US-listed global data centre behemoth Digital Realty (NYSE: DLR) decide to list a portfolio of 10 data centres in Singapore as Digital Core REIT.

A REIT listing a REIT.

You know that you are a REIT supermarket when a US$46 billion REIT decide to choose you. 267 million shares will be offered to retail and institution investors at US$0.88.

I shall not go into a long-winded story.

I think this REIT will do well due to the whole package that will be listed:

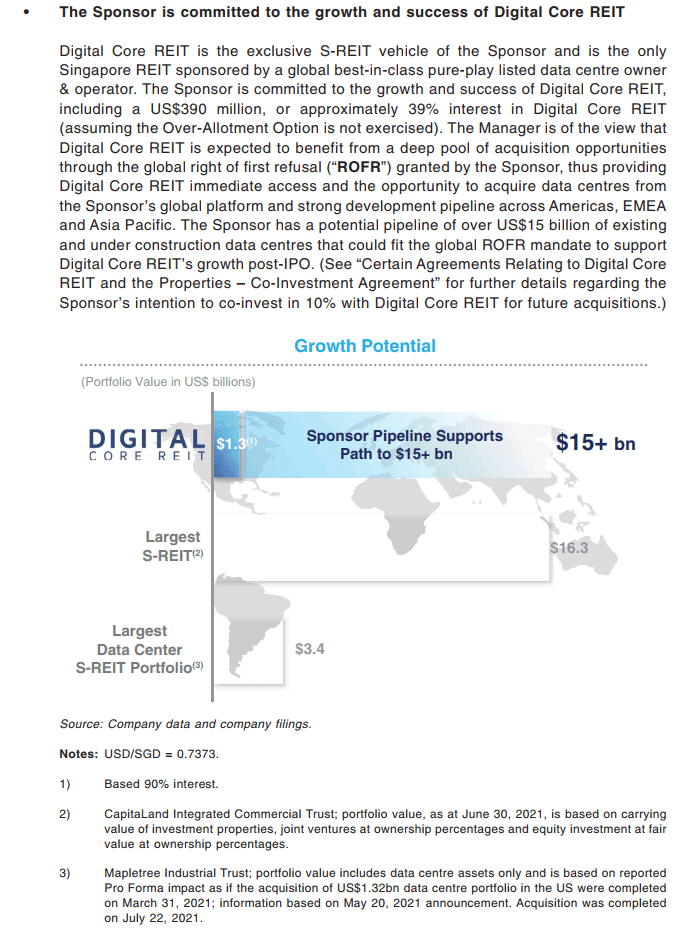

- A very strong sponsor with a strong development pipeline.

- A property segment that will be in demand.

- Freehold properties

- Triple-net lease with 1-3% rental escalation

- Weighted average lease expiry of 6 years

- Low gearing

- The committed cornerstone list is crazy

The dividend yield based on IPO price is 4.75% for full-year 2022 and 5.26% for full-year 2023 with a 100% payout. (You may wish to check this yield against other high yielding Singapore dividend stocks on my Dividend Stock Tracker)

The thing that is working against it is

- Some may think the yield is rather low but if you look at the number of cornerstone investors and institution investors flocking to this, you know they know something you don’t.

- That as well as the portfolio is rather concentrated but I think they are just seeding this and testing the ground before the acquisition flood gate opens.

- Almost half the properties are technically rather old buildings.

What is Digital Realty’s game listing a REIT here?

My guess is that they want to use this REIT to monetize mature assets to redeploy capital into growth assets. Listing in Singapore allows them to tap Asian investors and sovereign-wealth funds with longer time horizons and more patient capital.

Digital Core REIT can be seen as Digital Realty’s perpetual long-term vehicle in which they still have core control over.

Okay, here are some more of my notes.

When Can You Start Applying to the Digital Core REIT IPO?

Here is the timetable for the Digital Core REIT IPO:

From 29 November till 2nd December (A very short window!), you can go to the nearby ATM to apply for the IPO.

The results would be known as early as 3rd December.

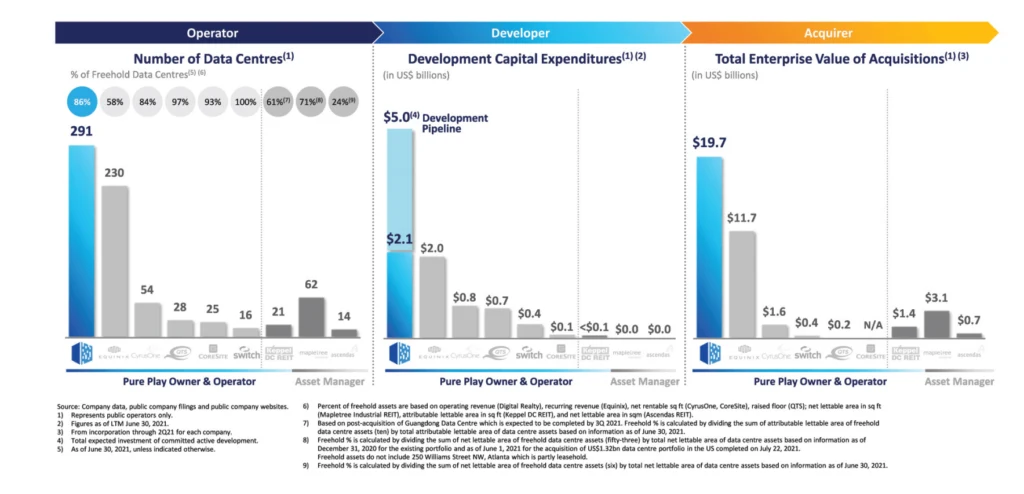

Comparing Digital Core REIT against Singapore Data Centre Operators

The closest local competitor to Digital Core REIT is Keppel DC REIT and Mapletree Industrial REIT.

Mapletree Industrial REIT technically is an industrial REIT but currently, 50% of its assets are in data centres with a large proportion in North America. Thus, this REIT is comparable to Digital Core REIT.

Here is the dividend yield comparison:

- Keppel DC REIT: 4.2%

- Mapletree Industrial REIT: 5.2%

- Digital Core REIT: 4.75% (FY2022) and 5.26% (FY2023)

We cannot just look at the dividend yield alone but the relative leverage of the three REITs.

Here is the net debt-to-asset (this will be different from what is published) comparison:

- Keppel DC REIT: 28.5%

- Mapletree Industrial REIT: 33.8%

- Digital Core REIT: 23.8%

If we evaluate the yield and leverage, Digital Core REIT is rather attractive. The yield is higher the leverage is lower and room for expansion.

Digital Core REIT Well Supported by Cornerstone Investors

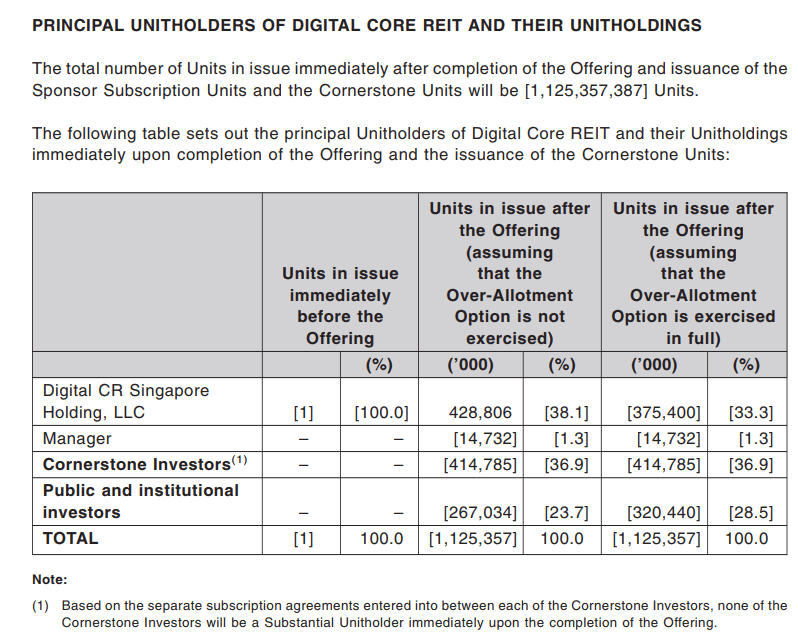

Digital Realty plans to co-invest in Digital Core’s future assets by taking a 10% stake. As the sponsor, they will own 39% interest in Digital Core REIT through Digital CR Singapore Holding, LLC.

Cornerstone investors, or the larger institutional investors, will take up 60.8% of the total IPO size.

The REIT can decide whether they would like their shareholder base to be made up more of institutional investors or retail. It is usually better to have a good portion of your shareholder base be institutional and rarely would a REIT go with a larger retail base. (If I remember well Prime US REIT comes to mind with a greater retail base during IPO. That turned out well.

Institutional investors now are thirsty for anything that looks quality and high yielding.

This one look to be it.

Here is the list of cornerstone investors:

- AEW Asia Pte. Ltd

- Affin Hwang Asset Management Berhad

- AIA Investment Management Private Limited

- AMP Capital Investors Limited

- B&I Capital AG

- Blackrock, Inc.

- Cohen & Steers Asia Limited

- DBS Bank Ltd.

- DBS Bank Ltd. (on behalf of certain wealth management clients)

- DWS Investments Australia Limited

- Eastspring Investments (Singapore) Limited (in its capacity as the investment manager for and on behalf of the investment accounts)

- FIL Investment Management (Hong Kong) Limited

- Fullerton Fund Management Company Ltd

- Ghisallo Master Fund LP

- Jane Street Financial Limited

- JPMorgan Asset Management (UK) Limited (for and on behalf of its clients)

- Kasikorn Asset Management Company Limited

- Lion Global Investors Limited

- Nikko Asset Management Asia Limited

- Principal Global Investors (Singapore) Limited

- Resolution Capital Limited

- Schonfeld IR Master Fund Pte. Ltd. and Schonfeld Global Master Fund LP

- Stichting Depositary APG Tactical Real Estate Pool, As Depositary Of APG Tactical Real Estate Pool

- The Segantii Asia-Pacific Equity Multi-Strategy Fund

- TMB Asset Management Company Limited

- Value Partners Hong Kong Limited

Digital Core REIT owns 10 Institutional Quality, 100% Freehold Data Centres

This REIT is very concentrated. It reminds me of Manulife US REIT and New Hampshire REIT whent hey were listed.

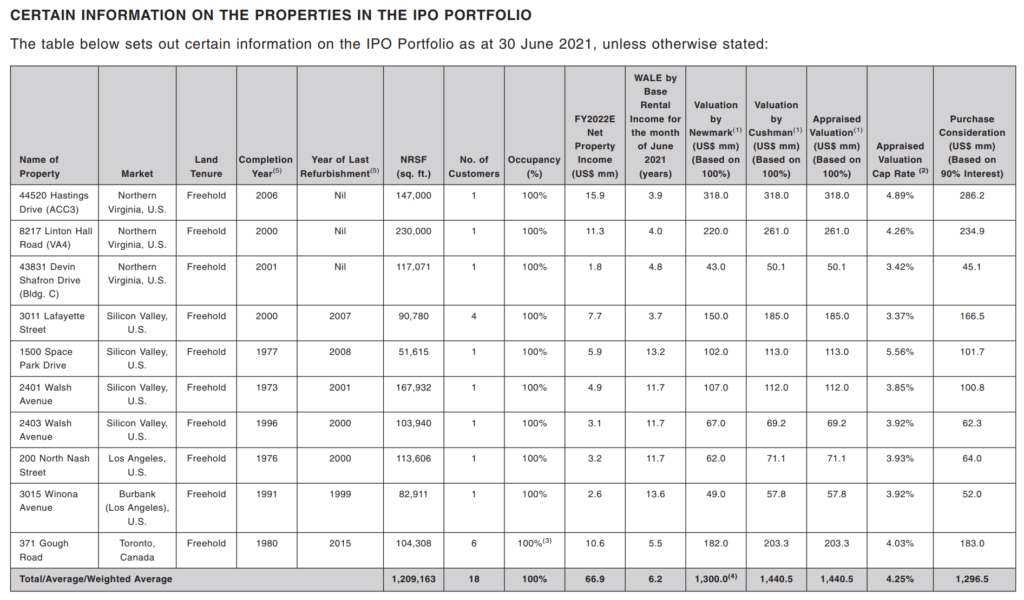

Here are the 10 data centres:

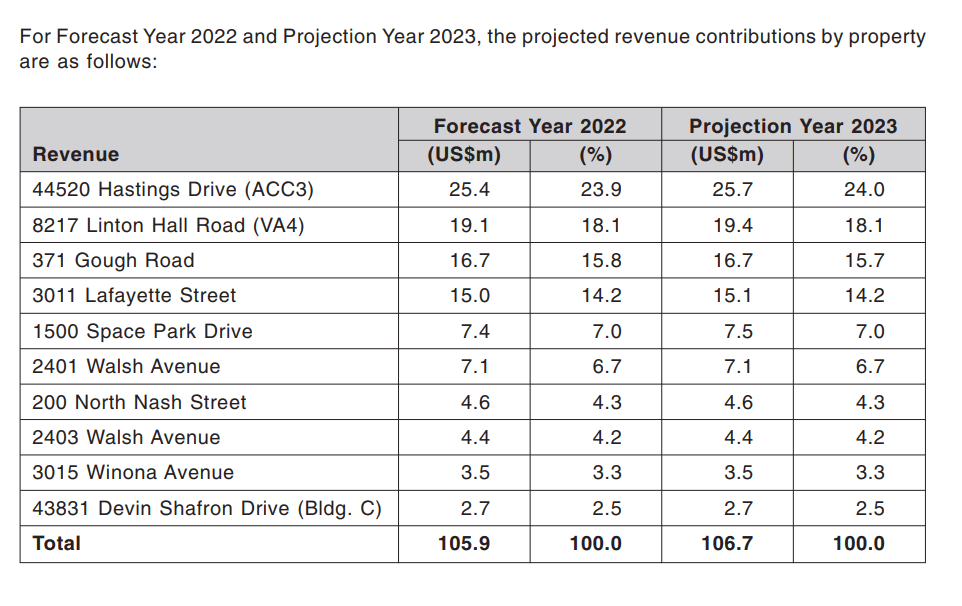

4 of the data centres drive 70% of the income.

The data centres are located in mainly 4 areas, the majority of which are in Northern Virginia and Northern California, Sillicon Valley.

The average CAP Rate of the property is 4.25%. The smaller ones looked more pricey but they were pulled up probably by Space Park driver which commands a higher-than-average CAP rate.

The 4 most significant properties were built in the last 2 decades while the other properties were more dated but refurbished in the last 2 decades.

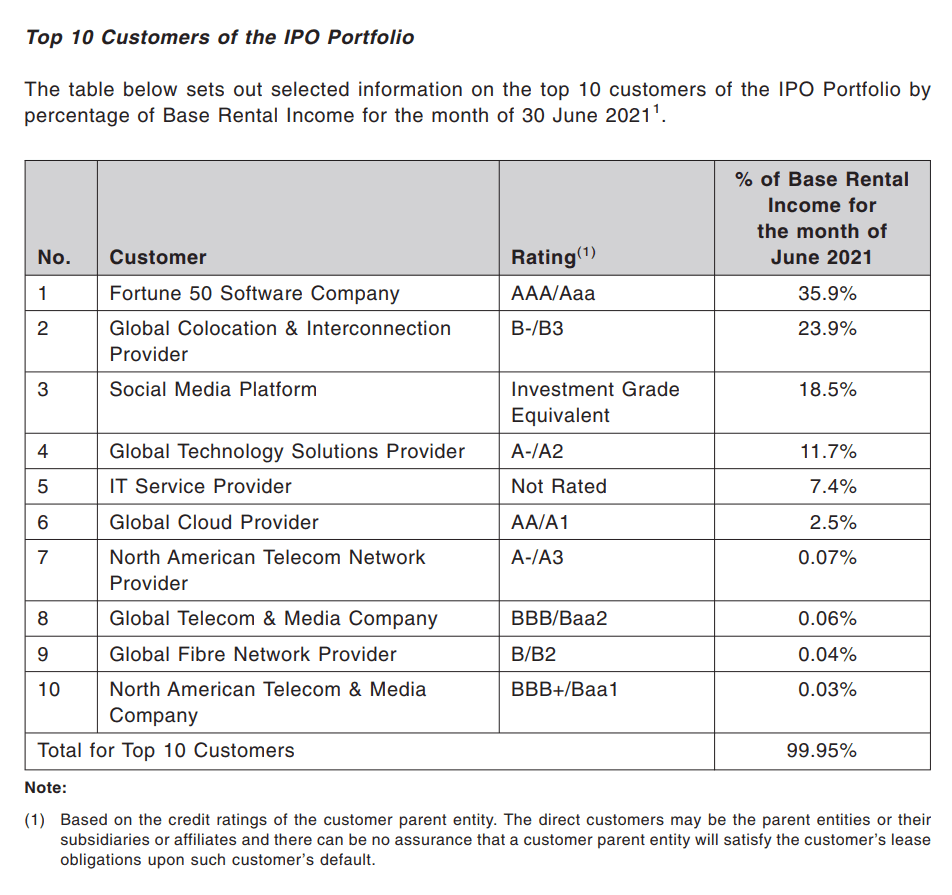

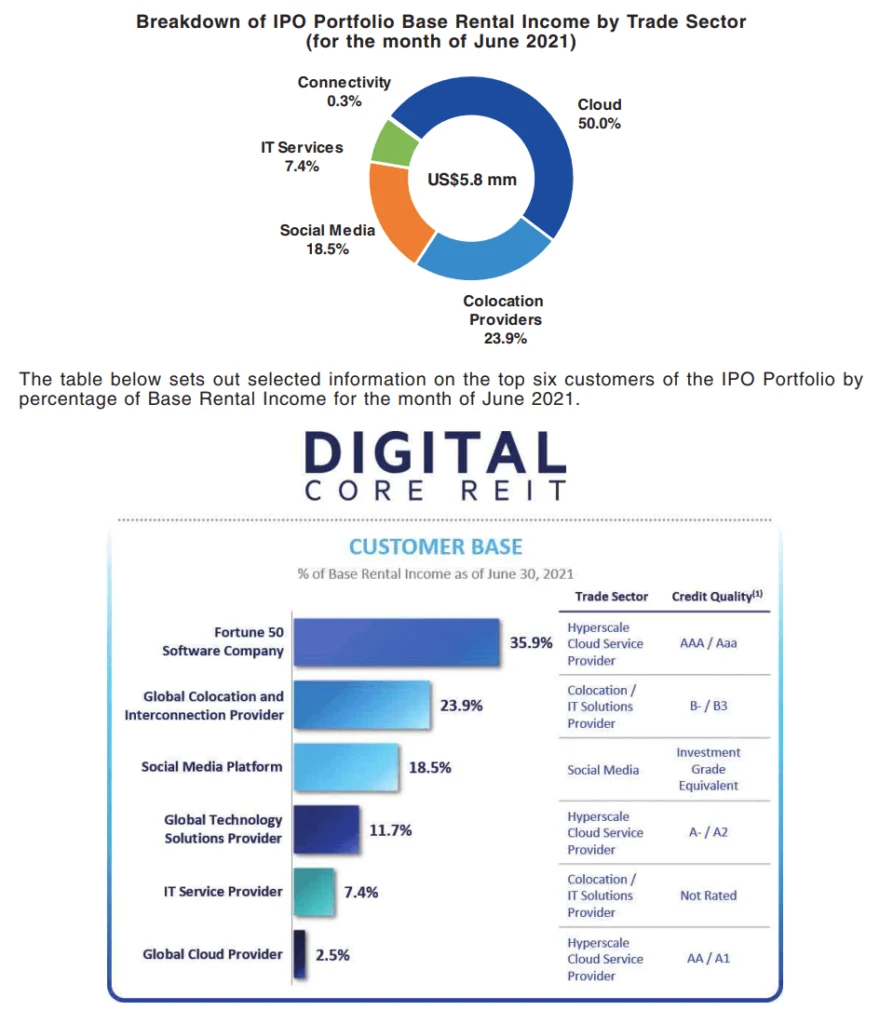

Here are the top 10 customers (which probably don’t give you a clude who they are):

Does Digital Core REIT Has Good Growth Potential?

Perhaps the biggest potential upside is not just the dividend yield but the potential to grow both organically and through acquisitions.

In the introduction, I have already highlighted the REIT’s potential. With a portfolio of freehold, rental escalating properties in a segment that is in demand, the biggest question is whether Digital Core REIT can do something similar to Keppel DC REIT.

I think they have all the ingredients if not better. The only thing that is not on their side is whether the sponsor would divest yield accretive data centers to them.

The sponsor probably have some capital recycling angle in mind. With their low debt to asset at 23.8%, they can make debt finance acquisition for sometime.

After that it will depend on the yield that they trade at.

Think they have outlined their intention here.

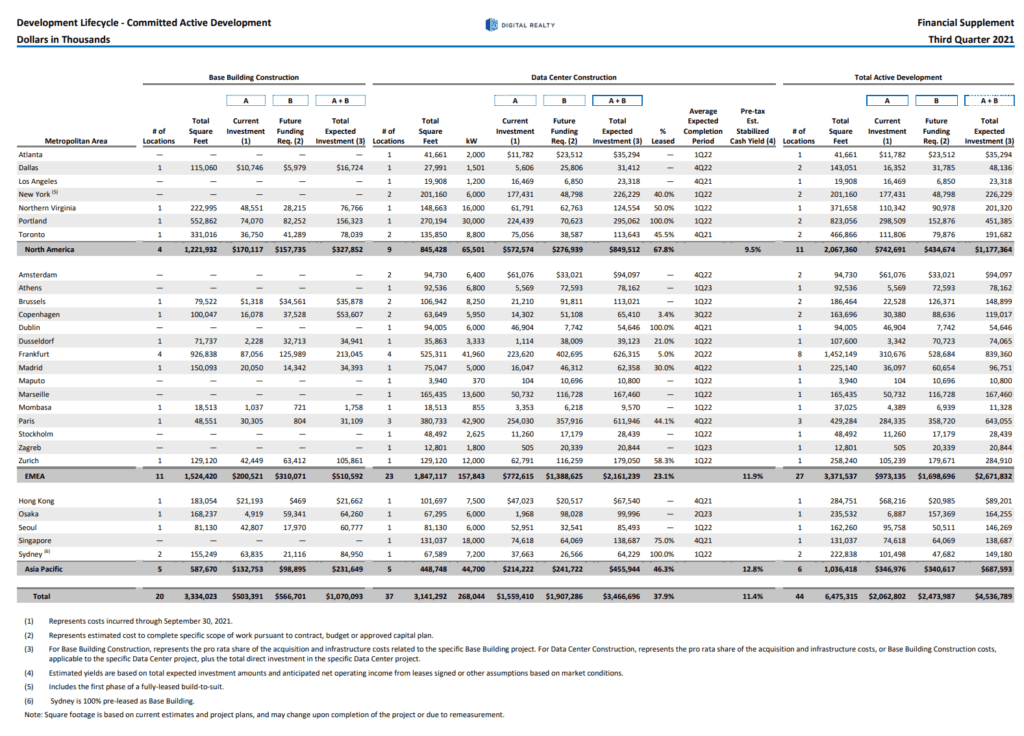

I taken a look at a supplementary document from sponsor Digital Realty:

This extract shows how global Digital Realty’s development footprint is. I got a feeling they will have a bite but it won’t be this.

Most likely, the sponsor will recycle some of their existing data centre.

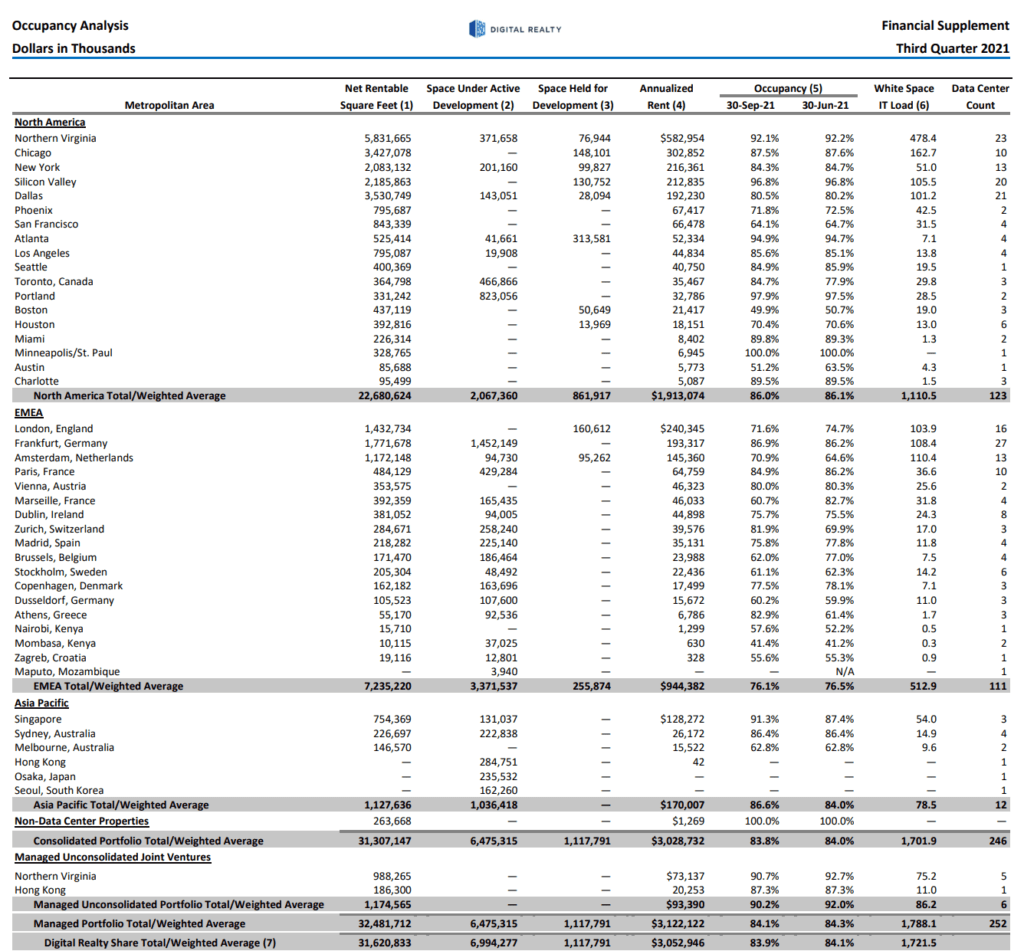

As you can see, while the sponsor put 500k sq ft of Northern Virginia properties into Digital Core REIT, they still have 5.3 mil sq ft left.

Also noticed that not all the data centers have above 90% occupancy, compared to the data centres that will be thrown into Digital Core REIT.

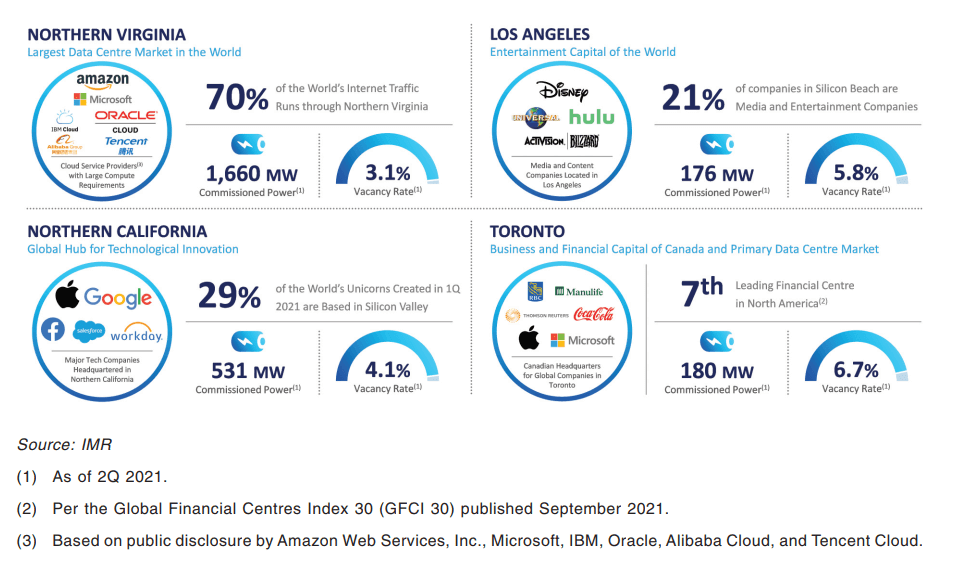

More Information about the Demand and Supply Dynamics of the Regions the Data Centres are Based In

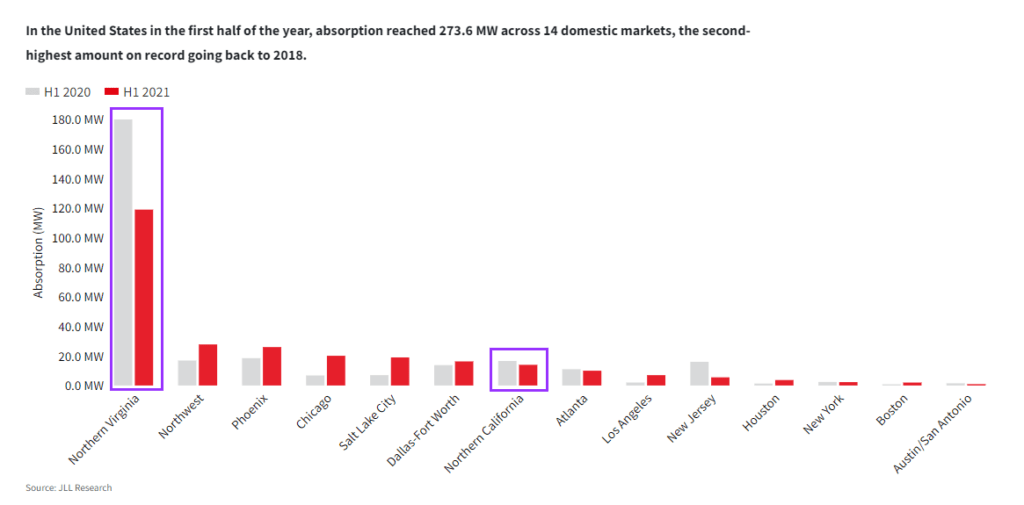

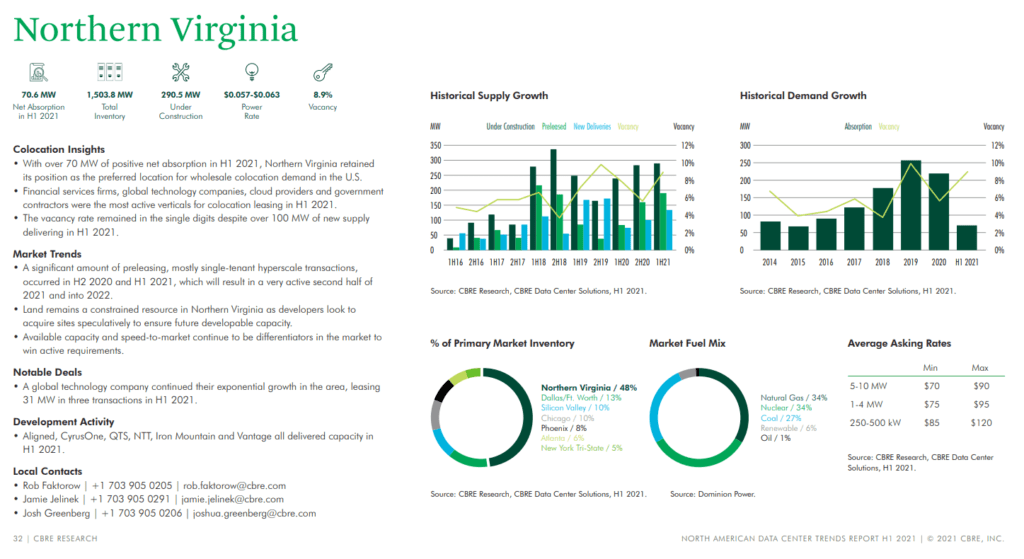

Northern Virginia is building data centers like crazy. Even before COVID, there were much construction built, and leased before completion.

Digital Realty is one of those that have committed to leasing before completion.

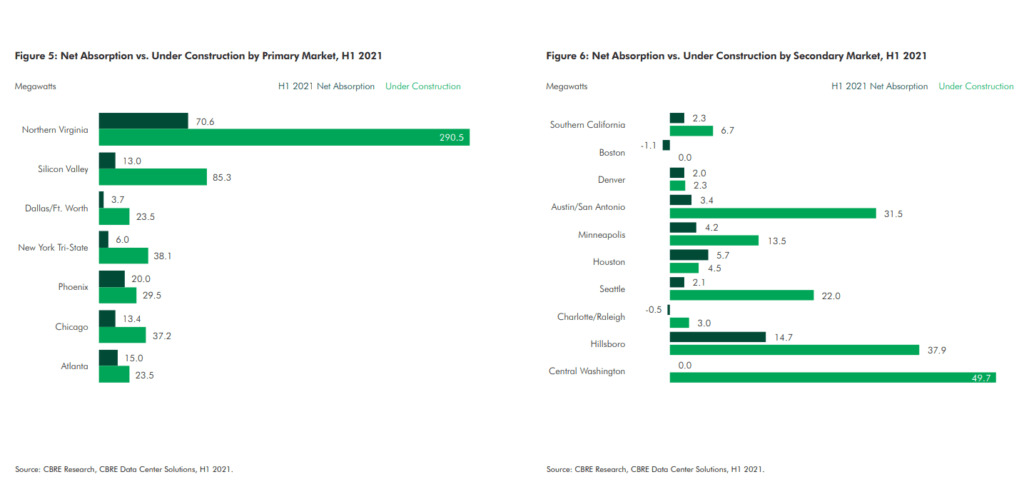

Absorption have been positive still but look at the amount of construction.

I think it is not wrong to assume that Digital Realty would recycle some of the capital by selling properties into Digital Core REIT to free up some capital for new construction and acquisition (although the coutner-argument is they will still hold a substantial sake in Digital Core REIT)

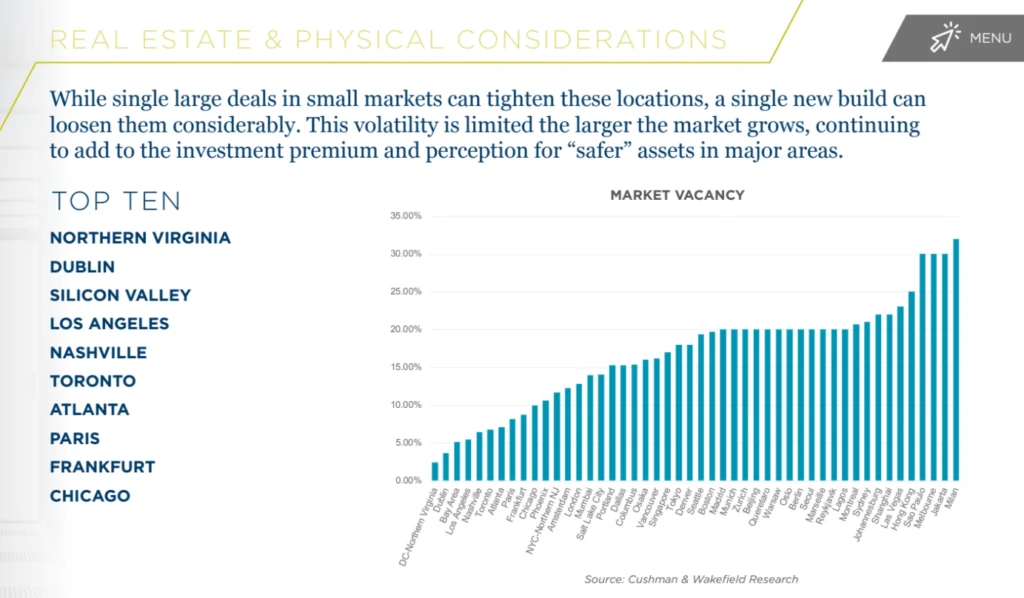

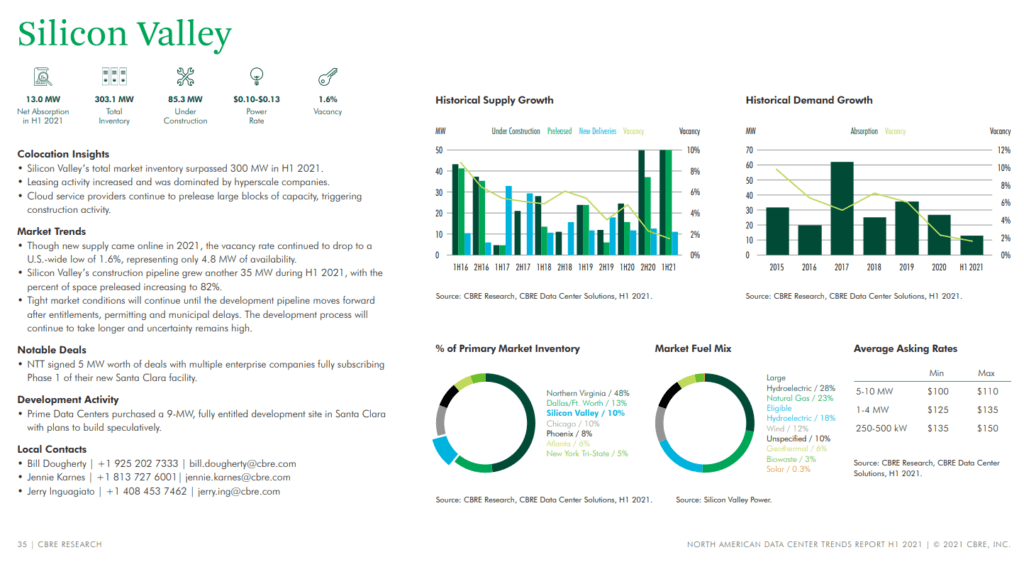

While there were a lot of construction, the market vacancy at Northern Virginia and Silicon Valley remains very low.

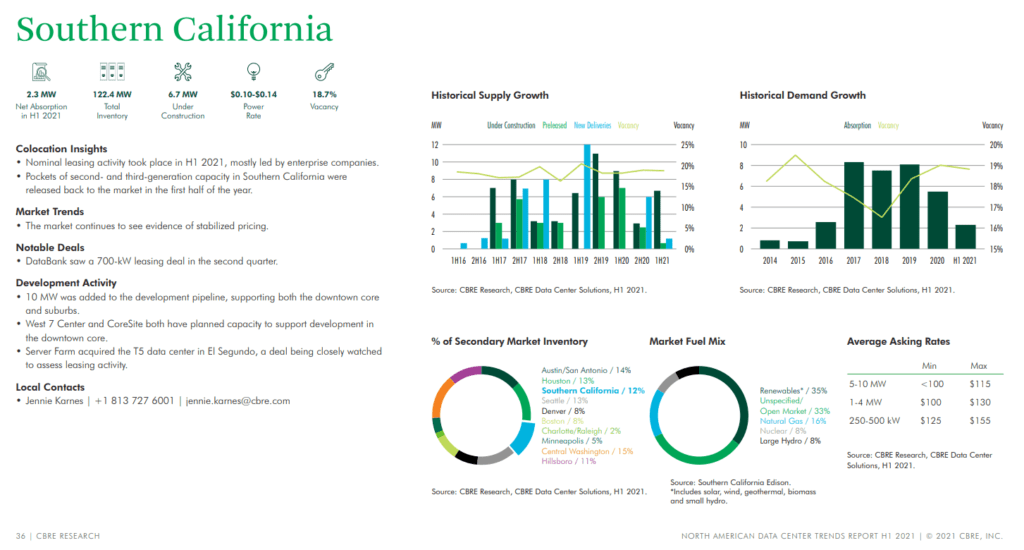

Here are more details about the regions the data centres are operating in:

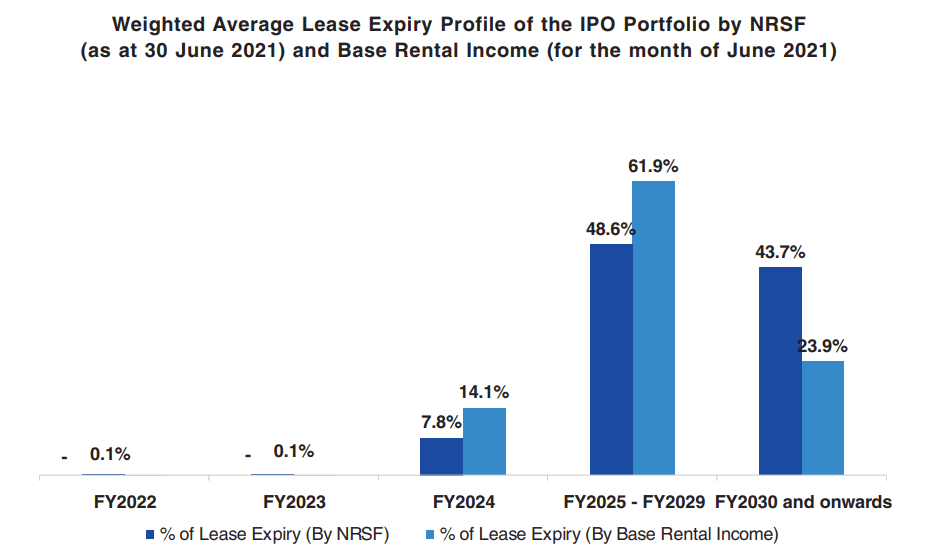

Majority of Digital Core REIT’s Leases Locked In

Based on the lease expiry profile, the earliest lease expiry will take place 3 years later.

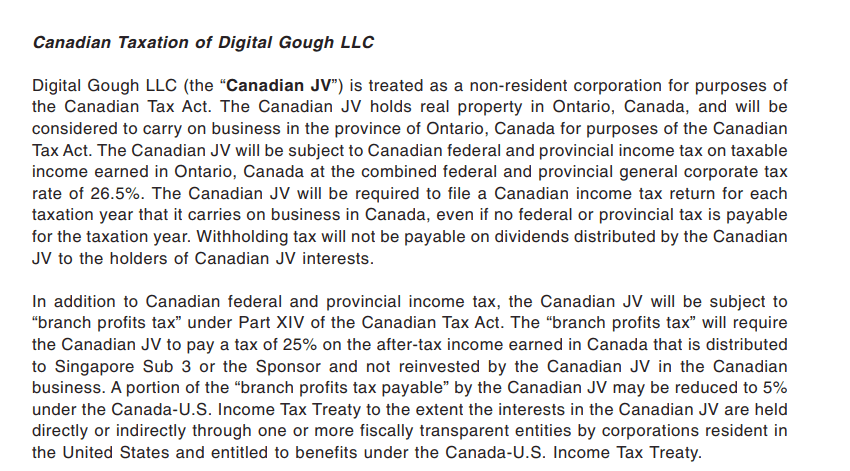

Do You Have to Pay Withholding Taxes on the Dividends Received from Digital Core REIT?

Okay, I am not your tax adviser, so if your case is complicated, you better bring this to your tax adviser.

By default, most countries tax monies flowing out of their countries. Just that the tax rate is different, and the tax rate is also different for interest, dividends. It is also different for individuals, partnerships or countries.

If you would like to find out more, you can read my guide to withholding tax for Singaporeans here.

If you are a non-US resident and you invest in US-stocks or ETF, you would be familiar that you need to pay a 30% withholding tax on your dividends.

The appeal of Singapore-listed US REITs is that you do not have to pay the withholding tax.

I think Digital Core REIT is no different.

Most of these Singapore-listed US REIT uses roughly the same structure. A couple of years ago, Keppel Pacific Oak REIT stir up some ruckus in their legal-style writing that seem to indicate that the Singapore-listed US office REIT face serious material risk that their distributable income will be impacted.

So after that experience, I sort of got schoolled in these tax stuff.

The Singapore-list US REIT leverage on a few tax rules to achieve this. You can read the section The Impact of Impending Clarifications to the 2017 Tax Cuts and Jobs Act – Some thoughts about it in my Manulife US REIT article here.

Non-US resident investors do not have to pay the 30% withholding tax due to the “Portfolio Interest Exemption” (PIR).

The REIT structure the money to be return to Singapore as interest instead of dividends. And if shareholders meet the strict criteria such that the interest is considered as a PIR, you do not have to pay the withholding tax.

For more information, please read the prospectus or read my Manulife article.

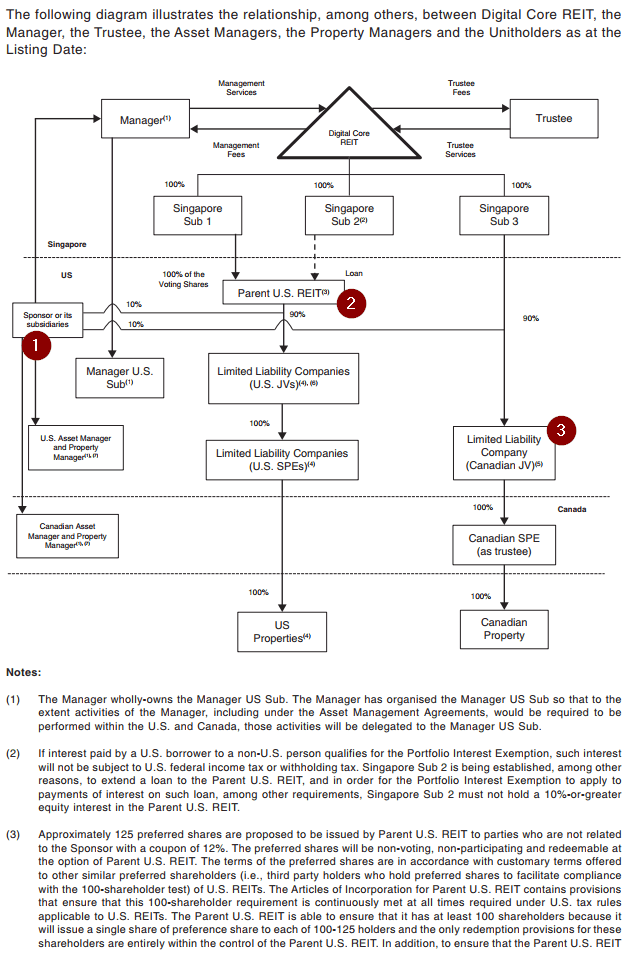

Here is the Digital Core REIT structure:

Notice #2. The Singapore Sub 2 loans a sum of money to the Parent US REIT and the Parent US REIT pays back Singapore Sub 2 as interest.

That is the magic juice.

The second leverage to reduce the withholding tax is to reduce the taxable income at Parent US REIT, using the interest (not shown in the diagram above). This is the one that we all think will be a material problem for the US Office REITs.

In any case, from what I read, this is handled in a similar manner as the Singapore-list US office REITs.

I do think that the investors do still pay Canadian corporate tax (#3)/

That is my interpretation.

I find it quite interesting that the Sponsor injected themselves at #1. I was wondering how the Sponsor can hold so many shares and not violate the portfolio interest exemption (each of the shareholders must not be a 10% shareholder… and Digital Core REIT’s sponsor holds 10% of the share)

So it seems, what they do is not own the stuff directly at the parent level but together with the Parent US REIT.

Why are there so many data centres in Northern Virginia?

Basically, it is a mixture of a few factors. This article in Data Centers today shed light on why Northern Virginia is so special.

- If you plotted Ashburn, Virginia, on a Google map and then zoomed out until the entire eastern seaboard of the United States was visible, you’d see that the region is essentially right in the middle. This geographic location makes data centres in the region optimally located to service many of the large cities up and down the east coast without significant latency. That location makes Northern Virginia a very desirable data centre location for local companies, as well as companies on the west coast – and international companies – that are looking to extend their reach and business into the Eastern United States.

- Yet it is only 30 mins from the nation’s capital Washington DC

- The location is safe. And you need a safe location to ensure uptime.

- Dominion Power, the electric utility servicing Northern Virginia, has a long history and strong reputation for providing consistent energy for its data centre customers. The company has also been investing heavily in renewable and sustainable energy – pledging to get 15 per cent of its energy from renewable sources by 2025.

- Tax incentives offered. The government understands the economic value. According to a study by the Northern Virginia Technology Council (NVTC), the total economic impact of the data centre industry on the State of Virginia was $10.1 billion in economic output. All told, the industry directly or indirectly contributed to the creation of 45,290 full-time-equivalent jobs in the state with $3.5 billion in associated pay and benefits. The NVTC study also found that the industry directly or indirectly generated $600.1 million in state and local tax revenue in Virginia.

Thanks to a reader for providing this heads-up

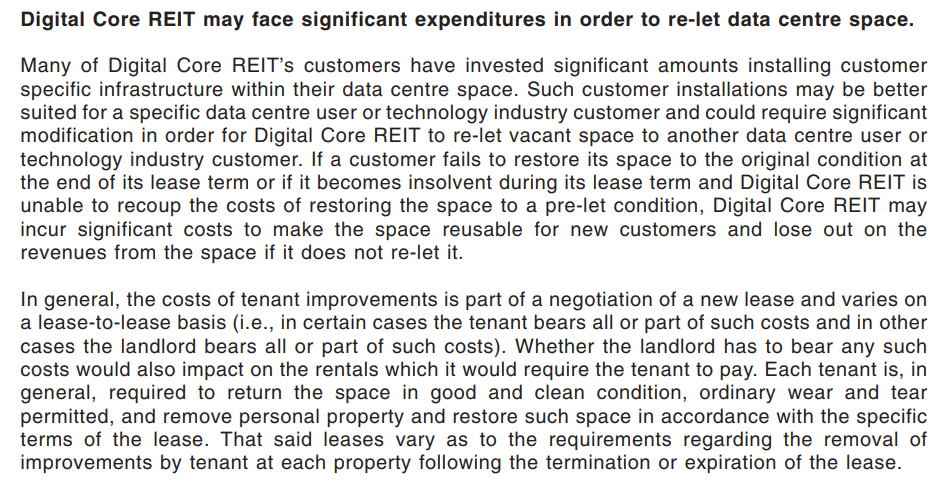

Some Notable Risks from the Prospectus

If you like my analysis and would like to level up your REIT knowledge so that you can invest better, you can take a look at my Learning about REITs section. It is FREE.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Tan

Monday 29th of November 2021

How do I apply to subscribe this IPO?

Kyith

Tuesday 30th of November 2021

You can subscribe to the IPO via the ATM at DBS, UOB, OCBC. I think it is available for subscription now.

retirewithfi

Thursday 25th of November 2021

Wondering aloud, can this PIR/share loan structure be used for ETFs?

Singapore based subsidiary loan the money to the parent ETF. The whole thing is listed/traded on SGX but the assets' legal structure mirror Digital Core REIT structure.

Kyith

Friday 26th of November 2021

good question. i cannot exactly advise as i am not sure this is possible only because we are dealing with properties. my guess is it can be done.

Elbert

Thursday 25th of November 2021

Do I need to convert SGD to USD in order to apply for the Digital Core REIT IPO?

Kyith

Friday 26th of November 2021

usually the bank will change which means you are at the mercy of the bank.