Well what a week it has been. I haven’t been able to blog much compared to last week but I sort of find that using a weekly moving average is bad for trading but great for positioning for the long term.

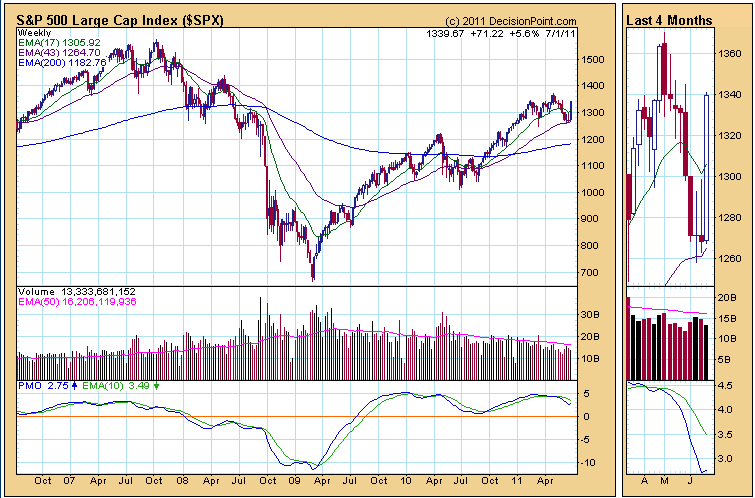

S&P500

We mentioned at Investment Moats last month that we should see a consolidation here or a break down.

This week we saw how important that 43 week EMA was and a huge bounce off it for a 5.6% gain.

Were any of you traders able to profit from it?

While such a bounce seem to herald a continuation of this bull market, we might still see my original scenario panning out, where the next week go lower, lower, higher. This would bring the 17 EMA and 43 EMA closer.

A sharp move next month my see another head and shoulders forming which would be bearish.

STI

We saw a similar 5% rebound this 2 weeks on the STI. Now the 3000 region have been established as a strong resistance or support. Lower highs since October last year forms a resistance line that the STI must breach should we want to see continuation in this bull market.

The caveat must be that the 17 EMA is close to the 43 EMA.

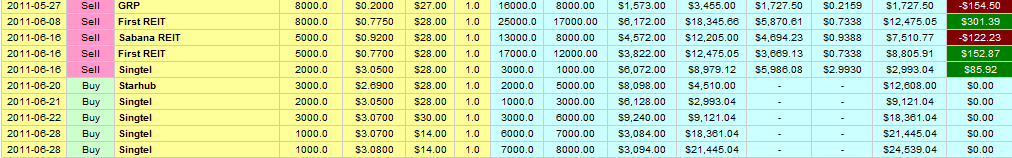

Portfolio Changes

There many sells to take profit there are many of buybacks. I am looking into that Sheng Siong IPO and possibly Diary Farm. Probably not for dividend but as a growth stock.

I am also doing a comparison across some industrial assets belonging to Sabana, Aims AMP and Cambridge.

You can tune in to any changes to it here at my Stock Portfolio Tracker >

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

so1trg

Wednesday 6th of July 2011

Comparing Sheng Siong and Diary Farm Financial Statements, I do note that Sheng Siong looks a tad more fundamentally attractive than Diary Farm.

Not too sure how they are going to price Sheng Siong though. I hope not too high a multiple of its earnings. Last i assess Dairy Farm is 28x EPS. Not exactly a number i like for a retailer.

Drizzt

Sunday 10th of July 2011

Hi so1trg, I do note that Sheng Siong doesn't have a levered balance sheet before IPO. The diff is that Dairy Farm is more diversified across. Perhaps the figure that we should be looking at is price to sales.