In my capacity on my day job in Providend, I was asked to make a comment on a recent MorningStar study that came out.

You can see my comments here:

Unfortunately, my Chinese is so lousy that I cannot translate this. Basically, Zaobao seeks a comment why local funds are comparatively so expensive and my answer is as above.

MorningStar’s global investor study seeks to examine the cost structure of funds for retail investors around the world.

They have produce this study every 2 years so this study in 2019 is the sixth edition.

It might not occur to many investors, but compared to many of my blogging peers, I started my investing roots from unit trust. From my perspective, unit trust fees have been high.

I am glad that we have more access to exchange traded funds (ETF). They are roughly similar and have lower cost. But unit trust have some advantages for the average investors that we wish exchange traded funds would have.

So let us explore why Morningstar’s study thinks our costs are high and what we can learn from the other countries.

How the Funds and Expenses Study is Structured

The first thing that we should take note is that this study covers mainly the retail fund classes and not the institutional fund classes. Institutional fund classes tend to be lower in costs compared to the retail fund classes.

The countries were scored in the following ways:

- based on asset-weighted median expenses

- Only for retail share classes

- Costs can be very different across different countries. So Morning-star used a data point called “Representative Cost”. This captures the recurring costs charged by the fund vehicle. This includes embedded distribution fees, retrocessions (known as trailer fees here) and performance fees. It excludes one-off fees charged by third parties such as advisers or platforms. In a lot of countries this is known as Annual Report Net Expense Ratio

The study grouped the funds into three categories: Allocation, Equity and Fixed-Income funds.

MorningStar has a certain philosophy on how funds should charged:

Lowering the cost of investment products via commission-free share classes and by unbundling other expenses from the cost of investment management, transparency improves and investors benefit.

In addition to lowering all-in-costs for do-it-yourself investors, those participating in a fee-based advice model may accrue additional benefits from more individualised service, including savings guidance, tax planning, and pension optimization, which collectively add significant value to the investor experience.

Morningstar

Morningstar sought to find out why some of the countries were successful in lowering their fund costs while others couldn’t. They tried their best to look at various factors such as regulation, the prevalence of exchange traded funds.

What are Retrocessions and Unbundling Fees?

There are a few terms that may be a bit confusing for you:

1. Retrocessions. In this region (and a few other), it represents as trailer fees that the funds pay the distribution platform.

The dictionary have a better term: Kickbacks.

Retrocession refers to kickbacks, trailer, or finders fees that asset managers pay to advisers or distributors. These payments are often done discreetly and are not disclosed to clients, although they use client funds to pay the fees. Retrocession commission is a heavily criticized fee-sharing arrangement in the financial industry because money flows back to marketers for their efforts in raising interest for a particular product.

Investorpedia

For example, your First State Dividend Advantage have an annual expense ratio of 1.7%.

However, as high as 50% of this or perhaps 0.7% goes to the distribution platform as trailer fees. So if it is a bank or an online platform such as DollarDex or Fundsupermart, they earn this trailer fee

(a caveat here. I am using First State Dividend Advantage as an example. The expense ratio of the fund is as stated in the factsheet but the factsheet does not reveal the trailer fees)

2. Unbundling. Morningstar largely means that the cost is not embedded as a black box. This means:

- Embed the broker, financial adviser commissions inside the fund itself

- Embed research costs inside the fund itself

By doing this, it means as a consumer, you pay a separate fee for financial advise or the services. In Europe, MiFID II is taking place, which restricts the ability to embed research costs within the fund itself but report it in the fund company’s income and expense statements.

A way of unbundling would be to see the cost transparently. Locally, it will be if you purchase from a robo such as AutoWealth or MoneyOwl.

In terms of financial advise, they prefer advice and the financial instrument cost be separate.

They prefer a remuneration of fee-based or fee-only financial advisory.

Let us take at the result.

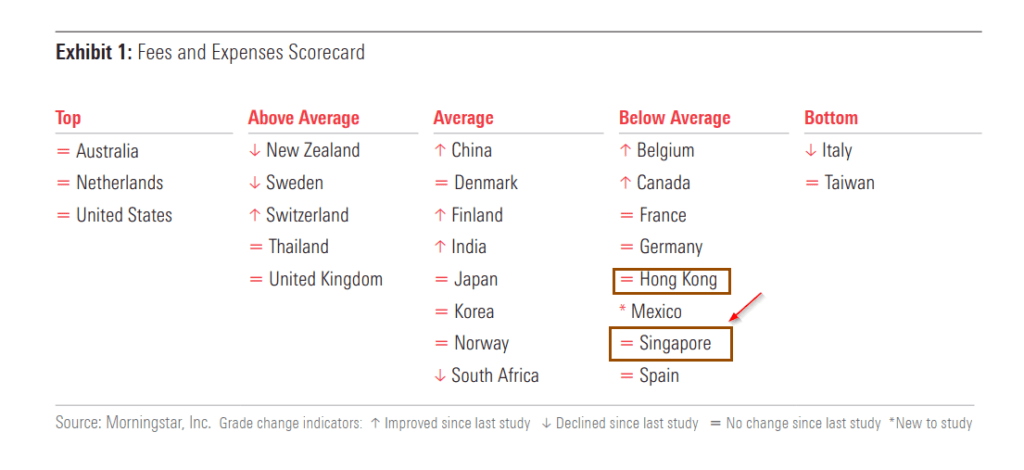

Singapore is Rated as Below Average when it comes to Fees and Expenses in the World

For a country that prides itself to be a wealth management center, Singapore does ranked rather low.

The saving grace for Singapore is that, they are not alone. Their fierce competitors Hong Kong is ranked in the same category. Developed nations such as Canada, Germany and France are in the same category as well.

I note that it doesn’t mean that if your country is developed you will do better in this area.

Also pay attention to that some countries have moved up and down the rating category relative to the last report 2 years ago.

India and China improved their position to be far higher than Singapore

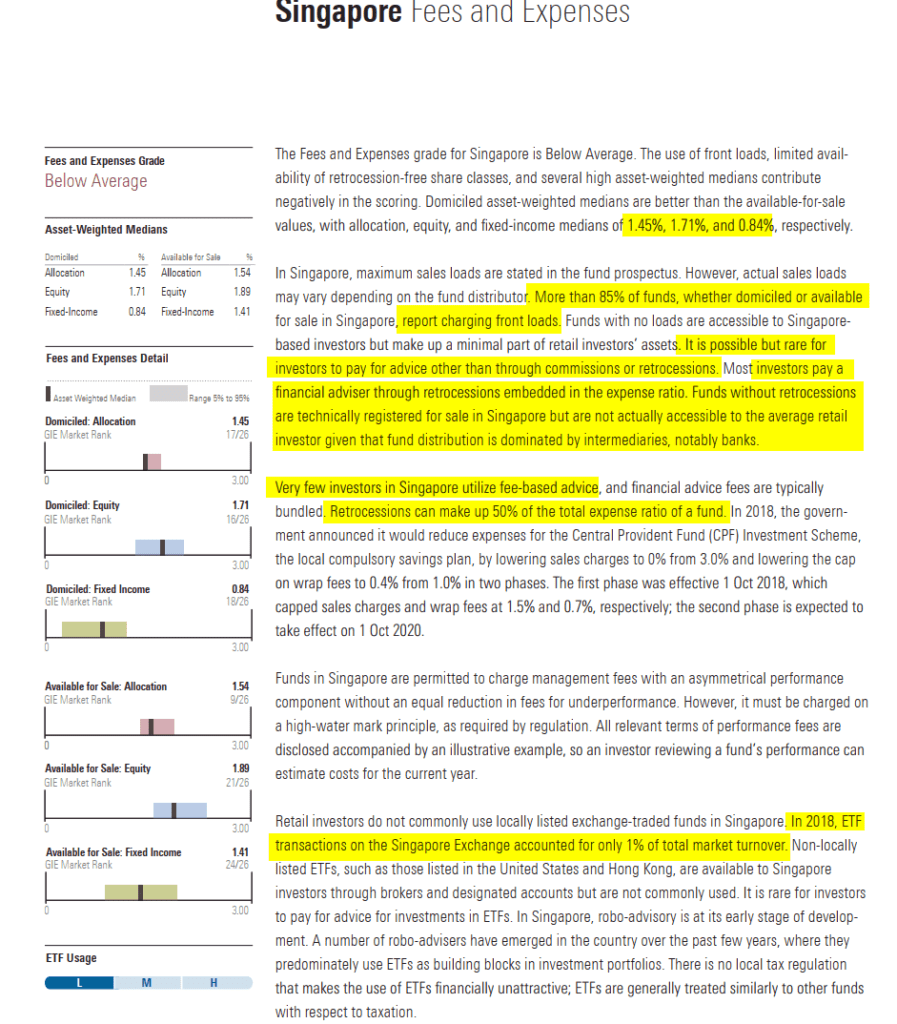

Here is what Morningstar reports of the fund landscape in Singapore:

I think they got majority of the fund landscape in correct:

- Our asset weighted median expenses are 1.45%, 1.71% and 0.84% for Allocation, Equity and Fixed Income funds respectively

- Most consumers pay their advisers through the trailer fees embedded in the expense ratio

- There are funds without trailer fees, but are typically not available to Singapore retail investors

- When it comes to getting financial planning advise, Singapore typically are not fee-based. The fees for the advice were bundled within the products

- ETF transactions are very small compared to the traditional unit trust in Singapore

- A lot of start-up robo-advisers have developed in Singapore

The study also mentioned what CPF sought to do more.

In 2018, the Singapore government sought to reduce the sales charges that the funds that can be bought with CPF Investment Scheme (CPFIS) from 3.0% to 0.0%.

They also lower the cap on wrap fees from 1.0% to 0.4%.

Some of the Reasons other Countries have Lowered their Fund Expenses Over Time

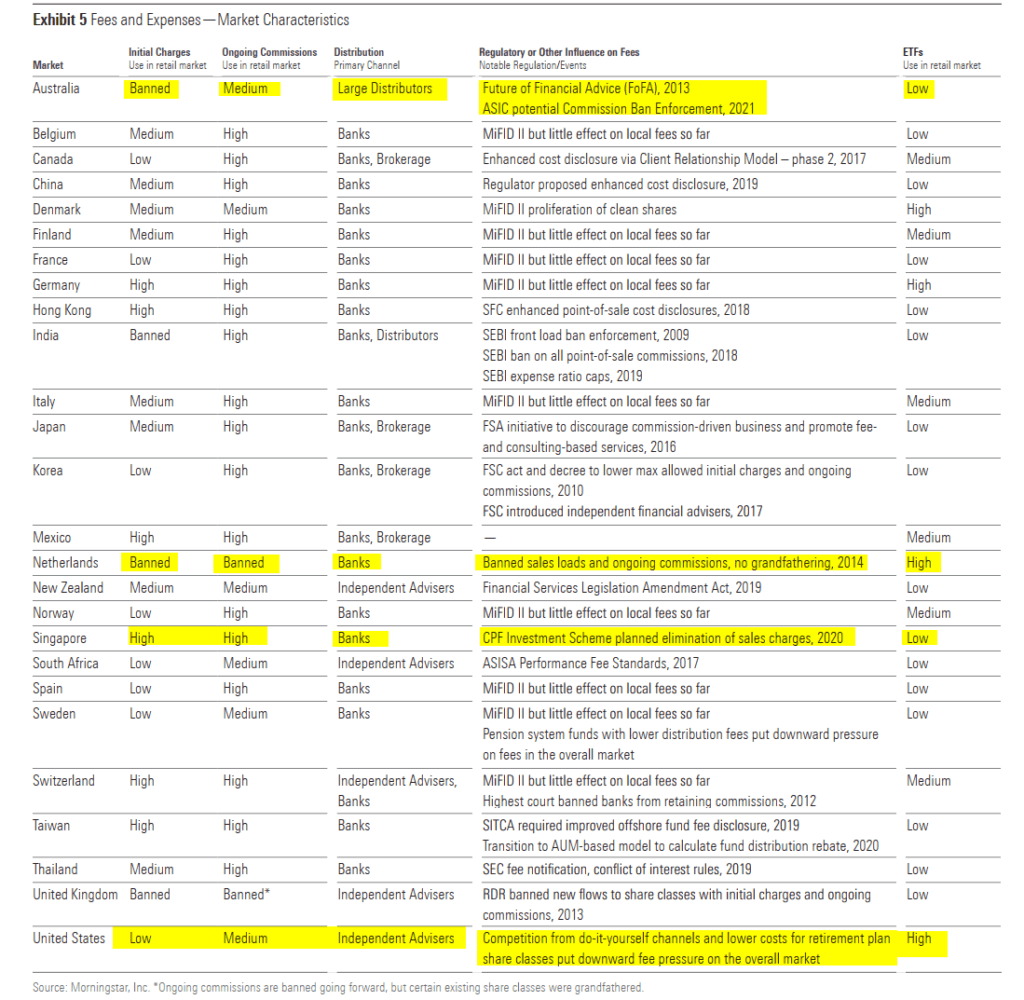

Morningstar gives a summary of the different areas that will contribute to difference in fees in various countries:

Not much has changed in most places. There are sales charges on purchases around, some have selling charges, some have trailer fees, some have performance fees.

I noticed that the countries where the main distribution channel are independent advisers tend to have lower initial charges and on-going commissions. For a lot of countries, the main distribution channels have been the banks.

Perhaps we can learn something from those countries that rank higher. Then we can see why are Singapore’s fees not dropping.

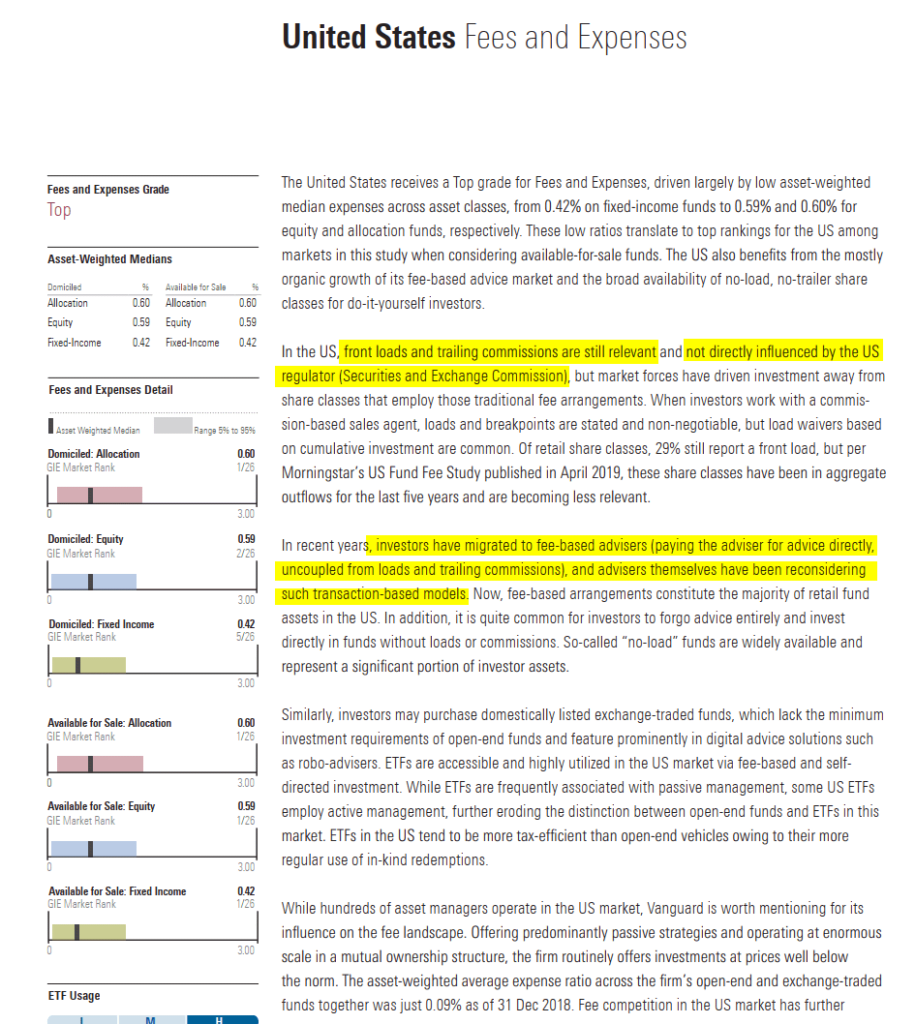

United States has a Unique Winning Fund Market Characteristics

The United States is unique in that their fund expense cost is very low. A large part of it is due to competition and investor demand.

This means that in the country you have a lot of investors that are not aware that fund expenses make a difference, but they have enough people that are in the know, yet willing to make a difference.

Charles Schwab in the United States made a strategic pivot a long time ago from traditional discount broker model into the low cost expense ratio fund space.

This set off an all out race to the bottom for expense ratio with Vanguard. Then Fidelity tried to play catch-up by going so far as to offer 0% expense ratio.

However, there is a motive to why Fidelity may be having zero expense ratio and likely what Fidelity hope for is to up-sell the clients the funds that pays more. However, the effect is that it caused a race to the bottom.

To race to the bottom and stay at the bottom, these players needed to be sustainable with these low fees.

United States have a larger addressable market and thus, for those robo-advisers who wishes to push the narrative of using low cost ETF, they can survive better due to the size of the AUM they could gather.

I was surprised that majority of the assets sold are based on fee-based advisers instead of the banks and independent platforms.

I feel that United States is a mixture of large market, investors led, industry competition.

Australia, Netherlands and United Kingdom have Strong Government Regulations to try and Induce a Fairer Consumer Landscape

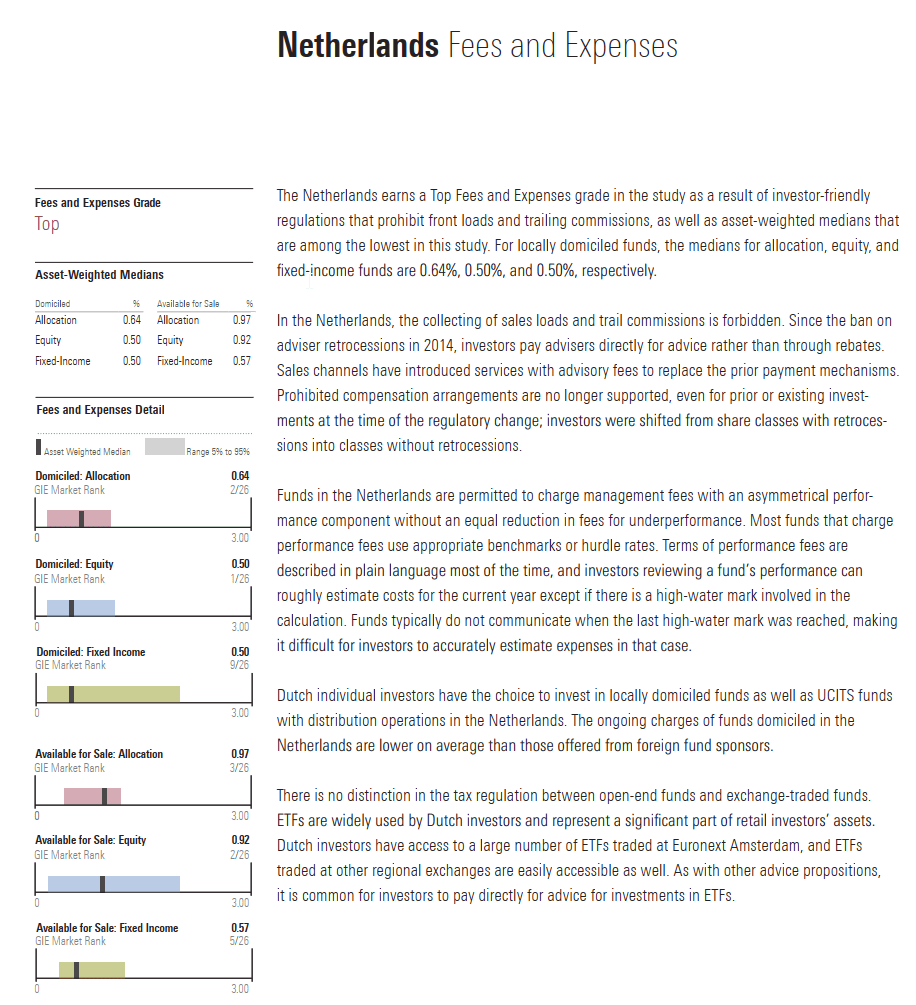

Netherlands is interesting in that they are pretty similar to Singapore in terms of country size. Most of us know that they have a good pension system and wealth tax on assets.

The expense ratios is rather low.

In Netherlands, adviser commissions and fund trailer fees are forbidden. Perhaps it is the trailer fees that is the main factor to reduce the fund expenses to this low average.

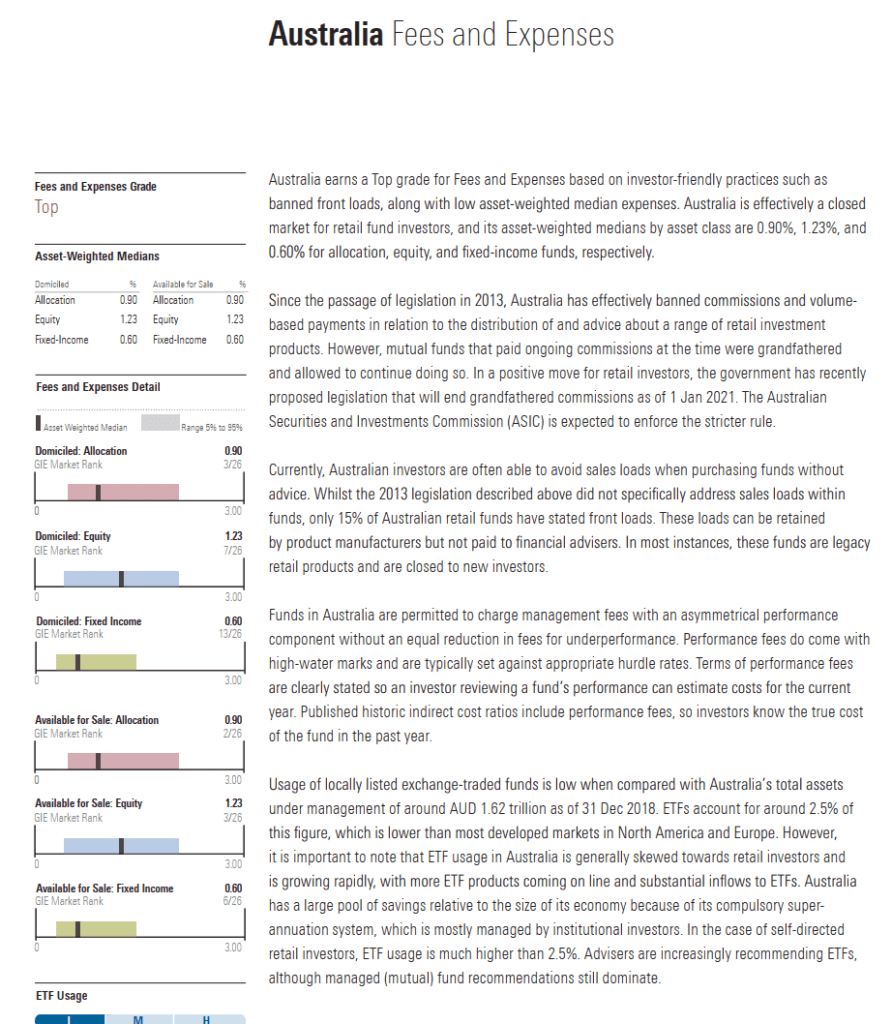

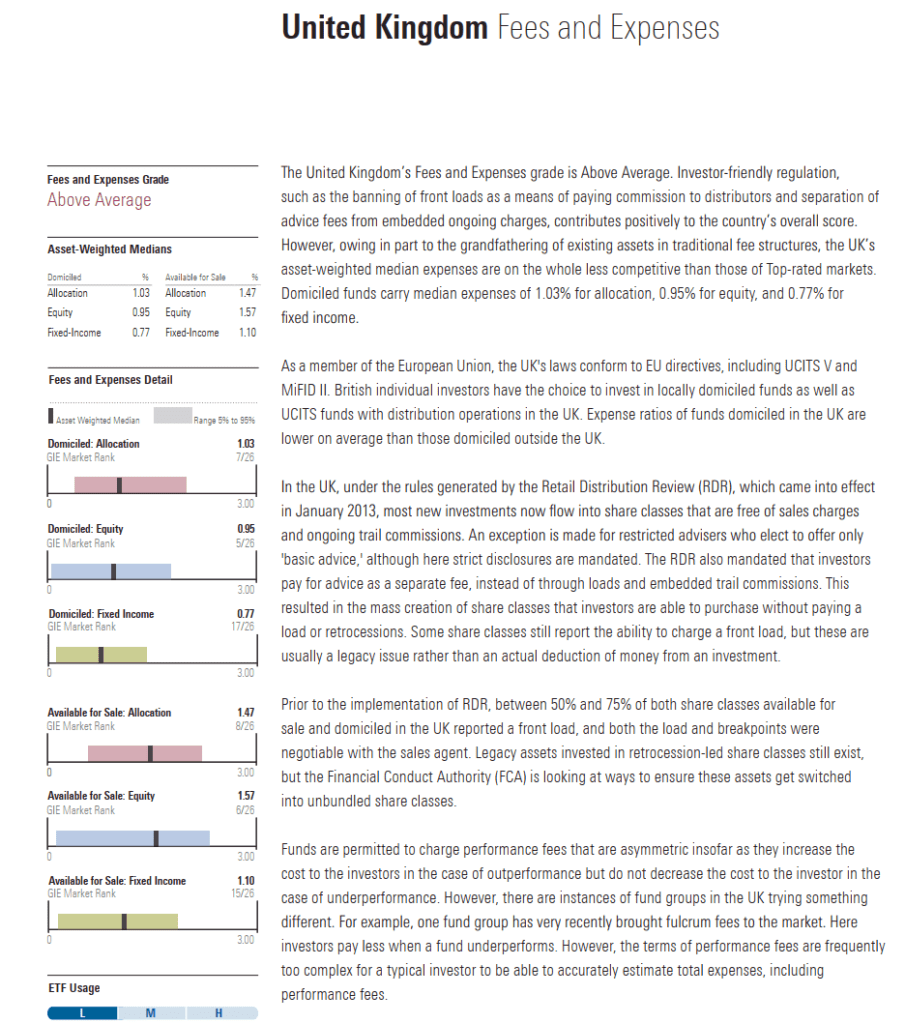

Australia and United Kingdom banned commissions and trailer fees. When the government does that, it greatly sends a message how they want the direction of things to go.

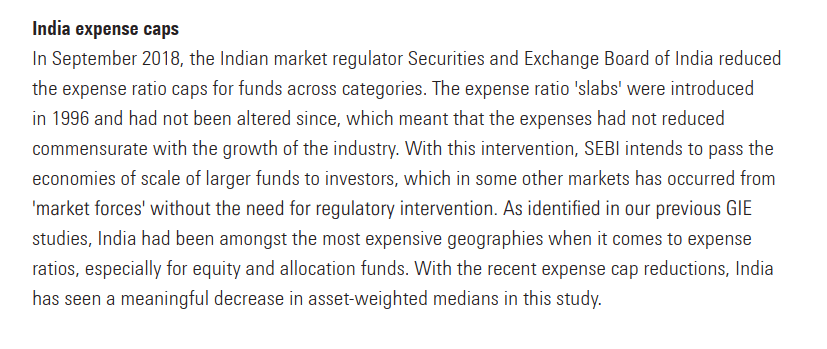

I wish to put a short note of India because they managed to moved up as with China. The reason China was able to moved up was due to their median asset weighted expense ratio in fixed income. Their equity and allocation funds weighted expense ratio is still high.

India regulation does help to reduce the fees.

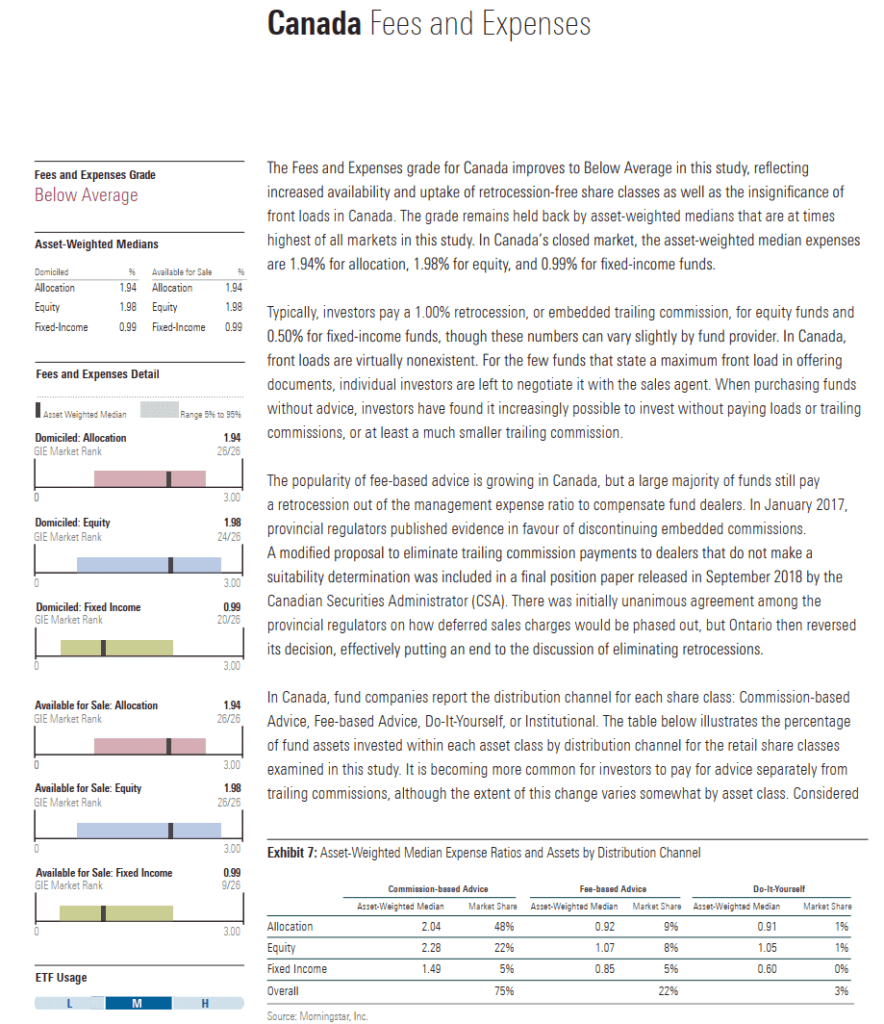

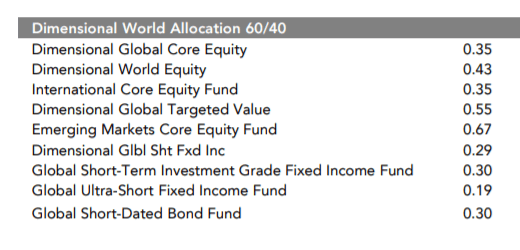

Canada & Germany are Two Developed Nations with Same Problems as Singapore

Canada and Germany are 2 countries that end up in the same category as Singapore. Morningstar’s analysis is that embedded costs such as trailer fees and commissions seemed to be a big feature for the funds in these countries.

What can be done to bring fees down – Tackling Trailer Fees Better

The government took the route of forcing the funds that qualify for CPF Investment Scheme to reduce their sales charge and wrap fees.

However, they could have pushed it further by doing something about the trailer fees.

I do wonder at times that as retail investors, we cannot be the only ones paying attention to this landscape.

The government should have a lot of people looking at this environment. They should also be wealth builders themselves. They have access to much better resources than us.

It cannot be the case we are the only ones seeing trailer fee as a significant reason why fund expense ratios is high.

There should be people in the government that understands that this is a bigger issue. However, as of now they choose not to do anything about it for now.

Even more befuddling is that… why did limit they choose to limit these regulation to only CPF Investment Accounts?

Does that mean that our money outside of CPF is less important or that the costs are lower?

By reducing sales charges to zero is a welcome move. However, it will force the financial firms to shift to charging wrap fees. By tightening the ceiling for wrap fees to 0.4% is good.

However, if the expense ratio of the funds we can purchase is 2% and 50% of it are the trailer fees that pays back to the distributors, then that is 1%.

1% is a much higher fee, especially if you consider the majority of the investors invest through regular savings plans.

If the government ban trailer fees, I would like to think it is going to upset a lot of people.

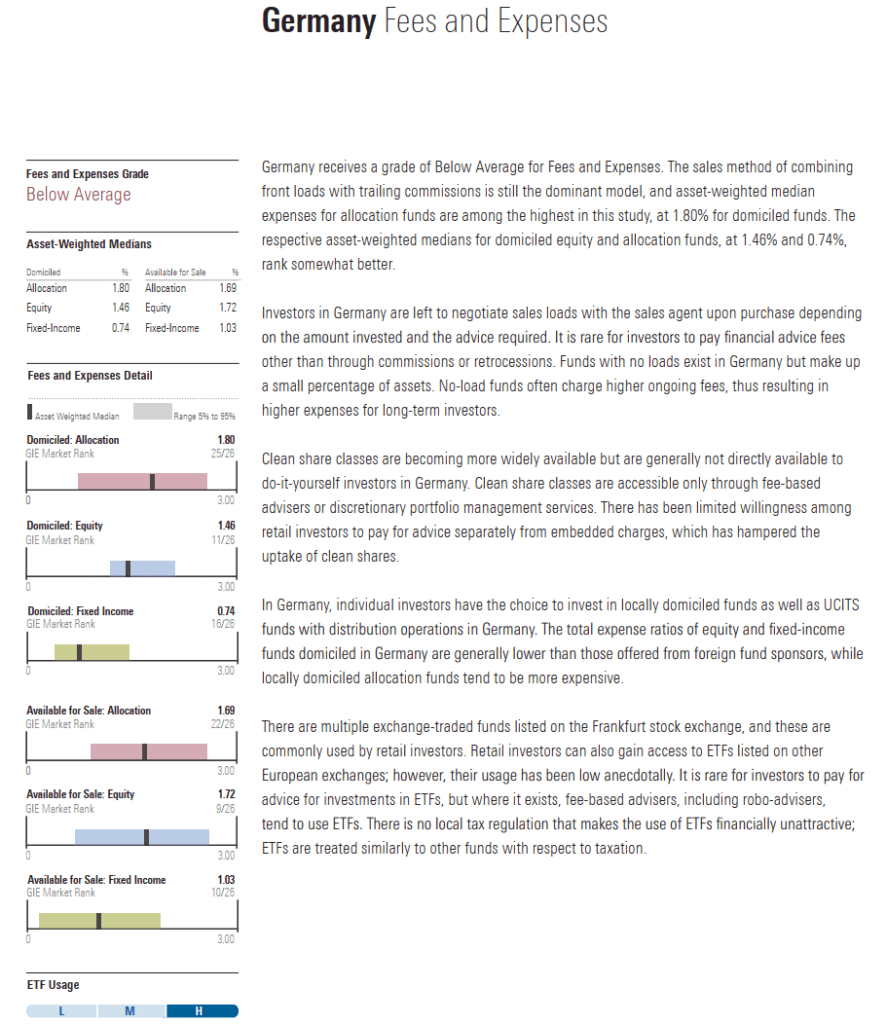

There is a reason DollarDex, POEMS can have 0% platform fees compare to iFAST’s Fundsupermart. That is because there is still the trailer fees. If they average 1%, then its even higher than platform fees.

While the general manager of FSMOne attribute in the Zaobao article that the reason costs are high is because the banks selling are selling high cost ILP, as veterans in this field, they could push for rebating everyone the trailer fees.

FSMOne take both the trailer fees and platform fees.

It is their business. And I suppose the banks have a similar structure now. I drew a lot of flak from my readers why I only talked about Fundsupermart and not Dollerdex and POEMS. I talked about them because I been on this platform for some time and I find it good to recommend to others.

However, this is the part where I thought they could have done it better. If you take trailer fees, at least don’t charge an AUM fee (currently will come up to 0.32% a year which is recurring).

What is Hard to Tackle – Singapore’s Small Market Size and Our Consumer Culture

Singapore is not like the United States. The funds there are seriously big. They are so big that even a 0.10% expense will still make them business viable.

The average robo-advisers here in Singapore have an AUM wrapper fee of around 0.60%. These robo such as Stashaway, AutoWealth, MoneyOwl, Smartly, as far as I know may not be currently profitable.

Suppose a Robo gathers $150 million and the average AUM fee is 0.30%. That is a pretty low fee, for the large account.

That is a revenue of $450,000 a year.

I think a CEO’s salary is probably already 25% of that.

Even if these folks wishes to push things, there is a certain limit.

Morningstar’s philosophy is to prefer fees to be separate from the product.

This is culturally very hard even for the consumers in Singapore.

Not just in Singapore, culturally we humans have shifted to detest seeing fees.

We will always called in and threaten to cancel our phone lines for the late charges. We hate this fee and that fee.

It is a tough sell for the everyday folks to pay for a fee of $2,500 to $5,000 in planning fee. However, they are OK if the fee is paid in commissions and trailer fees over the years.

I find it psychologically more acceptable when I do not see the cost paid outright.

To change the culture, you might need a dictator to outlaw things.

There are fee-based and fee-only firms out there that earns mainly from fees. This is what Morningstar feels is better.

My friend Wilfred Ling are the rare one that is a fee-based adviser. Not many of his peers around that makes it explicitly that they are fee-based. You can contact him (affiliate link) if you understand this model and need some help.

It is as rare to find fee-only advisers. Providend is probably the only one not taking in any commissions but charges a planning fee, implementation fee and assets under management fee. (if I missed out your firm, do let me know!)

Exchange Traded Funds (ETF) tends to have less issues with Trailer Fees

I guess I can understand why Morningstar highlighted ETFs. If they feel that the trailer fees are a big issue than ETFs, which are mostly used by the Robos tend to use ETF.

Most of the Robos are pretty transparent about fees in general (company wrap fee, platform fee, expense ratios…).

However, it is not that all unit trust have high fees. You can get unit trust with low fees as well.

At Providend, we use both Vanguard and Dimensional funds. Both are unit trusts. However, the expense ratios are without trailer fees.

These funds is not just available to us at where I work but those Dimensional trained advisers who use the iFAST platform (which probably covers Wilfred, GYC, iFAST advisers and a lot of financial advisers using their platforms).

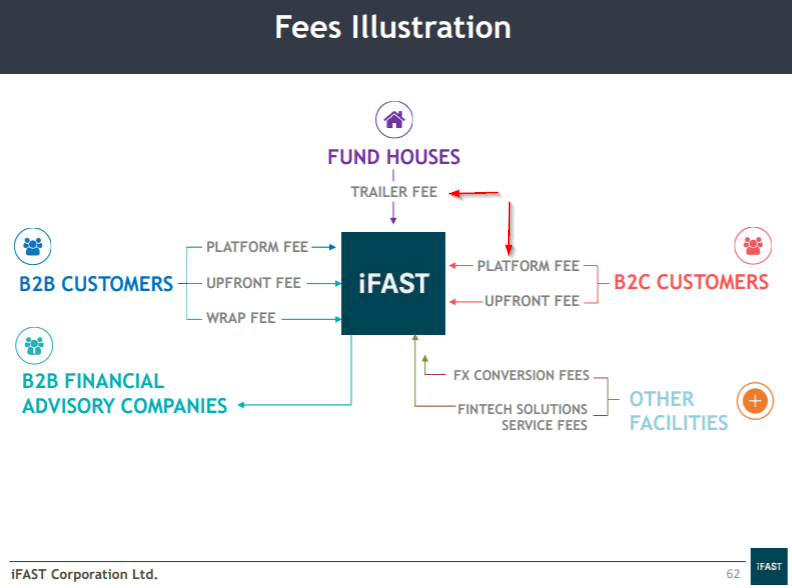

The above is taken from a Dimensional slide that I came across last week. It is one interesting wrap fund that will come online soon as an SGD fund (in other countries it is already available).

It is a 60/40 equity and bond fund that will auto re-balanced to a 60/40 allocation regularly.

The numbers you see are the fund expense ratio for the various funds within this World Allocation fund. They are not as low as the exchange traded funds listed in the United States, but they are low enough at least for me.

I find it interesting that I can get a portfolio diversified across the world systematically re-balanced for me with a total expense ratio of 0.41%.

Interesting enough for me to consider my SRS funds.

Summary

While we are on the topic of fees, Endowus is pretty staunch against trailer fees.

They are trying to change the landscape in the right way.

They are offering to invest the funds in your CPF Ordinary Accounts under the CPFIS at a wrap fee of 0.40%. Same for their SRS funds. The wrap fee for their cash investment is higher at 0.60%.

These are not their Dimensional funds but a few fund houses they are partnering with. So these are actively managed funds except probably the Infinity fund series under Lion Global. Why these funds and not Dimensional funds, I will leave you to ask them that question.

Endowus will rebate you all the trailer fees they earned.

It makes it particularly attractive for your CPF if you can purchase the Lion Global Infinity U.S 500 Stock Fund with your CPF. This is a Vanguard index fund that tracks the US S&P 500 index. Lion Global wrapped this index fund and charges us a 0.70% expense ratio.

Part of it is trailer cost. Endowus tried hard to drive a hard bargain to bring down the net expense after their rebate to be 0.40% plus minus. Including the wrap fee that will be about 0.80%.

I thought this is a worthy thing to let you all know about. So if you are interested do contact them through the link above or here.

I have a strange relationship with Endowus, given where I work.

Even stranger with some recent things I come to know about them.

Still, you got to do right with Investment Moat readers because it likely adds value with Investment Moat.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Joshosaurus Rex

Tuesday 1st of October 2019

I'm keen to know about what you recently found out about Endowus. Haha.

momo

Sunday 22nd of September 2019

"Endowus tried hard to drive a hard bargain to bring down the net expense after their rebate to be 0.40% plus minus. Including the wrap fee that will be about 0.80%."

Is your info the first public info available on this? Interested to know more about this. Thanks.

Kyith

Tuesday 24th of September 2019

This is probably first hand information but if you are interested, you can find out more from them.