When we cross over the age of 40, we think about certain aspects of our lives more compared to when we are 30.

Adequate savings for kid’s education is something that is on your mind as you watch your kids grow older. The adequacy of your retirement is another aspect.

And of course, whether you are able to live long enough to earn the money that is required for both.

The Top Things We Think About in Retirement Income Planning

Advisory firm MoneyOwl had these conversations with those who are looking to secure their retirement pretty frequently.

They often tell MoneyOwl these are some of their top concerns:

- They need certainty of income

- Wish to see that their capital to be intact

- When they are in retirement, their medical risks are addressed

Do you agree with these concerns raised by those planning for retirement?

In my experience, listening in on the experiences shared by the advisers at my workplace, settling on these 3 concerns rest pretty high on the priority list.

The solution to their problem is very simple: Put their wealth into assets that grow over time, then spend a reasonable smalle percentage of their wealth.

If you have $10 mil in wealth and you need $100,000 a year in income, a lot of the products out there will work for you. This is because you will likely only spend 1% of your wealth. If you deploy your wealth in assets that grow greater than that, the problem is solved.

However, for many of us, it will be quite challenging to build up $10 mil or 1% is too low of a percentage to hit by the time we retire.

The biggest problem will be what do you put your wealth assets into that will keep your capital intact and provide income.

Integrating Public Retirement Schemes with Private Retirement Schemes

The most appropriate solution for the vast number of people is a combination of making good use of government schemes and deploying your wealth into appropriate financial solutions.

MoneyOwl designed some pretty great bundles for

These bundles are made up of insurance products from various insurance companies. If you do not know how much you should be insured for as a young adult, or for your newborn, MoneyOwl’s bundles have provided a good baseline for you to ensure that you can secure adequate protection.

This time around, MoneyOwl attempt to tackle your retirement needs with their RetireWise Bundle.

In this post, I will try my best to deconstruct this RetireWise bundle.

How Does RetireWise Work?

Retirees have to tackle 5 main challenges:

- Longevity risk – The risk of running out of money versus your life

- Inflation risk – The risk of decreasing your purchasing power

- Market risk – The risk of not having the adequate amount you need, due to market volatility

- Withdrawal risk – The risk of overspending in your retirement years

- Healthcare risk – The risk that you will not be able to afford the medical care that you require

Notice that what retirees have identified as key concerns (in the top things they think about section above) in retirement is very different from this list.

They are looking for solutions that address all 5 risk areas when in reality, retirement solutions usually tackle longevity, inflation, market risk to varying degrees. #4 Withdrawal risk is address by financial planning and coaching. #5 Healthcare risk is address by having adequate healthcare coverage.

To address #1 to 3, a retiree requires income in retirement.

The main bulk of this income would come from your CPF Life.

Your CPF Life is an annuity that provides you an income as long as you are alive. We contribute to our CPF so that in the future, the income stream from this annuity will pay for our essential expenses.

But for a lot of us, the income from CPF is not enough. We require more income for our other expenses on top of the essentials.

In RetireWise, MoneyOwl augment your income from CPF life with an insurance solution that provides an income for 20 years.

- The majority of this income is guaranteed with the other portion non-guaranteed. In this way, you can have reliable income for 20 years.

- After the 20 years of income, there will be a lump sum at maturity. This sum is forecast to be greater than your premiums committed. This lump sum should provide you with income for another 12 years.

- Your premiums will go towards a long term disability care insurance that augments the existing CareShield Life in the event you cannot carry out 3 of the 6 activities of daily living (ADL).

- It is made up of a retirement endowment product, an investment fund, and a long term disability care insurance

This does sound very confusing so let use a case study to explain how all the cash flows will flow.

Let us take a look at how RetireWise can aid Mr. Tan in planning for his retirement.

Mr. Tan’s Case Study

Mr. Tan is currently 45 years old and he has this inking to retire at 60 years old. He decides to work with MoneyOwl by purchasing the RetireWise bundle.

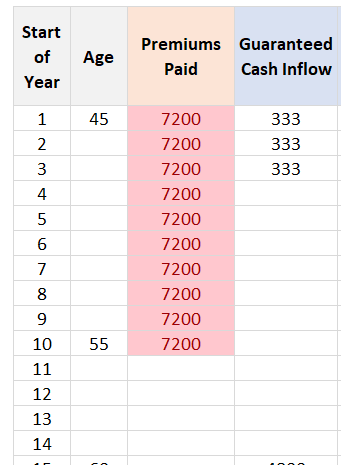

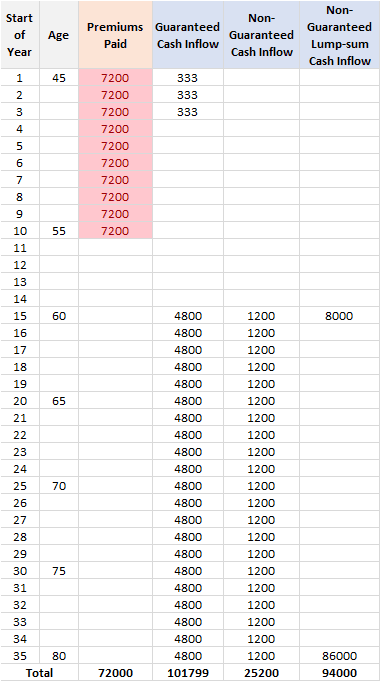

Mr. Tan saves $600 a month for 10 years. His total premium paid is $72,000. After these 10 years of premium payment, Mr. Tan waits for 5 years before receiving his first pay-out.

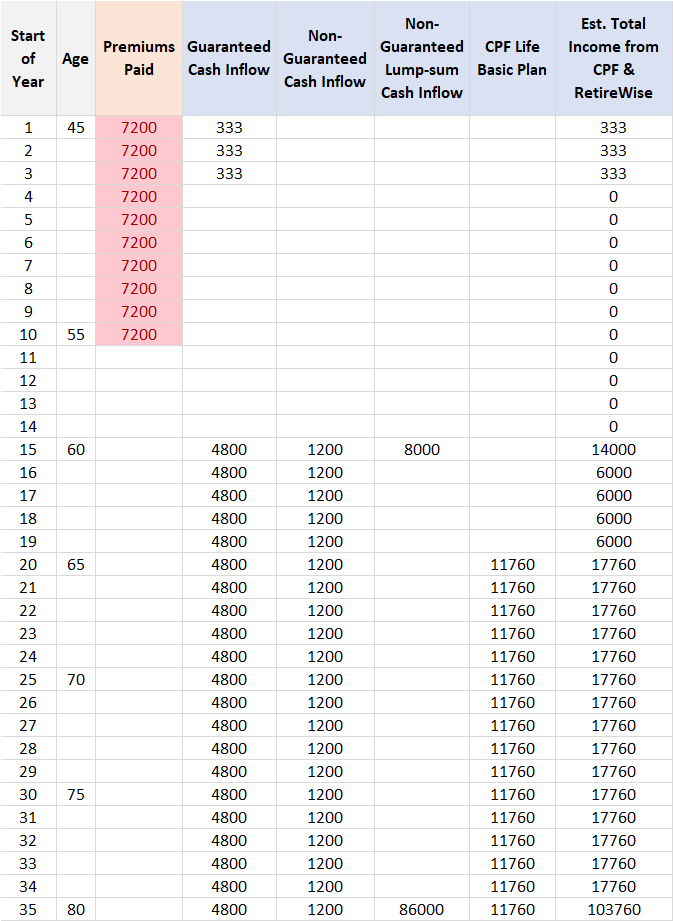

At 60 years old, Mr. Tan received a lump sum of $8,000. This is non-guaranteed. He will also start receiving $500 a month from age 60 to age 80 (20 years). Out of this $500 a month, $400 is guaranteed and $100 is non-guaranteed.

At 65 years old, Mr. Tan will start receiving his CPF Life annuity pay-out. The amount of pay-out will depend on which plan he selects from Basic, Standard, and Escalating.

At age 80, his $500 a month pay-out will stop, he will still have his CPF Life annuity income, and RetireWise bundle will give him $86,000 in one lump sum. This is non-guaranteed.

Now let us see how the cash flow works in detail.

How long would Mr. Tan pay for the Premiums and have to wait before getting the income

For most policies, there will be a period where you will not receive a pay-out.

I called this the Gestation period.

In the timeline above, Mr. Tan contributed $600 a month, or $7,200 a year in premiums for 10 years. If you prefer to contribute a lump sum instead, it is also possible. However, the projection will run a little different.

Within the first 3 years, MoneyOwl will rebate the customer an estimated $1000.

This $1000 comes from the commission rebate of the insurance product that MoneyOwl uses for the retirement recommendation. For most insurance products, MoneyOwl rebates 50% of the commissions after expenses.

Thus, you can see it as Mr. Tan is getting cash flow immediately.

There will be a period of 5 years where Mr. Tan will not contribute any money and no money will be paid out.

Mr. Tan’s Annual income and the lump sum cash inflow he will get

After the Gestation period, Mr. Tan will start to receive his income.

There will be a guaranteed cash income of $400 a month or $4,800 a year plus a non-guaranteed income of $1,200 a year.

This guaranteed and non-guaranteed income would last for 20 years. Mr. Tan has the option to change the monthly income pay-out to 5, 10 or 15 years instead of 20 years.

When Mr. Tan turned 60, he will receive a lump sum pay-out of $8,000. He can choose to see what he wishes to do with the money. The returns of this $8,000 is not guaranteed and it will depend on the investment returns.

At the end of the 20 years’ pay-out period, Mr. Tan will have received a lump sum. This lump sum will depend on the projected return of the underlying fund. The returns of this $86,000 is not guaranteed and it will depend on the investment returns.

Once all the income is paid out, the RetireWell Policy will end.

In total, Mr. Tan would have put in $72,000 in premiums and received $101,799 in guaranteed income or lump sum cash inflow plus $94,000 in non-guaranteed lump sum cash inflow.

How RetireWise will work well together with the Government Income System for Mr. Tan

To meet Mr. Tan’s income needs, most of the time, he cannot just depend on what RetireWise provides (unless he has a lot of wealth and contributed much more).

He will need to come up with a Sustainable Spending Plan (SSP). A Sustainable Spending Plan is one that incorporates all the available cash inflows that you have to come up with a plan to meet your spending needs. In such a plan, Mr. Tan’s spending is prioritized.

Mr. Tan will have cash inflows from various insurance products, managed investments, self-managed investments and government income stream that he would have to resolve.

The CPF Life is one income stream that Mr. Tan should see upon turning 65 years old. When he turns 65 years old, the money in his CPF Retirement Account will be used to purchase one of the three CPF Life Plans.

The client advisers at MoneyOwl can navigate with Mr. Tan in choosing out of the three CPF Life plans, which one is most suitable for his situation.

They can also advise him whether he should top-up using cash or the rest of his money in CPF OA and SA to the Enhanced Retirement Sum (ERS) to enjoy a greater income stream.

For example, if Mr. Tan chooses not to top-up, and he has the equivalent of his Full Retirement Sum (FRS) in his CPF RA, and he has chosen the CPF Basic Plan, he would receive an estimated income of $11,760 a year or $980 a month for the rest of his life. (Actual amount varies, and you can work with MoneyOwl, who would use their Proprietary CPF Analyzer to help you figure this out)

Mr. Tan’s income stream from 60 to 65 years old could reach $6,000 a year.

From 65 to 80, his income stream could reach $17,760 a year.

From 80 years onwards, his total income stream is $11,760 a year but he could supplement the $86,000 he received at age 80. This is equivalent to 12 years of the normal $6,000 a year income payment. With this lump sum, Mr. Tan could extend the income for a few more years.

Taking care of Mr. Tan’s Potential Long Term Care Needs

One of the healthcare risk that gain greater prominence is the risk that we might not be able to take care of ourselves. We might need external help in the form of care-givers or nursing facilities.

Here are some Morningstar long term care statistics:

- 52%: Percentage of people turning age 65 who will need some type of long-term care services in their lifetimes

- 47%: Estimated percentage of men 65 and older who will need long-term care during their lifetimes.

- 58%: Estimated percentage of women 65 and older who will need long-term care during their lifetimes.

- 2.5 years: Average number of years’ women will need long-term care.

- 1.5 years: Average number of years’ men will need long-term care.

- 14%: Percentage of people who will need long-term care for longer than five years.

- 22%: Percentage of individuals over 65 in the highest income quintile who will have a long-term care need of two years or longer.

- 31%: Percentage of individuals over 65 in the lowest income quintile who will have a long-term care need of two years or longer.

- 45%: Percentage of people requiring significant long-term care help (assistance with two or more activities of daily living) who are under age 65.

- 11%: Estimated percentage of individuals age 65 today who will incur out-of-pocket long-term care costs of between US$50,000 and US$150,000 during their lifetimes.

- 4%: Estimated percentage of individuals age 65 today who will incur out-of-pocket long-term care costs of between US$150,000 and US$250,000 during their lifetimes.

- 9%: Estimated percentage of individuals age 65 today who will incur out-of-pocket long-term care costs of more than US$250,000 during their lifetimes.

- US$350,174: Estimated lifetime cost of care for someone with dementia

From the statistics, the loss of independence is something we ought to be worried about.

RetireWise sought to help Mr. Tan address that risk.

The long term care risk is offset with the help of

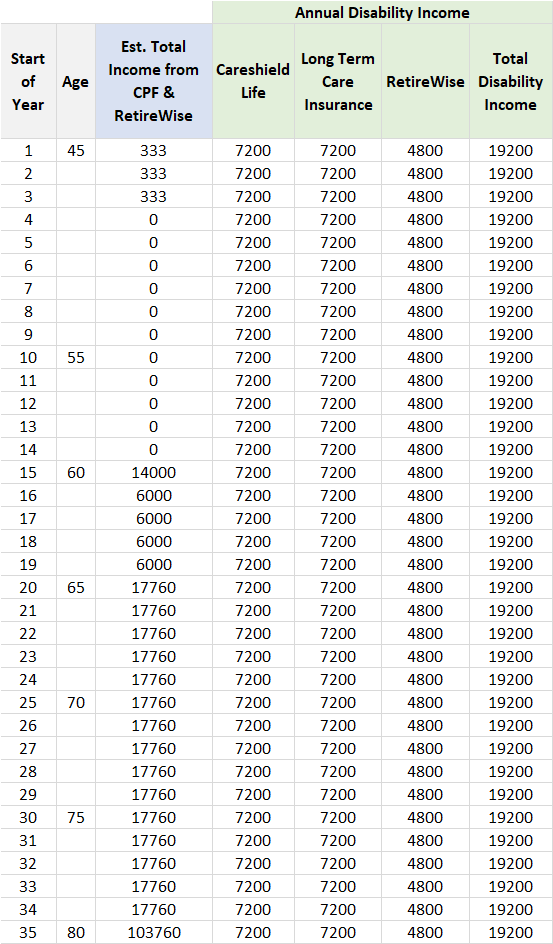

- Our public universal long term care plan called CareShield Life. Careshield Life provides an income for life if Mr. Tan is not able to carry out 3 out of 6 different types of Activities of Daily Living (ADL). This income starts at $600 a month and will go up depending on when Mr. Tan first needs to claim CareShield

- A Private Long Term Care Plan in Aviva MyCare. MyCare provides $600 a month in income for life if Mr. Tan is not able to carry out 3 out of 6 different types of ADL. The premiums for MyCare can be paid by CPF Medisave

- The insurance plan in RetireWise will pay an income per month equal to the guaranteed monthly income for 20 years if Mr. Tan is unable to carry out 3 out of 6 different types of ADL. This is on top of the standard guaranteed income paid out by the plan. In this case, Mr. Tan will be paid $400 a month for 20 years.

Thus in total, should Mr. Tan not be able to do 3 out of 6 ADL, he would get an income of $1,600 a month more or $19,200 a year.

In a way, with RetireWise, there is a potential for the plan to pay-out nearly $36,960 a year in income. This should help offset some healthcare and retirement goals.

The Forecasted Returns Expectations

We have gone through how much Mr. Tan will need to pay, when he needs to pay and for how long he needs to pay and when he will get the cash inflow, and how they will coincide with Mr. Tan’s other cash inflow.

I will have to remind you that not all the income is guaranteed, and part of the income is non-guaranteed.

Whether Mr. Tan would be able to get the $100 a month pay-out from the insurance product and the $8,000 and $86,000 would have to depend on the performance of the insurance product and the fund.

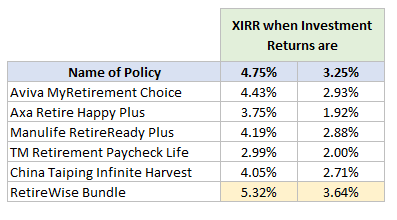

If you are looking at how well the RetireWise bundle measures up to the products out there, you can assess the XIRR.

The XIRR is also the Illustrated Yield that you normally see in your endowment and whole life’s benefit illustration.

The XIRR allows us to measure RetireWise against the return performance of different savings deposits, portfolio, properties.

This is basically the “compounded interest rate per year” that you get for putting your money in this stream of cash inflow and outflow.

Based on an investment return projection of 4.75% and 3.25%, the respective “compounded interest rate per year” for this stream of RetireWise cash flow is 5.32%, 3.64%.

This is based on my own calculation and not MoneyOwl’s. It includes both the guaranteed and non-guaranteed cash flow.

As I always say, these are projections. Other than the guaranteed part that I talked about, all these returns projections depend on the investment performances. Whether it is stocks, bonds, unit trust, or these plans, no one can be guaranteed all the returns that you will get going forward.

What if You Need Some Variation from Mr. Tan?

Your situation may be rather different from Mr. Tan. That is understandable.

And in fact, that is the way you should think about retirement plans on the market.

Financial companies try their best to come up with products that fit a certain segment of consumers that demand for things like this.

However, within these segments, not everyone is the same. Some of you

- do not wish to retire at 60 years old

- wish to retire at 55

- do not need the $8000 lump sum at 60 years old

- want an income that lasts longer than 80 years old.

The problem I heard often are folks buying all these products but at the end of the day, they have no idea:

- How much do they need to spend in retirement

- Whether they have built up adequately build up enough to retire at this point

- How they add up versus their CPF Life AND the excess in CPF SA and OA above the full retirement sum

You have a lot of financial widgets, but no overall retirement plans that you can depend on.

When you get a plan like RetireWise, you do not just get access to the product but the planning abilities of MoneyOwl’s salaried advisers. They are driven by helping you craft a good retirement plan.

The RetireWise Bundle is available today.

You can find out more and make an inquiry here.

This is a Sponsored post for MoneyOwl.

Kyith works for Providend Ltd. He does not work for MoneyOwl. Providend Ltd holds a 40% stake in MoneyOwl. He receives no affiliate income from any of the links above. Nor does he receives any commission income from any RetireWise bundle sold.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Ray Khoo

Wednesday 1st of January 2020

Hi Kyith, First and foremost, Happy New Year! Keep up the good work in your articles. I enjoy reading them.

In this article, the example of Mr Tan who is 45 now is used "For example, if Mr. Tan chooses not to top-up, and he has the equivalent of his Full Retirement Sum (FRS) in his CPF RA, and he has chosen the CPF Basic Plan, he would receive an estimated income of $11,760 a year or $980 a month for the rest of his life."

Based on the age of Mr Tan, by the time he is 55. The full retirement sum will be $244,000 computed at a compounded 3% increase each year. He should draw $1706/per month should he choose the Basic Plan or $1866/per month if he chooses the Standard Plan at age 65.

So is the article quoting on basic retirement sum instead of the full retirement sum?? Then Mr Tan will receive $853/per month if he choose the Basic Plan or $933 if he choose Standard Plan at age 65.

Kyith

Wednesday 1st of January 2020

probably i made some error in the CPF computation. i may have used a 55 year old today. I do mean full retirement sum