There is a new exchange-traded fund (ETF) that allows an investor to be exposed to some of the leading global cloud computing companies.

The ETF, released by CSOP, mirrors a market-capitalization weighted cloud computing index, rather concentrated and holds a rather high management fee of 0.99% a year.

That is a rather high expense ratio.

However, the main relavance of this ETF is it allows you to be expose to a unique segment and that the ETF is domiciled in HK.

Here is what we know about the ETF.

Who is CSOP?

CSOP asset management was established in 2008.

They are the first offshort entity to be set up by a regulated Chinese asset manager. CSOP have established many products that can be found in many markets including Hong Kong, Singapore, the United States, Japan, Luxembourg, Ireland, Cayman Islands.

I think both passive and active investors should pay attention to CSOP because over the years, they have been listing a few ETFs in different markets that may allow you to form your core passive portfolio or allows you to take strategic bets.

Here are some notable funds:

- CSOP FTSE China A50 ETF (HKSE) – RMB

- CSOP MSCI China A Inclusion Index ETF (HKSE) – RMB/HKD

- CSOP Bloomberg Barclays China Treasury + Policy Bank Bond Index ETF (HKSE) – RMB/HKD

- CSOP Hong Kong Dollar Money Market ETF (HKSE) – RMB/HKD

- CSOP Hang Seng TECH Index ETF (HKSE) – RMB/HKD

- ICBC CSOP FTSE Chinese Government Bond Index ETF (SGX) – USD/SGD

There are many funds aside form this, listed in HK that I did not list out and it might interest you to check them out.

The CSOP Global Cloud Computing Technology Index ETF

Here is a summary taken from a slidedeck:

The CSOP Global Cloud Computing Technology Index ETF sought to replicate the Solactive Global Cloud Computing Technology Index.

The index selects network infrastructure, communications, software, IT infrastructure and engineering software companies that are listed in HK and the United States.

The fund is rather concentrated with 50 holdings.

Currently the top 10 copanies account for 54% of the fund.

The ETF uses a representative sampling strategy. This means CSOP creates a portfolio using a limited number of securities to replicate the characterisitcs of the index as closely as possible.

Some reasons why representative sampling is done is because full index replication is not possible. Some securities cannot be easily bought by all investors. This is especially so for the A-shares listed in China and they might have to do it indirectly.

The strange thing is…. if it is listed in the United States and HK, you should not have problems with that. Well anyway, let us move on. They might ahve a reason why this is done.

Due to the minimum lot size (100 shares) and issue share price (HK$15.5), the minimum investment amount is HK$1550 or SG$265.

For readers who wish to only have a small allocation to cloud companies in a small portfolio, this ETF might be applicable (do make sure that the commission that you pay relative to the invested amount is not too high).

As the ETF is listed on the Hong Kong Stock Exchange, you will need a broker that allows you to trade on the exchange (Which is almost all the brokers).

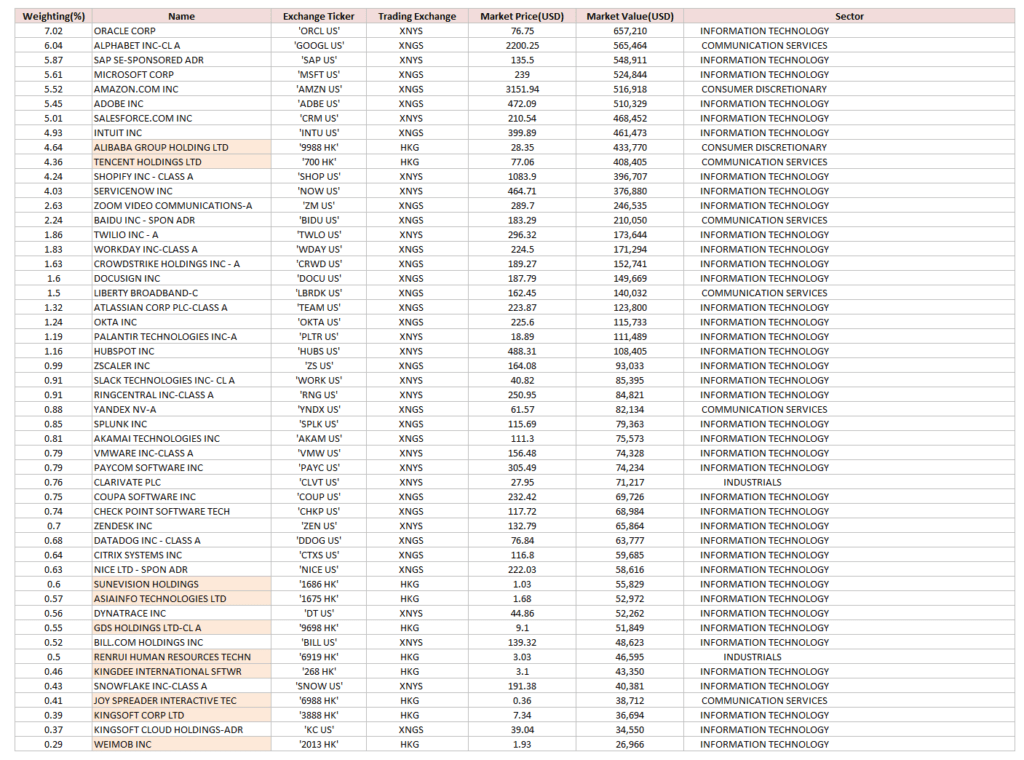

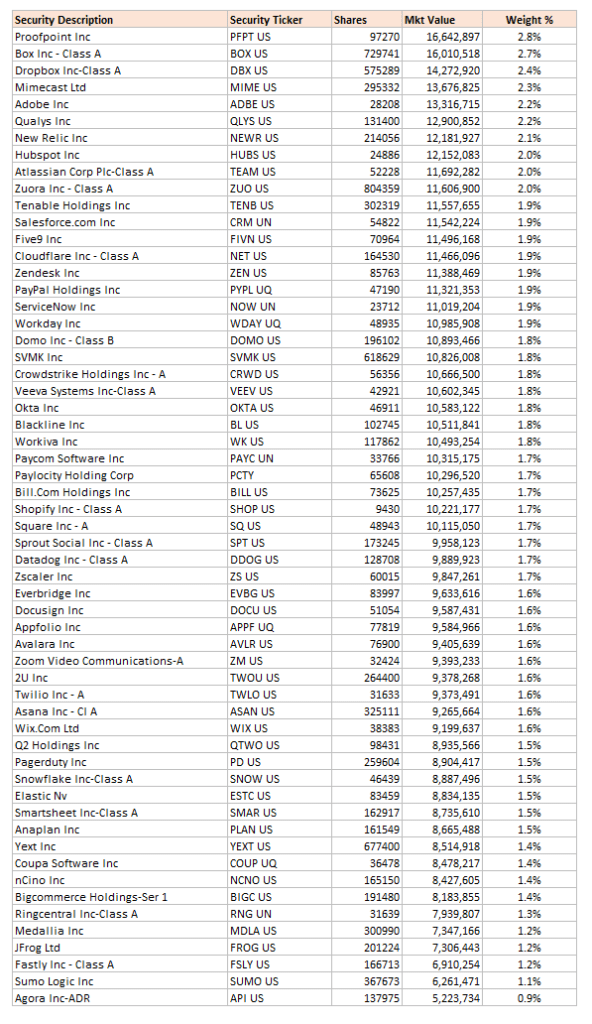

The Current Holdings in the ETF

The holdings in the fund will change over time. As the ETF holds the top 50 companies ranked by market capitalization, companies that become smaller will be replace by up-and-coming companies that grow larger.

Here are the current top 50:

If you are interested in tech companies, you would be familiar with most of the names. I am surprised Orcale is top of the list.

I think for a concentrated portfolio in a very volatile industry, we should see the stocks moving up and down every day. If you review the list on the CSOP website, you would really be able to see how an index ETF work in greater detail than a broad based ETF such as the MSCI World Index ETF.

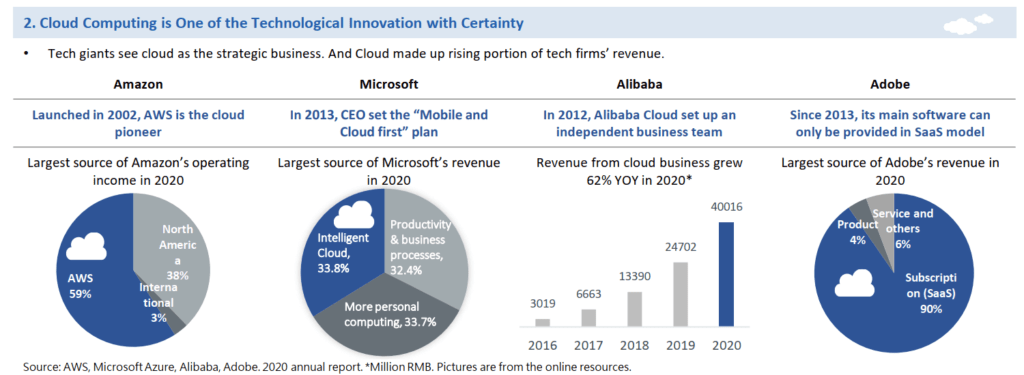

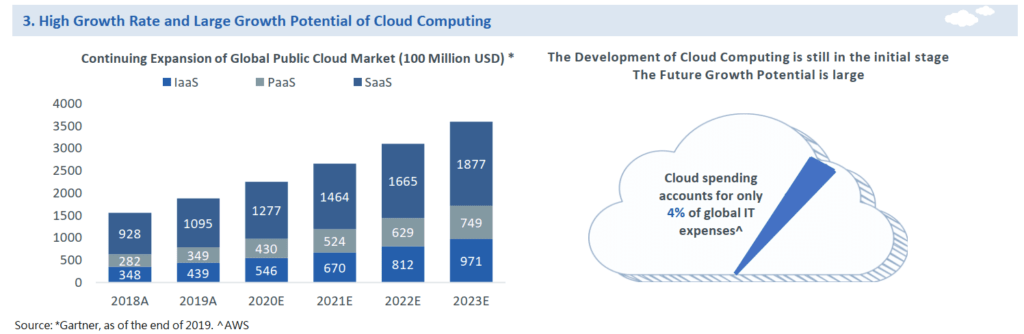

The Great Potential in Global Cloud Businesses

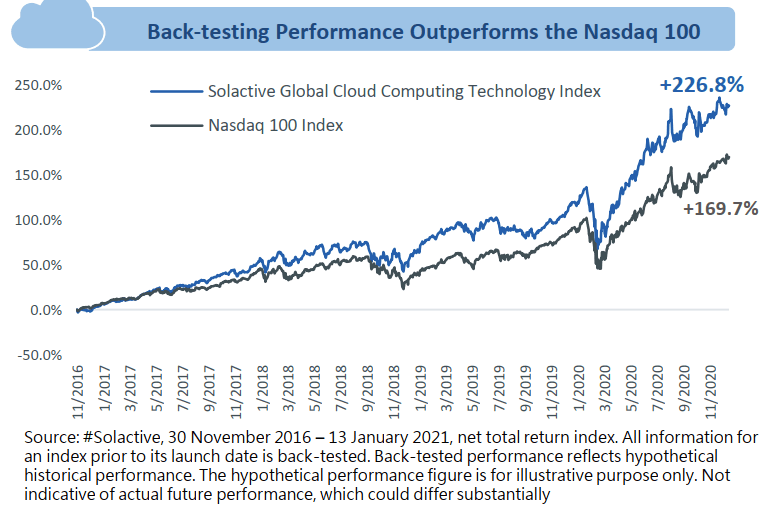

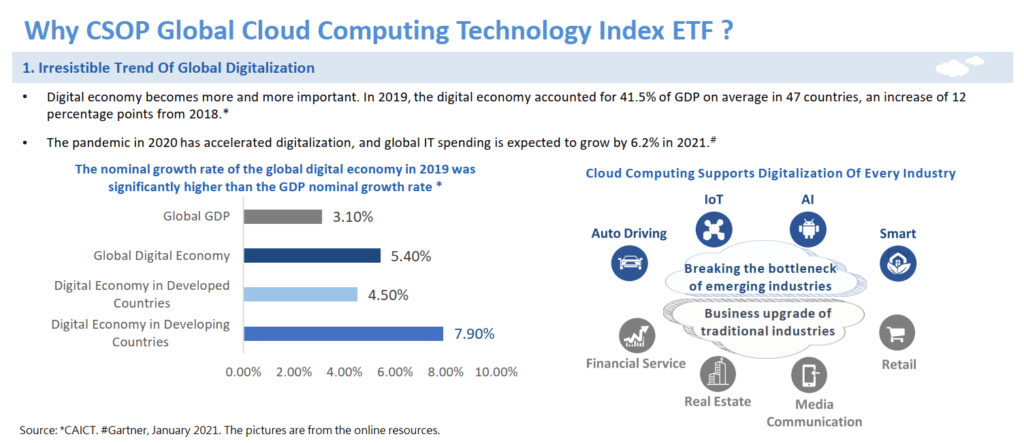

CSOP provided a few illustrations that explain why an investor should have exposure to companies in the cloud business.

They back-tested the performance of the index, if it is started in 2016.

The last illustration shows how much of the spending has moved to the cloud. There is likely a lot of mature businesses out there that are still running on-premise servers and software.

Alternatives to the Global Cloud Computing Technology ETF

If we want exposure to cloud companies, there are a lot of ETF in US that would do the job.

However, if you would like exposure to this sector yet be more tax-efficient, then you may wish to find an ETF that is domicile in a country that have more favorable withholding tax and charges low to no estate tax or inheritance tax (you can read about withholding tax efficiency and estate tax efficiency here)

Funds domiciled in Hong Kong generally are exempted from dividend withholding tax on the fund level and estate tax. Funds domiciled in Ireland are similar as well.

Thus, the Irish-domiciled funds listed on the London Stock Exchange are worthy competitors.

There are 3 ETF listed on the London Stock Exchange that are listed with cloud computing theme:

- WisdomTree Cloud Computing UCITS ETF UD Acc (WCLD) – $464 mil – 0.4% TER

- First Trust Cloud Computing UCITS ETF Acc (SKYY) – $487 mil – 0.60% TER

- HANetf HAN GINS Cloud Technology Equal Weight UCITS ETF – $23 mil – 0.59% TER

The most popular one among them is probably the WCLD as WisdomTree have a similar ETF listed in the United States.

The main differences between these three ETF compared to the CSOP Global Cloud Computing ETF are

- Low expense

- The London-listed funds have no exposure to China cloud computing companies

- The London-listed funds are generally equal-weighted while the CSOP ETF is capitalisation-weighted

Let me explain the difference between the market-cap weighted and equal-weighted.

In a market-cap weighted index, larger companies tend to grow and remain large and smaller companies become smaller. However, even within the CSOP fund, each single entity may not exceed 10% of the total net asset value of the fund.

In a equal-weghted index, all the stocks have the same weight. So a smaller market cap stock has the same weight as a company with larger market cap.

As an illustration, here is WCLD’s latest holdings:

Notice that the companies with lower market value have pretty high weightage.

There is still some disparity because some of the stocks in the fund become smaller and some become bigger.

The cloud computing firms have not done well recently so those who are currently smaller, are likely those who fell more in recent weeks.

Between market cap versus equal weight, there is no better index. You will get different flavor.

In a market-cap-weighted index, if the larger companies continue their growth (perhaps due to their competitive edge) they will benefit from the index. However, if cloud computing companies, like other stocks, also mean reverts, then the market-cap weighted index would suffer.

An equal-weighted index allows the smaller high-growth companies to drive the index performance (since they have relatively higher weightage versus the market cap weighted)

The criteria for a new cloud company to add into WCLD is that its annual revenue needs to grow at least 15% in each of the last two full fiscal years. To remain in the index, the cloud companies have to grow revenue at least 7% in at least one of the last two fiscal years.

So those entrants have higher growth then those who leave the index and since WCLD is equal weight, if they keep the growth momentum, they can drive the performance of the index.

The downside of equal weight is that, in an industry that is prone to failure, if majority of the companies fails and underperform, this index will go to shit.

The smaller cloud companies are less mature, and the majority tend to not have any GAAP profits. They are volatile and for a volatile sector, it is imperative that greater rebalancing and reconstitution frequency is carried out.

Summary

I think it is always good to have one more option for those who know the industry better.

I can see some engineers working in the tech sector looking for something like this. Then again, they may just buy the cloud companies they know better outright instead of using an ETF.

I am abit uncomfortable with the high expense ratio. I have not gotten my head round thinking about how equal-weight and growth work together. Those that enter the index should have stronger momentum, and based on research, the momentum usually last for 3 to 6 months.

If growth companies do mean revert frequently, then perhaps the CSOP Global Cloud Computing ETF is a more inferior implementation.

I dunno. My brain is abit fxxk now. If you have the answer, do leave a comment below.

One advantage of the CSOP ETF is, some investors may not have access to the London Stock Exchange. So the CSOP may become their sole option.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Sinkie

Friday 14th of May 2021

CSOP products are too expensive. Even US-listed etfs will be more cost effective despite dividend withholding tax (plus such underlying companies tend not to pay high dividends anyway).

And with LSE-listed etfs, it's a no-brainer as to which to go for.