I think for newbie investors, these 2 weeks have been a bit surreal. For as long as I could remember, we seldom have days of 2-3% daily up moves and 2-3% daily down moves since the financial crisis.

On usual markets, we should have the odd 2-3% moves but they should be over pretty fast.

A possible sign of a bear market is when you have many of these 2 to 4% daily moves clustering together.

Today’s post consists of some of the data that I see out there. It might be useful or might not be useful.

The chart above shows the 1-month yield change for Singapore’s 10-year government bond yield.

The 10-year government bond yield indicates a few things for me:

- It is the rate where corporate bonds take reference from when pricing their debts

- It generally indicates the GDP growth of a country

- Inflation expectations

- It shows the tug-of-war between stocks and bonds. A falling long term yield sometimes indicates that despite good economic times, the demand for bonds is increasing. This indicates cautiousness

The 10-year rate has fallen, even before the United States Federal Reserve decide to make an emergency rate cut of 50 basis points. This might indicate a mixture of lower GDP growth expected, lower inflation expectation and greater cautiousness.

In the past week, the yield has tumbled from 1.4% to 1.20%.

This is good news for interest rate sensitive assets such as REITs and Bonds. Their prices have shot up. This indicates that borrowing costs may be lower by as much as 1%.

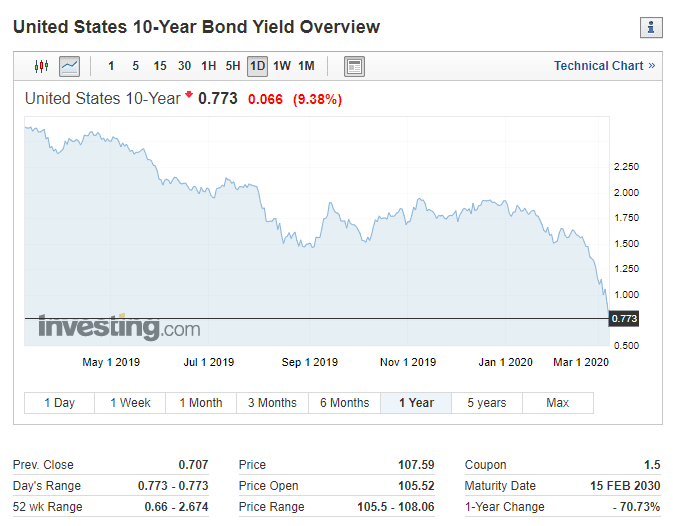

The chart above shows the yield movement of the 10-year USA government bond. The 10-year in its long history has never been below 1%. Until this week.

When we were with Manulife US REIT’s results brief on the 5th of Feb, we were discussing their upcoming debt refinancing. The rate was 1.64% then. Management indicated in the market back then they should be able to refinance at slightly below 3%.

Today, at 0.77%, they might save 0.6% in interest cost. If the interest rate remains at this range, it would be conducive to the REITs.

Be Wary of the Magnitude Interest Rate Could Change

Interest rate matters to a lot of our lives since many readers own private property or leveraged endowment plans.

The loans are likely priced with some of these interest rate swap rates in mind.

Not too long ago, there was this fear that rates are rising and it is better to lock in the rates.

Now there is no fear anymore.

I always wonder whether you realize how much interest rate can change. In 1 month’s time, the USA 10-year yield dropped 53%.

The implication for you is that if you are risk managing your loans, instead of factoring in a 5% to 10% interest rate sensitivity, perhaps the better metric is 25%, 50%, and 75%.

If you use these sensitivity tests, you might realize that maybe these leverage endowment plans do not have much margin of safety and could be cash flow negative.

A Possible Liquidity Crisis?

If the interest rate goes down, then interest-rate sensitive assets such as REITs, MLPs should benefit in these bear markets.

But why aren’t this always the case?

Because in bear markets, it is usually accompanied by a recession which is not good for business. So income is affected (which brings me to the point that REITs is not always interest rate sensitive only)

A second reason is that in these bear, the sentiments towards debt lending shifts from easy to stringent. If your REIT is poorer in quality, you might not be able to refinance. There is generally less money out there to be borrowed.

Howard Marks, in his book, Mastering the Market Cycle, he talks about the credit cycle:

- At the start, appropriately risk-averse investors apply stringent credit standards to the issuance of high yield bonds

- The same healthy economic environment that facilitates bond issuance makes it easy for companies to service their existing debt (meaning default is scarce)

- Thus high yielding bonds – with their generous interset coupons and little damage from defaults – provide solid realized returns

- Those returns convince investors that high yield bond investing is safe, attracting increased capital to the market.

- Increased capital for investment translates into increased demand for bonds. Since Wall Street never allows demand to go unmet, this results in increased bond issuance.

- The same condition that allows larger amounts of bonds to be issued – strong investor demand – invariably also allows bonds of lesser creditworthiness to be issued

Usually, the credit cycle turns when the economy turns (not always):

- A slower economy makes it harder for companies to service their debts.

- With the credit market closed, refinancing can’t be accomplished, meaning defaults rise.

- Rising defaults damage investor psychology

- Investors who were risk-tolerant when things were going well now become risk-averse

- Advancing capital to financially distressed companies – which seemed like a good idea just a short time earlier – now goes out of favor

- Potential debt buyers back away, refusing to “catch a falling knife” and saying they’ll wait until the uncertainty has been resolved

- Capital that is mobile flees from the market. Buyers become scarce, and sellers predominate

- Selling of bonds increases; bond prices cascade downward; funds that receive withdrawals become forced sellers, and eventually, bonds are available for sale at any prices

This is how textbook knowledge is thrown out of the window. I realize that you can rename companies in the above two lists into ourselves and it will explain some of our behavior.

What I learn is that the irrationality affects lenders and spenders as well. The whole mood is just cautious. Cautious mood makes everything cautious.

A liquidity crisis is something the Fed is always trying to prevent. But what could cause one?

Daffodilistic from our Telegram chat brought my attention to the distressed in the Banking Repo Market. The repo market is a black box market where banks can put up their debts (loans to clients, businesses) in a market so that they can get short term cash.

With this market, they can alleviate short term liquidity with the debts on their balance sheet. In Aug to Sep last year, I started hearing that the Treasury had to step in to offer liquidity because… the Repo rate went up to 10%. For some reason, there is a real shortage of liquidity.

If you go down this rabbit hole, it might lead you to some doomsday subprime kind of crisis. Is it possible? I think it is possible but we are not sure about the magnitude of all the things.

I believe this is possible because we are getting some crazy historical high/low data points. When markets are so connected you get the feeling it is not out of the question there is a flaw not many see it coming in the system.

Modeling a 1 Year Lost in Earnings

The Covid-19 Virus is going to cause some very ugly numbers for a lot of companies. The market is currently adjusting to price in this scenario. The adjustment is usually mixed with the psychology of the investors as a collective.

So the price in the short term might not equal to the value.

Brooklyn Investor(BI) has a nice post in which he tries to explain how to model the impact of the Covid-19 virus.

One way of valuing a business/stock/company is to do a discounted cash flow analysis on the stream of cash flow of the company.

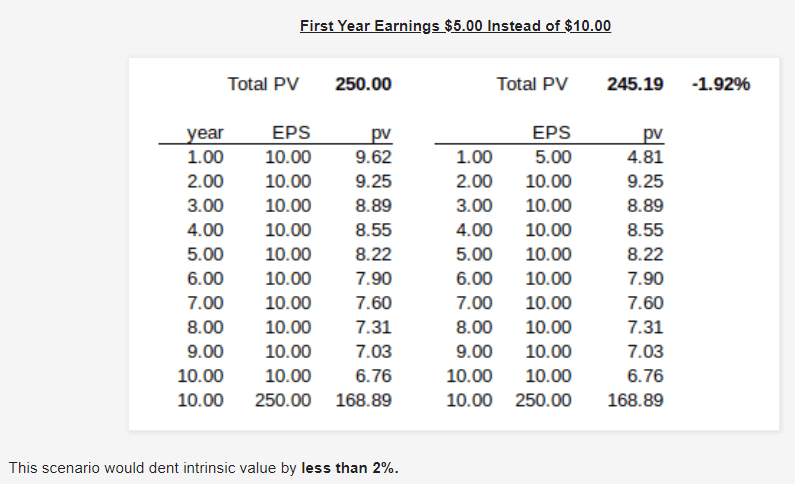

BI uses the case of a business that we do not expect the earnings per share (EPS) to grow over time. Suppose for this company we demand a discount rate for taking a risk of investing in this business of 4%.

Suppose we expect that this Covid-19 has a 6-month impact on the earnings of a particular company:

The image above shows the present value for an infinite stream of earnings from the company, discounted at 4%. In investing-speak, we say the intrinsic value of the company, based on discounted cash flow methodology, is 250.

If we reduce the 1st year EPS by 50% (deduct 6 months of earnings), the present value of the business is 1.92% less.

That looks quite ok because…. the value of the business is not just on the first year of earnings. The value of the business is in its future stream of earnings.

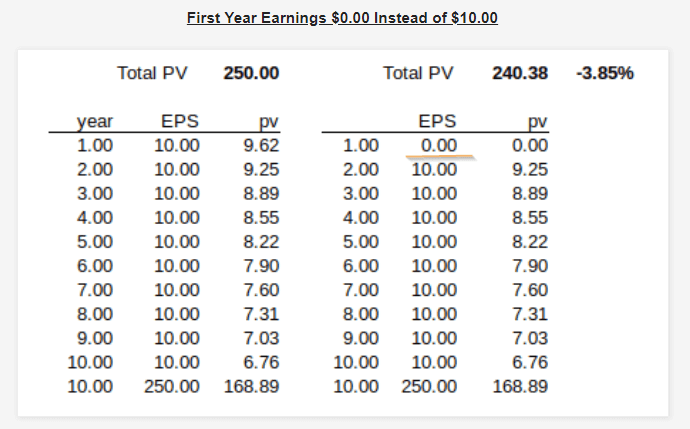

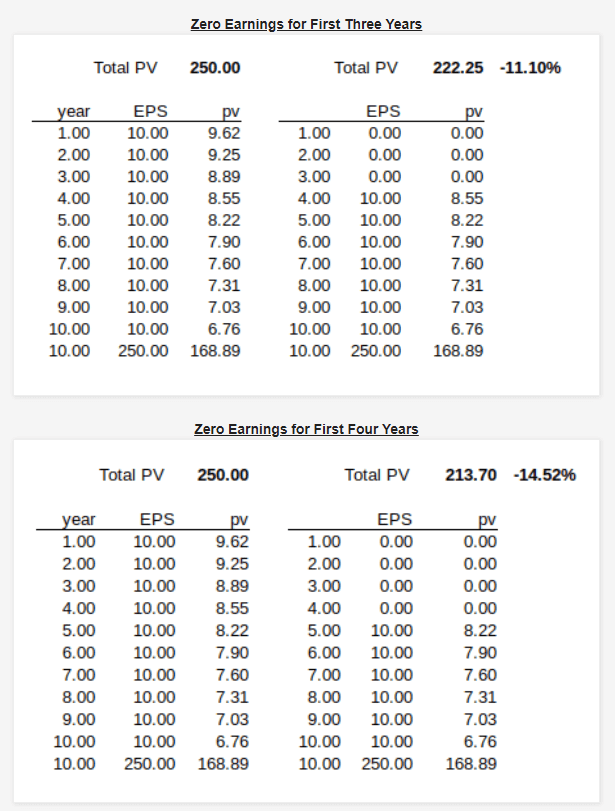

BI simulated the intrinsic value if the company did not receive income for 1 year:

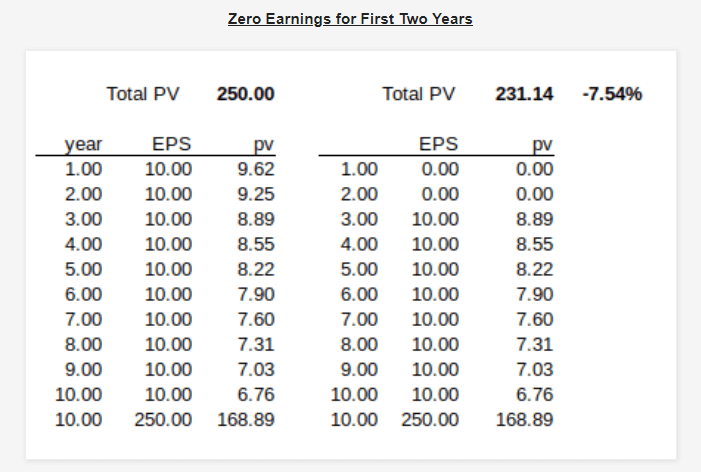

And 2 years:

And 3 to 4 years:

Even a 14% fall in valuation looks OK. The future is uncertain and I don’t really wish for this to be stuck 4 years.

I do however like to caution that EPS can be negative. I think if cash flow is negative, it is difficult to do a DCF, and thus putting it as 0 makes sense.

How low valuation can get also depends on the discount rate and growth rate. BI didn’t use a growth rate (which is conservative) and he used a discount rate pricing the business as PE 25 times.

Some of your business might not be like this. The business might be riskier such that you would demand a 10% discount rate (which is a discount rate I used by default for a lot of uncertain businesses). However, I do think the discount rate does not matter.

This is because we are comparing the same company. If you are using a 10% discount rate before the ordeal and comparing it against the company after the ordeal, the difference in valuation due to having 1 year less of earnings should be similar (I have verified the math).

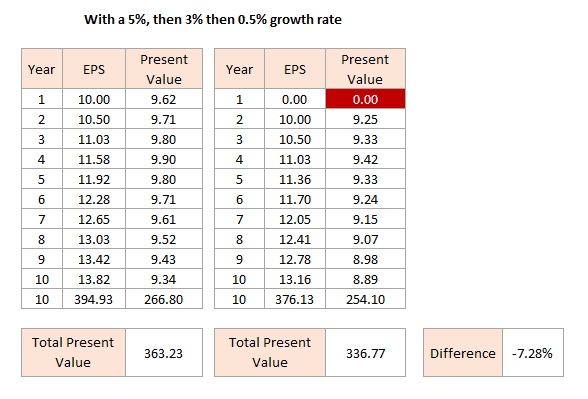

If we are realistic, let me modify BI’s case study to bed in a 5% a year growth for 3 years, 3% growth for 6 years and a 0.5% a year terminal growth rate after year 10:

The difference is 7.28% versus 3.8% if there is no growth (as illustrated by BI). But it is rather assuring that the intrinsic value is just a few percentage difference.

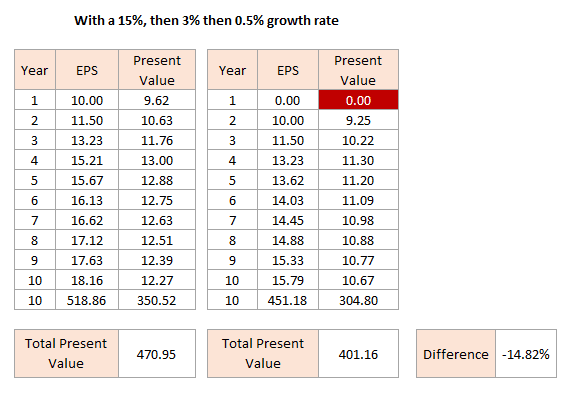

But what if the growth rate is 15% for the first 3 years instead of 5%?

The loss of 1 year of earnings matters much more to valuation.

This is because base on the time value of money concept, the cash flow in the earlier years is much more valuable than the future years. By “losing” 1 year of earnings, the impact is greater if you are expecting great growth rates.

A good example would be that if you like this high growth stock. It trades at 30 times of last year’s earnings. However, you are expecting a growth rate of 20% at least for the next 2 years.

The impact due to lower-income is going to affect the valuation of the company more.

However, these are theoretical and one reason I seldom use DCF so much in my valuation nowadays is because it is so hard to judge the stream of income going forward. Nevertheless, we can all learn from this exercise. It shows how important would it be to miss that 1 year of cash flow for the business.

My thinking: the earnings the company lost are just deferred to a later date. If the business is not a going concern, this is a good opportunity to pick up these stocks.

The businesses that will struggle to emerge with things intact are the businesses that have slim resources, have very tight working capital, those that do not have buffers.

I would normally ask you to have an emergency cash, and businesses need to have their own version of this as well.

I would see if I got some more posting tomorrow. Back to work.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Kay

Monday 9th of March 2020

I wonder, in this climate, if there is a particular stock, or a group of stocks that we should pay attention to go in and get some bargains for the long term (10-20 years) hold.

Any suggestions?

Kyith

Tuesday 10th of March 2020

Hi Kay, the Singapore stock prices have come down a fair bit. I choose not to make recommendations because I am not a financial adviser. You have to assess which businesses could still be around in 10 to 20 years' time. And note, investing in individual stocks is active management. Judging by how fast the climate changes, long term holds can face serious headwinds that affect their advantage.

There are many that asked me this question and they seek something that they could buy and just relax. I have invested a while and I realize that never happens often if I wish to grow my money.