I used to work in my corporate IT job where the pace of work tends to be consistently busy. It did not start off that way. 6 years ago, the pace of work was much more balanced.

When life was less hectic, your mind could sneak in some questions such as “Do I have something that I need to buy so that I could bulk buy during some year-end sale” or “What have I not done before the year-end that I would regret being so absent-minded about?”

In the last few years, what I nearly regretted was not taking care of some of the money stuff such as topping up my CPF Special account, or my family member’s Special account and contributing to the Supplementary Retirement Spending (SRS) account to enjoy tax relief.

If I forget to do that by 31st December of the year, I do not gain tax relief, more money flows out of my wallet and to the government.

This is money that could be used for other purposes.

I always like to say that the amount that I could save in terms of taxes is equivalent to about 250 packets of chicken rice.

I tend to favor contributing to the SRS versus topping up the CPF, but I think if you are privileged to earn a high income, you have both levers to pull to reduce your taxable income.

The SRS account is less well known, and, in this article, I would like to highlight some of its advantages and a special deal from MoneyOwl should you choose to invest your SRS with them.

What is the SRS Account?

SRS stands for Supplementary Retirement Scheme, which is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

Your contributions would allow you to gain tax relief.

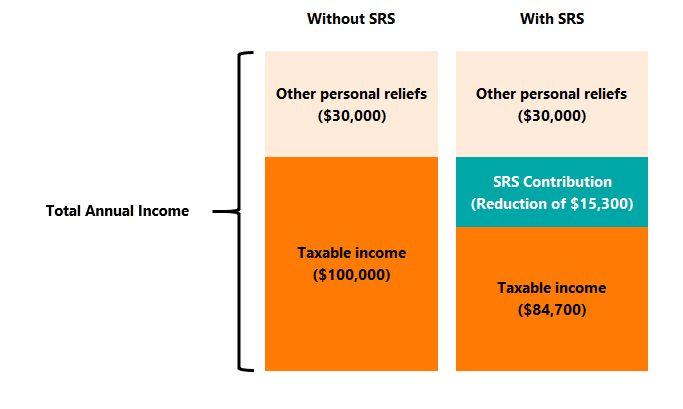

Suppose my total annual income is $130,000 a year.

I would have some tax reliefs such as CPF contribution, national service, and CPF top-ups that give me a total personal relief of $30,000.

My taxable income would be $100,000.

The total tax that I would need to pay next year is $5,650.

Now, if I make the maximum annual SRS contribution of $15,300, my taxable income will go down to $84,700.

The total tax that I would need to pay next year would be $3,890.50.

I would save $1,759.50 in payable tax.

The higher your annual income, the more worth it will be for your family to be onboard the SRS.

In short, the government is incentivizing you to be proactive in saving up for your retirement by rewarding you with tax relief.

SRS is a Tax Deferred Account -You will Pay your Taxes Next Time

The SRS is a tax deferral account because it does not mean you escape from paying income tax.

Rather, you will only pay taxes when you withdraw from your SRS.

If you withdraw from your SRS at the official retirement age (the official retirement age when you enroll), 50% of your withdrawal will be taxed at your prevailing tax rate.

The taxes are deferred through time and only paid at a different time. You enjoy an advantage if your income tax rate (based on your future taxable income) is lower than now.

For example, as an employed worker, your current marginal tax bracket is 11.5%. When you retired, you do not earn much income. In that scenario, your marginal tax bracket maybe 2%.

In that scenario, it works well for you.

Once you start withdrawing from your SRS account, you have to finish withdrawing in a 10-year period. At the end of the 10-year period, any amount (except for life annuities) in the SRS account would be deemed withdrawn immediately.

For example, suppose over the years you have accumulated in your SRS account $400,000 in total.

At 62 years old, you decide to start withdrawing from your SRS account. This roughly means you can withdraw $40,000 a year. Of the $40,000, 50% or $20,000 will be subjected to the prevailing income tax.

If you are fully retired by then, the tax on your $20,000, based on the current IRAS tax bracket is…… $0.

What if you have accumulated $800,000 instead?

If you sequence your withdrawal over 10 years, that will be $80,000 a year. 50% or $40,000 will be subjected to income tax. If you are fully retired by then, the amount of tax you will need to pay is $550.

I think you get the idea. For more information on the current Singapore tax bracket, you can review it here.

The SRS account is conducive for retirement planning because realistically, you should have accumulated your wealth and not be working when you start withdrawing from your SRS account.

In that case, you should be paying a lower income tax. In some cases, you might not be paying any income tax.

Do remember that $1 20-years from now is worth less than $1 today due to inflation. This means that the $550 you are paying 20 years from now, may only be worth $370 today (based on 2% a year inflation).

What Can You Invest in With Your SRS Money?

You can let your SRS contribution sit in the SRS bank account and earn 0.05% p.a.

There are a myriad of investments or savings products you can deploy your SRS contribution into, to accumulate towards your retirement goal.

- Endowment plans from various insurers

- Unit trust from various platforms

- Stocks and shares from various brokers

- Exchange traded funds from various brokers

- Singapore government securities

- Structured deposits and time deposits

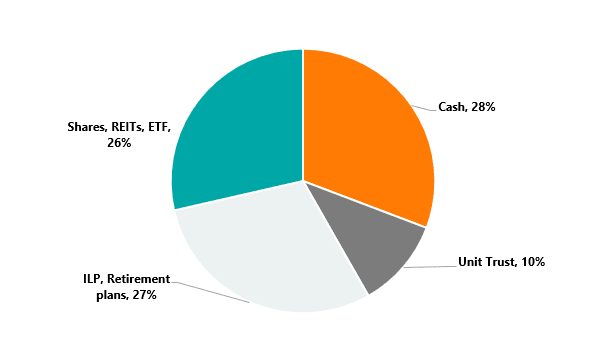

Based on the Ministry of Finance’s Dec 2019 stats there were a total of S$10.7 billion in SRS contributions.

Here is the breakdown:

While many have invested, there are a lot of people who have contributed still sitting on cash.

If your time horizon to when you need the money is long enough, it may be wise to deploy your SRS monies into higher-risk investments, so that you can build wealth for retirement in a more optimized manner.

You might want to explore MoneyOwl’s investment portfolios. MoneyOwl is a joint venture between NTUC Enterprise and Providend. They have a goal of empowering people to make wise money decisions and one way is through their fundamentally sound portfolios.

The Steps You Need to Take to Invest Your SRS in a Recurring Manner

Investing through MoneyOwl is very simple

- Create an account at MoneyOwl. With MyInfo integration, the process can be done entirely online. Your account can be successfully set up in less than 10 minutes

- MoneyOwl automated process will determine your risk tolerance. They want to ensure that the portfolio that you invest in matches your ability to take the risk and your willingness to take the risk.

- An investment portfolio is then suggested

- You can fund your MoneyOwl portfolio by specifying your SRS account (if you have opened one. If not, you would have to open an SRS account with one of the three administrators DBS, OCBC, UOB)

- Every year, as you contribute more money to your SRS account, repeat step #4.

MoneyOwl will do much of the sound portfolio management for you, this includes:

- Regularly rebalance your portfolio by systematically selling high and buying low

- Review the product landscape, identify sound, cost-effective and implementable investments, and incorporating them into your portfolio

While this is a topic on investing your SRS monies, do note that you can invest your normal cash into MoneyOwl’s portfolio as well.

Invest your SRS with MoneyOwl and Get Up to $200 in Shopping Vouchers!

Currently, if you start contributing to your SRS and invest with MoneyOwl today, you will get some eCapitaVouchers.

eCapitaVouchers are very useful considering how many CapitaLand Malls there are in Singapore.

Here is how much you would stand to get:

| Tiers | SRS Funds Invested with MoneyOwl | Shopping Vouchers |

| 1 | S$1,000 to S$10,000 fresh funds invested OR | S$50 |

| 2 | S$10,001 to S$50,000 fresh funds invested OR | S$100 |

| 3 | S$50,001 and above fresh funds invested | S$200 |

The promotion period is from 9th Nov 2020 to 31st Dec 2020.

The above three tiers are applicable for lump sum SRS investments only. Only new MoneyOwl clients will be able to qualify for Tier 1. You would need to stay invested and not withdraw their funds for at least 2 months after the campaign is over (estimated till end Feb 2021) Visit their website for fuller terms and conditions.

These vouchers are only limited to the first 500 people.

So, if you would like to sign-up for this, you have a short window!

Now let me continue and explain the kind of portfolios you would be deploying your SRS money into.

The MoneyOwl Investment Portfolios

When you invest with MoneyOwl, you are investing in specially prepared model portfolios that give you the highest probability of capturing the returns of the market.

Each of the portfolios differs based on their equity/stock and bond/debt allocation:

- Conservative: 20% equity 80% bonds

- Moderate: 40% equity 60% bonds

- Balanced: 60% equity 40% bonds

- Growth: 80% equity 20% bonds

- Equity: 100% equity 0% bonds

These portfolios are currently constructed with Dimensional Fund Advisors (DFA) funds.

I have written a very comprehensive article on what Dimensional Fund Advisers is about here.

These funds are what you would call unit trust. DFA has a 40-year history of implementing factor-based strategies. These factors, such as prioritizing smaller companies, cheaper companies, and more profitable companies have shown in the past to provide higher returns across different time periods and different markets.

You might not like unit trust but these unit trusts are unlike the unit trusts that you know previously:

- Their total expense ratio is low. The average total expense ratio is between 0.28% to 0.32% In comparison, the industry average is between 1.35% to 1.89%. Typically, you do not see this expense ratio as it is deducted implicitly in the unit trust.

- You do not pay a sales charge

- You also do not pay trailer fees or retrocession fees. What you may not know is that for the unit trust that you purchase, out of the 1.50% annual total expense ratio, the unit trust has to pay about 0.50% a year to the distributor. This is transparent to you and if the distributor does right by you, this trailer fee can be cut out and lower your cost. The DFA funds do not have trailer fees which explain the low total expense ratio.

So how does MoneyOwl get paid? (The TER of 0.28% to 0.32% is paid to DFA and not MoneyOwl)

MoneyOwl charges an annual advisory fee of 0.50-0.60% of the amount of investment under management. This is periodically deducted from your investments and transparent to you. MoneyOwl has absorbed the platform fee.

If your investment amount is less than $100,000, the annual advisory fee you pay is 0.60%. If the amount is greater than $100,000, the advisory fee is 0.50%.

So, if you are investing $15,000 today:

| Contribution | Advisory fee | Portfolio Expense Ratio | Total Investment Cost |

| $15,000 | 0.60% | 0.28% to 0.32% | 0.88% to 0.92% |

The DFA based portfolio that MoneyOwl have implemented is broadly diversified, filled with high-quality bonds.

I would not go through all the portfolios, but the Balanced portfolio has the following characteristics:

- Total number of companies: 8,723 (the MSCI World only has 1,600 companies)

- Aggregate price-to-book: 1.88 times (MSCI World currently has 2.3 times price-to-book)

- Total number of bond holdings: 267 bonds

- Average bond maturity: 1.04 years

- Credit rating: 30% AAA-rated bonds, 55% AA rated bonds, 15% A-rated bonds

In terms of equities, the portfolio invests in companies that you are familiar with. Here are the top 10 global and emerging market holdings:

| Global | Emerging Markets | |

| 1 | Apple | Samsung |

| 2 | Microsoft | TSMC |

| 3 | Amazon | Tencent |

| 4 | Alphabet | Alibaba |

| 5 | Verizon Communications | Reliance Industries |

| 6 | Johnson & Johnson | Ping An Insurance |

| 7 | Comcast | China Construction Bank |

| 8 | United Health | China Mobile |

| 9 | Petroleo Brasilerio | |

| 10 | Nestle | Vale SA |

To be fair, the top holdings constitute a much smaller allocation versus the MSCI World. It is very diversified.

So how are the Returns like?

We won’t be able to know the future and if you ask any decent money manager out there, they will not risk their reputation and guarantee you a return as well.

However, since DFA’s philosophy is to capture the market returns and try to do better by tilting to value small size and profitability, we can try and learn from history what kind of returns you may be able to capture.

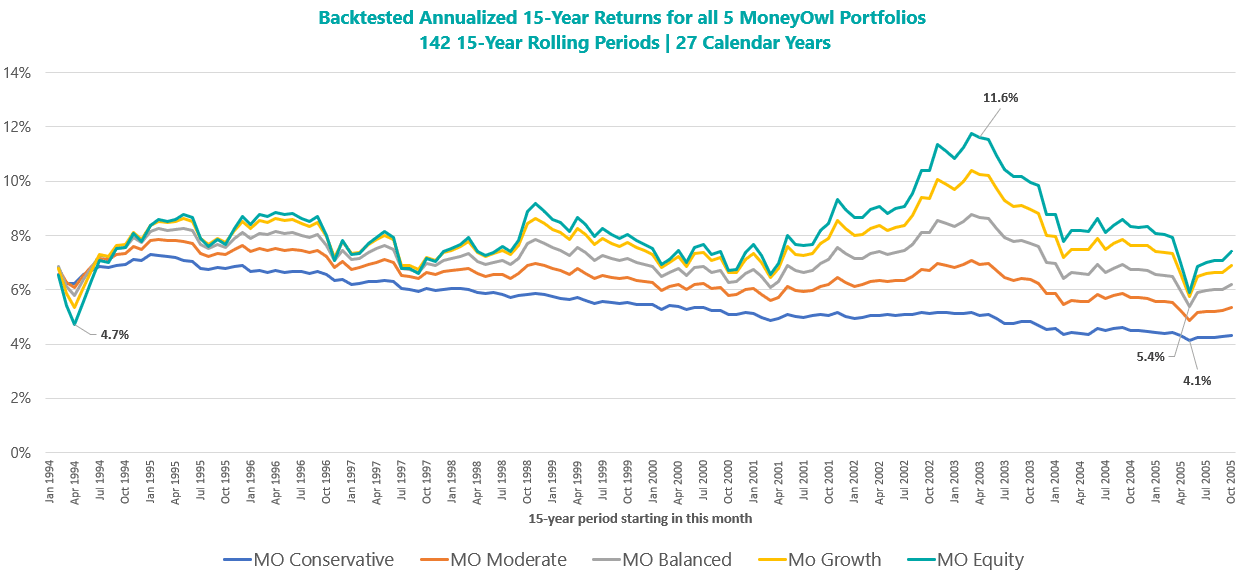

While the history of the DFA funds implemented by MoneyOwl is rather short, DFA did provide reference indexes which give us an idea of how these portfolios may perform if the same systematic strategy is implemented.

We have about 27-year worth of back-tested returns from 1994 to Oct 2020.

This factors in:

- SARS

- Great Financial Crisis

- The outperformance of emerging markets

- The outperformance of the United States

- Dotcom bust

- The 3-year bear market of 2000 to 2002

- COVID-19

- European crisis and the PIIGS crisis

- The underperformance of the United States

- The underperformance of Emerging markets

The follows show the 15-year annualized returns if we roll the 15-year periods month by month:

Despite a history of ups and downs, there are no 15-year periods that these portfolios lose money for the hypothetical investor.

Investors in certain periods were able to capture as high as 11.6% a year return for the 15-year duration. Investors in certain periods may only capture only 4.7% a year return for the 15-year period.

Based on your risk tolerance, different portfolios may be more suitable for you.

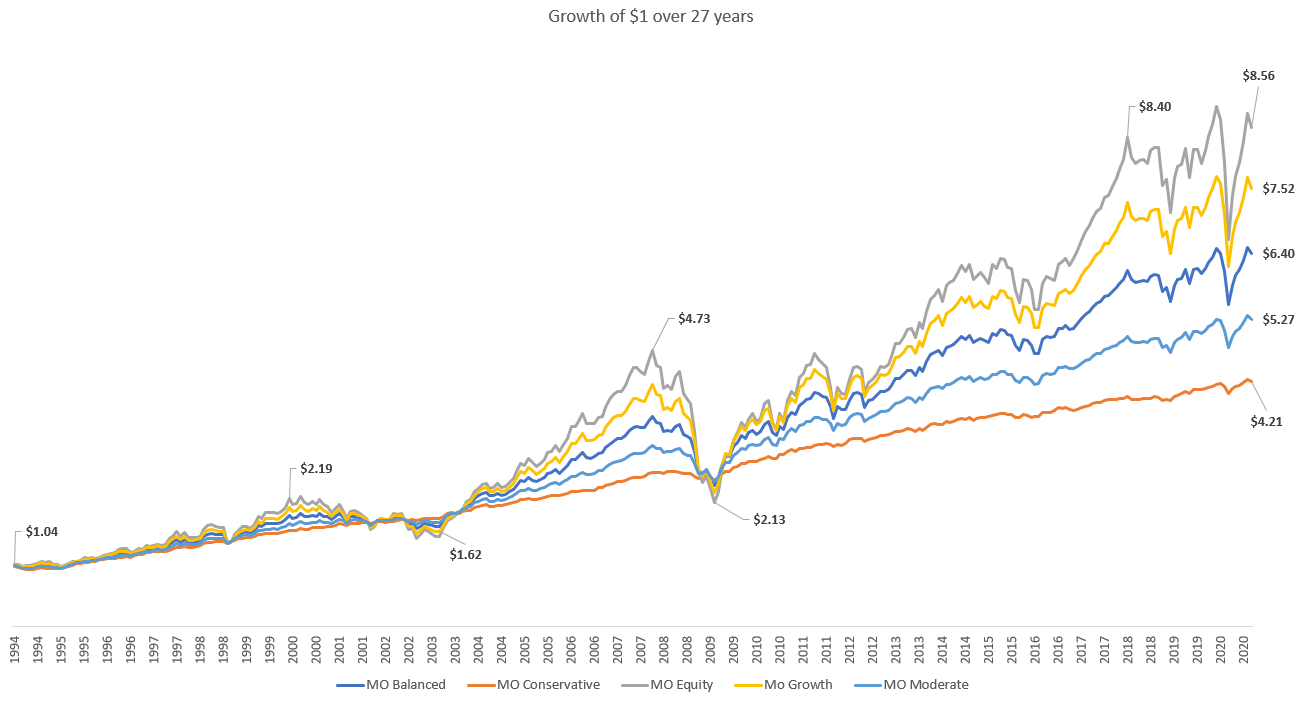

The chart below shows how much $1 invested in 1994 would have grown to in these five portfolios 27 years later:

The portfolios with more equities were more volatile, but because of the higher short-term risk, the potential returns that you could earn is also higher.

Do note that past performance is not indicative of future returns.

Some Other Things to Note About the SRS

Foreigners can also open an SRS Account

The SRS account can be opened not only by Singaporean, Singapore Permanent Residents but also by foreigners!

The annual maximum SRS contribution for foreigners is $35,700 a year.

As a foreigner, you can withdraw from your SRS account 10 years from your first contribution penalty-free instead of the statutory retirement age (currently 62 years old). You will be taxed at 15% or the local resident rate, whichever is higher.

Thus, you can enjoy this tax deferred lever as well.

There is an Early Withdrawal Penalty

You can withdraw your contribution from your SRS account anytime.

However, the purpose of the account is to accumulate for your retirement. So, if you withdraw early, there is a penalty for the withdrawal.

If you withdraw early, 100% of the sum withdrawn will be subject to tax. In addition, a 5% penalty for premature withdrawal will be imposed.

However, there are some exceptional circumstances where the penalty does not apply:

- Death

- Medical grounds

- Bankruptcy and

- Full withdrawal of the SRS balance by a foreigner provided the following conditions are met

- Not a Singapore Citizen nor an SPR on the date of withdrawal and for a continuous period of 10 years preceding the date of withdrawal

- Maintained your SRS account for a period of not less than 10 years from the date of your first contribution to your SRS account

- You make a one-time full withdrawal from your SRS account

There is a Cap to your Maximum Tax Relief

There is a cap to how much tax relief we can claim, which is a maximum cap of $80,000.

This means that if you aggregate all your tax reliefs together (including SRS contribution) and it amounts to $85,000, you can only enjoy a tax relief of $80,000.

Contributing to SRS Versus Topping Up CPF Special Account via Retirement Sum Top Up (RSTU) – Which is Preferable?

I would think that if you are a rather high-income earner and you need to optimize your taxable income, you should consider doing both.

However, doing an RSTU is considered the low-hanging fruit because the current return you can get for your CPF Special account is north of 4% p.a..

With the SRS, it will depend on what you invest in. If you put your money in cash, then the rate of growth of your SRS will pale in comparison to the topping up of CPF SA.

The advantage of SRS is that you can withdraw anytime.

Yes, you may face a penalty and 100% tax on your withdrawal, but it might still be worth it.

For those pursuing early retirement, you might be concerned about the prospect that you need money for something and that with RSTU, you could not reverse the money out of your CPF.

SRS would be more advantageous over RSTU.

(Though in reality, if you retired early and had to activate your SRS or CPF money, your plan might not have the adequate buffer.)

With solutions like MoneyOwl’s portfolios, you have every bit of a chance to do as well as RSTU with your SRS yet have some flexibility.

If you have a business venture idea in the future

For example, suppose along the way, you have a business venture that could potentially earn you a high rate of return. If you have computed that even after the tax expense and early withdrawal penalty and it is still mathematically viable, you could get your money out with the SRS.

If You Withdraw From Your SRS Early, You might still Benefit after Paying the Early Withdrawal Penalty

I do have friends who have this concern that in the future, they might need to tap upon this stash of money to spend if they are planning for early retirement.

With the early withdrawal penalty, they might have to plan their income in such a manner that they would only withdraw when they reach the official retirement age.

If you are planning for your early retirement, the sensible thing is to have enough income to provide for your expenses before the official retirement age.

But for some reason, if you need to access the SRS money before the penalty-free age, I think you would still benefit even if you withdraw the money from your SRS before the penalty-free age.

This is what I think:

The US has a very similar concept to our SRS with their traditional IRA. If you withdraw before 59.5 years old, there will be a penalty and tax implications. What I have learnt is that even if you take the penalty on your traditional IRA by withdrawing early (if you really have no choice but need to), it might still be worth it.

For example, suppose you have built up $200,000 in your SRS. The main idea is that you must sequence your SRS money to be used after the cash flow from your cash investments have been used up.

If it ever gets to that point, withdraw only the amount that you need. If you need $30,000 in that year, then withdraw $30,000 / 12 monthly.

You would still pay the 5% penalty but you would still benefit because if you did not contribute to your SRS, you would be at a marginal tax bracket of 7% or 11.5% or even higher. Even after paying the penalty, you would still come out tops.

Therefore, for those who are in a very high tax bracket, this gives you some peace of mind that if it ever comes to a situation where you would need to access your SRS earlier, it is not so bad.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Euphorius

Friday 13th of November 2020

Hi Kyith, I do not think it is likely to that one might still benefit from SRS early withdrawals, as not only is the early withdrawal subject to the 5% early withdrawal penalty, the early withdrawal amount contributes to the current year's assessable income and is subject to the usual income tax. If one were to assume that one's income has risen years down the road and thus a higher marginal tax bracket, then one is likely to pay more income tax (plus the 5% penalty)