I cannot remember when was the last time IREIT Global made an acquisition.

It was such a long time ago. So long that I forgot when. But fret not the management finally made an acquisition. This time they have acquired a portfolio of Spanish properties from Blackstone‘s Spanish REIT Corona Patrimonial.

Is this a good acquisition? Let us find out.

From my High Yield Dividend Stock Tracker, IREIT Global gives a 6.8% dividend yield.

That does not tell the whole story because they retained 10% of their income available for distribution (even though I could not detect why they retained it. Cash is the same, debt goes up).

Together with a rather low debt to asset, long debt to maturity of more than 6 years, very low cost of debt, I like to see how this acquisition can augment their portfolio. The black mark is that due to the exchange rate, dividend yield has come down a fair bit.

This is also the first deal done since CDL came on board to own 50% of IREIT’s manager and 12.4% of the REIT.

A Spanish Portfolio

This acquisition was structured in the form of a joint venture between IREIT Global’s parent Tikau Capital Management and them.

REIT’s share of the joint venture is 40%. Tikehau will take the other 60%. Tikehau has given the REIT a call option within 18 months to purchase the other 60% of the portfolio. If Tikehau sells to a third party, they can exercise a “Drag-a-long” option to IREIT to sell their portion of shares too, but not less than NAV. If Tikehau does not exercise the option, the REIT can “Tag-a-long” on the deal as well.

The interesting thing is that it says CDL fully supports the acquisition and extended to IREIT a EUR 32 mil bridging loan.

Somehow seeing this bridging loan gives me the feeling they have to end this deal fast.

From this paragraph, it looks that way.

This acquisition is one-tenth the size of its current portfolio.

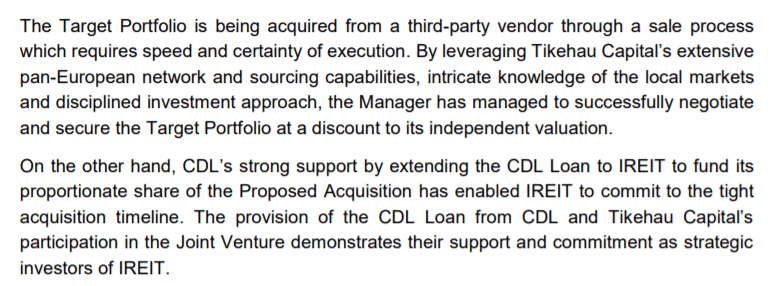

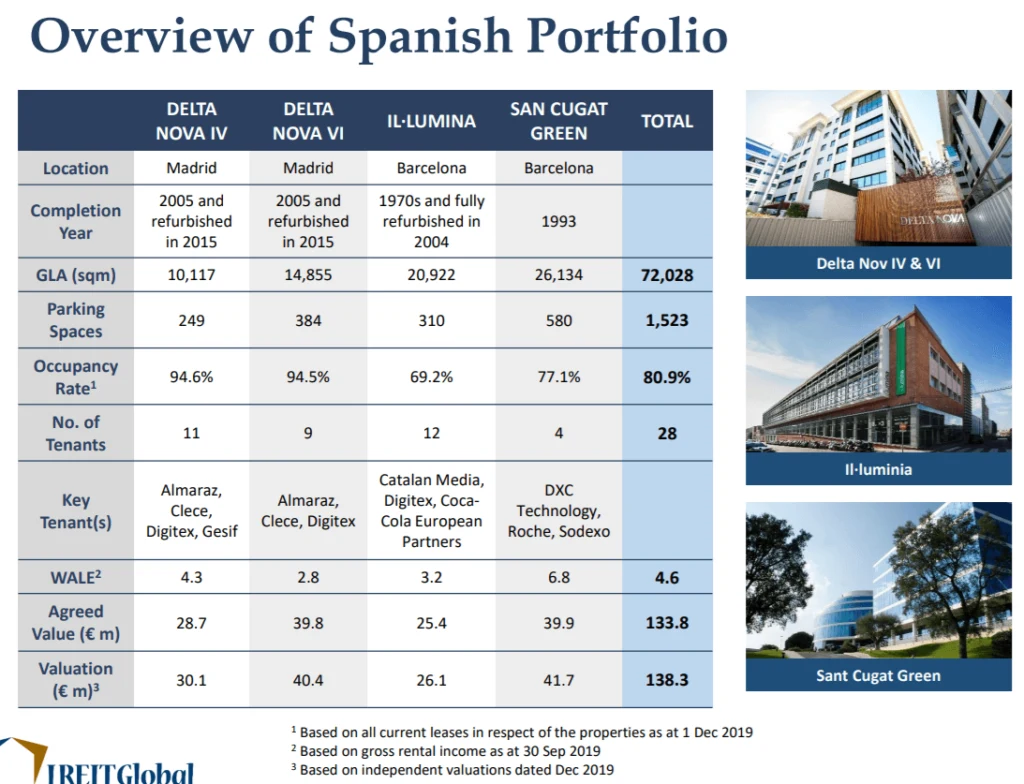

The portfolio consists of 2 buildings in Madrid and 2 in Barcelona. They are all multi-tenanted.

You can view some snippets of the portfolio in this video here.

The occupancy of the Barcelona is low. I wonder whether the manager sees this as a portfolio they can improve upon.

If it is so hard to rent out by previous owners, what are the chances we do better than them?

Since this is only one-tenth the size of the portfolio, I do not expect it to have a great diversification impact.

Clece, a cleaning company with footprints in UK, Portugal, and Spain, and Digitex are their key tenants.

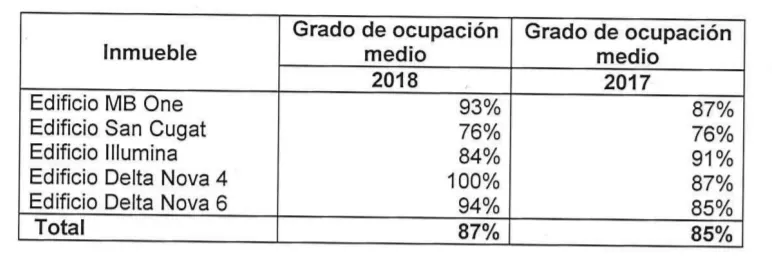

Past Occupancy

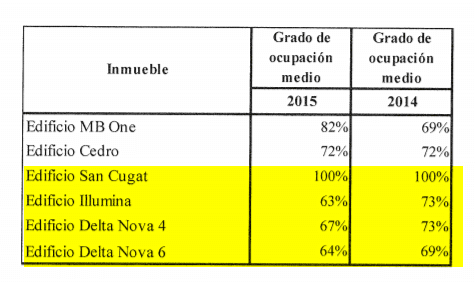

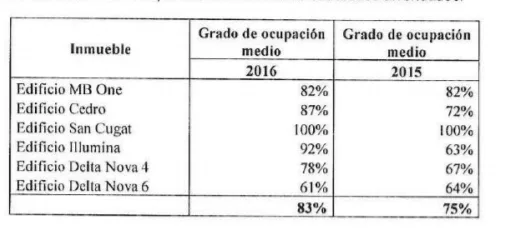

The occupancy for Lumina and San Cugat Green is not ideal right now. I wonder why Corona Patrimonial could not increase the occupancy.

Here are some of Corona Patrimonial historical occupancy figures:

The occupancy looks really volatile. Delta Nova improved massively from the past while Illumina and San Cugat occupancy has declined.

Management has said the passing rent is lower than market rent. Thus, if they could improve the occupancy or re-leased the property at market rent, there will be some upside.

However, judging by how volatile is the occupancy, I wonder if shareholders would like this to be added to their portfolio.

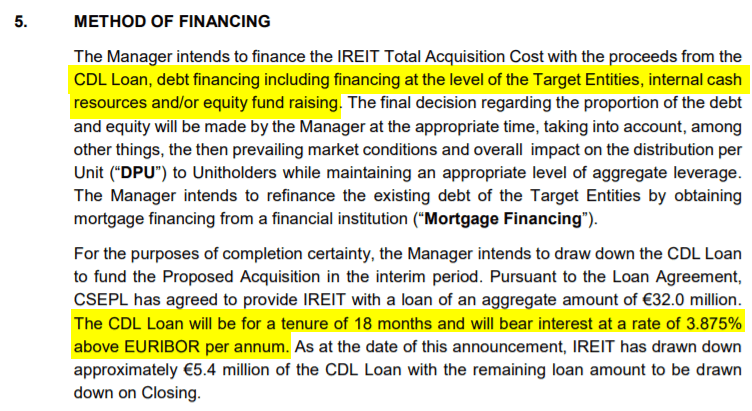

Method of Financing this Acquisition

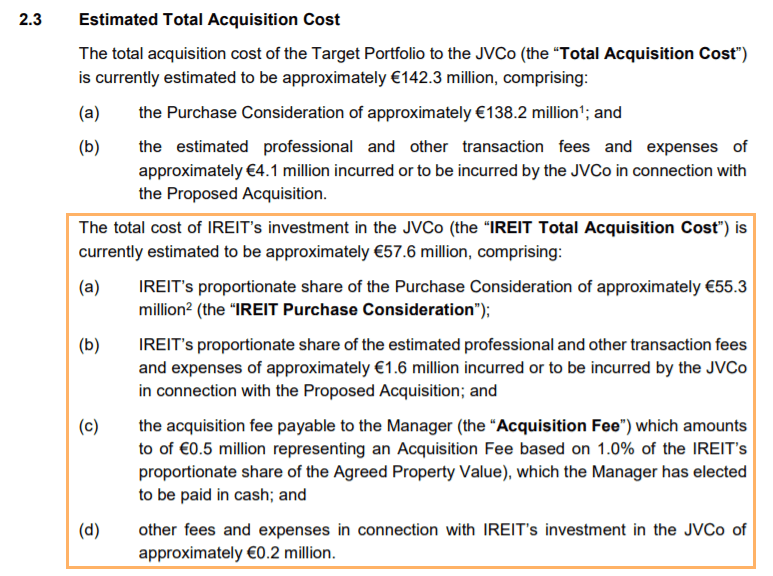

The size of the consideration to IREIT should be around EUR 57.6 mil.

Part of this EUR 57 mil will be financed by the EUR 32 mil bridging loan first. This loan looks to be pretty high-interest relative to IREIT’s current loans. There is another EUR 25 mil of loan, probably on the Target Entities level which is eventually attributable to IREIT.

I suspected that this loan at the Target Entities level is amortizing, which means you are paying part of the principal.

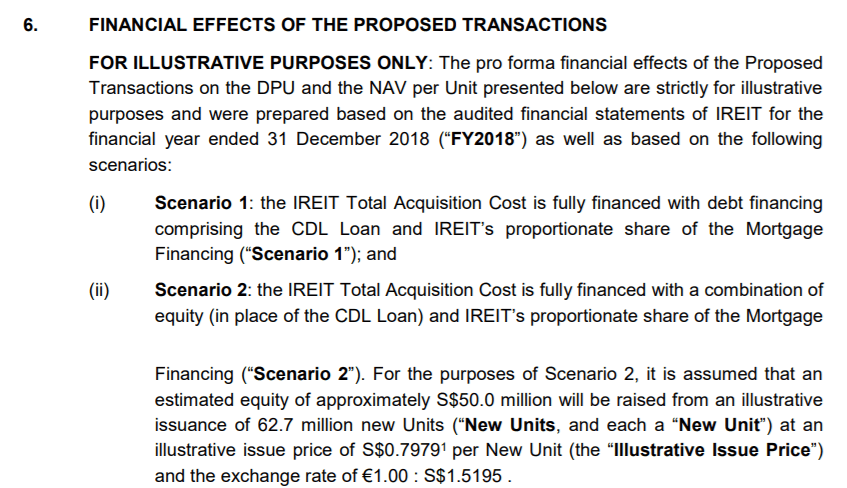

IREIT has 2 different ways of financing the acquisition.

The first way is to fully finance with a CDL Loan and IREIT’s share of the mortgage financing.

The second way is through a 62.7 mil equity issue at an illustrative issue price of S$0.7979. They will also take on their share of the mortgage financing.

If you ask me, it is weird that you would issue equity at last week’s closing price.

The document is short of details.

If they are using that illustrative price, I wonder if they can get a tight placement instead of a rights issue. Usually, the illustration communicates what they would like to do.

The way they structured this seem to indicate a preference for a placement, lightly discounted offering.

This might be a reason why they could only take 40% of the portfolio instead of 100%. A rights issue could have taken the whole thing.

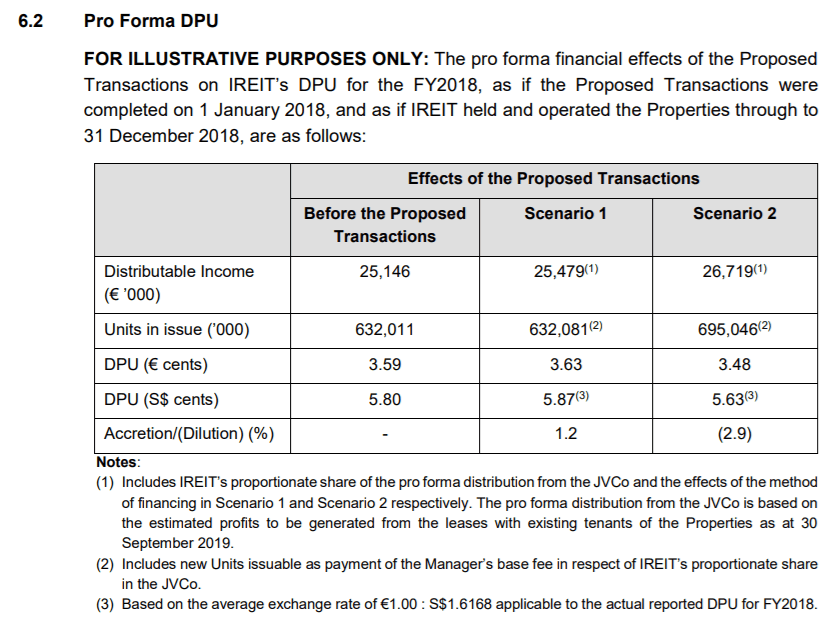

In any case, if it is fully funded by debt, the acquisition is accretive. If the second scenario is selected, the dividend per unit does not improve.

In fact, the DPU is lower after the equity issue.

I ran some of the figures and it does indicate this is correct.

Can the Cash Flow be Improved?

If we take the difference between distributable income of EUR 26.72 mil – 25.15 mil, we get a distributable income EUR 1.57 mil. Based on an equity of EUR 32 mil, that is about a 4.9% yield.

I could not figure out the net property income yield if the portfolio of properties is not leverage due to the lack of information.

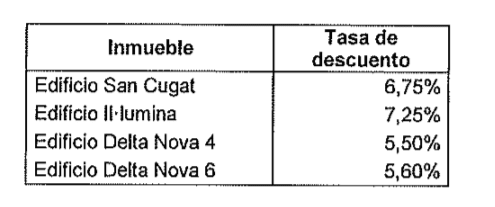

They do provide the discount rate used to value the property. The discount rate is usually higher than the NPI yield. The higher the discount rate, it means the investor is looking for a higher return to compensate for the risk.

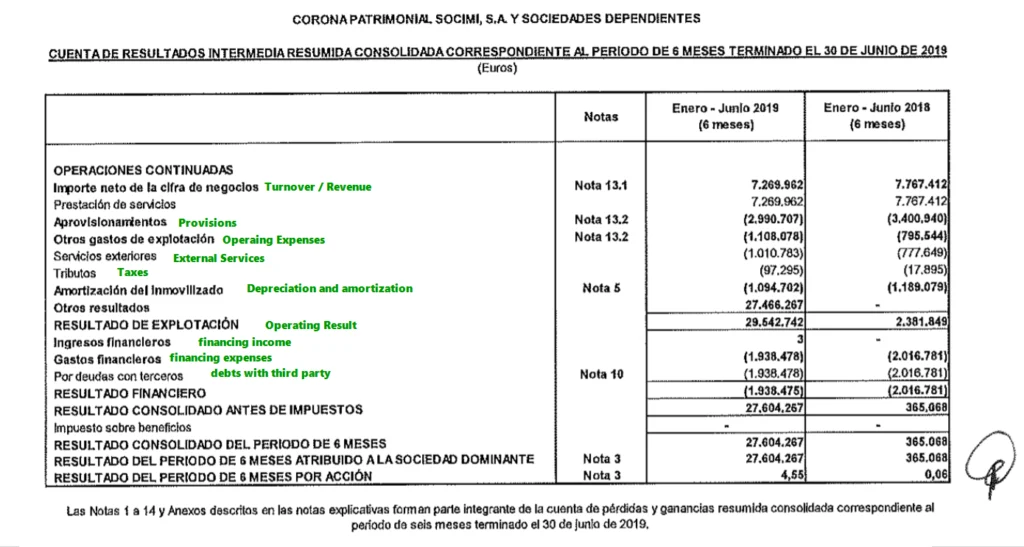

I was able to find the latest interim six-month financial statement and balance sheets.

The annualized net operating profit in 2018 was EUR 4.76 mil and in 2019 was EUR 4.15 mil. We add back the annualized depreciation & amortization of EUR 2.2 mil. The annualized operating cash flow should be EUR 6.35 mil. IREIT’s attributable operating cash flow should be EUR 2.54 mil

If the acquisition is done at EUR 138 mil, the NPI yield is 4.6%? That looks a bit low if you ask me.

Corona is paying a total of EUR 4 mil in interest expense on EUR 105 mil in loans so the interest rate is about 3.8% a year.

I suspect only EUR 52 mil is attributable as mortgage financing loan, with IREIT’s share being EUR 21 mil. If the loan rate is 3.8%, then IREIT’s interest expense is EUR 0.8 mil.

We get a net free cash flow after interest of EUR 2.54 mil – EUR 0.80 mil = EUR 1.74 mil.

EUR 1.75 mil is pretty close to the EUR 1.57 mil in available distributable cash flow. The difference is 10% and pretty close to the management fee paid in cash.

I think the question is whether they could:

- Improve the occupancy. This might boost EUR 0.5-0.6 mil

- Re-leased at higher market rent

- Re-finance 3.8% bridging loan at less than 2%. This might boost EUR 0.375 mil

Despite doing this, based on my math, it would just be about under the current DPU of EUR 3.59 cents.

In other words, if IREIT took the equity raising route, it will still be not accretive.

If they re-finance the loan and keep leverage above 40%, this would be accretive.

Why Can’t Corona Patrimonial Improve it?

Corona Patrimonial does not look like a company that has been around for a long time. It looks like it was set up to purchase properties that are in distressed in 2015. Other than these 4 properties, there were at most 6 properties in this portfolio before they were sold off.

I noticed this on Corona’s home page:

The Company, via its subsidiaries, has acquired office buildings in Spain at a good point in the cycle, and expects to benefit from the recovery of the property market. The Spanish market is improving in economic terms and seeing a change of cycle; this is reflected in macroeconomic indicators and is a sign of recovery.

The Company has a board of directors comprised of three directors whose areas of professional experience -including participation in processes for the acquisition of assets in Spain and abroad, the management of real estate companies or the implementation and supervision of management platforms in those companies- complement each other.

The Group’s leases are based on the selection of clients with economic solvency that provides security and visibility of long-term income, the aim being to increase the current occupation percentage.

The assets are located in the main business and consolidate offices areas of Madrid, Alcobendas and Barcelona (Sant Cugat del Vallés and Espluges de Llobregat) and have an average age of less than 14 years.

They probably have 4 years to stabilize this portfolio but from what we see, I wonder if it is improving (I cannot read Spanish btw).

Some More Information on Corona Patrimonial

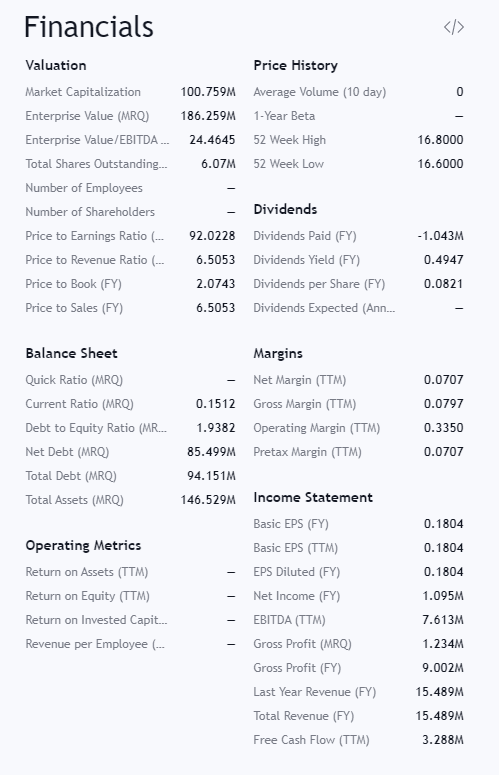

Corona is listed on the stock exchange. Here is some information I could gather:

This is likely Blackstone’s way of exiting this distressed deal (when they listed the company). The way they sell off this portfolio part by part reminds me of my MIIF heyday.

After this sale, there will be no more of this listed entity.

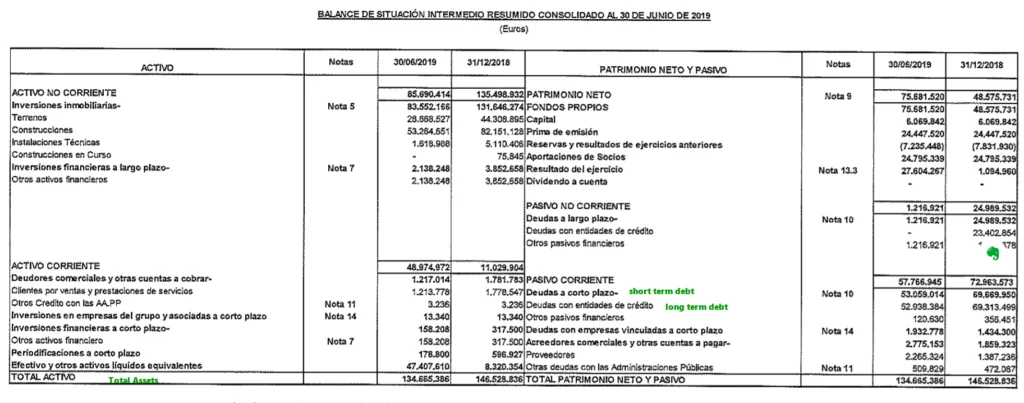

Tikehau and IREIT will purchase these assets at EUR 138 mil. Based on this information, last year, it was probably valued at EUR 146-149 mil. Currently, the REIT is traded at EUR 100 mil.

So through this sale, the listed REIT can wind up closer to their net asset value.

Summary

Whether this is a good deal for shareholder or not will depend on 3 factors always

- Whether the portfolio is operationally sound or provides upside for improvement, or the place where the property is situated is going to experience low to high employment, population growth, better demand, and supply dynamics

- The quality of the manager

- The valuation

You can read more about this here in an article in my REIT Training Center.

IREIT’s current portfolio is rather concentrated tenant wise. Thus adding a portfolio of multi-tenanted does help, if they eventually also buy the other 60% of the portfolio.

But when I look at the volatile nature of the Spanish portfolio’s occupancy from 2014 till 2019, I wonder if IREIT will get their hands full managing it.

There could improve the cash flow but you wonder what could they do that the previous owners could not.

An equity raising would not be accretive, even if debt is refinanced, and rental occupancy is improved to a certain extent.

I cannot determine if the portfolio is a bargain or not. On Corona’s 2019 interim statements, the net equity is listed as EUR 131 mil. Not too long ago it was nearer to EUR 145 mil. A lot of the valuation is determined by whether the properties are well leased out.

This deal feels underwhelming. Unless the manager can explain what a blue ocean the demand and supply dynamics are in Madrid and Barcelona. For well-informed readers, you might have a different perspective of this.

If the demand and supply dynamics, and there is a shift in the Spanish economy, this deal might be more worthwhile.

I write more about REITs in my Learning about REITs section. It is free.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024