If you are trying to value a company, the lifespan of a company is rather important.

If most of the value of the company lies in the future cash flow or the growth in the future cash flow that the company can produce, then the growth rate and how long the company will survive is very important.

However, if the majority of the value of the company is based on the cash flow today and the next few years, then the future growth rate is less important. If the company does not survive for a long time, that is also OK.

When you try to buy a business below its intrinisc value, or the true valuation of the company, you are trying to have some form of margin of safety.

The Benjamin Graham kind of valuation or the Net-Net kind of way of investing, prioritizes the current cash flow and assets over the future.

It is safer because growth in the future is uncertain.

The longevity of a company is also uncertain.

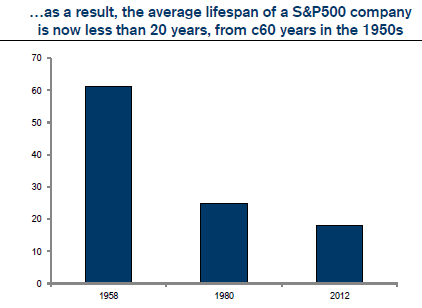

I have just listen to a podcast and one of the hosts was quizing the other two what is the average lifespan of the companies, from live to death (either being killed off or bought out).

“The average age of a company listed on the has fallen from almost 60 years old in the 1950s to less than 20 years in 2017”

This was a comment made by a Credit Suisse team after some studies in this area.

The lifespan used to be much longer, but increased buyout activity in the beginning of the 1980s certainly did something to shorten the life span. Today, increasing disruption by the big tech companies have also did something.

And going forward, there may be other disruptive force.

So How Does This Affect Investing?

If you have attempt to perform a discounted cash flow valuation, you may compute the valuation based on a very lengthy duration.

Your assumption is that the company can survive for a long time. If it is a business with a seemingly strong competitive advantage then it should.

The longer the duration the greater the intrinsic value.

Now what if a company in 2020 have only 8 years to survive since it has already been around for 13 years?

This means that if you are using discounted cash flow, the number of years used has to shorten. It may not be always safe to use the terminal value as the aggregate cash flow to infinity.

In a way, its indirectly saying today’s cash flow is more important than the future. The future cash flow is uncertain.

Base rate fallacy is a cognitive error whereby we focus too much on new information without acknowledging how this impacts original assumptions. In a way, we forgot that there are some fundamental rules that should hold steady despite how things change.

The base rate in this case is the duration of how long firms are able to survive.

Whether you are using DCF or you are basing your valuation on Price to Sales, fundamentally if the duration of the company is just that short, it means assuming the company that you are valuing can last for 40 years is risky.

If I were to bring us all back, average means that for all the businesses, there is a specrtum of lifespan. There will be the rare companies that last 100 years. There would be the uncommon ones that last for 50 years.

Your job may be to find them and successfully spot them. For a lot of investors, this is a tough ask.

Knowing this certainly lends more weight to being diversified enough to capture the businesses that is able to last longer than others.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024