Painful.

That is the only word that I can use. These days, I basically lost 1 year of my annual expense in 1 to 2 days (and continue to lose it). But what shocked me in a way was how ugly the tape was.

I shall not say too much as some of the folks in the Telegram group said my posts were often too long, too cheem. So I will keep this short, but I think it is going to be very cheem still.

Why? Because if you expect that I know what is going on every step of the way, then I am afraid I would have to disappoint you by saying I am still learning some of this stuff as well.

A review of Koyfin’s rather comprehensive dashboard showed that everything is down except for crude oil and the VIX. No factors were up. The 20-year Treasury is down 3%.

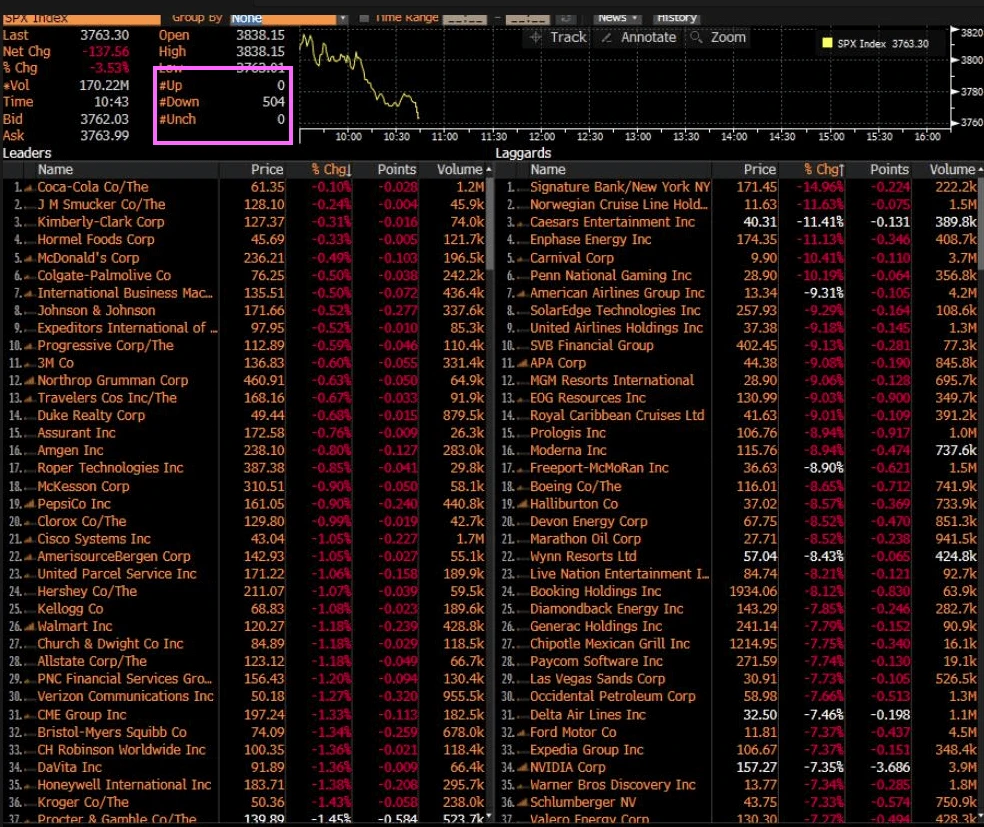

At 10.40 pm yesterday night, zero stocks on the S&P 500 were up.

In 4 days, the S&P 500 went down 9.6%.

Many people would attribute this fast move to some big news but actually, the news was not too different from the past. Various countries are fighting supply and demand imbalances, and certain central banks are trying to reduce the demand by increasing rates to reduce borrowing downstream, create cautiousness and reduce discretionary spending in order to cool demand. They are going to be successful on the demand-push side but they cannot do much about the supply side.

But this move today just looks like just systematic selling. In September last year, I wrote an article explaining that more and more, the options market seems to be affecting the underlying financial markets more.

It is some rather cheem stuff and admittedly, it is something I paid partial attention to because if it is something that changes things, maybe it is a good idea to study deeper into it.

As we get closer to the options expiry window (this Friday), depending on where the index is, in order for the options market makers to remain neutral in their position, they might be a supportive force or a force that amplifies on the downside.

In these few days’ cases, the index ended up below the pivot point, and we get a positive feedback loop that amplifies the selling to the downside.

Here is a rough simulation:

The index moves down -> options market makers need to sell more -> traders get in the red and due to bank regulations after GFC, they cannot lose too much so they sell -> markets today are being dictated by passive ETFs and funds more and more, which reduce the liquidity. When the index gets sold, the underlying stocks systematically get sold -> more selling causes retail panic and they will sell more -> more people use options to hedge or speculate so they buy more puts -> options market makers sell the puts to them so to hedge they need to sell more stock to remain natural -> … you get the picture.

So what we get is a financial system that can be rather “pinned” like in 2021… or if there is some positive or negative news, there is a positive feedback loop that takes the price much higher or lower in a short span of time.

If I am right, we should see a couple of days of this kind of accelerated selling. Given where the VIX is I would not be surprised in 2 days we are down 8% more on the S&P 500.

So what would stop this drawdown in the markets?

We got to see but Friday is the options expiry and after that, next week there may be a massive gamma unclench and the market would move more freely.

According to Goldman Sachs’ Flow Trader Scott Rubner, during this option expiry window, the notional value that comes off is equivalent to $3.2 trillion. The number of funds, banks, and insurance companies that use options in their business is getting so much that the market structure may be altered.

$3.2 trillion is equivalent to 6% of the entire US equity market.

You can imagine that up to this Friday, there is some force in play due to where the market is and the options positioning then after that this force is no more.

Being free can mean positive or negative. In the case of March 2020, the market hears positive news from the Fed that they will ramp up their support of the market right at the edge of options expiry, that freedom allows the market to move up damn fast.

But if we get some negative news, then the market will also move down damn fast.

But Goldman Sachs Scott Rubner feels the conditions are there for the market to go up after the expiry. The primary reasons are due to corporate buybacks, and short-covering.

Much of the direction will depend on whether there is some good news or not to trigger a rally. This may sound like nothing much but things could turn very easily with some news and some buying.

Surprisingly, during the week of the 6th of June, there was +21 billion worth of mutual fund inflows which is the largest weekly inflow in 10 weeks. The money seems to be deployed in the USA and not the rest of the world.

If there is any rally, I suspect it will be a short-lived 2-week rally at most. Will I be correct? I am not certain but just observing.

Don’t treat this as investment advice. If you don’t understand this, it is probably a good idea not to use any of this information in execution.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Revhappy

Thursday 16th of June 2022

I am on vacation in India right now, so although I watch the screen, I don't get affected as much as on normal days when I am in Singapore. So I think we just need to switch off our mind from the markets and focus on other interesting stuff in life.

The best returns are made by people who just forget about their investment.

Sinkie

Tuesday 14th of June 2022

USD is also the only other asset that is up lolz.

It's too soon for any rally to be sustainable. The Fed is now your enemy. So yeah, any fast rally now should be seen as counter-trend bear trap headfakes.

Fun to put in 0.5% or 1% of your warchest on these rallies though (or short term shorts if you're inclined). But not yet time to back up the truck & pump in 30% of your warchest.