JPMorgan came up with a nice slide deck showcasing their data collection about things related to retirement planning.

If you are interested in planning for your own retirement, this slide deck might interest you. I reviewed this slide because I am interested in this area for myself and for work.

I picked out some of the slides that I find interesting or resonated with me.

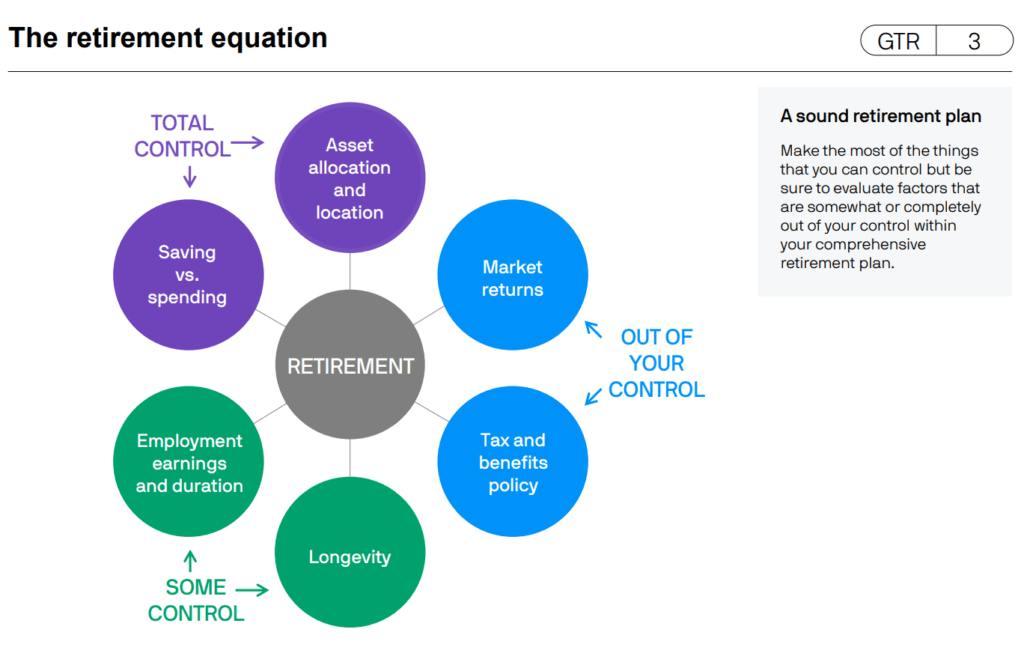

This slide resonated with me because I think many think that if they can get one or two things right then they can have the kind of retirement they want.

It may not be one or two things but a breadth of areas.

The challenge for many is they try to find the people to help them control Market returns, which are typically out of their control.

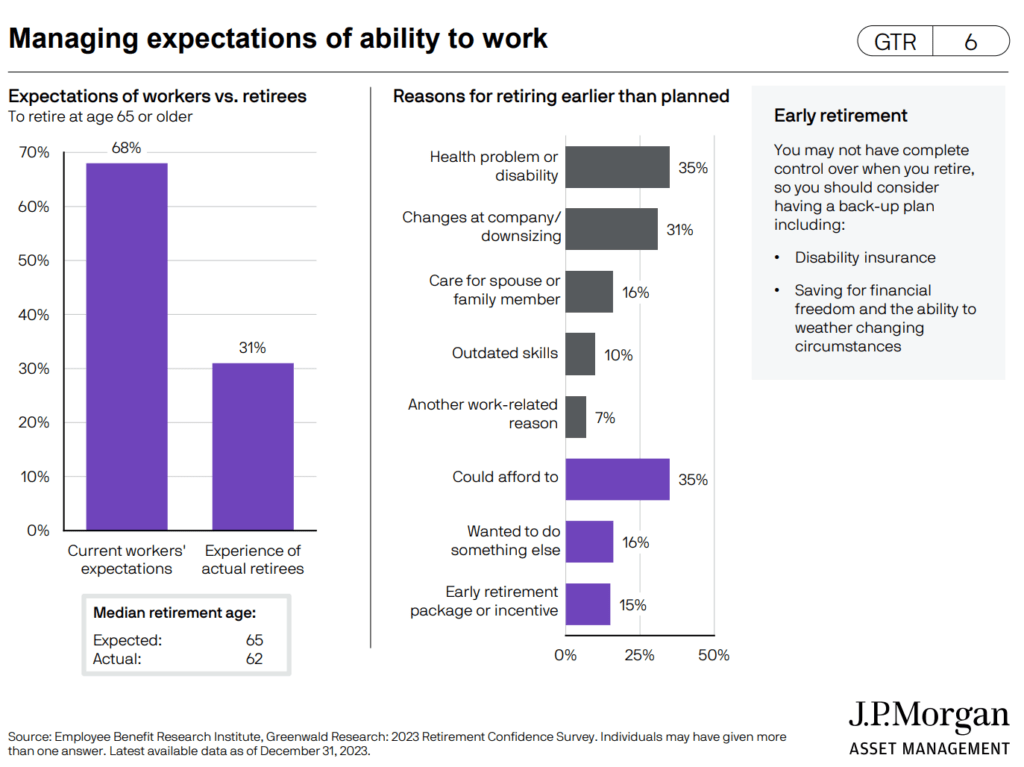

This slide list for us the reasons why retiring earlier became earlier than what people plan for. There are some that fortunately is able to retire because they were able to but it is worthy to note about 60% retire early due to health problems, disability and company downsizing.

Sometimes, it is not whether we want but a predicament of life.

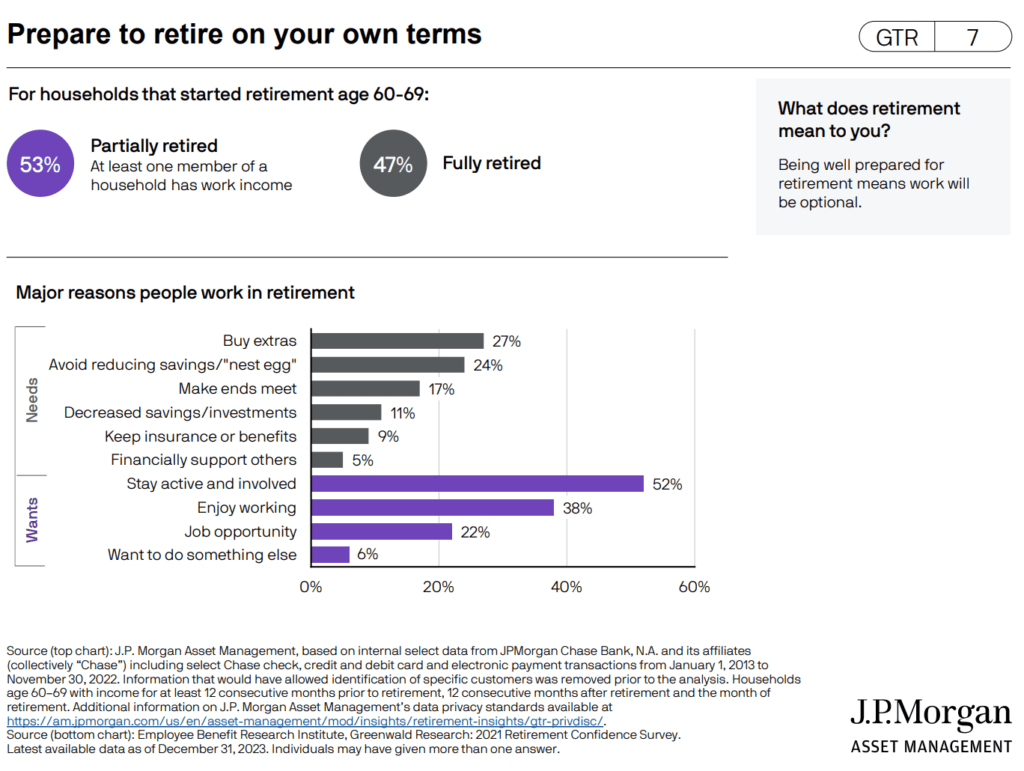

I feel that this is a significant slide. For half the group, one of the spouses is working.

Many work because they wish to stay active and enjoy their work. But there are also those who work because their savings were reduced, they needed more and they don’t have a choice.

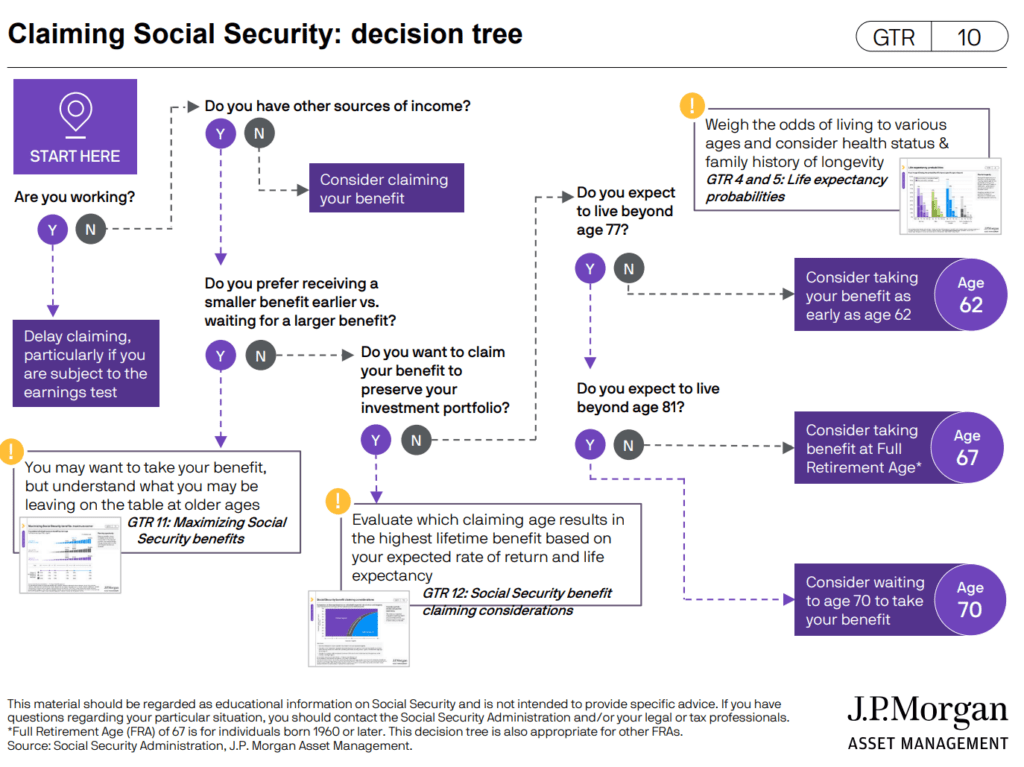

I love decision trees because usually, the most suitable recommendation is not based on just one thing.

This decision tree is to help a person decide whether to delay taking their social security but I think the decisions are applicable to decide if you should delay taking your CPF LIFE at 65 or later.

The sequence of decisions:

- Are you working?

- Do you have other sources of income?

- Do you prefer receiving a smaller benefit earlier vs waiting for a larger benefit?

- Do you want to claim your benefit to preserve your portfolio?

- Do you expect to live beyond age XX?

- Do you expect to live beyond age yy?

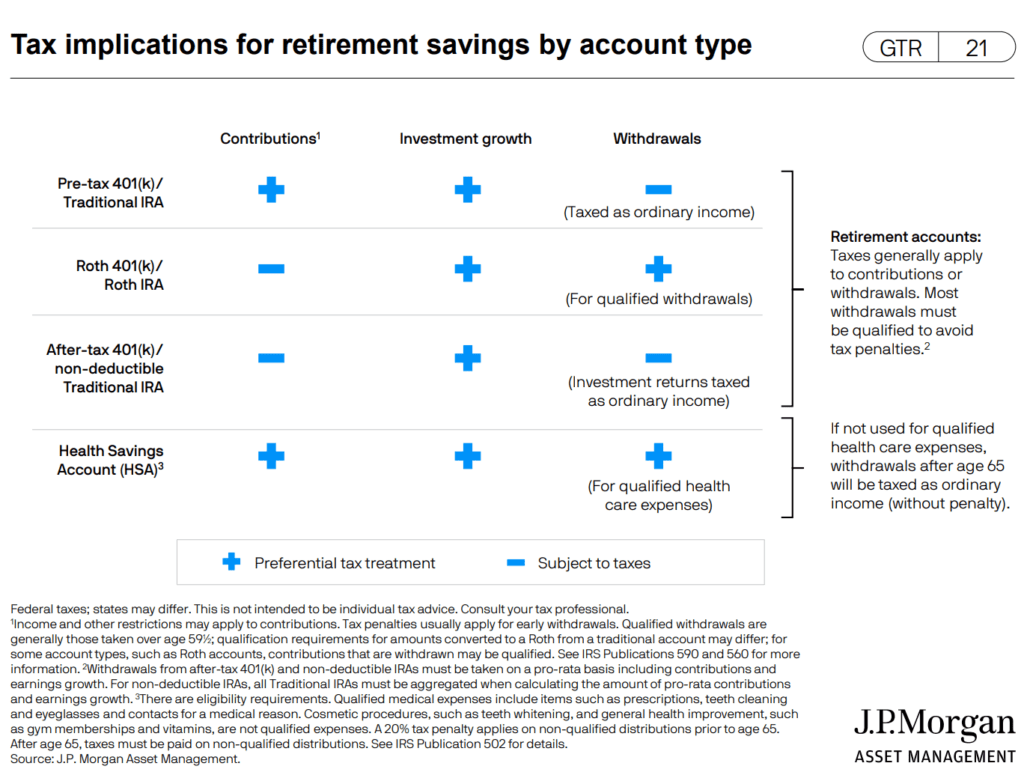

You are probably not interested in this slide because it talks about the tax implications of various US accounts, but it is info to expand the breadth of what I know (provided I can remember).

The plus and minus show us at various phases of the accounts, is it a preferential tax treatment or subject to taxes. This is why they say the HSA account should be prioritize because there is a plus whether it is during contribution, for the investments or during withdrawals.

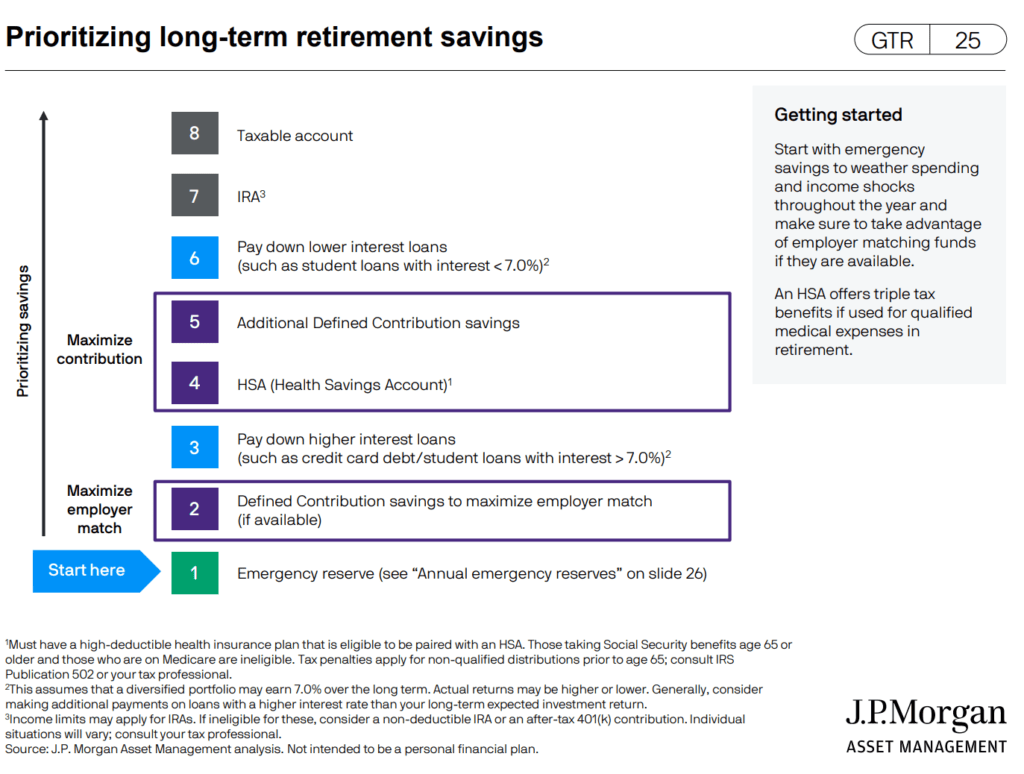

This slide shows the preferential order of what we should be doing with the “Free Cash Flow” that we get after spending on necessities. They are in order of safety, but also prudence. Some of the contributions are in that order because it is beneficial to be maximised early (defined contribution savings and HSA for example).

Do you have such an order in the Singapore context?

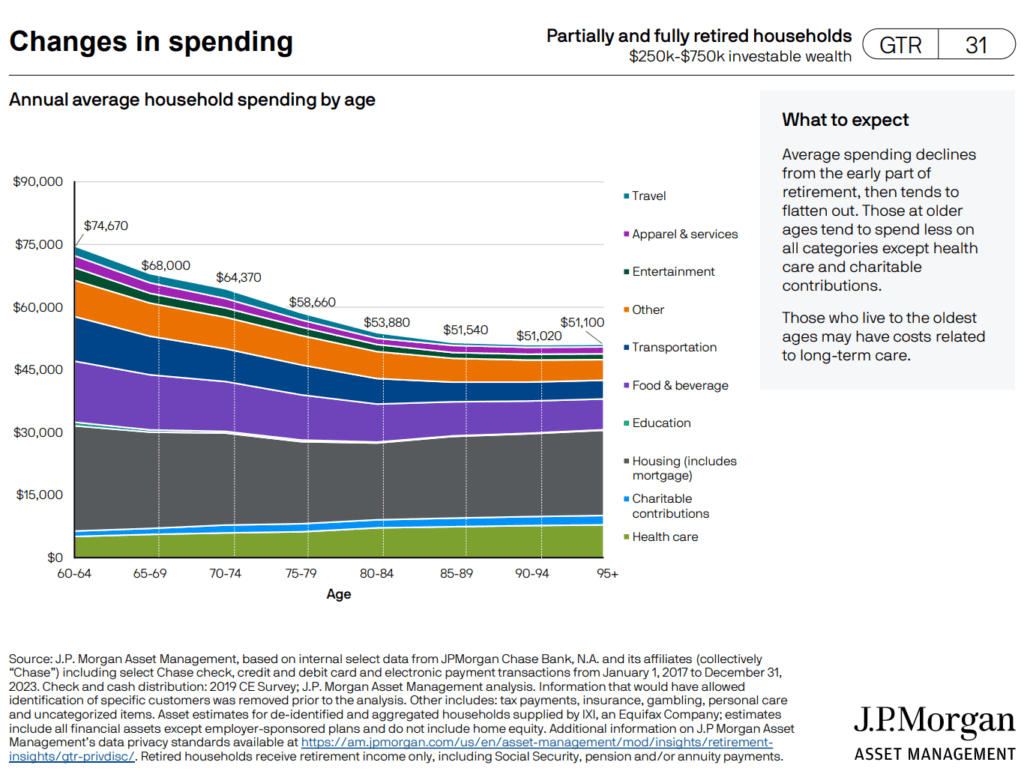

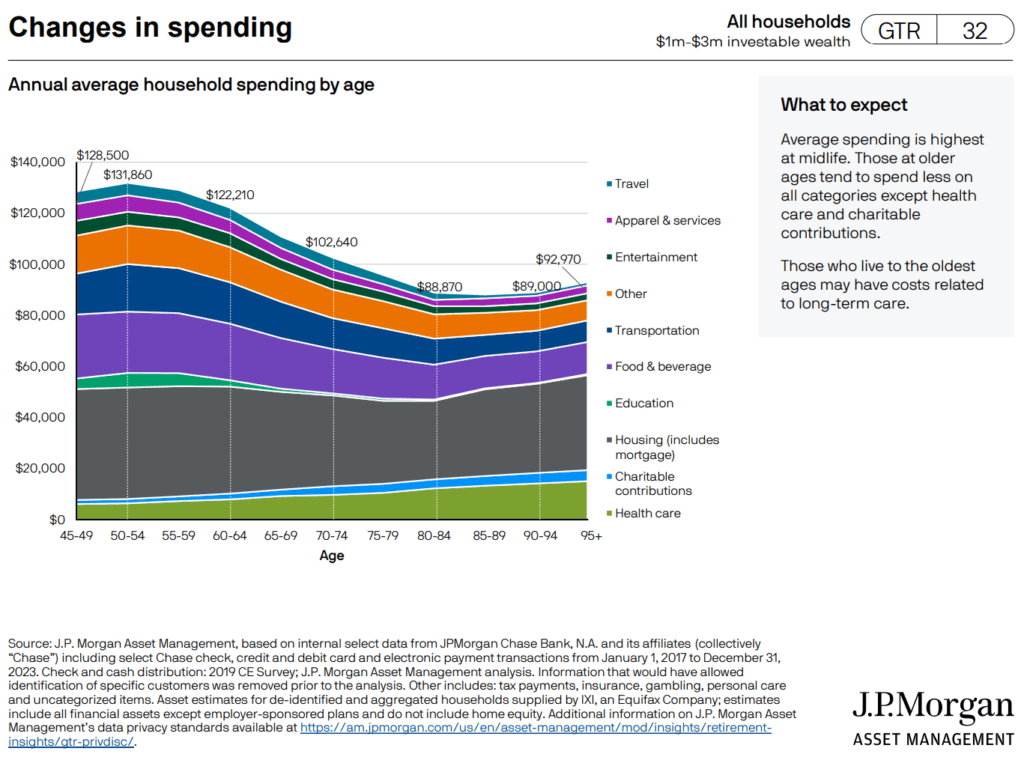

How much does your spending lifestyle change as you grow older? JPMorgan has the data from JPMorgan Chase bank, and its affiliates to collate check, credit and debit card, and electronic payment transactions from Jan 2017 to Dec 2023, to piece together this spending trend.

This one is for those with $250,000 to $750,000 investable wealth or the affluent.

- The total amount spend for the average household go down as we get older.

- The dark grey is housing and it does not change with age but yet it is a big piece (includes mortgage).

- Purple represents food & beverage and it is the second biggest at 60 but goes down slightly over time.

- Green is healthcare and it grows overtime but not by too much difference.

- Dark blue is transport and that goes down over time.

This is a similar chart to the previous except that this is for the high net worth with $1 million to $3 million but it also extends back to 45 years old.

- If you look at from 60 onwards, the charts of the high net worth and the affluent look pretty similar.

- Food and beverage stay rather consistent but eventually goes down.

- Unlike the affluent, this group sees higher healthcare spending. I think with money, you can afford better care and they do spend on higher care.

- Spending on housing does not go down and still a big chunk.

- The high networth have some education spending from 45 to 60 years old.

This might give you an idea on how to plan on what can be more flexible spending and what would be more permanent.

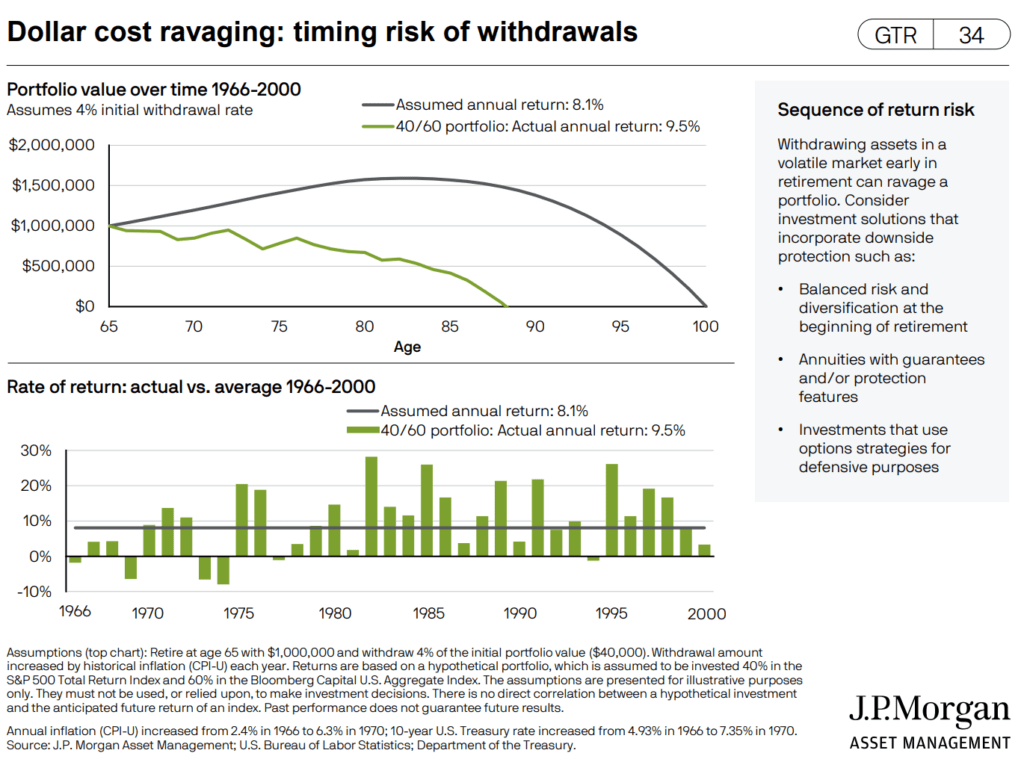

JPMorgan picked out the worst almost 30-year sequence out of the 68 unique 30-year sequence in history to show you how you can run out of money prematurely.

Let me try to explain.

Suppose you are a retiree who starts your retirement journey in a period similar to the start at 66 years old. You plan to spend $40,000 in the first year of a $1 million portfolio and wish to preserve your purchasing power. So you will adjust the income you take from that portfolio based on the prevailing inflation rate. If inflation is 10%, you will adjust the next year income by that much.

The plan is for the money to last till 100 years old, with an assumed rate of return of 8.1% yearly. The green line shows… if you live through this 1966 period, you ran out of money before 90 years old.

The interesting thing (bottom panel) is that the actual rate of return of a 40% equity and 60% bond portfolio is 9.5% which is HIGHER than the assume rate of return of 8.1% a year.

You will notice… there isn’t a lot of draw downs in this 30 year period (bottom panel).

So what went wrong?

Crazy high inflation.

This sequence is probably the toughest to navigate because you will only know you face persistently high inflation only in hindsight (not all high inflation will kill retirement. It has to be persistent).

The silver lining is… if you know this is a challenging sequence, it gives you a chance to “curve fit” a plan that would work with this.

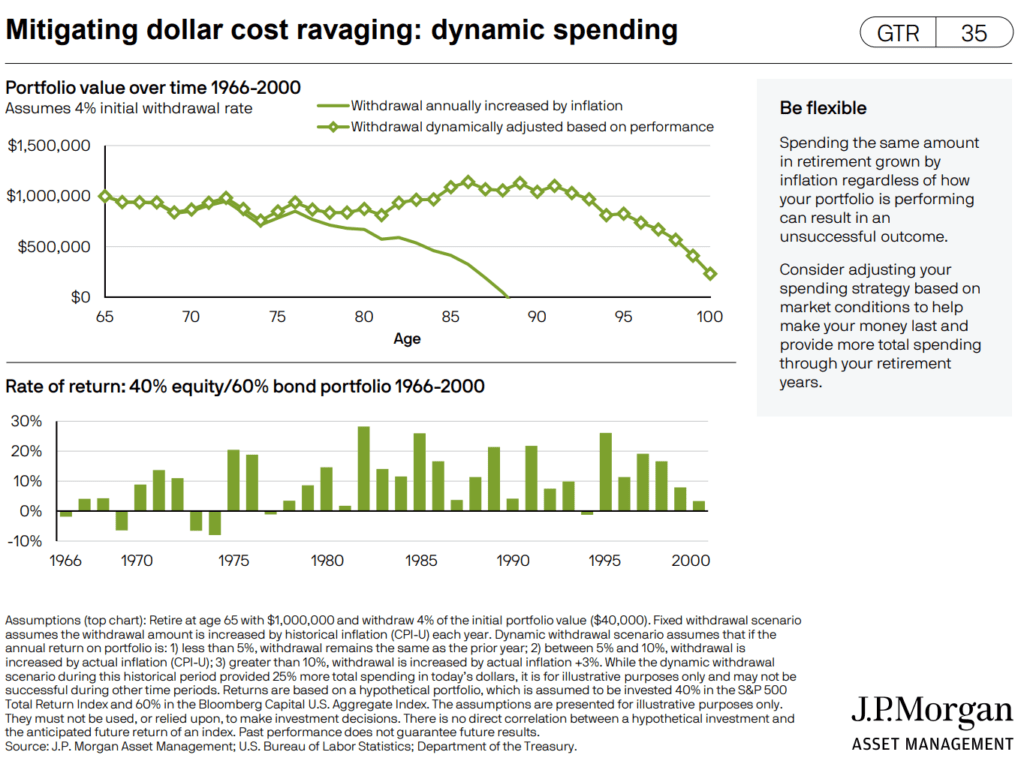

The medicine to this tough retirement plan is to be flexible in your spending.

This is JPMorgan’s flexible spending plan:

- If the annual return is less than 5%, spend similar to year before

- If the annual return is between 5% and 10%, increase spending based on actual inflation

- If the annual return is greater than 10%, increase spending based on actual inflation + 3%

This rule works for this scenario to last till 100 but not sure if it will work for other scenarios!

You should note that this increases the chance your money last longer at the expense of preserving your purchasing power.

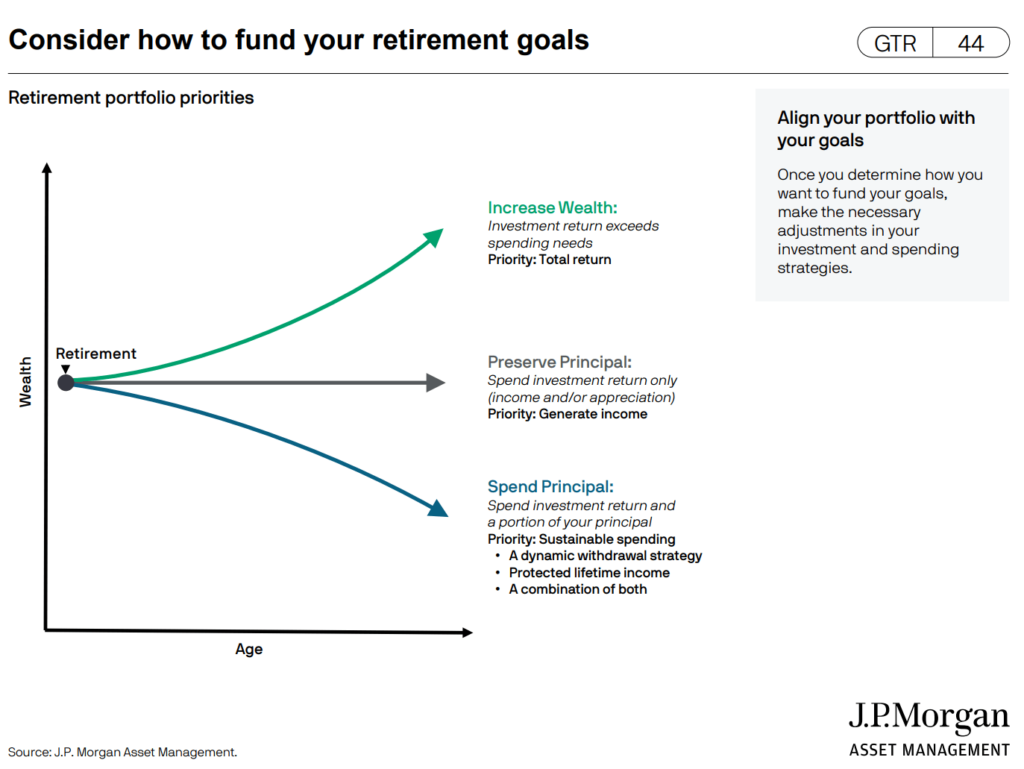

I like this retirement portfolio illustration. I can imagine putting this to clients or prospect to illicit their preferences. However, I struggle to connect with the priorities.

I think it frames things well in that each of us may have different income objectives and therefore we should prioritize differently.

Many may think there is one good solution but the complexity of income planning means if our objective is to increase wealth while spending down, we need high total return.

To increase wealth, the priority is that investment return needs to exceed spending needs. This also means to keep spending needs low. If we want to preserve principal, we can only spend investment return.

I find it hard to specifically target the middle one.

If we wish to spend down our money, we need to prioritize sustainable spending.

I question whether JPMorgan’s strategy will work that well.

But nevertheless, I like the framing.

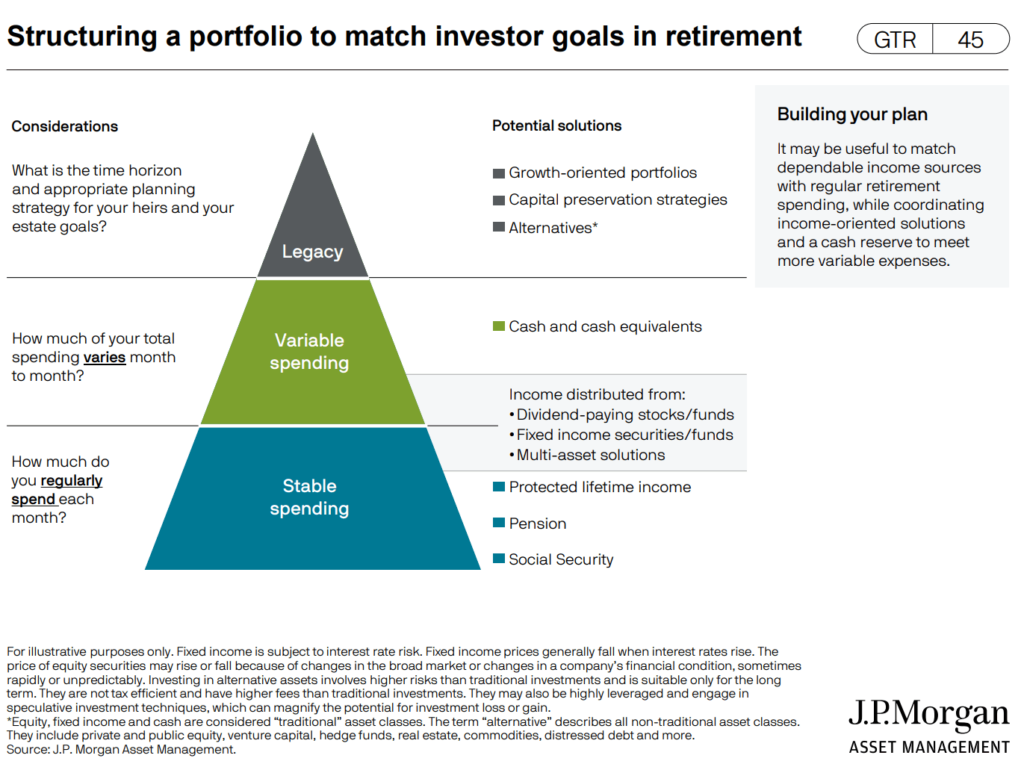

Finally, we each have different spending needs and if we break them down to category of needs, we can designate the most appropriate investment solutions for them.

I get the legacy one, and the stable spending. The middle part looks a bit confusing. I guess the right part is that variable spending will come from dividend paying stocks and fixed income securities.

In this way, JPMorgan have a lot of things to sell to everyone.

You can review the rest of the slides over here.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024