My friends Victor and Rusmin over at Fifth Person informed me that they recalibrated their Investment Quadrant course.

I reviewed the course materials, and I got this to say:

If I were to impart what I know about quality value investing comprehensively and sequentially, I could not do it better than this course Alpha Quadrant.

That is about the highest rating that I could give the course.

The course may or may not suit you, and you should hear what I say.

A Course about Quality Value Investing

Alpha Quadrant is a course for those who wish to:

- Be a do-it-yourself portfolio manager investing in a portfolio of individual stocks.

- Executing your investment philosophy that good companies at reasonable valuations are the way to go.

- Do not wish to frequently sell stocks that revert to the mean close to their intrinsic value but wish to focus on curating and holding a group of companies.

Alpha Quadrant will focus on companies that exhibit the characteristics of businesses with high gross profit margins, reasonable ROE/ROIC and able to grow their revenue over time.

But if we delve deeper into Victor and Rusmin’s philosophy is about buying companies with an economic moat, or emerging economic moat, with a quality balance sheet.

This is what Superinvestors like Warren Buffett do, and where Monish Pabrai eventually shifted to.

The stocks synonymous with such characteristics are Moody’s, Verisign, Factset, SPGI, Autodesk, Apple, Google.

In the past or even now, you may always wonder if you can have a systematic way of creating a portfolio of these businesses, buying them at reasonable prices, and at the same time not falling for the “pretenders”, then this may be the course for you.

The Empirical Evidence Behind Investing in Quality or High Profitability Businesses

At a certain point, academics wanted to see whether what Warren Buffett do can be replicated.

And they narrowed that what Mr Buffett did is an intersection of two style factors: Quality + Value.

Quality refers to the stocks which prioritize a combination of a cleaner balance sheet, higher return on equity/invested capital and a few other metrics. Different people have their own definition of what is a quality company. Victor and Rusmin have their own set of metrics as well.

What is synonymous with quality may also be gross profitability, which refers to prioritizing companies that have higher net operating income relative to their book value. In 2013, Professor Rober Novy-Marx discovered that gross profitability could be a factor that generates significant excess returns over market returns.

Value refers to investing in cheaper companies relative to the more expensive ones.

Value and Gross Profitability are applied in Dimensional Fund Advisers fund, which fits into my Investment Philosophy.

How does this compare to index investing?

You can look upon selecting and investing in a portfolio of more quality companies at reasonable prices as taking more risk than the market, but these are risk where there are empirical evidence that you get compensated with higher returns, over different markets, as well as different time periods.

In the chart above, I plotted the Fama/French US High Profitability Index (select the top 30% of stocks with higher operating profitability in the NYSE listed company universe) versus the US Large Cap Research Index.

Each dot on the line represents a 15-year return period. A dot on 15% means that for the period of 1975 to 1989 the annualized return is 15% p.a.

What you will notice is that the blue line is consistently above the light grey line.

Victor and Rusmin is not discovering something new, but there is research showing you would get a good outcome following such a philosophy.

The Challenge You May Face Going Down this Path

I choose not to go down this path of individual stock investing, but time and again, there will be someone asking me about my opinion on investing in individual REITs, High-Quality stocks compare to an ETF (If you wish to invest in higher quality companies, there are ETFs that target that).

I will explain that you could, but I am unsure if it is worth it for you to stock pick, and you need enough sophistication.

Yet there is people who are still interested, but what they don’t realize is that they will need to embark on a long journey of learning. We basically learn all that we know over at least a decade, but I think many felt that what we learn can be picked up in a month by learning on their own.

How is that possible?

There is enough things for you to figure out (not just read, but really FIGURED IT OUT), and some of them are below:

- Learn to read the financial statements.

- Recognized what are the metrics that are more impactful to you, which are less but still necessary and which metrics are sanitary.

- Where to find the info you need about the company you are researching on?

- When do you sell? Should you think about selling at all?

- How many high quality stocks is the right number?

- What separates those companies that grows very well exponentially from those that doesn’t?

If I put it out here, it means that you can figure it out on your own.

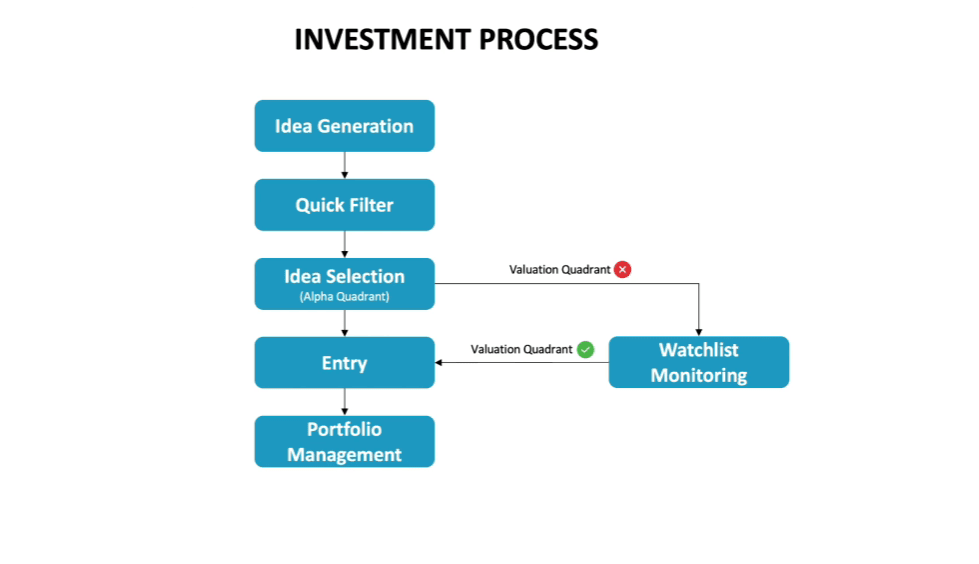

But what is toughest is… how do you frame all these in a sequential order, or a decision-tree mentally?

It is not only about knowing but about systemizing it.

As I review the curriculum, I really appreciate how much area Alpha Quadrant covers and how they sequence things because that is likely how Victor sequences his stock prospecting process mentally.

Alpha Quadrant is an online course that covers the following area:

- Setting the Stage (4 sub topics)

- Finding investment ideas (4 sub topics)

- The industry life cycle (3 sub topics)

- Income statement (5 sub topics)

- Cash flow statement (4 sub topics)

- Balance sheet (3 sub topics)

- Key ratios (4 sub topics)

- Business model (5 sub topics)

- Economic moats (6 sub topics)

- Growth drivers (4 sub topics)

- Key risks (9 sub topics)

- Management matters (4 sub topics)

- Capital allocation behavior (5 sub topics)

- Valuation(6 sub topics)

- Portfolio management (4 sub topics)

- 3 Case Studies on business that satisfy Alpha Quadrant.

The difference of video form compare to a book is is that it can be rather interactive. Books can be more detail, but I would contend that in both format, we can gloss over certain aspect and not get things.

The breadth of Alpha Quadrant’s topics pre-empts you the breadth of knowledge areas you need to be aware of. This should give you a warning of the work that lies ahead for you.

Here are some notable mentions from going through the course:

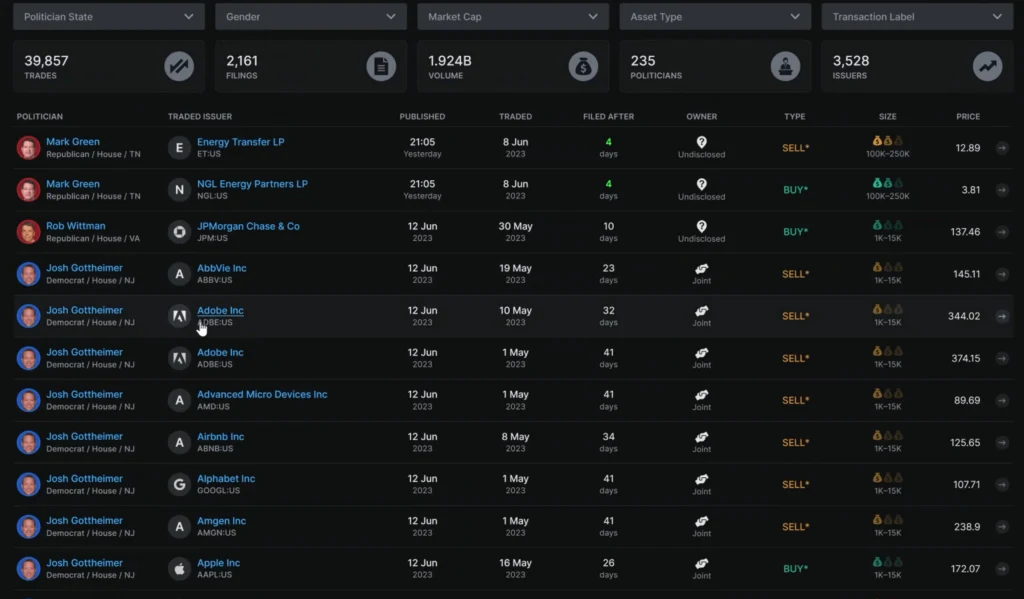

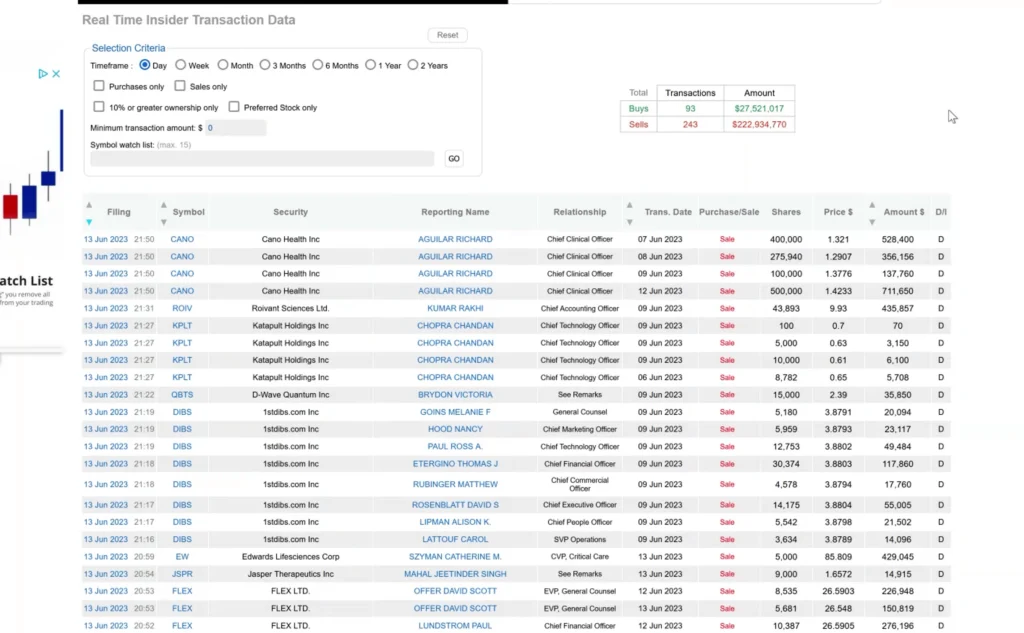

There is this part of the process that we consider as idea generation. Where can we get our ideas from?

There are ways, and the folks at Fifth Person will show you the available resources that you and I can access to.

Victor, Rusmin and I learn about this stuff through asking, and listening to others who are prospecting similar businesses. If you are on your own, you might not know these tools exist at all.

Sometimes, we bump into this stuff by coincidence.

But you need to do less bumping with what they point you to.

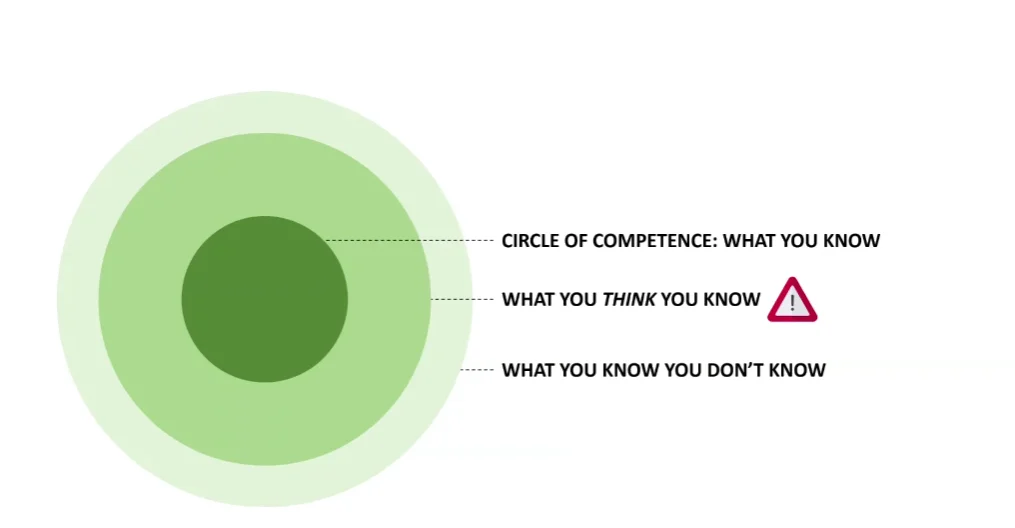

In investing, it may be important to recognize what you and I know we are unable to know, and also recognize the things we think we are able to know but in reality we won’t be able to know.

If you get better, you may realize that we don’t have a choice but to just stick to our strengths.

If no one teaches us, we have to construct our own investment process framing like the one above. If you are less sophisticated, then you will have a more naive diagram above. If you are more sophisticated you will distill to a very nice, high-level process.

Framing, in my opinion is critical to help communication with others.

Portfolio management is something we don’t think about until when some shit hits the fan. It is during those times that we realize we fail to understand sizing that well.

This lack of awareness is normal, because there is just so much things to be aware of.

LIVE Web Classes and Student Forum

Alpha Quadrant is a curriculum that takes a hybrid approach to teaching.

There is just so much you can absorb learning on your own but what if you have some gap in understanding?

Alpha Quadrant comes with a full-day web class where you can learn from the trainers in a more interactive manner.

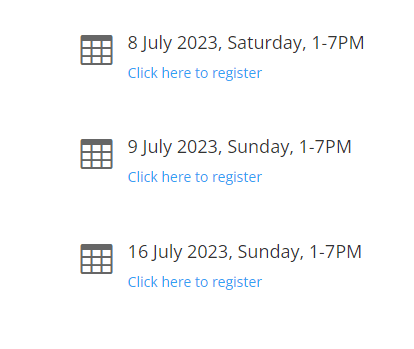

Here are the classes:

There is also a student’s forum where students can have in-depth discussion with like-minded fellow attendees:

Sign Up For Alpha Quadrant Today

If you always wanted to embark on a journey to create a portfolio of great businesses and own them for a long time, but are not sure how to get started, then Alpha Quadrant may be suitable for you.

Alpha Quadrant is LIVE now.

The course is currently SGD 597 after $100 off.

You have until 16 Jul (11:59 pm) to sign up.

To sign up, you can use my link here to apply.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024