I have never written much content on crypto probably because this is not an area that I am familiar with.

When my friend Soju asked whether this is an area that he can help with, I thought it is a good opportunity to collaborate. I have known Soju for some time. He got in touch with me 2 years ago and we have been in contact since.

Soju and his friends run Metafrens, which is a discord community of like-minded crypto users. It is not some shady stuff. If not I would not be in the community at all. If you have always wondered about the subject of cryptos, decentralised finance (Defi), Play2 Earn, find these things overwhelming then do feel free to join the Metafrens discord group here.

I think some of you might have heard your friends or acquaintance express that they can earn a much higher interest rate by putting their cash on these platforms.

There is no risk at all. Is that really the case?

I tapped Soju to try and explain some of these things from his perspective and also coloured that with how I looked at this.

If you like this and would like to see more (or less) of this kind of content, do let me know.

Stablecoins are an essential part of what I would term the “Cryptoverse”.

Stablecoins offer various participants a way to bridge the gap between fiat currencies and digital cryptocurrencies.

Fiat currencies refer to mainly government-issue currency that is not backed by commodities such as gold or silver. Our Singapore dollar SGD, US dollar and Swiss Francs are examples of fiat currencies.

Stablecoins are smart contracted-enabled, cryptographic digital assets that are price-stable and behave somewhat like fiat but they maintain mobility and utility due to their digital properties.

These unique properties allow the Stablecoins to be used by various crypto chains and exchanges such as BTC or Ethereum.

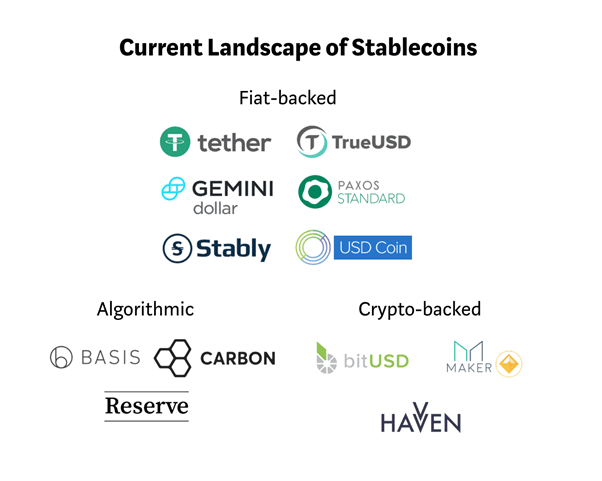

The following graphic list down the different players that have come up with their very own Stablecoins that permeate throughout the crypto space:

For example, tether issues USDT, Gemini issues GUSD, Circle issues USDC, Terra Luna issues UST.

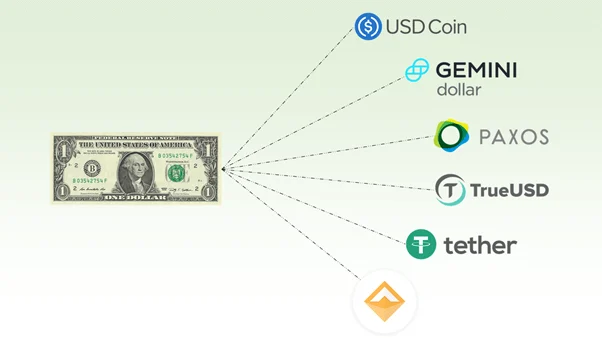

These Stablecoins try to peg their value to that of the fiat USD. There are other Stablecoins that are pegged to another currency such as EURO for example.

So 1 USDT should have an equivalent value of 1 USD.

You may be interested in this space because some of your friends tell you that you can earn an astounding interest rate if you put your money in these Stablecoins.

You might be wondering: if the interest paid is so much higher than what you get if you put your money in a traditional bank, then is there some risks that we aren’t seeing?

Some of you who paid more attention to the finance space may have come across articles like this:

- Tether (USDT) is a massive ticking timebomb (or something along these lines, there are quite a fair bit, here is one)

- Mark Cuban gets REKT in a new Stablecoin (here is one article)

- SEC’s Gensler likens Stablecoins to ‘poker chips’ amid calls for tougher crypto regulation

It makes you wonder how stable or safe Stablecoins are. This is what I will try to explore today.

To understand how stable these digital assets are we might have to understand how they gain their stability.

In general, we can group Stablecoins into three types:

- Fiat-backed Stablecoins

- Crypto-backed Stablecoins

- Algorithmic Stablecoins

What are Fiat-backed Stablecoins? How are they backed?

Most of the large name stables that you see today are fiat-backed Stablecoins, which means that they are issued by a central issuing authority that holds fiat reserves to “back up” their Stablecoins. Stablecoins that does this is

- USD Tether (USDT)

- USD Circle (USDC)

- Paxo (BUSD and many more).

Under this category, there are also partially or fully backed fiat Stablecoins.

For example, Circle & Tether both invest their treasuries in short term government paper and other forms of stable investments. This allows them to generate revenue and cover their operating costs.

While Paxo (issuer for BUSD) holds 100% of its reserves in cash.

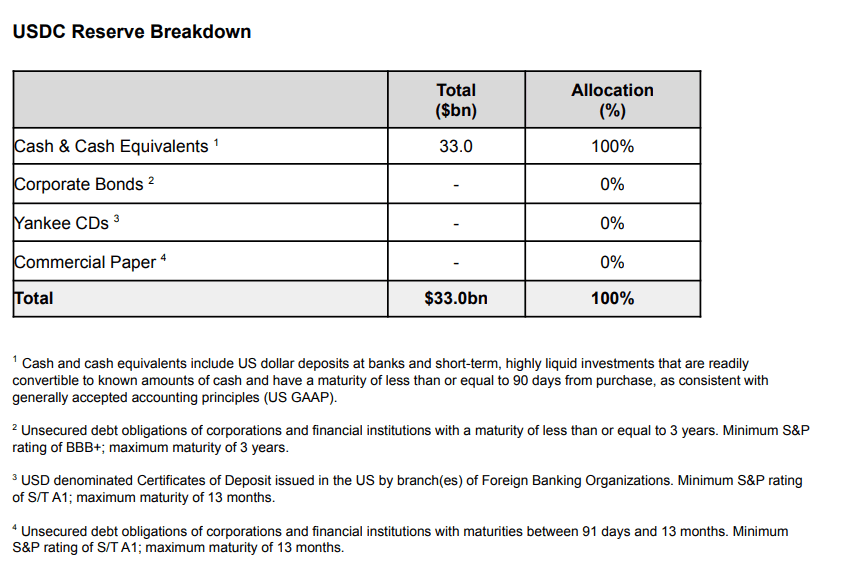

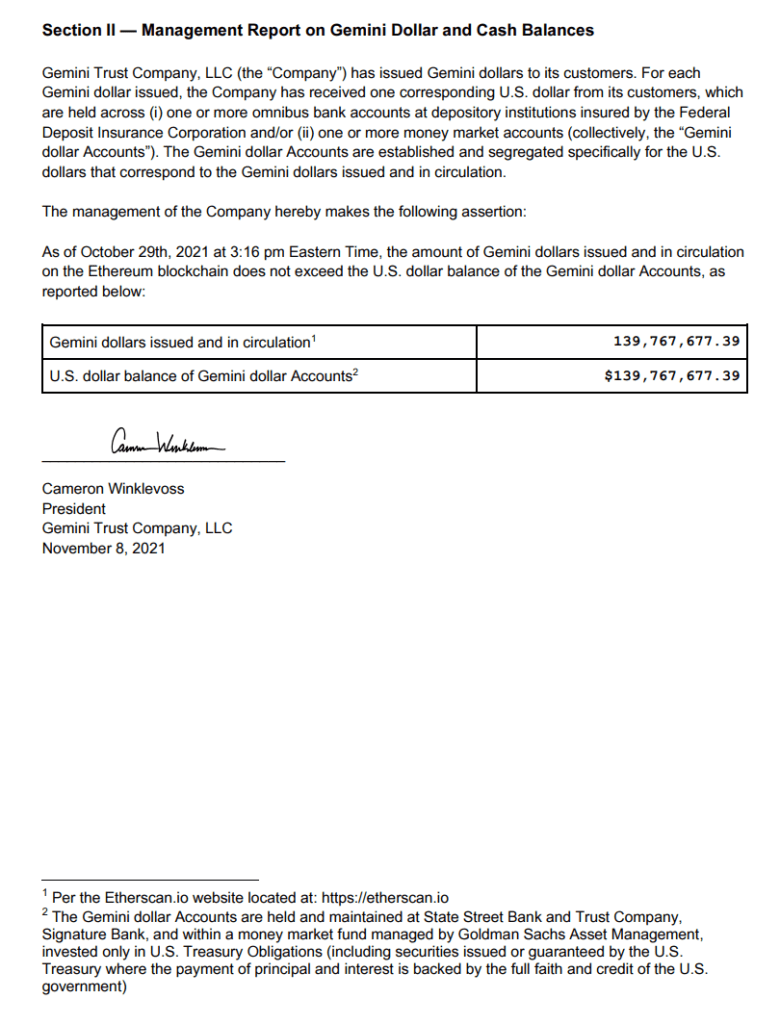

You can take a look at audited updates on the nature of assets that backed the Stablecoins and how much is in circulation.

For example, here is the list of attestations report that is audited by Grant Thornton LLP on the US dollar-denominated reserves that back the USDC tokens in circulation:

Here is the list of attestations reports for GUSD:

The main advantage of these types of stable coins is they provide a bridge between fiat and crypto.

You can deposit fiat with them and mint (create) the corresponding Stablecoin (in large quantities usually), increasing the circulating amount of the Stablecoin and their reserves at the same time.

What are Crypto-backed Stablecoins? How do these Crypto-backed Stablecoins work?

On the other hand, we also have Stablecoins that are backed by crypto-assets instead of fiat assets.

A good example is DAI.

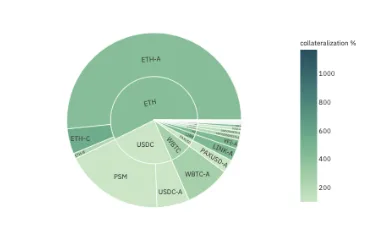

These crypto-assets are stored on the crypto network “on-chain” in smart contracts, such as on the Ethereum network in the case of Dai.

To mint $100 worth of DAI, you would lock up $150 worth of crypto assets such as ETH, and over collateralize it.

It means that instead of backing coins 1:1 with their underlying assets (Ether in this case), the ratio is always more than 1:1. For example, if Ether is worth $100 and the collateralization ratio is 150%, you can create 66 Dai.

The over-collateralization allows the platform to manage risk, ensuring that there are sufficient assets to guarantee the $1 value of each Stablecoin while allowing its users to still benefit from price fluctuations of their underlying assets.

What are Algorithmic Stablecoins?

Algorithmic Stablecoins are the fun stuff.

Algorithmic Stablecoins rely on a wide array of mechanisms to maintain their pegging.

These mechanisms frequently rely on math formulas or trigger events that are automated using crypto’s powerful smart contracts.

One of the most popular will be UST (not USDT) on the Terra network. the Terra protocol creates Stablecoins that consistently track the price of any fiat currency. It consists of two main tokens the TerraUSD (UST) and Luna.

UST is the Stablecoin that is supposed to track the USD. Luna is the utility and staking token.

The Terra protocol is designed to maintain a balanced equilibrium between the fiat-based Stablecoins like UST using specialized algorithms.

- When UST usage increases, the Terra protocol will burn existing LUNA tokens to remove supply so as to maintain price stability (think of burning like buyback shares and cancelling them)

- When UST usage decreases, the Terra protocol will mint new LUNA tokens to maintain price stability.

$1 worth of Luna will be minted when $UST is below $1 and if UST is greater than $1, $1 worth of Luna will be burnt.

Another example of an Algo-Stablecoin is Iron Finance and its IRON and TITAN tokens. This experiment is best known as the one that Mark Cuban lost money in.

What differentiates these tokens, and why do Algo-Stablecoins frequently fall (fail)?

Just like real-life currency, Algo-Stablecoins rely heavily on “trust”.

However, these stable coins find it extremely difficult to gather enough trust for their own token (such as TITAN) and the Stablecoin (such as IRON).

Without trust, a small price shock will end any stable coin.

Iron Finance is an example of a stablecoin that grew quickly due to its high returns on IRON (1% a day).

The high returns led to high demands of IRON, which drove up Titan’s price.

The meteoric rise of Titan would create lots of fear of missing out (FOMO) in the market and people bought it without knowing what it was.

Large investors (also known as whales) remove their tokens from Iron finance’s liquidity pools by selling their Titan for IRON and then selling that IRON for USDC. This caused the value of Titan to plummet from $65 to $30 in a short time.

since IRON is partially backed by TITAN, IRON lost its peg, and its value dropped.

More IRON is redeemed, which results in large amounts of TITAN being created, which reduce the price of TITAN further.

This becomes a negative spiral:

- Investor redeems IRON. This reduces demand. New Titan was created which flood the market.

- Investors sell their newly mined Titan.

- The price of Titan on decentralized exchanges falls due to selling pressure.

- Since IRON is partially backed by Titan, IRON’s price falls and loses peg.

- IRON cannot regain its peg, so investors mint more Titan to sell.

The largest difference between Titan and Luna/UST is that Luna holders are believers in the vision of $UST, and frequently “buy the dips” and not sell the LUNA token, in the event of a price fall.

This blocks the death spiral that Titan suffered and allowed Luna/UST to grow way beyond what Titan did.

Why do people keep building Algo-Stablecoins?

The issue with current Stablecoins such as USDC and USDT is their centralized with their main entities.

Algo-Stablecoins hold much promise, in terms of decentralization and many smart talents are working on Algo-Stablecoins to usher in another round of innovation.

Algo-Stablecoins can keep their peg based on smart contracts alone, without relying on centralized entities, while being widely available and used is the end goal.

Terra is close to achieving this, with 6.4bil worth of $UST circulating around.

However, there exist lots of players who create Algo-Stablecoins for self-enrichment, instead of achieving these ambitious goals, leaving a bad rep for the Algo-Stablecoin name.

Why is the interest yield on Stablecoins so high?

In traditional finance, we often say that the returns are high to compensate for the risk you undertake.

The risk can be in different forms such as liquidity, business, credit, interest, default risk.

Stablecoins are no different.

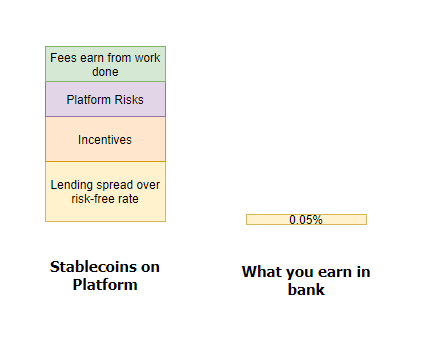

Platforms such as Celsius, Blockfi, Gemini, Hodlnaut and Decentralized Automated Market Maker (AMM) can pay you high interest due to a combination of:

- Work performed (market-making, validation, providing liquidity, lending money)

- Incentivisation

- Risks

Work Performed – Lending

Usually, to prove that something is not a scam, firstly we have to find out the economic driver behind the security or product.

When we own stock or equity, we are taking on a certain level of business risks and we gain compensation from the free cash flows earned from the business in the future. If we own a bond, we are participating as a lender and our compensation is in interest.

Ultimately, the business participates in some form of value creation.

Based on what we explained previously, you would realize that by themselves, the Stablecoins do not provide much value creation.

If we were to push it, the Stablecoins participate in lending money to platforms (e.g. Celsius, Blockfi, Gemini, Hodlnaut) or when we deposit our Stablecoins to AMM, we are doing some work for the platform.

Blockfi and Gemini (through Genesis) are the big players in lending to institutions for their Bitcoin future trading. You can read this Not Boring article for more explanation.

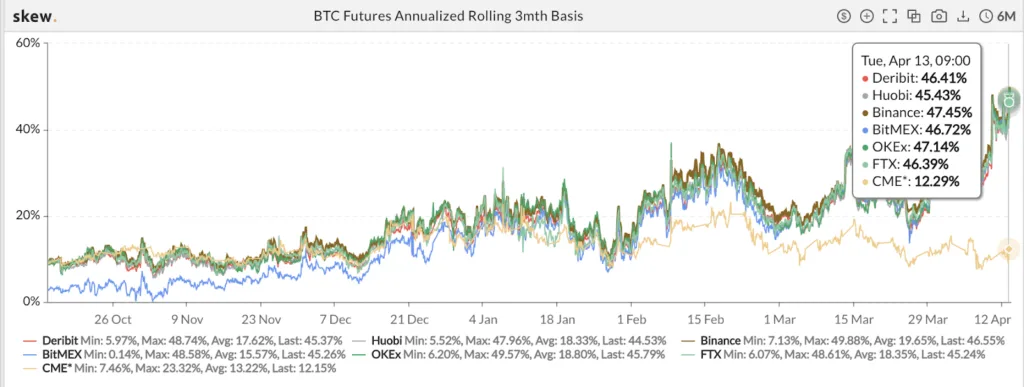

Bitcoin futures prices tend to slope upwards where future prices are higher than today. In future, we call this to be in contango. Contango occurs when investors believe the price of something to worth more in the future than today.

If you look at this chart, the futures trade at a 46% premium (it is so high if we do 4 3-month futures trade in 1 year) to today’s price. The trade to be done is to sell the futures contract and buy today’s Bitcoin at a spot rate, to earn that premium.

This to institutional trades is free money or a riskless trade.

But it will be better if the traders can do this on borrowed money.

But the problem is… the banks are less reluctant to lend for this purpose.

Enter companies like Blockfi and Gemini (through Genesis). They act as lenders to these institutions. You lend the money to Blockfi and Gemini.

If you can earn a high interest to lend to these institutions, then these platforms have no problems paying you 8-10% annualized in interest.

This is very demand and supply. In the future, as more lending solutions come out, these margins may be compressed.

On decentralized finance protocol such as Anchor on the Terra network, part of the high interest comes from lending as well.

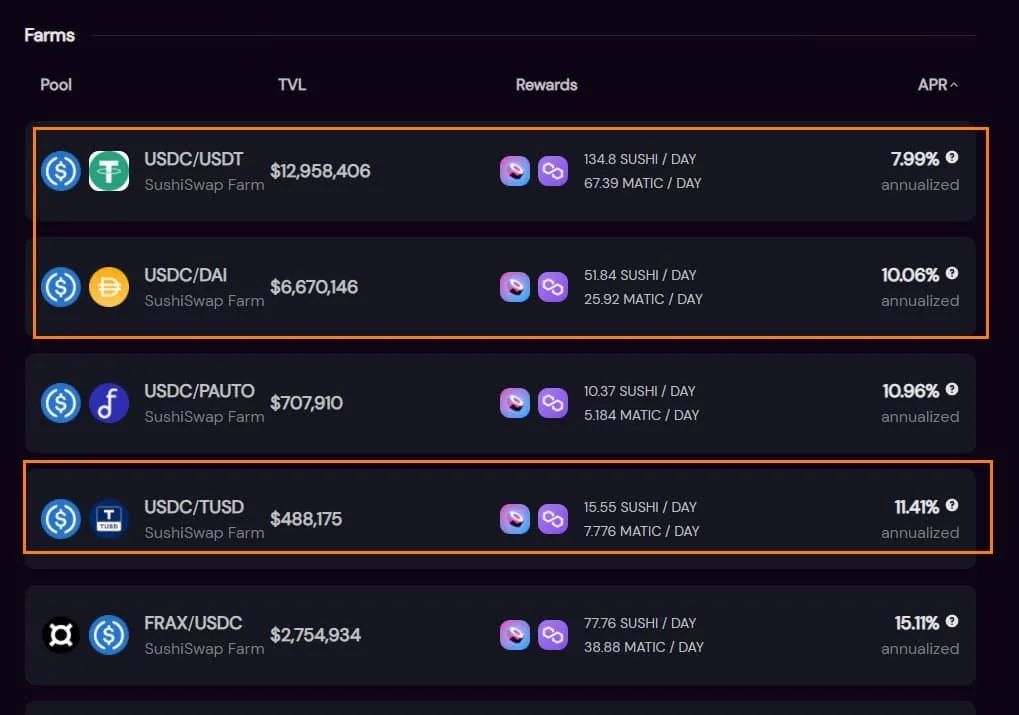

Work Provided – Providing Liquidity

You can also earn high fees on decentralized platforms. These fees come mainly from providing liquidity.

Many of those platforms need to seed liquidity to create a market so that actual work and innovation can be carried out.

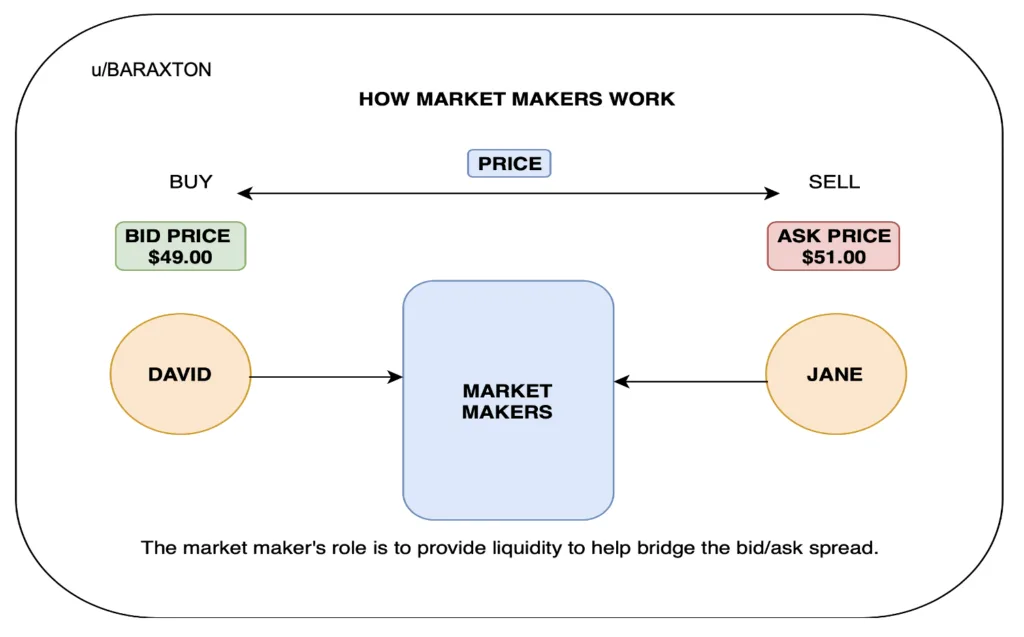

If we take a step back, if you are a stock or ETF investor, you may be familiar with the following diagram:

If you want to buy a stock at a certain price, there must be people who want to sell it. For some small-cap stocks, not many people want to sell or buy at a specific time. Thus, the liquidity is rather poor.

Market makers, which are certain firms, do the job of providing this liquidity. In return, they earn slippage or a certain spread between the buy and sold price.

Now, what if you could be that liquidity provider and earn fees for it? That is what you can participate in these liquidity pools:

If you look under APR (annual percentage rate), that is the return for providing liquidity. These fees are paid in typically the utility tokens of the AMM (which you could trade for stable coins).

This brings us to the next point.

Incentive Fees

Sometimes it is difficult to separate the attribution of the high returns.

Partly, this is like a start-up. They will use the funding to create an incentive for you to provide liquidity, participate or stabilize the platform.

For example, the Avalanche Foundation announced a $180M liquidity mining incentive program to introduce more applications and assets to its growing DeFi ecosystem. Avalanche Rush will bring Aave and Curve, two of the largest DeFi protocols by total value locked (TVL), to launch on Avalanche.

With these incentive programs, a certain amount of money will go into the fees or rates that participants are able to earn.

Risks

The risks may not come from the Stablecoins. It comes from using Stablecoins to participate in these different platforms.

And there are risks to doing that and so there is a risk premium.

If you are participating in DBS or OCBC bank, the rates may look very very different.

To put it bluntly, there are smart contract risks for participation in these decentralized finance platforms, regulatory risks.

If you understand what was explained in the section on Stablecoins backed by cryptos and Algo-Stablecoins, you would be able to see the risk there.

In a summary, the returns that you get are less a function of the stable coins on their own but the returns provided by various centralized and decentralized platforms.

What you earn is a mixture of risk that is taken, work done and incentives. These will change over time and does not stay constant.

How safe are stable coins then?

Here is what Soju has to say about safety:

If your goal is to keep the dry powder in the crypto world and utilize it to buy the dips on crypto tokens or generate a safe yield, sticking to safe stable coins such as USDT, USDC or BUSD and DAI is the most appropriate.

These stable coins are fully or overly backed by fiat or crypto assets. Despite the fear around USDT, it is still fully backed by fiat assets, just not fiat cash itself and is still the world’s largest used stable coin.

It serves its initial purpose, which is to allow you to store your assets on-chain, while not being exposed to crypto fluctuations, and be used to purchase crypto assets or generate yields easily.

Algo-stablecoins shouldn’t be used for this purpose as they can be easily affected by market movements or price actions, such as Iron’s failure.

I do agree.

As traditional finance people, the best way to look at it is that these stables are like your very short duration bonds and cash. If you expect them not to be dislodged, then that is not the right way to think of them.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

C M

Monday 14th of February 2022

Keith, I still don't hear any response to my questions...

C M

Wednesday 22nd of December 2021

Hi Kyith, pls assist to answer my questions above. Thanks.

C M

Sunday 12th of December 2021

Hi. After I created an account with Holdnaut using the affiliated link, how do I go about purchasing & earning interest?

1. Which are the recommended stablecoins to consider & purchase? 2. What are the steps to purchase? 3. How to transfer USD if I don't have a USD bank account? 4. How often is the interest paid out? 5. Is the interest rate of the coin dependent on its market price (like BTC)? Like it would fall if BTC price fall? 6. What are the possible scenarios where an investor would lose all his/her capital in the coin?

Thanks.

Nikolai

Monday 22nd of November 2021

Have to disagree about USDT being "fully backed". See this Bloomberg report: https://www.bloomberg.com/news/features/2021-10-07/crypto-mystery-where-s-the-69-billion-backing-the-stablecoin-tether?sref=SCKvL4TY

In the meantime, stick to more reputable stablecoins like USDC/GUSD.

RC

Monday 22nd of November 2021

Don't think your hodlnaut sign-up link is working.

Kyith

Monday 22nd of November 2021

HI RC, so sorry! I fixed it! If you need the affiliate link here is my Holdnaut affiliate link