One of the keys to fulfilling your financial goals is to clearly articulate it.

I was listening to a two-part series by Joshua Sheats on setting financial goals, and this stuck out to me.

“If you know exactly what you want, to get it is easier. “

If you do not know precisely what you want, then to get there is harder. You would argue that if your goal is to have a wealth machine that gives you rather reliable income that keeps up with inflation for 100 years, it is rather hard.

I would say not true.

You need $10 mil and put it in a broadly diversified Global stock and Global bond portfolio. This should grow between 2% to 10% a year depending on the future sequence of return.

During the initial year, you will spend 1% of that $10 mil, and for subsequent years, adjust the $100,000 a year with inflation.

$100,000 should be enough for your family.

You do not need to go to a financial planner. Just need $10 million.

A problem for many… is that they are clear what they want… but they want too much. They want so much that, they did not even get to enjoy a little bit of what they desired. They think that anything less than what they want is totally not functional.

I would say… you do not know what you really want.

Securing My Accommodation for the Rest of My Life

If I know what I want, then the solution is usually more simple.

Readers know I am the odd one in Singapore that owns no residential property.

Currently, I do have a place to stay but what if there is a dispute next time and I could not find a place to stay?

There is this common train of thought that due to inflation and growth, it is infinitely better to secure a home today, then in the future.

But I think let me practice some wargaming / red-teaming / contingency scenario planning, and clearly articulate what I want:

- How long is “the rest of my life”? I am almost 40 years old, life expectancy due to health problems might not be long. Could be between 70 to 100 years old. Thus, looking to secure the place for 30 to 60 years

- Due to how my life is set up, do not need close proximity to town for work purpose

- However, prefer about 5 minutes walk to MRT station. In that way, if I need to visit somewhere it is almost close to doorstep.

- Prefer the east side but for whatever reason, if I need to be in the other part of Singapore, I could switch easily

- I don’t need the asset to build wealth. Have my own wealth machine that generate cash flow on the side. So I can treat this as an expense

- As long there is a market for me to sell off the present value of future rent and get another place, I am OK

- I want to have the option of having some privacy or the ability to sub-let out. A four-room or three-room HDB flat would be good

I wonder if this differs from what my readers are looking for. You can let me know.

If I can clearly articulate this, then I can find a solution to it.

My requirements looks like I am buying some sort of term life insurance HAHA. In fact, many have said paying for rent is a waste of money, just like paying for life insurance without cash value built up.

Would Renting or Buying Fit What I Need?

So would I prefer to rent or buy if it comes to that scenario?

I think sometimes if prices move up too fast too soon, we needed to see the effect. If I do not buy a residential property today and growth is 3-5%, I might be priced out.

But that may also mean that my wealth machine grows even better than the growth it is doing now.

Net-net, my cash flow from my wealth machine in the future can afford me the more pricy rent. That will depend on the inflation rate versus the growth of my wealth machine.

If I am not forced to buy it immediately, what are my considerations?

Mainly is this:

- If the present value of 60 years of future rent is cheaper than the current price of HDB flat in the region, rent

- If the current price of HDB flat in the region is cheaper than the 60 years of rent, buy

A valuation metric which is similar to this is the price to rent. It values whether a residential property is expensive or cheap relative to the rent it provides.

If the price to rent for a place is above 16 to 20 times, perhaps it is cheaper to rent. This is just a rule of thumb. There is no study there.

Let us look at some case studies.

Yishun HDB Flats Next to the MRT

I used to live in some parts of Yishun 19 years ago. It is not an unfamiliar place for me.

The places around the MRT looks pretty good. There is a huge Northpoint City to meet up with people, the MRT has an NTUC to buy the groceries.

The blocks of 740 to 760 looks to be ideal for my situation.

At 35 years old, these flats are rather old. As long as the flat I purchased is younger than 44 years old, I should be able to use CPF for financing (read the 4-year max rule).

The flat costs about $370k to $400k for 4 rooms and $290k for 3 rooms.

If I were to rent, the rent is currently about $1700 a month for the 3 room and $2000 a month for the 4 room.

The Price-to-Rent Ratio for the 3 Room HDB is 14.2 times.

The Price-to-Rent Ratio for the 4 Room HDB is 16.6 times.

Both Price-to-Rent are pretty low compared to the 16-18 times I use to determine between renting and buying. The higher the Price-to-Rent the more it feels it is better to rent.

Now let me compute the rent that I would pay if I were to rent for 60 years.

The Present Value of 60 Years Worth of Rent

Your 60 years worth of rent goes up with inflation. The rate of inflation will vary depending on luck. As a reference, for the past 30 years, the inflation rate in Singapore averages below 2%.

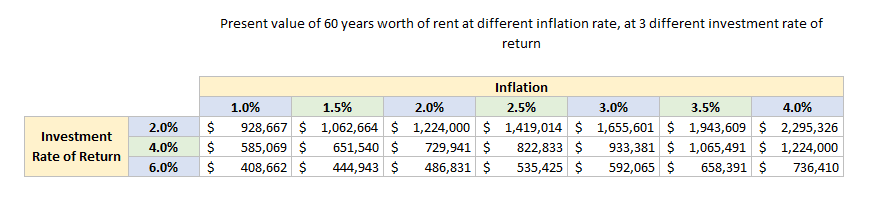

A lump sum that you set aside to generate this rent may grow at 2%, 4% or 6%. For those who are more investment savvy, your investment rate of return is higher at 6% for those who are less savvy, that would be between 2% to 4%.

Your investment rate of return is also your cost of capital.

In the table above, I worked out the present value of a stream of rental expense for a $1700 a month 3 room Yishun HDB flat.

If your estimation of inflation is 2%, and you are conservative with your investment rate of return (2%), then by choosing to rent, you would need the equivalent of $1.22 million in today’s money in rent.

Any of these figures are lower than $290,000.

If I throw in some much-needed renovations and furnishings, my first-year cash flow would be $80,000. My mortgage would be $1,175 a month for 25 years. At 2% investment rate of return, the present value of the mortgage is $275,280. The aggregate present cost is $80k + $275k = $355k.

By paying $355,280, it is much cheaper than choosing to rent for 60 years, unless my investment rate of return is higher than 6%.

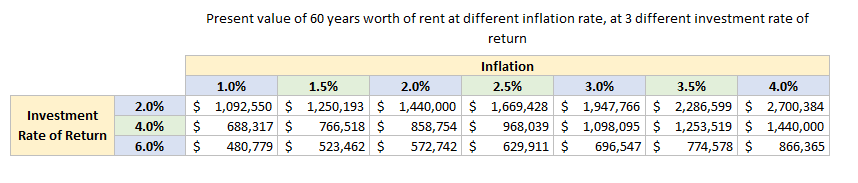

In the table above, I have presented the present value of a stream of rent for the Yishun 4 bedroom flat. Readers would realize it is still much cheaper to pay a 25-year mortgage and buy this lease.

The margin of safety is narrower if the inflation rate is 1% and I have an investment return greater than 6%.

Punggol Flats Near the MRT

My friend told me about his place at Punggol Walk.

It sits pretty close to a large shopping center and a little off the MRT. Punggol is a town that is really out of the way. If you are still working, and work somewhere in the west, then living in Punggol can be quite a nightmare.

For someone who has a different set of life configurations, this could be a good place to operate in.

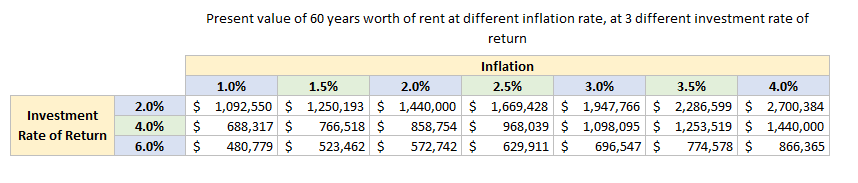

His 4 Room Flat in that area rent for $1800 a month. It used to rent for $2100 a month. He could rent it out due to special permissions but a flat that is so close by should fetch close to $500,000.

The Price-to-Rent Ratio for his 4 Room HDB is 19.8 times.

At 19.8 times, it is quite out of my buying range.

His rent would put the rent or buy an HDB leasehold decision to be more narrow. We can see that if we have a high return on investment, perhaps renting might not be a relatively poorer decision.

In all honesty, most of us would assume a large margin of safety by assuming our cost of capital/investment rate of return is closer to 2%. In this case, buying a $500,000 Punggol HDB flat that is close to Waterway point would be worth it.

If You Know What You Want, Open to Options, Life is Better

I decide to put 2 examples here but I believe if I am serious about this, there are many ideal options that fit my criteria.

I should not need to be forced to make a tough decision.

You can arrive at a good decision for a lot of your financial decisions that you need to make in life if you know very well what you want.

The decision is good if you have a good mental model about it, or have someone that has a good mental model that helps you.

Knowing what you want can be very difficult because we tend to have a herding mentality. There are some aspects of what I presented that might be difficult to swallow, such as purchasing an old flat.

If you know what you want, what you needed to do next is to be able to make the most fundamentally sound decision you could.

This sounds simple but from our experiences, people come to our office at work because either they do not know what they want, or can’t figure out the fundamentally sound solutions.

When it comes to these housing decisions, I have time to slowly evaluate because there is less of a fundamental need to move to another place. There is a non-monetary reason this is a preferred place to stay at right now.

Sometimes the non-monetary part is an important criterion. We just have to be sensible to our own situation. It cannot be the case that you decide to buy a condo near MRT because you have gotten used to living near an MRT as a child but both your finances is not ready for it. This is just one example.

A Good Article to Frame the Decaying Leasehold HDB

This week, I read this thought-provoking article by Charlie He on the Decaying HDB Lease.

Charlie’s piece is good in that I struggled to frame how to look at leasehold and freehold well. Charlie is an investment person and explains the contrast between leasehold and freehold as a combination of

- Land Value

- The Future Stream of Rent that You are Buying Upfront

All things being equal, if you wish to buy a stream of rental expense upfront, you can forgot the land value.

As the lease runs down, your leasehold will be worth close to nothing. However, that is OK because the amount you saved from not buying freehold can be invested in your own stock and bond portfolio at your required rate of return. e.g. 4% a year.

Charlie also explains that while your HDB lease might have 20 years left, if the property is well maintained, there should be little difference between your rental income earned and a flat that is newer.

There may be a sweet spot that for the next 20 years, your internal rate of return may be very high. This is because your purchase lease is low and rental income is comparable to a flat that is newer.

If there is one good article to read on the subject, it is this one.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

KK

Thursday 12th of December 2019

How about staying in hotels instead of renting?

Kyith

Thursday 12th of December 2019

That is probably a little too expensive isnt it.