On the first day of 2020 and I have already got my first negative news.

Last year May 2019, I wrote about how you can have greater interest in more of your savings if you fulfill one additional criteria for your DBS Multiplier Account. (Read Why I continue to save with the Boosted DBS Multiplier)

It seems there is some bad news on the horizon, at least for myself.

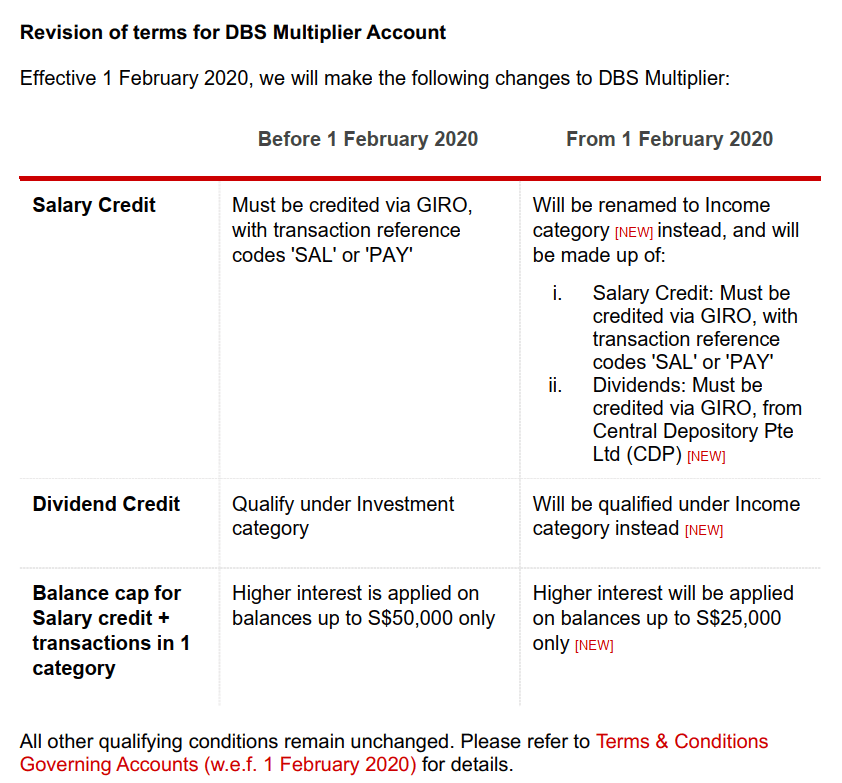

So here are the changes to DBS Multiplier

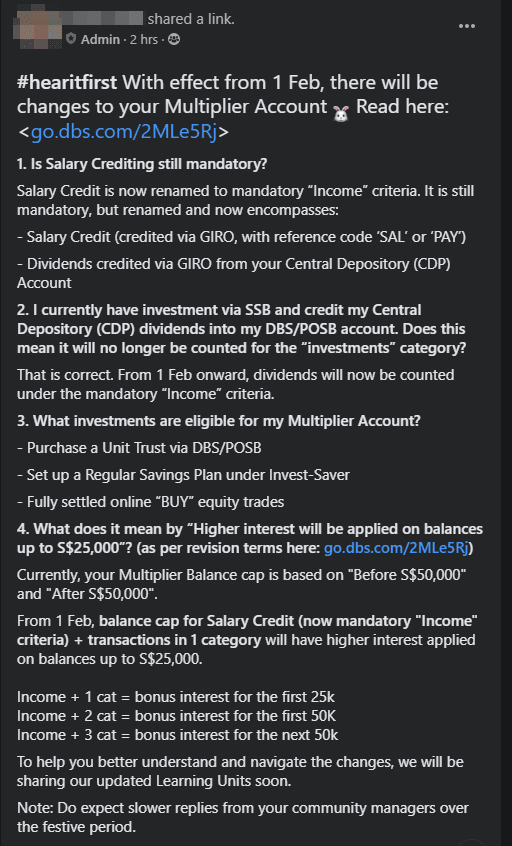

Update: There were some clarifications done on DBS’s Facebook Group the Burrow. I will paste the clarifications here:

If I were to convert to English, it means that dividends from your local stocks, bonds, and Singapore Savings Bonds held in your CDP will be under the income category now.

The second thing is that if you have only fulfilled the salary credit plus 1 category of transactions, the interest is applied on only $25,000 instead of $50,000.

If you manage to satisfy 2 spending category and above, the bonus interest is applied on $50,000 still.

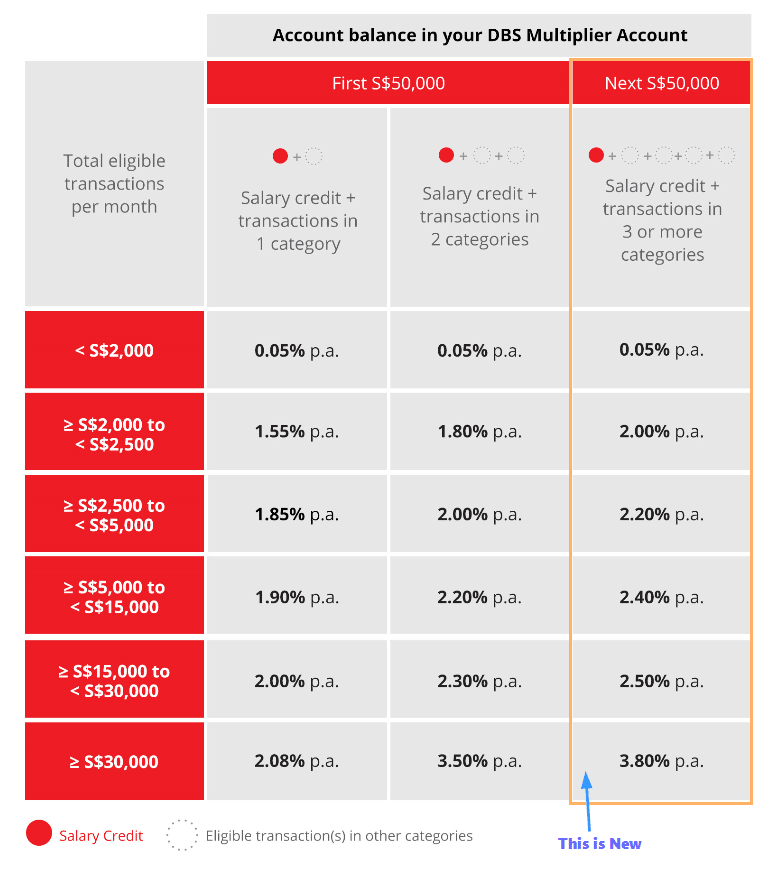

To make it easy, you read what I have written against this infographic in the last article.

Here is Roughly the Impact

- If you just satisfy the minimum of salary credit and 1 more category of transactions, the amount you can earn interest on is halved. This is NOT GOOD.

- For those that previously do not qualify for salary credit, the interest from your Singapore Savings Bond Ladder (refer to my past DBS Multiplier article) or if you have consistent almost monthly dividend income, DBS Multiplier is unlocked for you. This is because, at the minimum, you have to credit salary into any DBS/POSB account. The dividends/interest income now qualifies on top of your work income. This is GOOD.

- If you qualify for the current Investment category because you get consistent monthly dividend income or do the Singapore Savings Bond Ladder, you lost one category. You will qualify for Investment if you purchase their product. This is NOT GOOD.

Your effective interest might be reduced. This is a bit vague because they did not saywhat happens if you satisfy salary credit + more than 1 category of transaction? Do you earn a different bonus interest on the first $25,000 and the next $25,000 or the same bonus interest on $50,000?

There is some good news for you, and yet for some, this is not good news.

If you have a home loan mortgage with DBS, insurance or investment, plus credit card spend with them but do not have salary credit, you could have a way to engineer the income with the Singapore Savings Bond ladder.

You can now earn higher interest on $25,000 to $100,000 of your money.

However, if you are like me, who qualifies for the Investment category due to dividends and interest income, you just lost one category. This means that DBS Multiplier will still work but the interest is applied only on $50,000 instead of $100,000.

My sensing is that this move would push me to try and qualify for one more category that is tougher.

These categories would either be home loans, investment (the Manulife products kind) and insurance (the Manulife products kind). It pushes us to their higher-value products.

If this is too much for you, its time to look for some alternatives. Personally I am disappointed with the change in my situation and the timing of it.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

John Ng

Tuesday 11th of February 2020

Hi, re DBS Multiplier A/c, your post mentioned: 'The joint savings account is not the only account that you can maximise. There are a few accounts that are joint, that can boost the total transactions: Credit card. Joint and supplementary cards Mortgage CDP Accounts. Both your buy transactions will boost the transactions, and so are both your dividends' unquote

I have a personal (not Joint) CDP Acct: 1) Will my buy equity transactions with DBSV and payable from a Joint DBS/POSB Savings Account via GIRO qualify as an Investment category? 2) You commented 'electronic payment' for the investment disqualifies it. Do I really have to pay by 'cash' or cheque? 3) View I paid from the Joint DBS/POSB Savings Account with my wife, will this trade be counted twice ie the full amount be credited to each of my DBS Multiplier Account and my wife's DBS Multiplier Account? 4) In due course when the resulting dividend is paid via CDP into our Joint DBS/POSB Savings Account which is considered as an Income category, will this single dividend be counted twice in both mine and my wife's DBS Multiplier Accounts? Thanking you for your clarification, John

John

Thursday 20th of February 2020

Kyith DBS Multiplier A/c Re your advice that my buy equity transactions with DBSV and payable from a Joint DBS/POSB Savings Account via GIRO is eligible as an Investment category. FYI DBS now tells me payment from joint a/c is not eligible!

You may want to clarify with them view others may also ready your advice and open DBS Multiplier because of it?

Kyith

Wednesday 12th of February 2020

Hi John,

1) This will qualify in an investment category if you buy for that month 2) I have no idea which part you are referring to 3) If you pay from a joint account, both your DBS Multiplier account will qualify for that category 4) Same as the answer for number 3.

Mrs Ang

Thursday 30th of January 2020

I bought the retireReady insurance plan, with the benefits of the multiplier account as a package deal. Now just a few months after my purchase, the bank decides to reduce the multiplier benefits substantially, unless I buy more products like a unit trust from them. A retrospective policy like that has caused me to have doubts about the credibility of the way DBS deals with its small customers.

Kyith

Saturday 1st of February 2020

Hi Mrs Ang, well i am affected as well. But Mrs Ang, know this: All the banks are trying to do that. They are hoping you do a lot of banking with them and do not switch when they reduce these benefits.

What is the way out? Invest and build wealth well so that we do not have to be so reliant on these hurdle accounts.

financialmtc

Thursday 2nd of January 2020

you do not need to use DBSv to buy. Sign up for RSP with $100/month and the fee is less than 1%

curious_one

Wednesday 1st of January 2020

Why not just RSP $100 per month to either sti etf or bond etf. That will satisfy the investment category for 12 months. Policy might change again when the time comes.

Victor Zhang

Thursday 2nd of January 2020

Interesting, there are 4 ETFs available for RSP at DBS, even though their web site says only 2. https://www.dbs.com.sg/personal/ibanking/faq/etf-rsp.page

Isaac

Thursday 2nd of January 2020

Does rsp monthly into sti etf count for the investment category?

Victor

Wednesday 1st of January 2020

Singapore ETF has a smaller fee (0.12%, no minimum fee.)

Victor

timjoe

Thursday 2nd of January 2020

Anyone knows if there's a link that states that SG ETFs do not have a minimum fee? I was looking around and could only find that the fee is at a minimum of $25 - https://www.dbs.com.sg/vickers/en/pricing/fee-schedules/singapore-accounts