Let us take the current war taking place in Ukraine out of the equation and look at where we are if this geopolitical situation did not appear:

- As a commodity, oil is consumed and is not circulated.

- As an energy source, it is hated upon and people predicted that it will go away soon.

- Rig counts are still very low.

- Valuation of oil stocks still lag commodity prices, but that is usually the observation at commodity cycle tops.

- Capital budgets for oil companies are still very low.

- Percentage of cash flows that are spend to sustain production is still very low.

- Prior to this war, you do not have enough people in the media actively talking about it.

- Capital is not flowing into funding oil and gas companies due to ESG. A good case study is Apollo cannot fund the companies due to ESG mandates, even though in the past, based on the valuation of these companies, Apollo would be going in big on these companies.

- ESG activisim is also forcing direction changes in oil and gas companies resulting in underinvestment.

- There is a strong possibility that OPEC is going to hit a wall soon in terms of production. OPEC has this product quota that they publish and they have been missing the quota the last few months. (Read November oil output missed its target again, marking the latest in a several months long trend that has consistently seen OPEC nations unable to reach their production quotas)

- CEOs of oil companies operating in OPEC regions have been saying successively that they cannot increase production.

- Value investors who thought oil stocks were deep value in 2014 were kill so badly that it left a permanent scar. Why this time may not be like 2014:

- Back in 2014, there was also a growth in private capital. There was a growth in uncommon private equity more into assets such as shale wells, where the managers have a poor understanding of the economics. The investment managers that manage to make good money did so by initially drilling for production, then flipping the land to make a profit.

- There was also a private high yield fund available concurrently in an oil downcycle.

- Compared to that period, there were almost no new funding to drill new wells currently.

- Why demand will not taper off as a result of greater than $100 oil prices

- Indicators of tops in the oil cycle

- High percentage production.

- Production rates above commodity prices.

- Every dollar that they take out from the ground is reinvested back to production

The combination of the above gives a strong case that this time, we may really have the real peak oil.

Peak oil is a term that was very popular in the 2000 to 2010 period. Various thought leaders, most notably Matthew Simmons (now deceased), argue that the production of oil cannot keep up with the demand for oil due to the supply and demand dynamics.

During those times, there was always a strong case for investing in energy-related companies.

Well, peak oil didn’t happen because oil prices got so high that it became one of the factors that tip the economy into recession (not the main factor but an aiding factor).

The price of oil got so high that it reduces the demand for both energy and non-energy related consumption, and we didn’t get that supply and demand issue that peak oilers talked about.

Shortly after, the United States became the Saudi Arabia of shale oil and they became a net exporter of oil instead of the net importer.

Could peak oil really happen this time around?

I am not sure. On the supply end, based on the data, there is a strong case that we are overestimating our progress on the ESG front.

We might get into a situation where countries like Germany may need to walk back their stance regarding nuclear energy and restart their nuclear power plant (which might be a boon for uranium prices).

There is always the fear that eventually, high oil prices would lead to demand destruction like 2008 again.

If you are bullish on energy, you are betting that supply is so constrained that despite lower demand, prices still remain high.

Why Rising Oil Prices Usually Precede a Recession

You might have seen a chart that looks like this where it explains the price of oil, overlayed with recession periods.

Given that we have a spike in oil, many investors may be worried that we may fall into a recession soon (which has bigger implications which I may choose to discuss in a separate post)

In the previous section, I might have explained a bit that it is more likely high oil prices aided the acceleration into a deflationary scenario but probably not the only cause of it.

The obvious way high energy prices hurt is that they are demand destructive to both energy and non-energy consumption. In that regard, the good news is that the US economy is less energy-intensive.

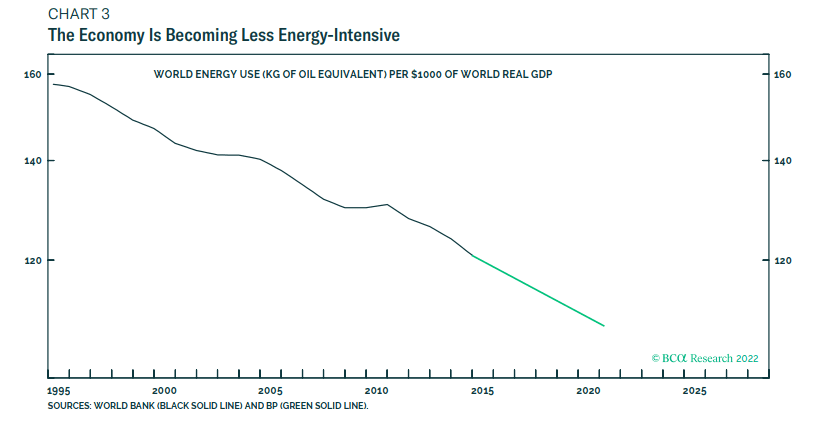

The chart above shows the energy used to generate $1000 of world real GDP. That has been going down gradually.

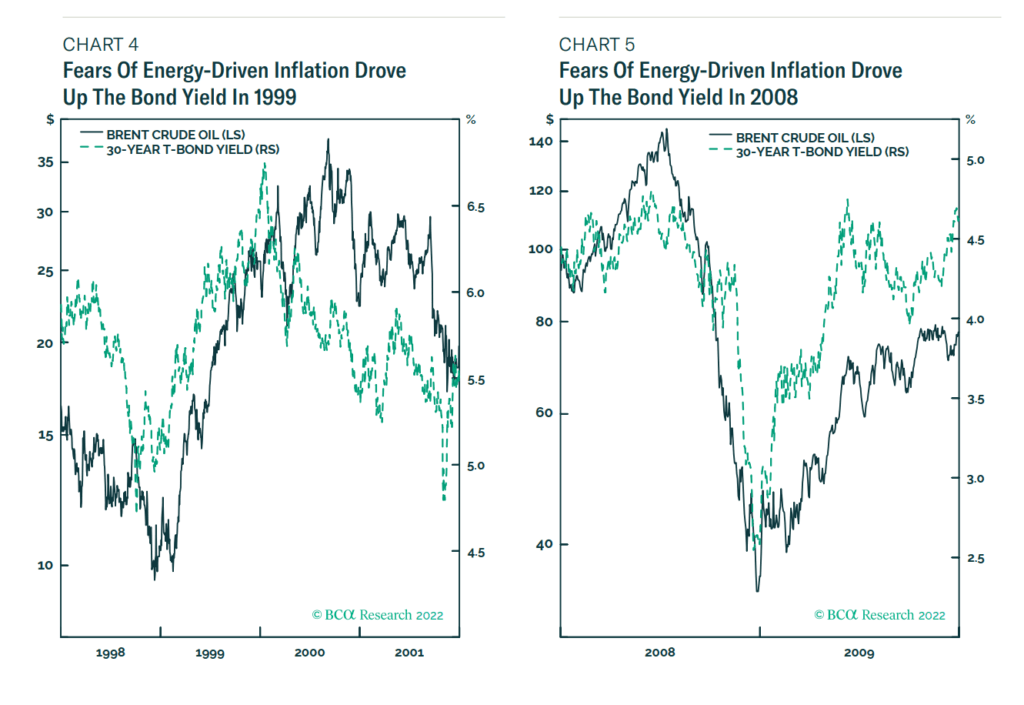

What is not so obvious is that high energy prices drive up the long-duration bond yield.

When long-duration bond yields rise, it risks tipping more important economic and financial fragilities over the brink.

We observe that the 30-year bond yield seem to turn earlier than the crude oil price.

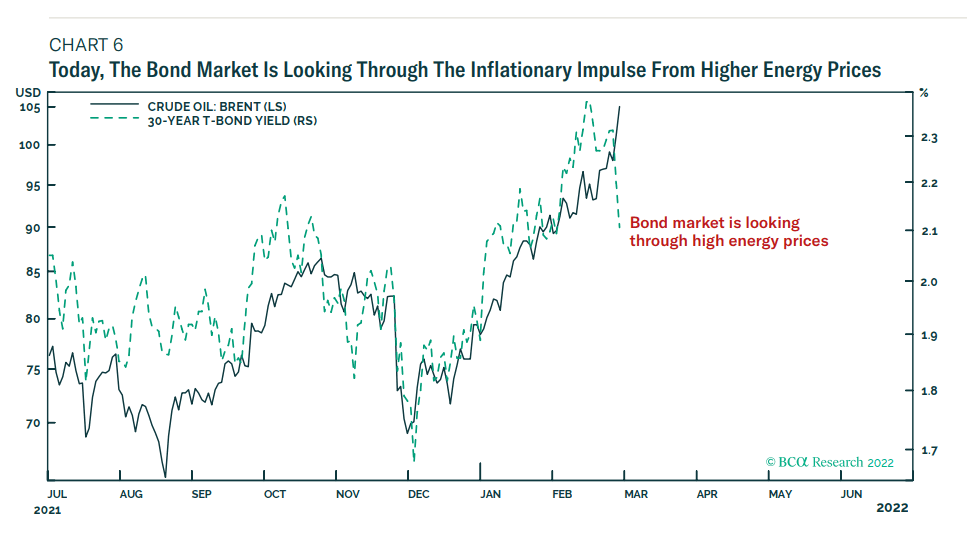

The 30-year bond yield seems to be looking through the short-term inflationary impulse of higher energy prices and focusing on the deflationary impulse that will come from the demand destruction that the higher oil prices will trigger.

Recent yield movement in the 30-year bond may suggest that oil prices would follow the bond yield lower.

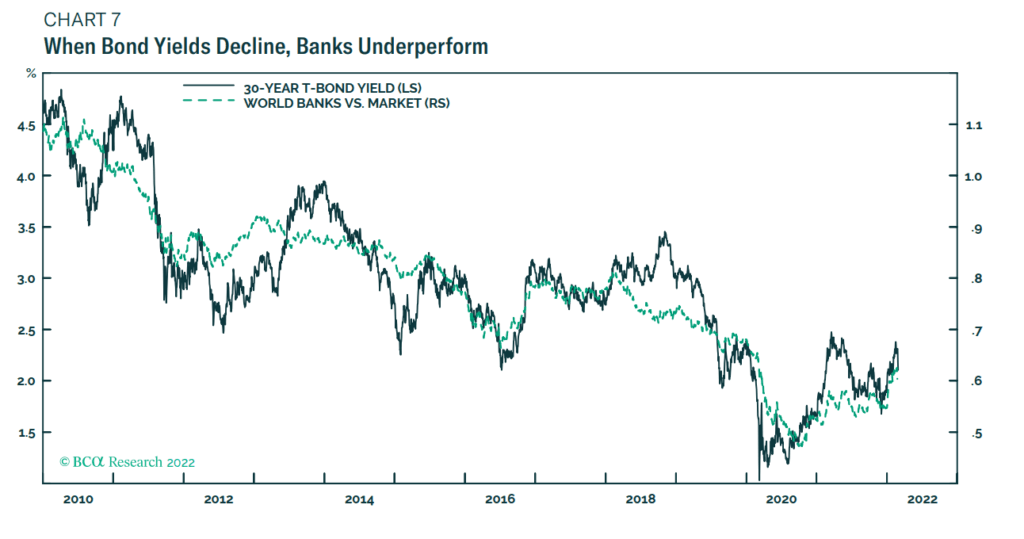

If this is how it’s going to play out, the banks are not going to have a good time. Perhaps value stocks are also not going to have a good time.

Conclusion

I gave enough evidence in the first part of this article to justify why this time, in a long time, oil and perhaps other energy-related commodities are going to do really well. In the second part, I gave the bear case.

The difficult thing about investing in specific stocks or sectors is that there are good arguments why both sides are likely. There is risk and therefore the potential returns are high.

Sometimes the good return requires you to make uncomfortable bets and usually, a lot of the value purchases are uncomfortable stuff.

And they are often stuff that people hate or neglect.

The best test is you try mentioning this investment to your other more sophisticated investing friends and they wince at your pick. That means it is not really crowded.

And these things, likely are not doing well for the past few years. I think I might do a post on that because I see this mindset that something has to trend for “the past few years” to make it a better investment than neglected things. Folk’s long term history is 10-years and they failed to see the evidence that what performed well in these 10-years… didn’t perform well in the prior 10-years (Read this article that somewhat explains this). Yet the barometer to find great companies were companies doing well in the past years.

Anyway, Russia is not reducing their oil production. It is people not taking their oil. The bigger shock may be that some nations are highly dependent on Russia and Ukraine for their commodities. Can green energy development speed up so much so that we don’t have to consume so many dirty oil sources?

I think it is less likely.

The bigger problem may be how higher energy prices might tip the economies into recession. Then we don’t have to worry about what value, energy, or IT stocks. Everything will just go to shit.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Hungryhippo

Sunday 6th of March 2022

So we might be headed to stagflation or recession. We all know commodities do well in these economic conditions. But historically does the data tell you whether energy stocks and mining stocks do well to go with commodities? Or do they do badly since they are equities not commodities?

Kyith

Wednesday 9th of March 2022

Hi Hungryhippo, that is a good question. That would be something I would try to pay attention to. I think they should do well since these mining firms have operational leverage as the prices of what they mine go up. Of course, they will face the same problem as companies in other industries such as higher wage and higher maintenance costs.