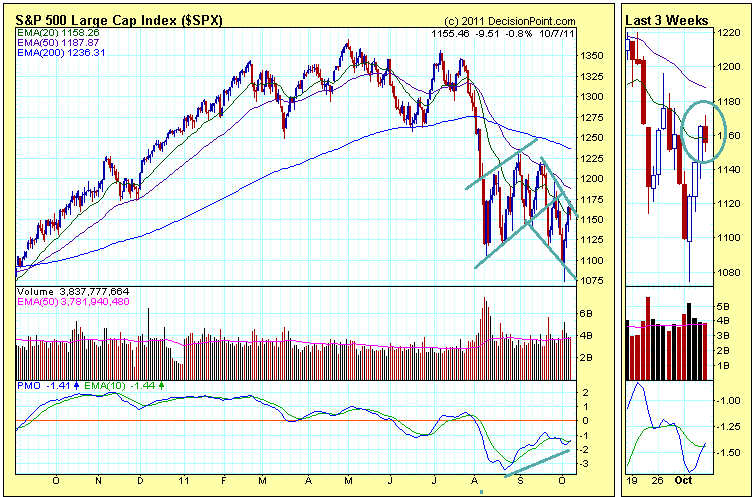

Not sure whether it is a coincidence but US market did an about turn at the end of the trading day going below the 20 day EMA. The question is whether the bulls have what it takes to make higher highs.

If it follows the lower lows, we could see 990. That will be a 30% draw down. But equally likely this may be the end of a correction. We are experiencing the kind of volatility as if this is a mature bear market.

Whatever it is, evaluate which stocks you want to get in, space out your purchase. Staying 100% out is a bad idea because when it turns it turns hard and fast and likely you will miss the best 10 days. But you are susceptible to the worse 10 days as well. Go for stocks that can stay profitable and will not be a going concern.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024