How much do you think luck’s role factors your success or failure today?

We didn’t ponder enough of it.

I stumbled into personal finance because I got disillusioned in my final year of computing degree in NUS. If I wasn’t so pissed about it, I wondered if I would be this intentional about some of the things that I do.

Michael Batnick reflected in Lucky in Life how a confluence of events had to happen for him to be a managing partner at Ritholtz Wealth Management. He had to struggle to find a career in the financial crisis and finance wasn’t the first thing in his mind. He only met his future partner Josh Brown in a subway train and needed the courage to approach him.

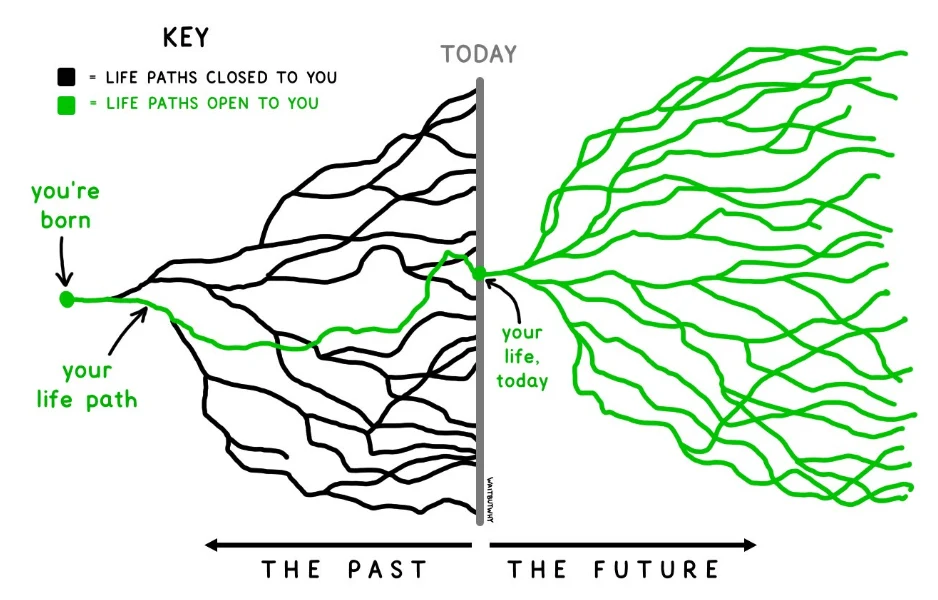

Where we are now, is because we pick out an option out of many options, and then another option out of many options and so on and so forth.

We chose the path and it is intentional but we cannot underestimate the role that luck plays.

People also expect that unluckiness won’t befall them.

Tan Ooi Boon tries to scare us in his Straits Time article this morning.

You must have heard enough success stories of people decoupling their residential homes from their spouses in order to buy another property without paying ABSD.

I wonder what is the risk management process that goes through a couple’s minds:

- If they each keep the debt servicing so that it is below 50% of their individual income if one spouse loses the job, the other person can cover.

- Have three years of the mortgage in some liquid stash.

Unfortunately, most think that:

- At most try their best to service the mortgage

- Can sell off the property in the worse case

The couple in the article had a condo valued at $2 million and a mortgage of $500k which they should have the resources to pay off. However, they chose to decouple (the property is under the wife) so that they can buy a second $3 million property (under the husband). Their total loan then jacks up to $1.25 million.

The monthly mortgage was $5,800 a month when interest is at 1.2%.

What are the chance that:

- The husband, who ran his own business, was hit by a once in hundred years pandemic, got into business problems, was sued by creditors and became bankrupt.

- Since the $3 million property is solely under the husband, the property was seized by creditors as part of the settlement of his debt.

- The wife also got retrenched, and the new job comes with lower pay.

- Interest rate decided to climb in the most significant jump probably in 20 years, and the mortgage jumped to $7,600 a month.

The chances of these things happening on their own may not be high. The chances of all of these events occurring at the same time (including the decision to decouple) is sooooooooooooo low.

But should you not decouple and not risk such a potentially lucrative strategy?

Maybe not always but we cannot blame people for not having contingency for such dramatically risky situations.

People hope that these Unlucky Situations won’t befall them. It will always be Someone Else

Hope is sometimes a form of laziness.

One of the reasons we buy life insurance is while the probability of a claim is very, very low, the impact is so large that we don’t wish to take risks but just to transfer the risk to an insurance company. You could take that risk if you have enough contingency money to pay for a mortgage if you had refinanced at a higher interest rate. Setting aside perhaps 3-4 years of mortgage payments at 3.5% interest rate when interest rate is at 1.2% is prudent.

But we hope that we are not the unlucky ones.

People Cannot Accept that They Can be Unlucky in Retirement or Investments

There is a dark secret to why there is so much talk about investment professionals, planners, advisers selling the wrong things to your friend, or a friend of a friend. Or a relative.

You know…. sometimes it is because you were looking for it.

You were looking for something near certain.

To accumulate enough for retirement, you need to hit a return of 7% a year. That to you is not demanding. In order for your income to last in retirement, you felt that you need a portfolio that is low in volatility but 7% a year in return.

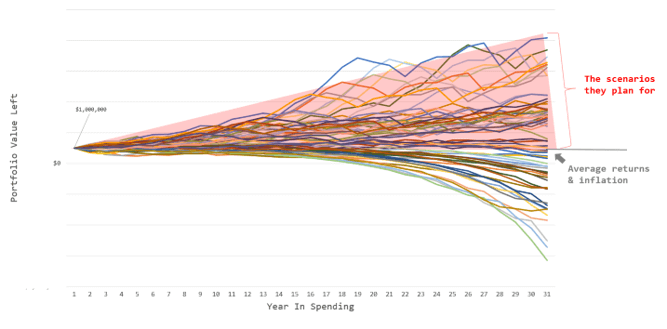

I did up this illustration to show my internal team to illustration a point during my solutioning work at Providend.

Each line shows an outcome for a thirty year retirement if you start spending $40,000 to $50,000 a year of the portfolio in the initial year, then adjust the income with the prevailing inflation for subsequent years. In some outcomes, you end up with a lot of money left, even after having real income that last for thirty years. In some years, you end up running out of money.

The standard financial planning may lead you to a reality that takes care of half or 30-40% of those outcomes. For the rest of the outcome, you ran out of money.

If we go forward in time, to you when you realize that you will run out of money, you will be cursing your adviser.

They are partly to blame if they sold you this retirement solution.

But the hard truth is… many people cannot accept this reality. They believe returns are so important and asked for certainty in returns.

So your adviser, wanting your business say until their solution got dragons and tigers.

Because if they illustration the way I do, there will be enough uncertainty in your mind (basically, the layman cannot process so much in such a short period of time), that you will forgo the solution that tells you that you can only spend $30,000 a year and go with the one that they “promised” you $50,000 a year in “consistent” income.

Life is the Result of a Spectrum of Choices and Outcomes

Planners don’t like uncertainty but the reality is that where we go in life is uncertain enough.

Building buffers is admitting that there is a spectrum of outcome in life with unluckiness being as probable as your luckiness.

You have a choice of building a system based on reality or an imaginary world that you live in.

For many, they can only accept solutions that work in imaginary world because that is their world view.

Sometimes, we have to take pause and count our blessing how lucky we are living in a small country where our currency is one of the strongest in the world.

And our property are so in demand due to our unique positioning.

You do not live in Lebanon, where some are so desperate to get their OWN MONEY from their local bank that they are forced to rob their bank to get their own money. (Read The Bank Robbers Who are Stealing Their OWn Money)

Larry Swedroe gave a good answer when asked in the last podcast I profiled what he thinks of what John Bogle said that you don’t need international diversification (View What we can learn about capital preservation from Larry Swedroe’s portfolio at 40 mins).

If John Bogle was born in Japan, Columbia, Venenzula or Lebanon, what would his answer be?

To stay and invest locally?

Or to have more humility in his portfolio?

But if we are so lucky, then it is important to admit there is a presence of bad luck as well.

It is something we find it difficult to accept because…. we don’t have a good solution for that and it gives us enough uncertainty.

So what is your solution to deal with the role of luck in your life?

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.