I have been known to wear many hats, from writing about personal finance, index investing, wealth management, financial independence and commentating on all the affairs surrounding me with regards to money.

What may be less known to most today is that I accumulated most of my wealth through active individual stock investing.

In the past, I spent my time prospecting stocks in Singapore, Hong Kong and the US to identify opportunities for good businesses that I can invest in for the long term. Sometimes, we are able to find special situations where there are upsides for limited downsides.

These sometimes culminated in research such as whether M1 and Starhub is a value trap or the Transportation business of ComfortDelgro.

You may wonder what I would call the style of investing I did in the past. Some people would liken it to value growth investing, or CanSlim. Perhaps dividend investing.

I tend to keep it simple by calling it Active-management of an individually-managed portfolio. I invest in an individual stock. I spend enough time on it. So this is probably the most appropriate name.

If we strictly wish to pigeonhole the Smart Beta style of my investing, it would be a mix of value, high dividends, and smaller companies with higher quality.

Active management of my own portfolio would not be suitable for everyone but I used to enjoy the process of having this second job. This second job would revolve around looking at financial statements, and spending my waking hours thinking about the qualitative aspects of the businesses that I own, or am interested in owning.

However, if you have always been interested in this path, you might wish to learn how to do it well.

Learn about Active Stock Investing through Investment Quadrant 2022

This post contains affiliate links.

In the past, many have asked me do I have a course. Unfortunately, my brain and mouth are so incoherent that I don’t think I would do a good job teaching other people.

If you wish to find out my thoughts on managing your own portfolio of individual public listed companies, you can read my consolidated stuff here.

If you wish to learn about it in a lesson format, I will try to link you to the resources that are good, and won’t cost you an arm or leg.

And it so happens to be closest to how I look at active stock investing and you can get access to it.

When it comes to individual stock investing, my go-to resource is my friends Victor and Rusmin over at Fifth Person have come up with their course Investment Quadrant 2022.

And I think it’s a suitable paid course to go for if you wish to shorten your learning curve and get up to speed on active stock investing.

To me, this course is suitable for you if:

- Wish to embark on individual stock investing across multiple industries and not constrained to a particular country

- Wish to learn about a proper, full investment process, from idea generation to the maintenance of a portfolio on an ongoing basis

- Wish to learn about the different ways of valuing companies

- Look upon investing not just gambling on a piece of paper but as speculating on listed business

- Wish to equip themselves with the competency to get started

- Wish to learn from practitioners how they make use of each competency area, within the full set of competencies required for investing

- Has time and is willing to put in the effort to look into individual stock investing? Also for those who think this is a good skill-set to invest upon

Students of the course learn through a series of articles and video-based modules. These modules will go through all the competencies of their investment methodology.

Thereafter, students will be able to sign up for 6-hour Investment Quadrant Webinar Workshops conducted by Victor and Rusmin (usually during weekends).

Through these workshops, students will be able to refresh or be enlightened on the nuances of each module that they might have missed out on. During these workshops, case studies and questions & answers will be carried out, so that students can come full circle to see how the concepts come together.

And students can sign up for these workshops as many times as they wish (but your mileage may vary)

There is also an online question and answers medium where students can interact with trainers and fellow students

The cost of the Investment Quadrant 2022 is US$358 (approx SG$497). This is a $200 discount from the original price of SG$697.

Investment Quadrant is LIVE now but only in a limited window.

If you are interested, you have until 10th July, Sunday 23:59 to sign up for it.

Why I think Investment Quadrant May be Suitable for You

When I put out something here and recommend it to you, it’s also putting my reputation on the line.

So if I work with the folks who are not competent, my reputation gets shot.

There are those that are strong, but they cannot teach or choose not to teach. There are those who think they know a lot but they actually know less than what they think.

The scope to learn for individual stock investing can be wide. Learning about how to do idea generation, how to screen for companies in a quick manner, how to deep dive into companies, and valuing companies is multi-disciplinary.

Investment Quadrant 2022 gives you a glimpse of the entire scope.

Once you know that, then you can have a checklist to get better in each discipline.

Again, the sound investment process will drive sustainable returns. Your competency is not just one area but being relatively competent in all the areas will drive your results.

Investment Quadrant’s process is not so different from mine (it is likely everyone’s process is slightly different) but it’s close enough. They have their investment quadrant, I have a very incoherent set of things I look at.

So you can see the benefit of someone able to articulate and present things in an applicable manner.

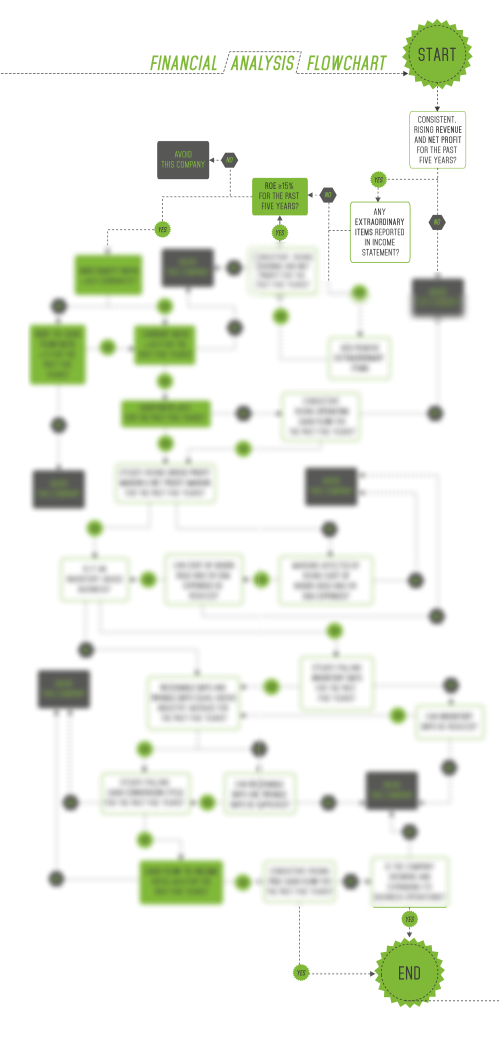

These high-level workflows will not be what you rely on, on a day-to-day basis.

They have managed to systemize the decision tree on how you can prospect the financial statements and annual reports so that you can focus on what is important first, then drill down deeper.

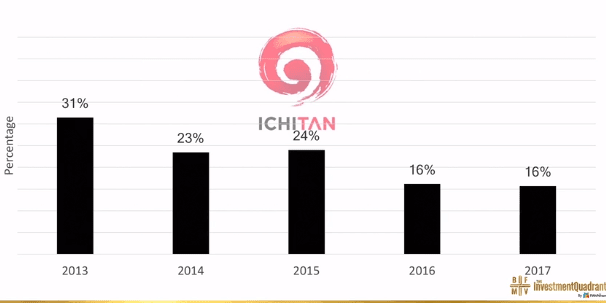

The goal here is to understand the nature of many listed businesses and invest in the undervalued ones with an adequate margin of safety. The above is an example of the kind of business that we all hope to identify through the process.

The Empirical Research Behind the Factor Styles Investment Quadrant Most Closely Aligned To

I would say that every active manager who is managing their portfolio is trying to find and actively curate a portfolio of stocks around style factors that they feel will be able to grow better than the general market.

In terms of factor style, Rusmin and Victor’s style is closer to Quality + Value.

This is the closest factor definition to how Warren Buffett invests.

Numerous empirical research has shown that quality and value independently exhibit positive premium over time, across different markets, and also different asset classes.

The chart above comes from Morningstar, which shows the relative outperformance of the MSCI USA Quality Index versus the broad market MSCI USA Index. The MSCI USA Quality index ranks the companies in the USA basket based on a few quality factors such as returns on equity, low debt-to-asset, and earnings variability.

If the points are above 0 over time, it shows that investing in companies with higher quality outperforms the general USA index over time. There will be periods where quality does not do as well, such as in the 1980s, late 1990s, and mid-2000 (note: it does not mean that there is no return, it means underperformance) but generally, we can see the existence of premium.

In AQR Capital Management’s 2013 “Quality minus Junk” paper, Cliff Asness, Andrea Frazzini, and Lasse Pedersen demonstrated that stocks that meet many quality criteria and thus fit the high-quality mould produced significant risk-adjusted returns in the United States and 24 other global stock markets.

In the same research, the authors emphasize that quality minus junk pairs well with the value factor, in a quality-at-a-reasonable-price way.

Similar to the paper, Rusmin and Victor believe that we should try and pay low to fair value for even quality businesses. In other words, let us try not to overpay for even businesses with outstanding fundamentals.

Instead of investing by screening based on fixed metrics that will identify more quality companies, you will learn more quality and value metrics that will give you more granular control over your selection of quality businesses.

The Type of Stocks That Will Be Covered In The Course

You might be wondering what kind of businesses are we talking about here.

One of them would be small-cap businesses such as Hartalega holdings in Malaysia.

Or it can be a business that produces recurring cash flow such as Adobe in the USA.

Another company covered in the past would be Factset, whose research and software are used by various institutions or firms that need their data to do financial research.

You can also take a look at the investor education videos that Fifth Person put out on their site to help you make sense of a few notable quality businesses.

A Comprehensive Range of Active Investing Segments Covered

Being a good investor is pretty similar to being a good project manager. You cannot just be good at scheduling or managing your own people.

You will need to be reasonably good in almost all the areas pretty well. If you are not good at certain areas, you should find someone or some resources to make up for that deficiency.

Here is a breakdown of the range of topics that would be covered:

- Investor psychology

- Thinking like a business owner

- Remember your downside

- Keeping a long-term perspective

- Business model

- A few different business models

- High recurring revenues

- Avoiding disruption

- Segmental breakdown

- Economic moats

- 7 of them which I will not elaborate on here

- Growth drivers

- 6 different types of growth drivers

- Business risks

- 9 different business risks highlighted

- Management quadrant

- 7 different management traits

- Financials quadrant

- Revenue

- COGS

- Gross profit

- SGA expenses

- Financing costs

- Net profit

- Extraordinary items

- EPS

- Cash flow statement

- Balance sheet

- Profitability ratios

- Activity ratios

- Debt ratios

- Valuation quadrant

- Screening for stocks

- Entry and exit

- Portfolio management

- Monitoring your portfolio

You will Learn the Metrics that Help you Identify Growth Companies

What I learn from Victor was this proprietary indicator that they learn after going through the school of hard knocks. And that is what separates them from the others.

We know that investing in the Asian context is a little different than in the west. A lot of western fund managers came over and they had to close their funds because they applied all the teachings in the west in emerging markets and they suffer substantial capital losses.

Also, what are the metrics to use to spot a growth company, before it became a growth company?

This has always been a problem that many of us find hard to deconstruct.

I am not saying they have a foolproof metric, but they have one or two that they can help.

If you are a seasoned investor or a critical thinker you might come across it. But I am pretty sure most of us didn’t go as deep as Victor to think so much about this.

And in Investment Quadrant, they go through some of these metrics.

There will be Webinar Workshops to Help Tie What You had Learn Together

The fifth person used to run physical workshops to help you deepen your knowledge.

After COVID, this method is pretty difficult to implement. So they decide to replace this with regular webinars.

I attended the workshops and to describe it, it is a way to let you see how all the things you learn come together.

During these live sessions, you will be able to catch a lot of the nuances of growth investing that you might have missed out on when you look at the materials.

Rusmin, Victor, and Kenny will deconstruct some of the picks that they had in the past to show you why these stocks became the growth stocks they are.

While not just showing past picks, during these sessions, they will also show you some current picks that fit the criteria that they are looking for.

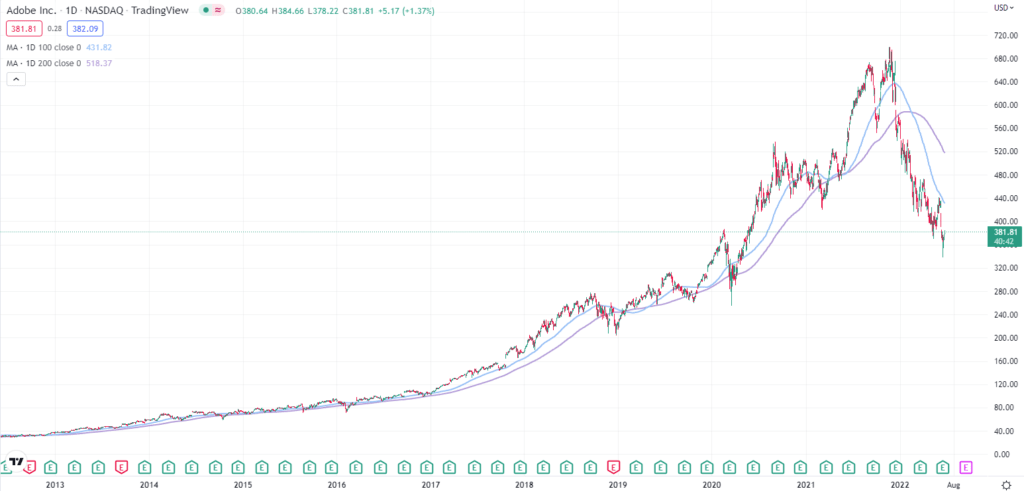

This is one of the stocks that their US analyst Kenny de-constructed during the session I attended. Back then, the market was in a corrective mood but not just that, analysts were not very favourable about their outlook on a short-term basis as well.

Kenny gave a thorough qualitative analysis of this business. Most importantly, he worked through how this stock looked with the metrics that they pay attention to.

It is useless if they just talk up a stock that is pretty good but doesn’t make use of what they said helped them.

You will Learn Proper Portfolio Management to Maximize your Returns while Reducing Capital Impairment

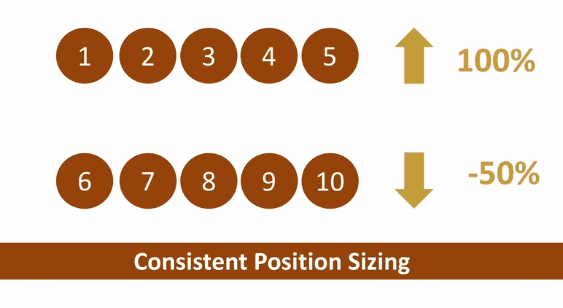

Not all will turn up this way, some would not go 300% like this but go 30-40%. Some of you will lose money because we misunderstood the business or we execute poorly.

This is where portfolio management comes in.

I had a conversation with Rusmin some time ago.

I was sharing with him some questions that I had to tackle a lot. These can be pretty subjective.

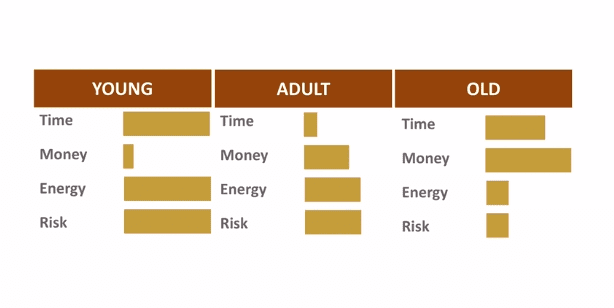

I have readers from many walks of life, so should the entry and exits be the same?

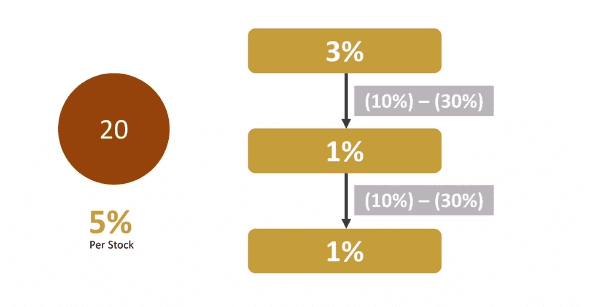

Should the sizing of each stock in the portfolio be the same?

How do you guard against the risk of ruin for a retiree?

And we had a delightful conversation about this topic.

In my opinion, the decision management, and portfolio management aspect, is seldom discussed, or superficially glossed over most of the time.

But portfolio management is one of the most important, together with executing the process.

And I am glad there is enough focus on this area. We invest for different reasons, we have different commitment levels, and we are at different stages of our lives.

If you have a good, high-level grasp of the portfolio management portion, it will drive your return in the long run.

It will also reduce your risk of ruin.

While I don’t always agree with all the nuances of the portfolio management modules of Investment Quadrant 2022, the thought process, and the completeness gives me peace of mind that it guards the students adequately from major screw-ups.

For even more nuance KungFu, such as your previous challenges in investing, you can discuss with them during the live workshops.

Lastly, if you wish to measure the value, a novice who has a $5000 portfolio can easily lose 10%, or he can prepare himself by spending that equal amount, go for the course, find like-minded investors, engage with Rusmin and Victor to learn the ropes.

If you are a 40-year-old attempting to wealth accumulate, and your initial capital is around $50,000, the fee is almost 0.9% of your capital.

Investment Quadrant 2022 is Live now but only in a limited window.

If you are interested, you have until 10th July, Sunday 23:59 to sign up for it (approx 14 days more).

This article contains affiliate links. Kyith earns a referral fee for each signup. Sign up if it fits your need. Don’t sign up if you are not serious about this.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024