A good fundamental stock picker would usually think that it is better to pick strong stocks to invest in, instead of investing in an index that tracks the broad-based markets.

They will find it difficult to invest in a basket of stocks with some seemingly challenging companies among the top 10 holdings. Or why do they have to invest in companies that will drag down the strong companies in the index?

We have a bias to invest in stable things because we think they have the quality to remain stable or grow even stronger in the future.

In Singapore, investing in blue chip, stable things would be to invest in UOB, OCBC and DBS instead of the STI Index. In the US, it would be to invest in a basket of Apple, Microsoft, Meta, Amazon, and Google instead of the S&P 500.

This week’s biggest tech companies just announced their earnings.

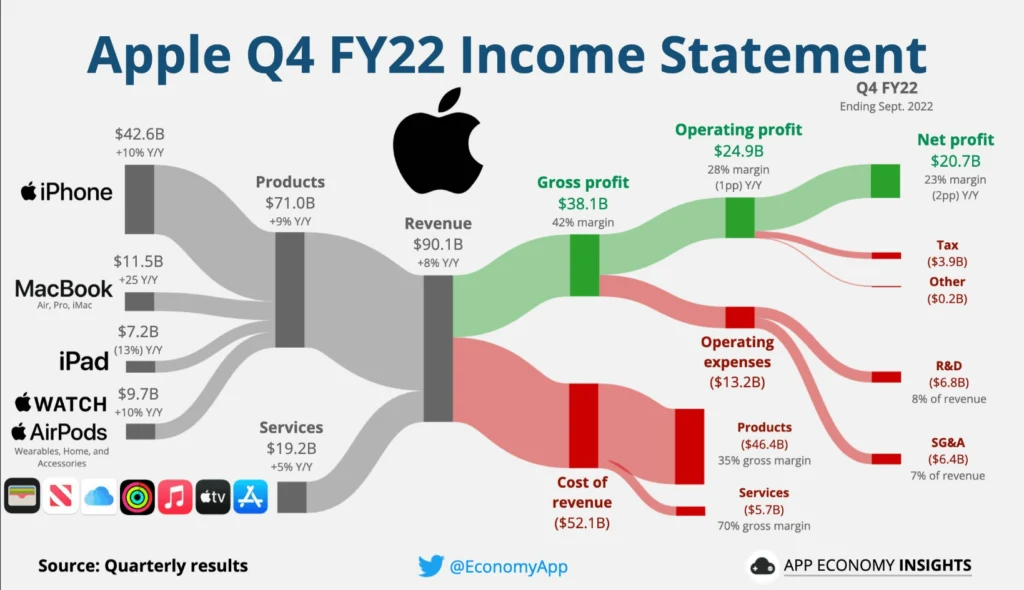

- Apple’s 4th quarter earnings beat Wall Street expectations on revenue and EPS but came up short of revenue expectations in core product categories, including the company’s iPhone business and service. It is currently up 7.76%.

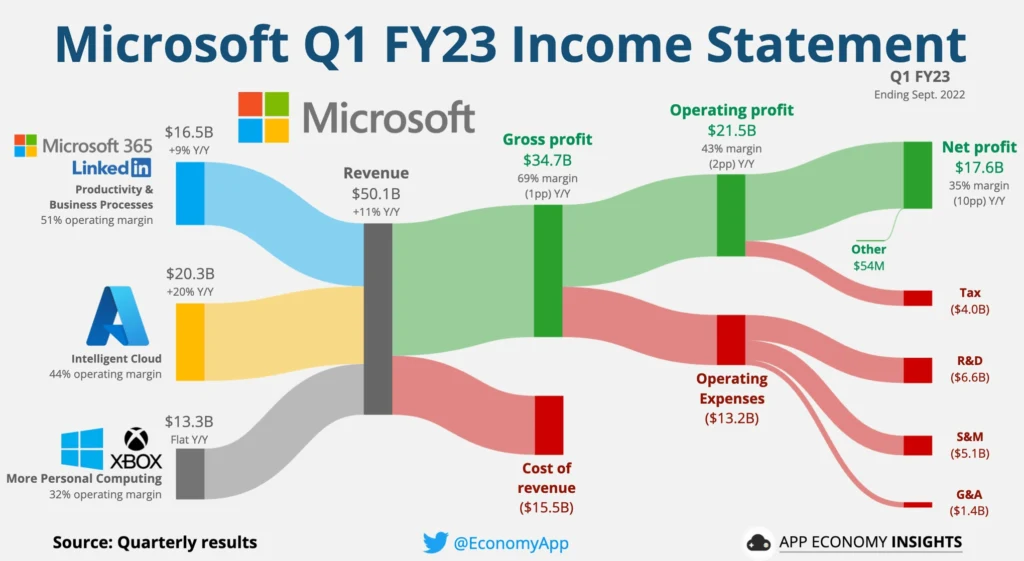

- Microsoft reported softer cloud revenue than expected in its fiscal first quarter and gave weak quarterly guidance. It fell 7% for the day.

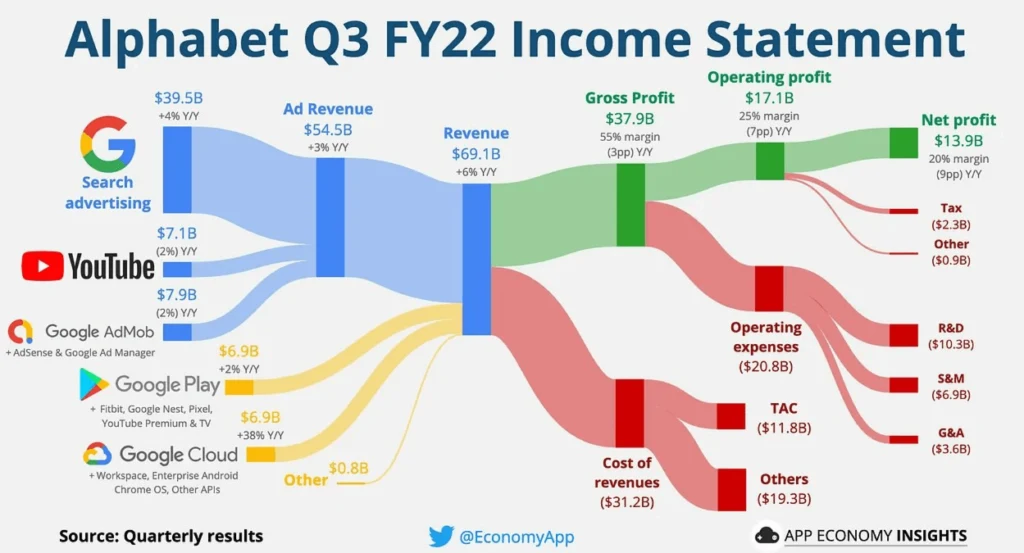

- Alphabet reported slightly lower revenue than expected, while year-over-year growth fell to 6%, the slowest rate since June 2020. EPS was also lower than expected, and YouTube’s revenue fell for the first time since its numbers were reported separately. It fell 10% for the day.

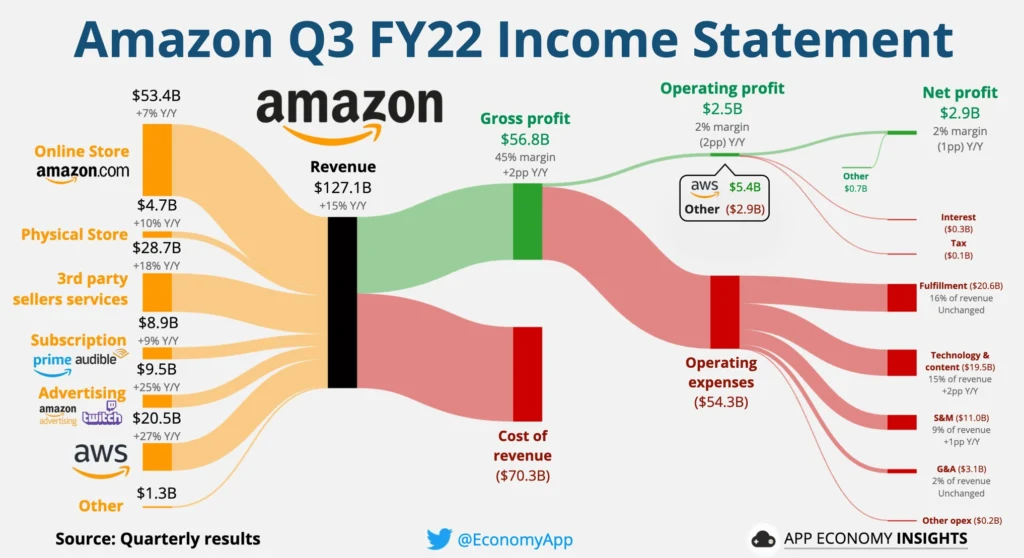

- For the next quarter, Amazon gave revenue guidance of $140-$148 billion. This was far below the consensus estimates of $155.15 billion. Amazon’s important cloud business reported a 27.5% revenue growth rate for the quarter, the slowest growth since 2014, when the company began breaking out AWS results. Its share price fell 9.96%.

- Meta reported ANOTHER quarter of declining revenues and failed to convince investors that big bets on the metaverse and artificial intelligence were paying off. Its share price fell 25%.

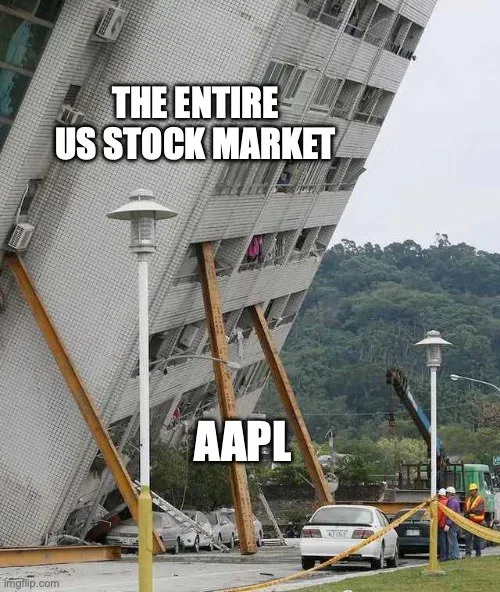

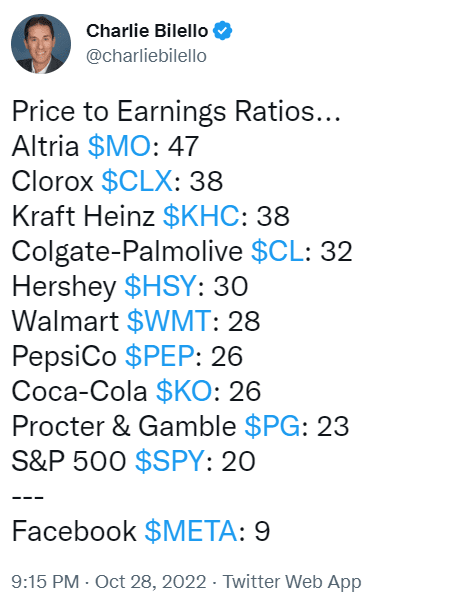

This Tweet probably summed up things well.

Since 2021, Apple, Alphabet and Microsoft have announced good earnings and growth, while Amazon and Meta’s returns were patchy.

People prefer to buy blue chip companies because they think the strength translates to good future share performance and lower volatility. In other words, they believe that there is a free lunch there.

As investors, we want volatility to the upside but not volatility to the downside.

We think the market values them based on their current cash flow as the terminal cash flow. In reality, market prices a significant part of their value to the growth of future earnings. When that growth is under threat, the market reprises the stock to the downside.

Ultimately, you need to know that investing in individual stocks means living with greater volatility than buying an S&P 500 ETF. The ETF is more diversified, so the volatility is more shared.

Despite 4 out of the five stalwarts being down 7% or more, S&P 500 ETF ended up 8% for the week. Here is how the S&P 500 stack up against the five stocks:

Sure, you may lose out on the upside volatility if you invest in the S&P 500, but you will also need to see what the S&P 500 do better than your “quality” picks:

- Lower downside volatility.

- If a strong company’s growth rate finally slows, it will be balanced by another company with a higher growth rate.

- Quality companies do not mean you will earn a good stock return on owning the companies. Dimensional’s research shows that your return will be severely reduced if you miss out on the year’s top 25% performing stocks. The problem is… you won’t know the top-performing stocks for the year unless you have a good crystal ball.

Which Level of Investment Decisions Do You Wish to Make? Which Level of Investment Decisions Do You Wish to Eliminate?

Zooming onto Meta, the stock is down almost 70% this year.

An investor can develop a weird conviction that at age 55, he should invest in the best companies and allocate $250,000 out of $1 million into Meta. His $250,000 would be worth $75,000 now.

You will only start asking yourself specific questions when your stock price moves massively against your expectations:

- Why can Meta’s revenue and income deviate so much in a quarter?

- How is it possible that a top-10 stock can fall by more than 20% in a day?

There might be other questions that go through your head as this happen, most that never surfaced until this happens.

Meta may be a hold for you, or a buy more, or a sell.

But as a wealth builder, either accumulating wealth or retiring, do you wish to consider your investment decisions at this level?

With different investments, you would have to bother with uncertainty, but what kind of uncertainty do you wish to bother about and which kind do you wish not to?

- Do you wish to consider whether the company will be able to preserve its quality and resume its growth trajectory and whether it is not a value trap that will destroy your capital if you choose to average down?

- Do you wish to worry whether fundamentally a basket of US stocks can return to the all-time high?

You can eliminate #1 by not holding an excessively concentrated position in one company. This does not mean you are free from uncertainty. You will still have to think about #2.

But you might overestimate and realize you do not have the sophistication to consider #1 well. The unique thing about the market is that if your time horizon is long enough, #2 might be less of a problem.

Concentration has its advantages but also has its downsides. You don’t want to realize the downsides at the wrong time, usually when you are near your retirement age.

It is essential to have a form of rebalancing or portfolio reconstitution strategy if you don’t wish for capital impairment. An ETF or unit trust has that essential mechanism. If you own four companies, you must do your fundamental or technical evaluation and decide accordingly. Your portfolio cannot be a buy-and-forget.

Interesting Information I Picked Up This Week On Meta, Alphabet, Amazon, Microsoft and Apple

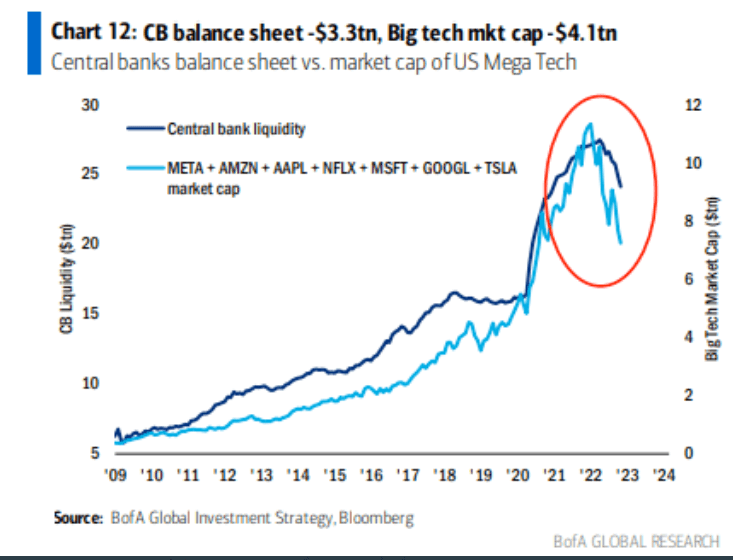

Given the price movement, this picture made a lot of sense. But it is also important to note that other S&P 500 stocks also made relatively good earnings announcements and guidance.

Here are some excellent Sankey charts on MSFT, Amzn, Goog and Aapl:

Now, I do not know whether Meta is really cheap or the old-school businesses are too expensive:

Does correlation equal causation:

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Should I Take Less Risk in My Fixed Income Allocation by Moving Away from a Global Aggregate Bond ETF? - May 5, 2024

- Singapore Savings Bonds SSB June 2024 Yield Climbs to 3.33% (SBJUN24 GX24060A) - May 3, 2024

- New 6-Month Singapore T-Bill Yield in Early-May 2024 to Stay at 3.75% (for the Singaporean Savers) - May 2, 2024

akimoto san

Sunday 30th of October 2022

You are giving wrong idea of what is a Blue Chip Company. Apple, Meta, all these are speculative. Don't give wrong idea.

akimoto san

Monday 7th of November 2022

@Kyith, if Meta is not speculative, then why the share price so fast and big drop?

SIA: Good example of a non-speculative stock.

Kyith

Saturday 5th of November 2022

Why do you think they are speculative? So what are the non-speculative stocks? Are blue chip companies suppose to be non-speculative?

Revhappy

Saturday 29th of October 2022

Excellent article! This year has shown us staying with global allocation is the best strategy for long term. Just look at how China and Asia has performed. Most Singapore robos and financial institutions were super bullish on Asia and China. All that money is now NPA. I think you have done very well by staying with global allocation. You must do an article to warn investors from over weighting any particular market no matter how great their prospects may be.

All the best! Cheers!