This morning, some of my friends received a mailer from Stashaway.

In the email, Stashaway updated that they will lower the projected interest rate for its cash management portfolio Stashaway Simple, from 1.9% to 1.4%. This will take effect from September 1 onwards.

The reason given by the CIO is that “to stimulate the economy, global central banks keep lowering interest rates. Although this is great news for people looking to borrow money, the lower interest rates also make it more difficult to earn rates on cash.”

So they analyze and believe interest rates won’t go back up for the foreseeable future.

Stashaway Simple is made up of two LionGlobal money market unit trust:

- LionGlobal SGD Money Market Fund

- LionGlobal SGD Enhanced Liquidity Fund

Stashaway also said that these two funds have not been performing well a few months ago but StashAway had added a rebate to bridge the difference between the projected 1.9% rate and the actual rate.

My friend zzXiaoboizz has written his thoughts about this reduction. In his piece, he goes a bit deeper on why he was not surprised these two funds were not able to endure and give 1.9%.

Cash Solutions like Stashaway Simple are Not Immune to Market Interest Rate Forces

There is not a lot that I would add but maybe I will talk about the Enhanced Liquidity Fund later.

I told those folks around me to be realistic about your returns from short term safe instruments.

A lot of my friends find these pools of money to be refreshing. However, beneath a very nice sounding wrapper, the underlying are unit trusts that have existed for a long time.

These unit trusts, or money market funds, typically invest in fixed deposits or equivalents. Some funds, such as the LionGlobal SGD Enhanced Liquidity Fund push their holds to bonds/debt instruments that will mature within the next 12 months.

These bonds are more risky and because they are more risky, they may give a higher return to compensate for the risk.

If you find that the interest rate of all your fixed deposits are collapsing, then it is a matter of time that the returns of these money market funds move closer towards your fixed deposit returns.

The only way to get higher returns

- Go further longer in duration to capture the term premium

- Go further out the credit quality to capture the credit premium

Basically premium is a nice sounding word for risk.

The High-Interest Projection Have Served its Main Purpose

Here’s the thing: Everyone in the industry knows the way to attract money to your company is to offer attractive savings interest rates.

The majority of the people are not investors, they are savers and on the lookout for safe products with attractive rates. This is how Yu-Er-Bao grew in China. This is why when the government structure the digital license, they did it in such a way that the future digital banks cannot compete through the attractive interest rate way (correct me if I am wrong).

If you advertise you have a savings solution that is cash deposit like that give near 2%, you are going to attract a lot of money.

You just have to check out Endowus and Stashaway’s websites. The hottest, most visible areas of both their sites are reserved for their cash solutions. For the rest such as MoneyOwl, FSMOne it is buried deeper.

If they bring you in with the cash offer, then they can slowly massage you to invest with them.

The cash is more of a lead generation.

Stashaway came up with a very sophisticated system that is able to know when the economic regime is going to shift, compute the correlation of different asset classes, sectors, then dynamically shift the portfolio allocation.

What are the chances they don’t know a 1.9% return sometimes is unsustainable? If it is unsustainable, why not just… maybe give a lower return?

They just got another round of funding, so by right they should be in a more comfortable position to continue rebating the difference in performance.

I think they have gotten all of you in. That is done already and no need to keep sustaining this.

Some Notes on the LionGlobal SGD Enhanced Liquidity Fund

This fund is damn hot.

You can find it in FSM’s CashSweep, Both of Endowus Cash Solutions, Stashaway Simple.

If Stashaway said the performance have been poor then I think all the solutions will be impacted.

The fund is rather new (incepted in November 2018). The fund seeks to preserve capital, enhance income and provide a high level of liquidity by investing in a broadly diversified portfolio of high-quality debt instruments.

The portfolio can invest in various debt instruments, of different tenures but seeks to maintain a weighted average portfolio credit rating of A- and an average duration of around 12 months.

The fund currently has a management fee of 0.35% a year. The year to date return of the fund in 2020 is 1.06%.

Since inception, the fund has delivered a return of 1.6% per annum. This contrasts with the 1.8% return per annum of its benchmark, which is the 3-month MAS bill.

The fund’s holdings is not fixed deposits or equivalent securities. The holdings are higher credit rating bonds that are maturing soon.

Here are the fund’s top 10 holds:

The LionGlobal SGD Enhanced Liquidity Fund can enhance the return over the traditional savings deposit by:

- Going further out the risk spectrum by holding corporate bonds of companies they deemed to have at least credit rating of A-. While you may find that a bond rated with rating of A- is high, there are bonds with higher credit rating of AA and AAA.

- Flirting with bonds that are longer in maturity to capture the term premium

While we think that over the long term, the fund should yield positive returns, because the majority of their holdings are corporate bonds, in the short term, there is a likelihood that the value of your investment may be negative.

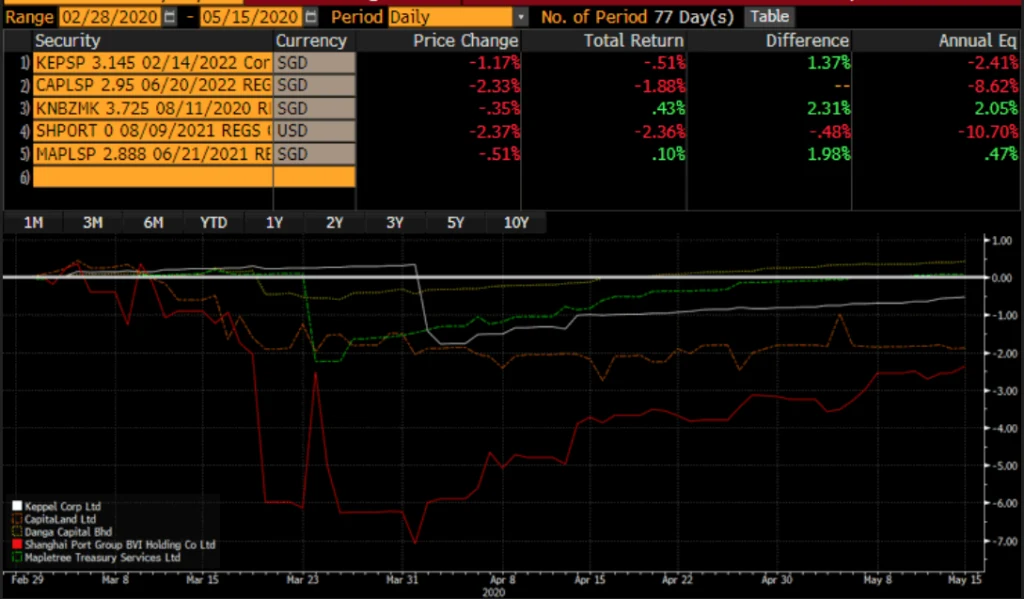

The Bloomberg chart above provides a snapshot of the total return for 5 of the top 10 holdings during the period where the bond market experienced greater volatility.

On a short-term basis, some of the bonds suffer losses (refer to the column labeled Total Return).

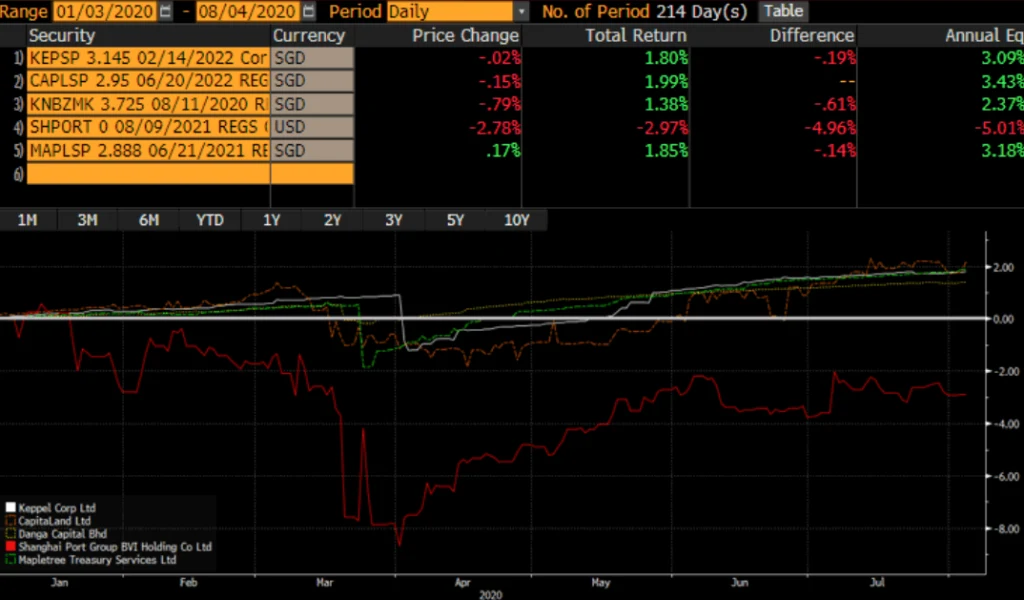

If we extend the timeline from the start of 2020 to the 4th of Aug 2020, you will observe that majority of the bonds recovered in terms of total return.

The manager of LionGlobal SGD Enhanced Liquidity Fund needs to manage these short-term fluctuations well.

This does mean that there exists the possibility that the value of the fund can dip into the negative range.

The returns chart for the fund looks very smoothed and you do not see these price volatility. I think the reason is that the manager do not mark-to-market the value of the asset.

Conclusion

In the spectrum of risk versus returns, stuff like this would lean closer to the low-risk side. I am not going to be that idiot who dug up some data and then proceed to tell you not to put money into it.

But I do find that our brain tends to go into that lazy mode that this should be relatively safe. Just know that these are safe but not going to be the super safe sort.

In the grand scheme of things, if they fund can still get 1.4% a year, it is better than decent. However, based on zzXiaoboizz thinking, even this would prove to be a challenge.

If you ask me, I will tell you I dunno how the rates will go. The way to use these cash account is…. to use it for the real purpose: To have a certain pool of money for liquidity purpose.

Take advantage that these money market funds, through their economies of scale, can get better interest rates that you could not.

Expect the rates to fluctuate.

Don’t treat these cash account as your main wealth-building machine. View the cash portion in totality with your higher-risk investments. Manage your cash, bonds, equity allocation according to your duration and risk tolerance.

If you follow zzXiaoboizz que, maybe even for the most risk averse one, deploying 10-15% of your portfolio in equities, might yield a better return while keeping the volatility of your portfolio low.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Sinkie

Thursday 27th of August 2020

The writing was already on the wall back in April (after QE Infinity started) when the price appreciation of the local 3 biggest MMFs slowed precipitously.

The enhanced liquidity fund isn't legally a MMF, so they can take on riskier bonds. Although they try to limit risk by the weighted A- quality and weighted 12-mth duration limit.

The strange (or not so strange) thing is that ELF price appreciation has been accelerating in recent weeks & months. Last 30 days: 2.88% annualised Last 90 days: 2.28% Last 180 days: 1.98% Last 1 year: 1.92%

Looks like central banks buying of corporate bonds is having an effect.

Kyith

Thursday 27th of August 2020

If it is accelerating then it isn't an issue right?