Followers of my Dividend Stock Tracker have notice that the price is not reflecting well recently. Well this is because Aims Amp did a share consolidation of 5 to 1 and a symbol change.

I have updated my tracker as well as its recent 2Q FY2012 data.

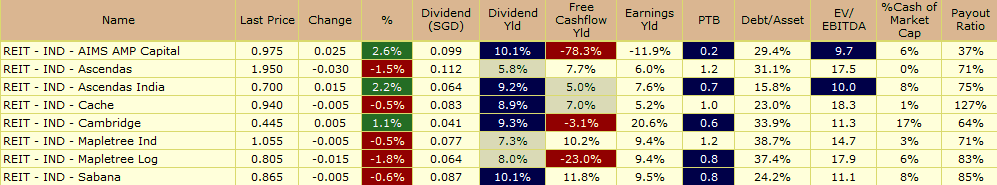

Its become really really high yield

- The debt levels are 30% debt to assets. This looks ok but they will be increasing funding for a redevelopment for 20 Gul Way. This will bring their gearing up to 39% debt to assets. (This is not factor into my stock tracker)

- 10% yield. Enough Said.

- Aims Amp asset historical purchase price is average. There are assets that is still trading below their purchase price. There aren’t many that are valued way above their purchase price. Shows the past problems created during its MacArthurCook days.

- Aims Amp Industrial REIT have the lowest management fees compare to AREIT (24mil), Sabana (5.5mil), MLT(23mil), Cambridge(6mil)

- Average Land Lease is 47 years compare to AREIT (53), Sabana (41), MLT(60), Cambridge(41)

- If we take off the debt, and focus on asset yield, or return on assets over 47 years, the asset’s XIRR is 5.25%. This is compare to AREIT (5.65%), Sabana (6.75%), MLT(4.58%), Cambridge(3.8%)

- Average debt maturity of 2.8 years.

This Q2 result is not bad

- The distribution is less compare to last few quarters.

- Strong increase in the level of distribution 48% yoy.

- The Ex dividend date is 18 October 2011. Payment on 7 December 2011.

Conclusion

I think the risk of Aims Amp Industrial REIT comes during

- Credit Crisis. During 2007-2009 difficult to get debts refinance. Debt level is ok but debt maturity in 3 years. Still unknown.

- Slow down in industrial production. For that we will have to have a very negative outlook on Singapore manufacturing. I am neutral on this.

Disclosure: Not Vested.

I run a free Singapore Dividend Stock Tracker . It contains Singapore’s top dividend stocks both blue chip and high yield stock that are great for high yield investing. Do follow my Dividend Stock Tracker which is updated nightly here.

Latest posts by Kyith (see all)

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Dividends Warrior

Sunday 9th of October 2011

Hi Drizzt,

Thanks for the info. I am vested wif 5 lots. I agree with the 2 potential risks mentioned. During a credit crisis, difficult to refinance debt. Secondly, industrial sector slowdown will have a negative impact too.

I am using AIMs to give my dividend portfolio a little extra boost. I dun think I will increase my holdings any time soon.

Gonna expand my dividend portfolio into the US market soon. ^^

Btw, you look exactly how I picture you! Lol.......