Louis Blanqui was a French socialist revolutionary who devoted himself to his ideology and fought against the world.

He advocates the dominance of the proletariat and extreme violent revolution. The word ‘Blanquism’ became synonymous with armed struggle. He fought fiercely during the French revolution in 1830 and participated in many fights and demonstrations. He spent 30 years or nearly half his life in jail.

Karl Marx was greatly influenced by the ideology of Blanqui and was expelled from France. Marx published Das Kapital in 1867, while he was in exile in London. During the 15 years spent writing the book, he and his family lived in poverty.

He dedicated himself to research, but his family lived in miserable conditions. Of his seven children, only three survived.

This was the part that infuriates me the most.

I think we can commit to our passion or our interest in something. But I think you have to be aware of the need to put food on the table at least. If you do not work, food seldom magically appears (unless you go and scavenge for them)

Karl Marx’s influence on economics is just one economist profile that I learn from Principles of Economics.

I was asked to review this book, so it took a few train rides for me to eventually finish it. When they pitch the idea of this book to me, I thought the idea of a manga style economics book will be interesting. (Stay tuned till the end of this article. There will be some discount promo code and a giveaway)

I scored A2 for Economics during my JC time.

That was really lucky because prior to my A levels, I have never passed ANY of my economics essay question paper.

My economics teacher used to teach in such a formulaic way that we would be able to answer the questions. After that, I did not comprehend why things are this way. I would also struggle with how economics relates to real life.

Principles of Economics by Gregory Mankiw came at a time to see if I could refresh some of these economic principles. Gregory Mankiw is a Harvard economics professor. When I started learning about the markets in the early 2000s, Mankiw’s blog was one of the blogs that I followed.

This book is nearly 300 pages but you would not have a problem reading it because it is mostly illustrated. It focus on a few areas:

- How people generally make decisions

- How people interact

- How the economy as a whole works

- Thinking like an economist

- Ten propositions most economists agree on

Personally, 3 to 5 was pretty good to read.

The Destructive Nature of Rent Ceilings

I somehow have the idea that rent ceilings and floor creates a lot of inefficiency or losses. My favorite part of the book was where they highlight the 10 propositions most economist would agree on.

Placing rent ceilings, on the surface seem to be implemented to help the poor. Imagine if your REIT could not raise rent. Your maintenance and replacement costs go up with inflation but you could not raise the rent.

So eventually they fall into disrepair.

The ones who benefit the most are the rich because they can rent at such a relatively cheap rent. This free up a lot of free cash flow for them to even grow richer.

The page above shows the unscrupulous things Donald Trump can do to kick out tenants (which he could not due to rent control laws)

The Problem with Populism

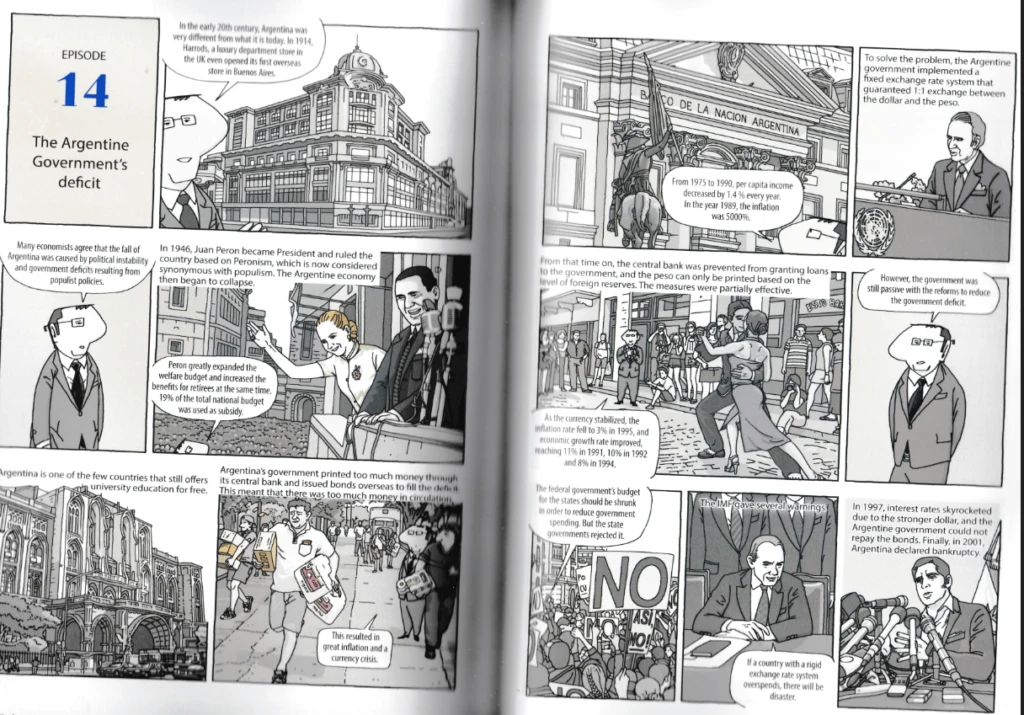

I was surprised how great Argentina was last time.

If we do not exercise some fiscal restraint and do not have the capability to meaningfully reform, we just make the situation worse. A large federal deficit, in the long run, will create many residual problems for the country.

Designing the Right Incentives

Left on their own, the free market might make some people better off than the others. The government should not interfere more than they should.

But where is the middle ground?

That is where putting thoughts into design comes in. Mr. Mankiw mentioned the importance of knowing how to set conducive incentives. If you are able to do that, you can create extraordinary results.

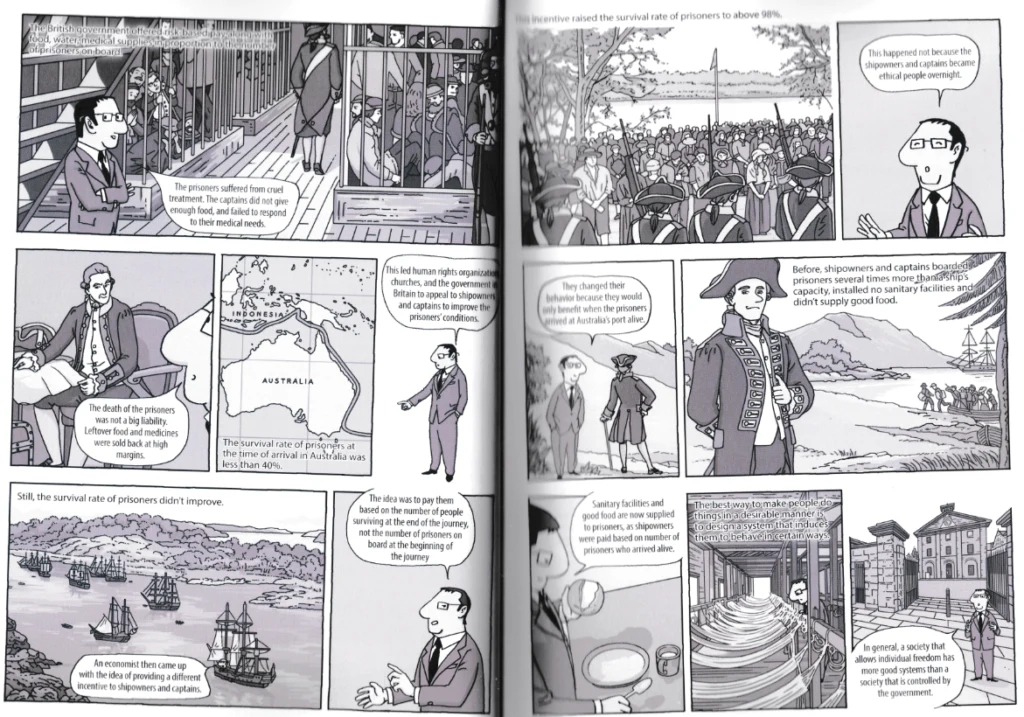

The page above shows how that by changing how captains are renumerated, it shifts the incentives of the captains thereby resulting in a higher survival rate for people they care much less about.

This is how different governments try to police their countries. When things do not go the way where it benefits everyone, they shift the incentives.

At one of my short finance course, I attended as an engineer in my last job, the course trainer shared with us a part of his old job.

He worked in Shell back then and how do we motivate people to have good focus?

You put a pool of money in front of them and make them think about how they can earn it.

We may always have passive colleagues that ride on the success of others. A bit too much sometimes. In an environment where everyone has a common goal that is motivating enough, those that subtract more from the team rather than add to them will be called out. You have more people willing to put in the effort if they can really see how their work translates to a better life for themselves.

How to Use This Book

The Principles of Economics is better used as a primer if you are trying to get immersed in the world of economics.

Economics can be a very dry subject, and this book helps us by introducing us to the important economics players in history.

You can become interested in these players from another perspective. When you dive deeper into the economics texts next time, you are better able to connect with the whole subject better.

I suggest having this book lying around so that some of your younger siblings, nephews, and nieces can pick up and start reading. They can then ask you questions that may lead them down the economics path.

This book is better as a primer than the be all end all guide to economics. It explains demand and supply, Philips curves but not to a deep enough level that you can actually make use of it.

Book Giveaway and 20% Discount

As readers of Investment Moats, the distributor of Principles of Economics (Graphic Edition) can get a 20% discount if they use our PROMO Code: POEMOATS20.

Here is where you can get more information of the book @ CENGAGE.

This code is only valid if you purchase from CENGAGE directly and valid till May 2020.

I will get an affiliate fee if you purchase the book through CENGAGE with my promo code but really, only buy the book if you find it useful otherwise don’t waste your money.

I have 5 books to give away for the readers of Investment Moats.

Those who win the book can personally meet up with me. If you have some doubts about your financial independence or investing path, you can ask me about them.

Here is how you can win them:

All you have to do is write in ([email protected]) about what you need help on what kind of problems you faced along your wealth-building path. If I think I can help, you win the book and we can have a conversation.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024