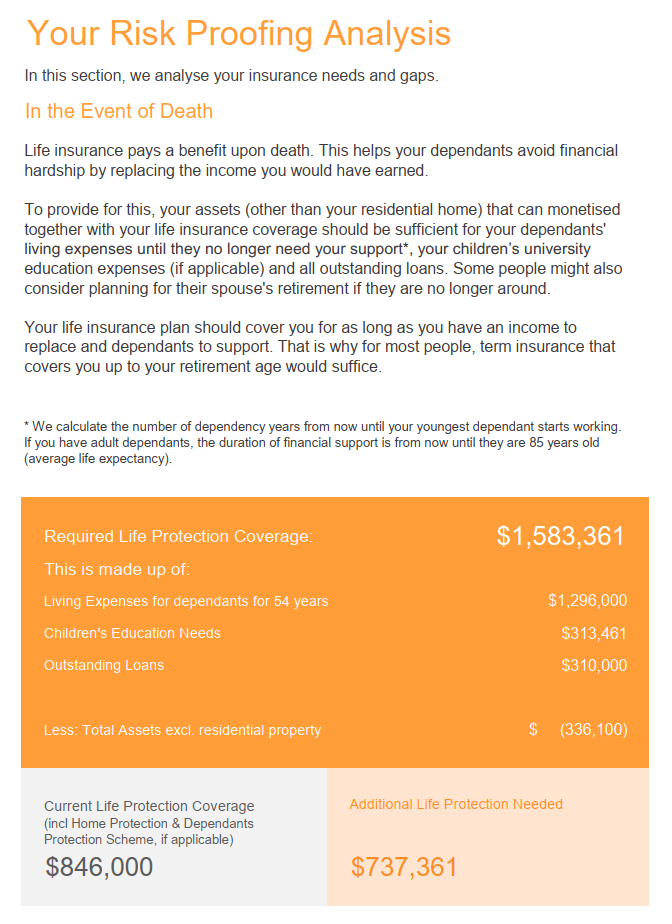

5. An Assessment of Your Protection Adequacy

What could potentially set you back on your financial goals are health-related events that have a low probability of happening but if they do occur, it would greatly impair your wealth.

MoneyOwl have been doing online insurance evaluation for some time and in their comprehensive report, they assessed your life insurance need, critical illness needs, disability income needs, and health insurance needs.

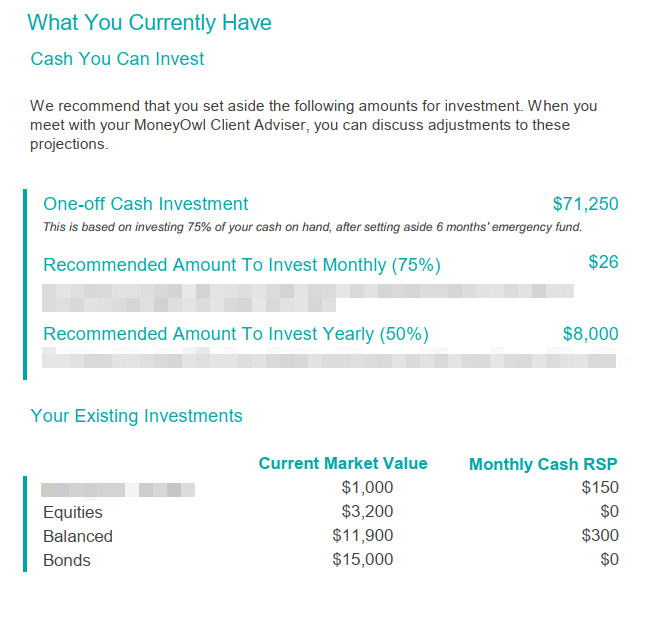

6. A Summary of Your Investible Assets and Surplus

In this section, the report summarizes based on your current net worth and surplus, how much you could commit to your financial goals.

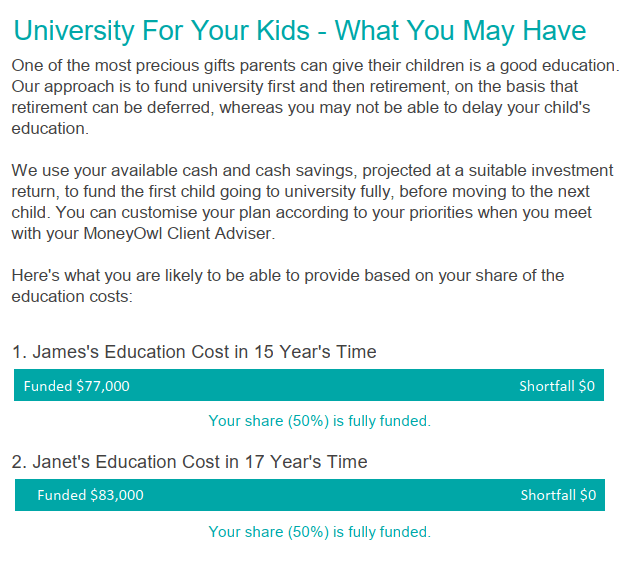

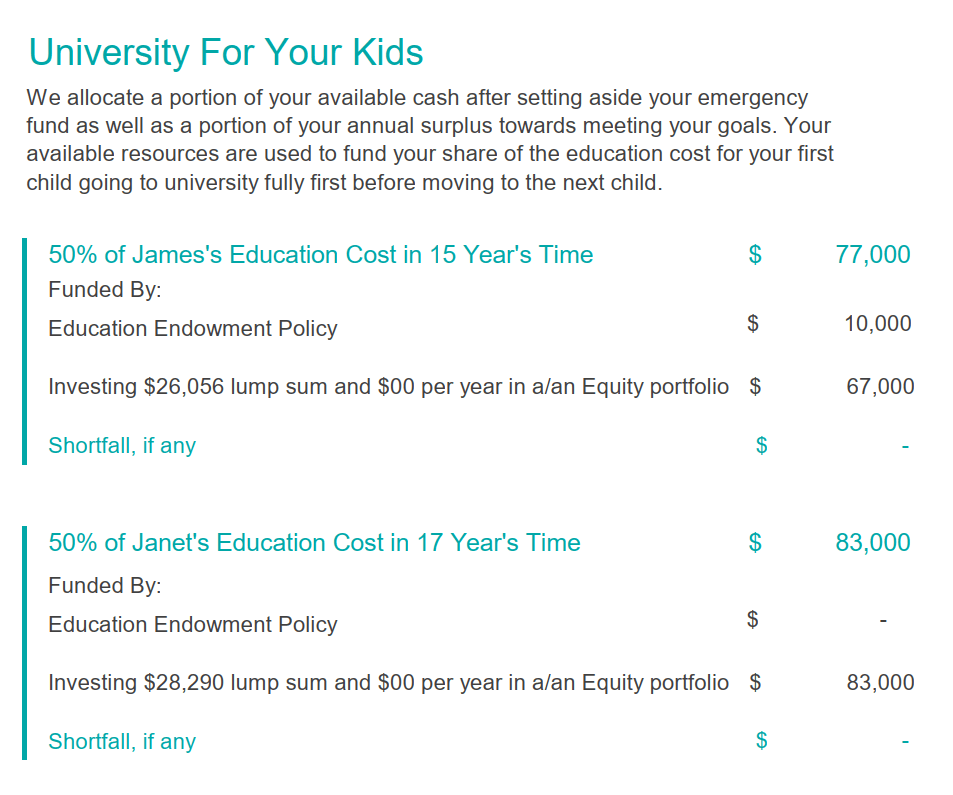

7. Status for Your Kids’ Education

A big goal for many parents is to provide for their children’s education. MoneyOwl helps you estimate how much you need in the future, and how much you need to fund to achieve those goals today.

In this example, both the children’s education is pretty well funded.

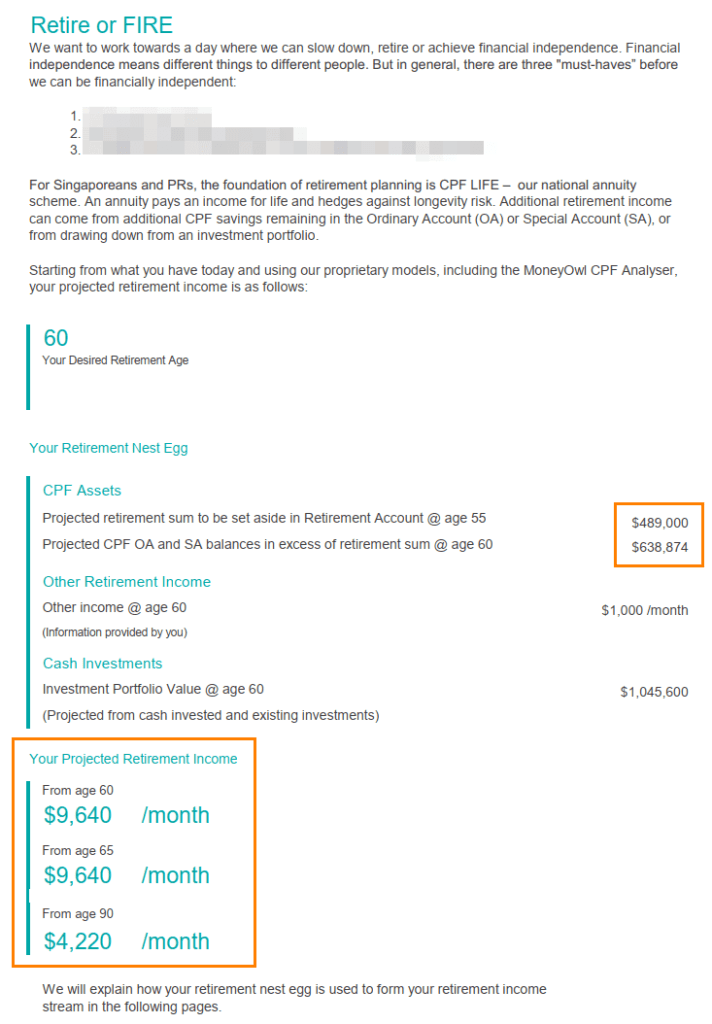

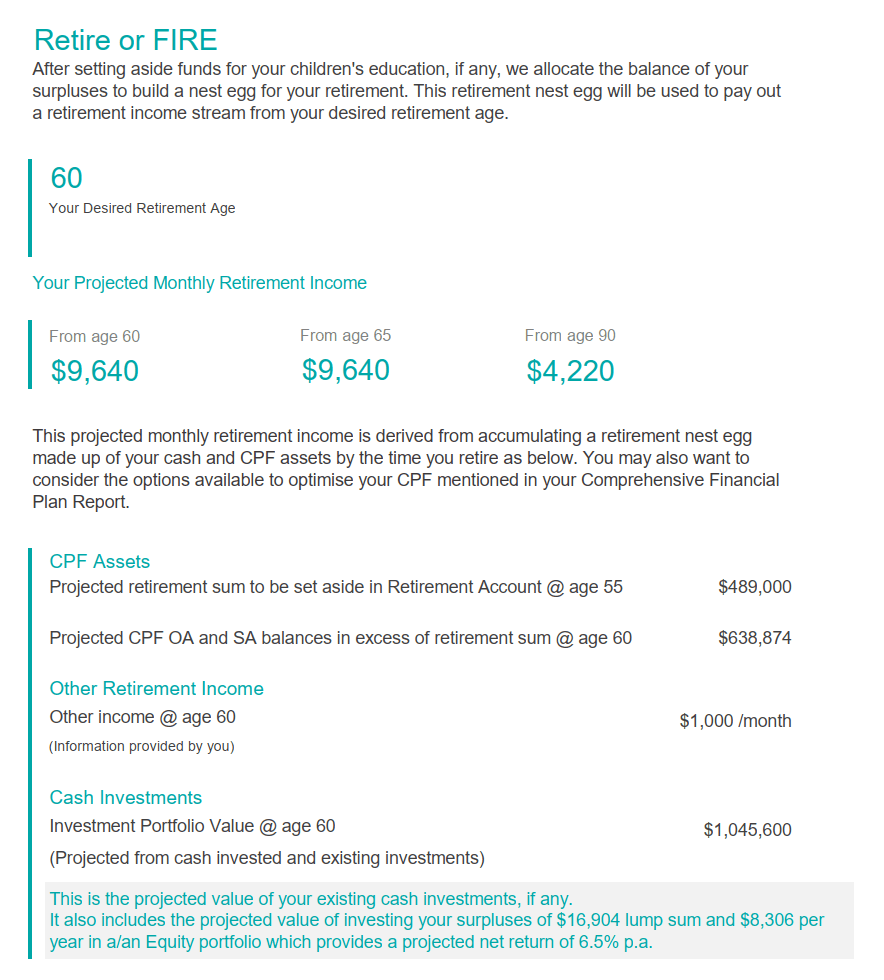

8. Projecting Your Financial Independence Income

What should concern a lot of people is whether they could be financially independent.

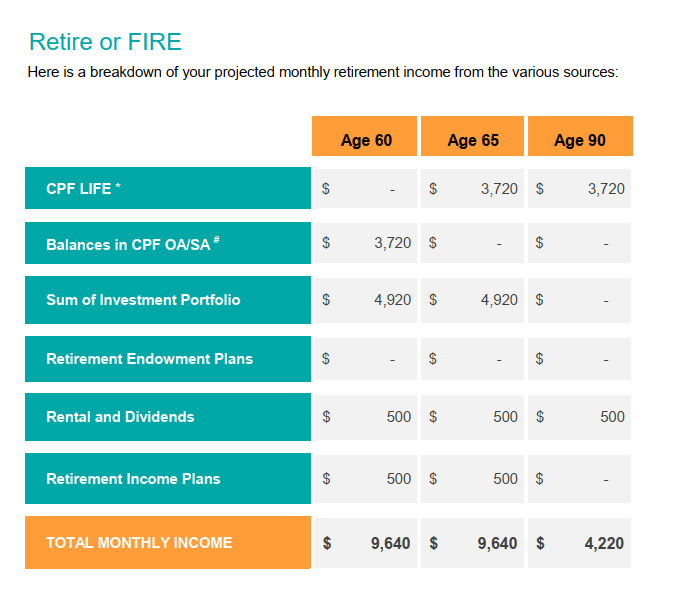

MoneyOwl’s approach is to incorporate all the various income streams that you have or could have and provide an assessment of your total income at various pivotal ages.

In this example, at 60, the total income stream would be $9.6k a month, remaining the same at 65 and end off with $4.2k a month.

MoneyOwl factors in your various income sources. You would be able to see different income activation at different stages.

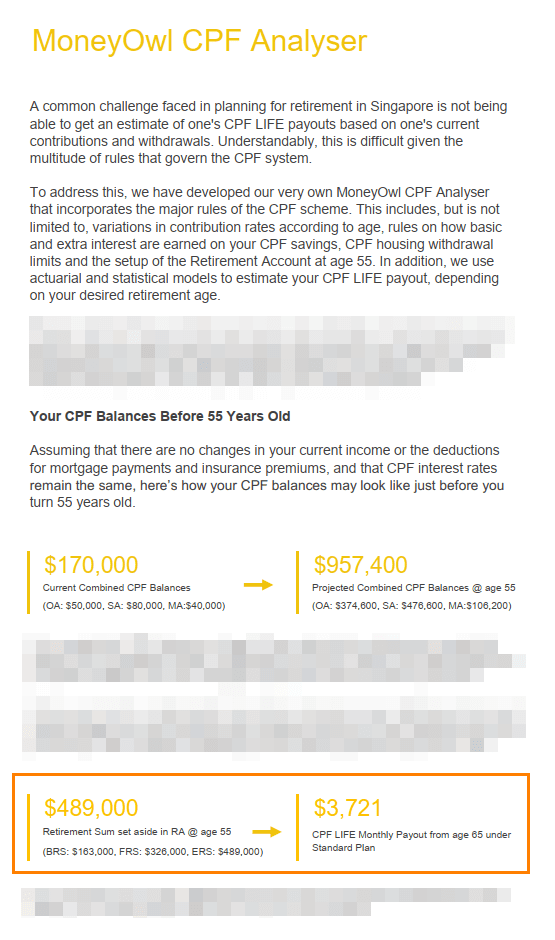

9. Analyzing Your CPF Retirement Income

The challenging part of your CPF is that you do not have an idea with your current assets, how much CPF income you may get at age 65.

Your CPF is also used for various purposes and there are many inflows and outflows. So what is the net effect?

MoneyOwl’s proprietary CPF Analyzer gives you a forecast of the likely income at age 65. It will also show you how much your CPF would have grown to.

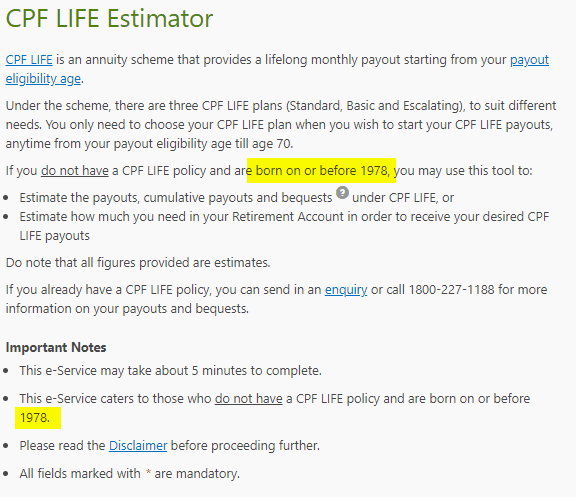

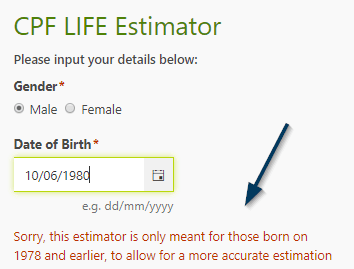

This is a big deal because, if you are born in 1978 and below, try to use the CPF Life Estimator from CPF to estimate your future annuity income.

There is a limitation of the age group for those who could successfully use the CPF Life Estimator.

Thus, it is a big upside for this comprehensive planning.

Technology Could Only Do So Much And Why You Need a Client Adviser to Go Through the Report With You

I think the key to MoneyOwl’s comprehensive financial plan is not just the report but how you could pivot your current situation towards your goals.

Your report will show what MoneyOwl thinks is the most appropriate plan for you. By no means should you just blindly carry out what the financial plan tells you.

For example, you may have a different interpretation of the report, compared to MoneyOwl’s adviser. You may also be less aware of the actions that you could take to improve certain aspects of your financial situation.

You might gloss over the insurance protection portion when the adviser may think it is an area we needed to place a higher priority upon. Your surplus rate, together with your future income could be better optimized if the adviser and you discuss the options for certain financial investment commitments that you have now.

By diverting some spending, and investment commitments to investments that fit your time horizon, you might be able to improve your outcome.

After you have received your comprehensive financial plan, you can arrange for a face-to-face review with a MoneyOwl salaried financial adviser.

You can explain certain nuances to the adviser, such as some of your history with other types of investments, why you are less confident to reach your financial goals despite seeing this diagnosis.

The adviser can help clarify any misinterpretations of the report, but also misconceptions about protection planning, financial planning and wealth-building that you have.

The only way to truly own your plan is to get your financial doubt addressed, leave with a connection that these are real numbers provided by yourself, and the action steps are not generic responses to everyone but your very own situations.

The financial adviser then provide a recommended and action plan (REAP Report) of the actual financial changes that you need to take so that you can reach those financial goals.

Fundamental Reasons Why You Should Get A Comprehensive Financial Plan Today

Personally, out of all the offerings by MoneyOwl (Online Will Writing, DIY Insurance Protection, Low-Cost Evidenced Based Portfolio), this is the one that I was most excited about, along with their investments offering.

I think it will prove to be a very useful service, even if you are a very finance savvy reader.

A. Treat the Comprehensive Financial Plan as a Stock Take of Your Current Wealth Position

Many of us routinely pay for a comprehensive health check. We may not like to make the effort to take a blood test, stool & urine test, ECG test. However, we do it because we are concern about our current health situation.

You would make an appointment to meet up face to face with a professional to hear their interpretation of your health report because you want to make sure you are not interpreting it wrongly.

A Comprehensive Financial Plan shows you a diagnosis of your financial life. It shows whether we have been doing things right or not.

Some may be confident and think they have their financial life under control but they did not realize that their current financial management is pretty poor compared to how average people manage their money.

Your financial situation may change and may not change much year on year. Which is similar to your health situation. But if there are some issues, you would like to know about it and get it addressed.

B. Clarify How to Invest & Get That Income Stream with Your Current & Future Net Wealth

Once you have clarified your current financial position, you can then move forward to discuss with the client adviser how best to get the retirement income that you need.

You would have noticed in your financial report the income your net wealth could generate at your desired financial independence age.

What I found out from the client adviser is that clients wish to clarify with advisers how they could realistically achieve that estimated income with their current and future resources.

At the time of writing, the markets are having a sizable correction and this would present an opportunity for you to re-allocate your cash assets at a better valuation to work towards your financial goals.

C. Tell Your Friends Who Are Less Finance Savvy of a Trusted Way to Checkup on their Family Financial Wellness

There will be those of you who feel that some of your friends need to stock take their financial lives.

And you may be equipped to help them since you are savvy enough to do it yourself.

However, you may not have the bandwidth to help. In truth, you understand that this hand-holding can be a lengthy process (read that as years).

Yet, if you would like to delegate and get them professional help, you might struggle to find a firm whose wealth building, financial management philosophy are similar to you.

MoneyOwl is a joint collaboration between Fee-Only Financial Firm Providend Holding and NTUC Enterprise Co-operative Ltd. You may or may not agree with NTUC Enterprise’s mission, but its mission is to address social needs in areas like health and eldercare, childcare, daily essentials, cooked food, and financial services.

You may find that by getting MoneyOwl to help your friends, there may much less probability that this recommendation will go haywire and come back to bite you.

Get Your Comprehensive Financial Plan Today

Given the value I have explained, there should be a cost to this comprehensive financial plan.

Yet at this point, if you sign up, it is FREE.

So what is the downside to this? You have to sign up for a MoneyOwl account and you maintain a relationship with them.

Sign up today to MoneyOwl’s Comprehensive Financial Planning here today.

This is a Sponsored post for MoneyOwl.

Kyith is a salaried employee of Providend. He does not work for MoneyOwl. Providend Ltd holds a 40% stake in MoneyOwl. He receives no affiliate income from any of the links above. Nor does he receives any commission income from any Comprehensive Financial Plan sold.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Leon

Tuesday 25th of August 2020

Any reason why the planning is for ppl 54 years old or younger?

Kyith

Tuesday 25th of August 2020

Hi Leon, the planning is for people of any age. There is no age limit. Could you let me know which part of the post that led you to believe the planning is for 54 years or younger?

divvy

Wednesday 11th of March 2020

Hi Kyith are there any strings attached to this free promo? what does " maintain a relationship with them" mean? thank you for your wonderful sharing, as usual

Kyith

Thursday 12th of March 2020

When you are assessed your financial situation, both yourself and MoneyOwl will know your surplus and investible assets. When you discuss face to face they can let you know their investment solutions and their protection solutions. Those are the strings attached.