Recently, my friend gave me Atomic Habits by James Clear.

James Clear is such a good writer. At this point in my life, I observed that I am having trouble reading more and more.

This is definitely not a good situation because a key part of my work… involves reading and processing what I learn.

One of the key lessons from James that stuck with me, may not be found in the book.

There is a season for taking in knowledge, and there is a season for turning that knowledge into productive things. If we spend the majority of our time taking in knowledge, we might not have the bandwidth to turn it into productive stuff.

James reminds us that while learning is important, we need to deliberately try and internalize what we learn more and more. We then practice or use what we know in the work that we do.

If not, we spend most of our time just consuming and nothing good came out of it.

A Great Method to Reflect and Internalize Investment Learnings

One of my readers a year and a half ago shared with me a practice that he did.

He was telling me about this stock Thor Industries that he has been looking into and he is open to letting me take a look at his slide deck.

I thought the idea about his slide deck is interesting by itself. He shared that whenever he is interested in a company that he would potentially invest in, he would try and organize what he learned about the company, its strengths and weakness into a presentation slide deck.

Since then, I noticed that more and more of my note-taking happens in a set of slide decks instead of just word documents or a third-party note-taking application such as Notion.

Here is a shot on one of the slide decks that I have at work:

We are in the business of coaching our clients to help them make sense of this seemingly chaotic investment world so that they can view the world with the right lens.

So we need good case studies to communicate the point across, and we also need to arrange these case studies.

Slides are uniquely laid out as cards and I think we can treat them like snapshots in our minds. We can shift these cards around to arrange them in the right order.

Each card is pretty self-contained.

There is a limit to how much content you can put on one slide. Sometimes, you are forced to explain an investment illustration that you came across.

If you managed to arrange the cards in good order and review it from time to time, it might be easier for your brain to remember the cards.

If you have a slide deck, you can readily use it to explain to someone the subject. At most, you can create a copy and take out certain slides.

Each slide deck is topical.

We often just keep reading and reading, watching and watching.

Creating a slide deck for yourself is a commitment to see if you manage to internalize what you have consumed.

If you would like to have more conviction in your investments, create a slide deck on the company you invest in. Put in the qualitative business case, and the numbers.

The slide deck is a combination of your investment sophistication and what you learn about the company.

If you struggle to create a coherent slide deck, do you think that you have a clear idea of what you are trying to invest in?

A Very Visual Way to Inspire and Motivate Yourself and Others in Your Wealth-Building Journey

Creating slide decks for companies you want to invest in is more intuitive but you can also create slide decks to communicate with others.

One of the more prominent members in the 1M65 Telegram group (a Telegram group to help people make sense of living with CPF) have this very impressive set of slide deck about how he manages his money.

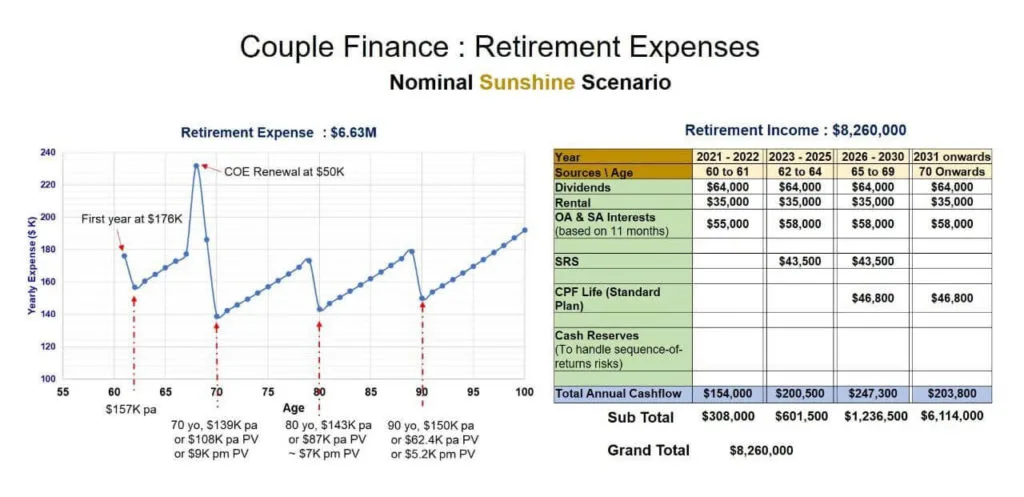

This slide shows how much passive income he will get at a different phase of his life moving forward. Your cash flow is not always equal.

Notice that he labels this the Sunshine Scenario.

It shows that he understands that the future is uncertain and that while we can plan for a scenario where everything is nice, we should also plan for scenarios where things may not turn out so well.

This is something you will get a wealth adviser to do, but this member creates managed to internalize what he learned over time and did this himself.

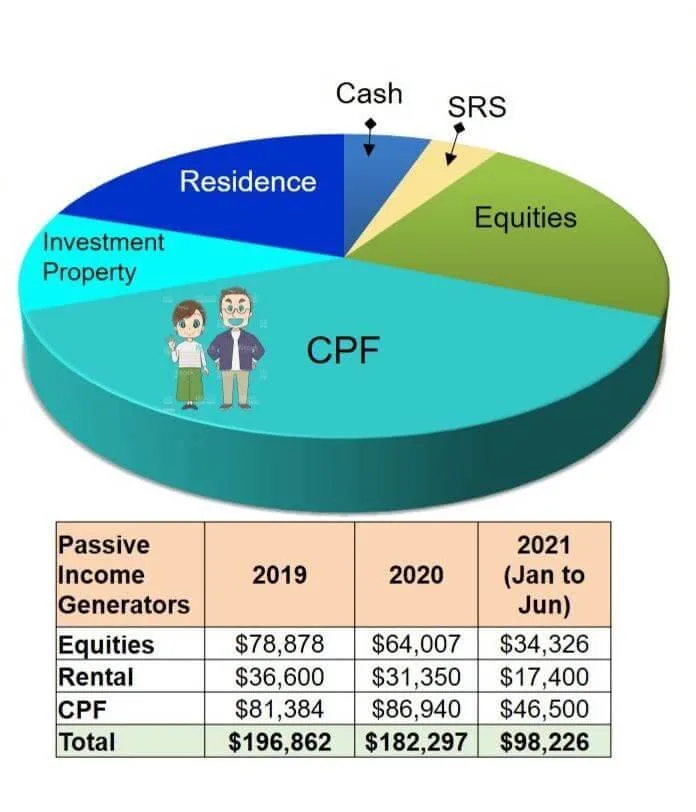

This one zooms in on his income from 2019 to 2021 (yes, it is annually $182,297 in 2020).

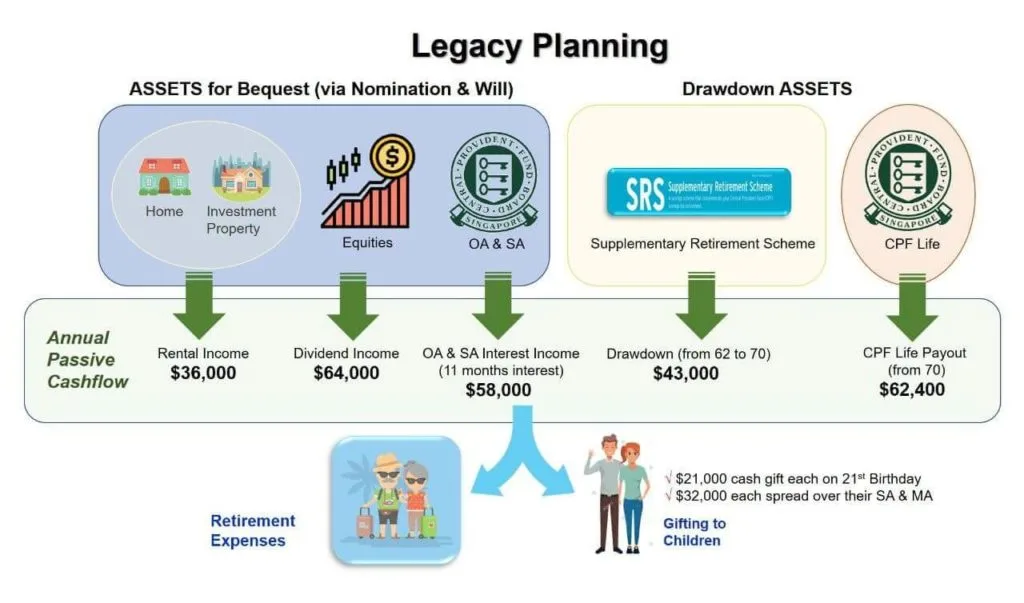

Here is his framework for Legacy Planning.

As a financial commentator, I can see that he has a cash flow priority. In his models, cash flow takes a central figure.

Whether we agree or not, we have to acknowledge that in order to create a slide like this, you got to have enough clarity in your head, distil things down and create things like this.

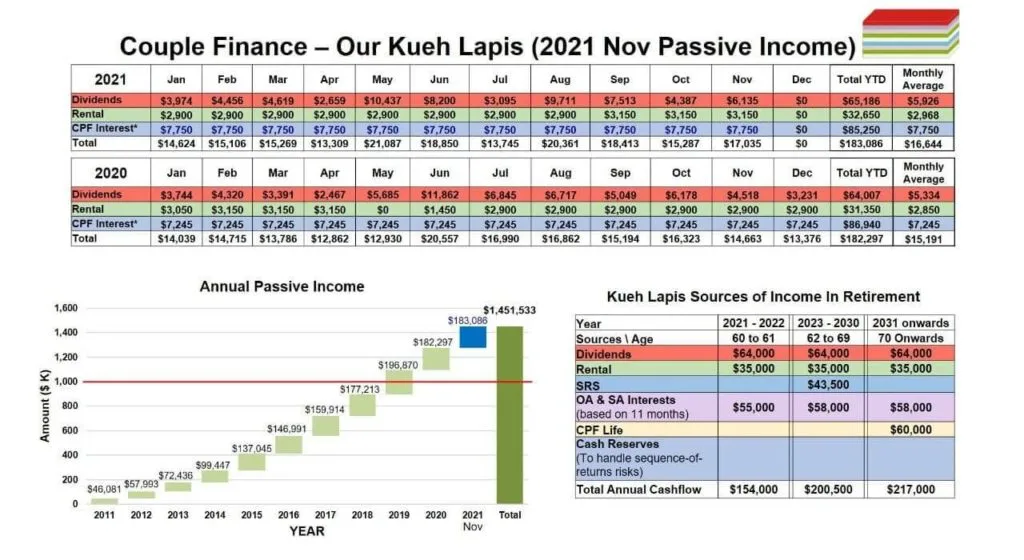

This slide shows his passive income by month and how much income he has aggregated over the past decade.

Do we all have to create something like this?

I would constantly receive questions from friends what are the available software, SAAS to help them make sense of their financial life.

This might look like a lot of work to you, but I think this person enjoys it enough. Your situation may be unique and you wish to tell your financial life in your own way.

Sometimes, instead of relying on some sophisticated tool, perhaps we just need to set aside some time and draw on a blank slide how our financial life looks like.

Do you do something similar? Do share with me your own unique way of internalizing what you learn along the way.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Revhappy

Saturday 15th of January 2022

Very well said. I also have a very elaborate networth tracker in Google sheets and my value averaging plan for investment over the next 2 years. Setting up this kind of plan has really helped me with sticking on the investment path. Now I don't fear a crash, infact I look forward to it, since I have made a value averaging plan which benefits from a crash.

MT

Saturday 15th of January 2022

Interesting post there. I recently heard of the book and plan to read it some time in the near future because I agree with the premise of making small but persistent changes in life can be more effective than attempts of making big changes that have a tendency to be unsustainable and easily lapsing back to old ways. But I digress.

I work in academic research, so making slides is a staple task (alongside writing manuscripts). Slides are not just used for the purpose of making presentations, but can also be used to guide lines of thoughts / investigation during projects. Academic research projects in general deal with unknowns and unexpected results. Consequently, slides can help collect results, thoughts, and conclusions together. You can do theoretically do the same with a Word document, but most will find Powerpoint slides to be more handy at this. Granted, there may be more specialized tools that are more suitable, but Powerpoint is highly available in most organizations and most people know how to use it such that it sticks around.

Kyith

Sunday 16th of January 2022

HI MT, you sum it up perfectly! There were a few times when i got frustrated trying to squeeze things into a slide or a couple of slides and was wondering if i should do it in a word but sometimes that is the beauty of this. I can just imagine the situation where i wanna rearrange my thoughts in word and find it more awkward.