One of the key challenges for advisers is that they have to juggle communicating with their clients, yet not boring them with too much of the financial planning details.

Communicating with clients is just as important with the financial figures behind. If you do not do well with the former, you do not get the business. If the plan, which constitute of the figures, is not fundamentally sound, then over the long run, your clients will one day see the lack of sophistication in engaging you to help plan their finances.

Recently, someone from Goalsmapper contacted me to review their software. I was wondering why the heck would I want to do something like when I am not even a financial adviser (which is the main purpose of this tool). Eventually, I relented after numerous persuasion.

The person explained to me, then I try out the tool for myself, and I realize they have a compelling product.

Goalsmapper is a subscription based software as a service (SAAS) that financial planners can use to work with their clients to come up with a coherent financial plan. The idea with financial planning is to come up with a good financial plan so that their clients can achieve their goals.

Goalsmapper is able to

- collect the client’s personal balance sheet

- collect the client’s personal cash flow statement

- existing insurance and investment plans that the client have

- what are some of the short term, medium term and long term goals of the family

- simulate how real life scenarios like death, disability and helping out other family members can affect your retirement plan

Goalsmapper is rather polish, but it is a shame I cannot show more of it to you. The owners are rather secretive about it. If you are an adviser, and I don’t show you more, you will be less converted.

So I am going to show you why I think it is good, without showing you much.

I used Goalsmapper to simulate my own financial situation. And Goalsmapper was able to show me a few ways my financial situation and life could change.

And the result can be rather startling. It basically showed that I might be able to live without touching my wealth portfolio for a long time. This is pretty surprising.

Visualizing how your future Wealth, Net Worth and Cash Flow will Panned Out Year by Year

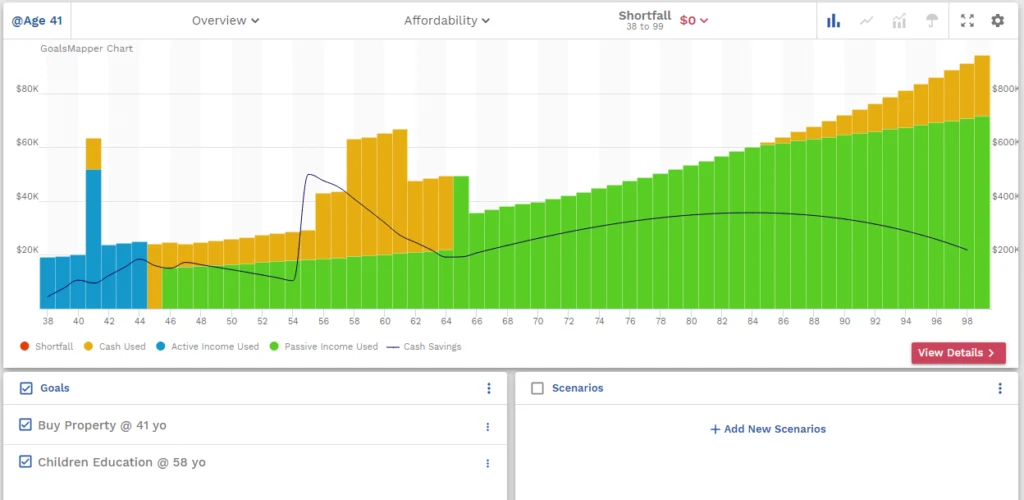

One of the main advantage of Goalsmapper is that the adviser can match the things that excite the client. These are the numbers and Goalsmapper is able to quickly, visually show the client how will their financial life be altered.

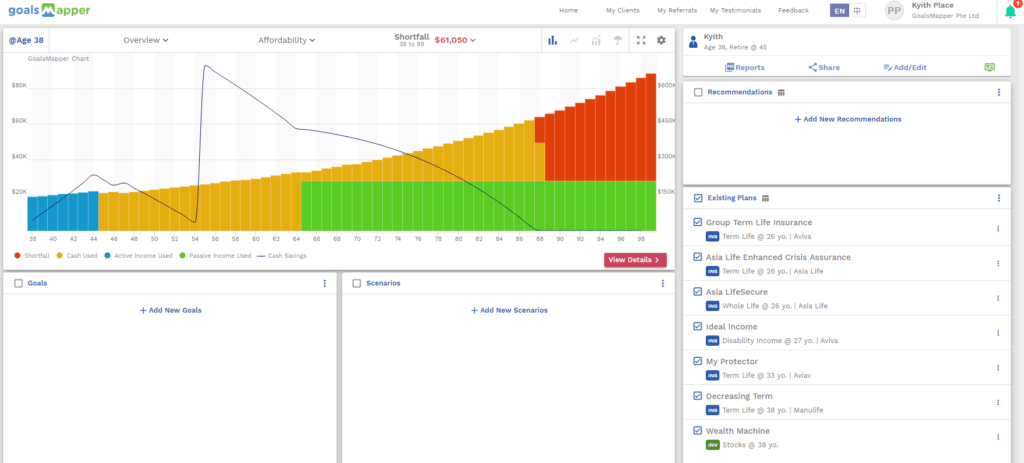

The adviser will work with the client to come up with their assets, liabilities, income streams and expenses. All these information will be aggregated into the Goalsmapper chart above. There are also a few charts such as the Cash Flow chart, Net Worth chart, and Insurance Benefit chart.

A very colorful chart like this aggregate the numerous positive and negative cash flows.

In this example, the client is myself.

The blue bars show the active income I earn from 38 years old to 45 years old, which is what I put as my official retirement age. So my net cash flow from job after expenses grow from $44k to $234k.

The yellow bars show that, in the event I do not have passive income, Goalsmapper will tap the cash that I have built up ($234k) for living expenses.

The green bars show my passive income. That is currently from 65 to 99 years old, which is my CPF Life Full Retirement Sum, which I specified is what I chose in the asset section.

The red color bars show my shortfall. So the red color bars is what will grip clients attention how long the money will last. In my case it is 88 years old.

There is a black line that goes up and down. That is the Cash Savings. It shows the changes in my cash savings over time (this excludes investments). The big spike is due to the excess out of my CPF Full Retirement Sum that I can get out at age 55 years old.

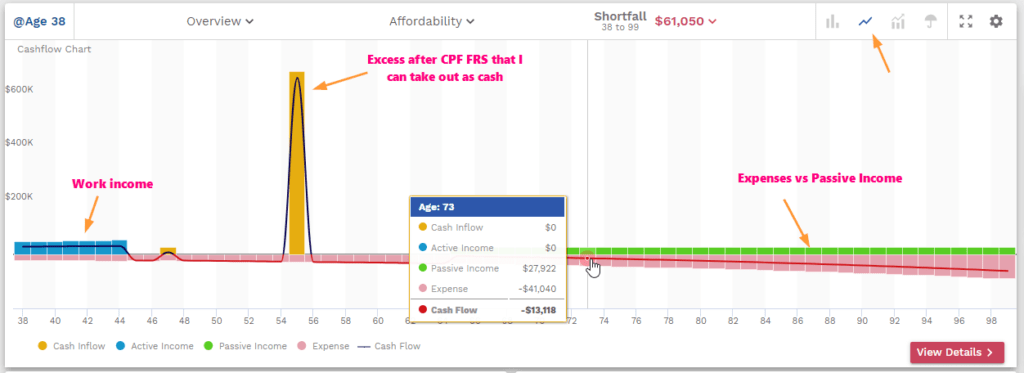

The Cashflow Chart shows the client’s cash inflow (on top) and her cash outflow (below). The black line shows the direction of the client’s cash flow.

At any point, you can move your mouse over and Goalsmapper shows you the cash flow profile. In this example, at age 73, I have a passive income of $27k (from CPF life) and expense that grew to $41k.

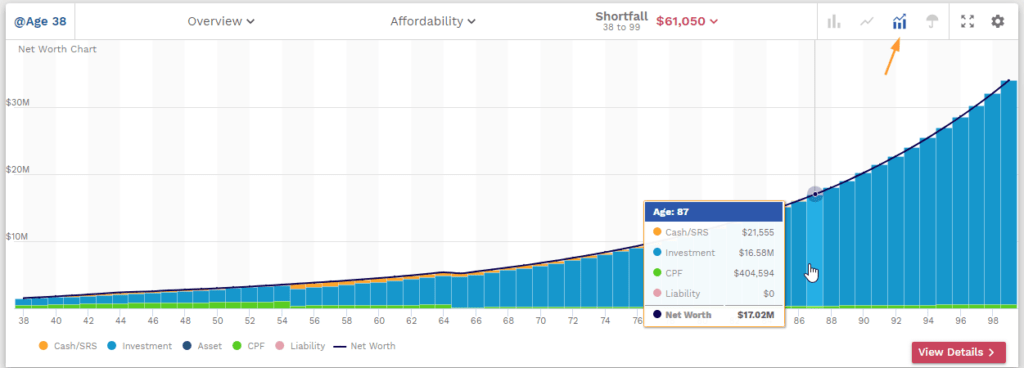

The Net Worth chart shows the client’s net worth over time. If you mouse over each bar you can see the net worth snapshot at that point.

There is something wrong with this picture if my investments is $16 mil at age 87 and I am about to run out of money!

The three charts above I feel, is very good to visualize the numbers for the clients. The adviser was able to show clients their financial life up to now and whether they can reach their goal.

In my case I fell short and would run out of money.

Adding Life/Financial Goals to your Current Net Wealth Situation

The biggest advantage of Goalsmapper is that, given my net worth and Goalsmapper chart of my current situation, let us see how some of my goals will impact these charts.

Goalsmapper is very flexible in that it allows you to specify goals that

- increases or decreases the income

- increases or decreases the expenses

- increases or decreases the asset

- increases or decreases the liabilities

And that is what goals are, they should translate to some money value.

Goalsmapper provides some custom goals that the adviser can use to specify in an easier manner:

- Buy a property

- Having a child

- Buy a vehicle

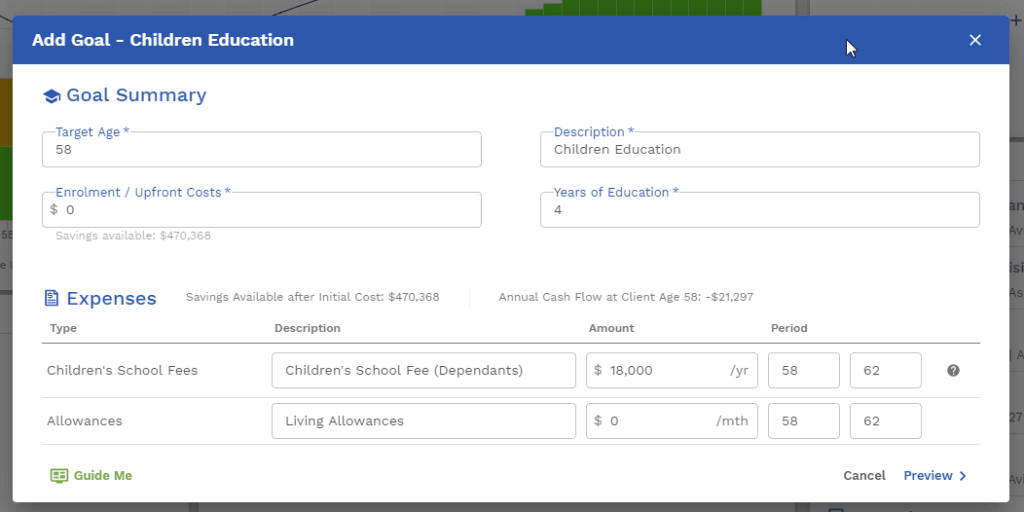

- Children education

- Getting married

- Further studies

- Starting a business

- Holiday

No doubt, this is a feature request after listening to some of their client’s needs, where Goalsmapper originally fell short of.

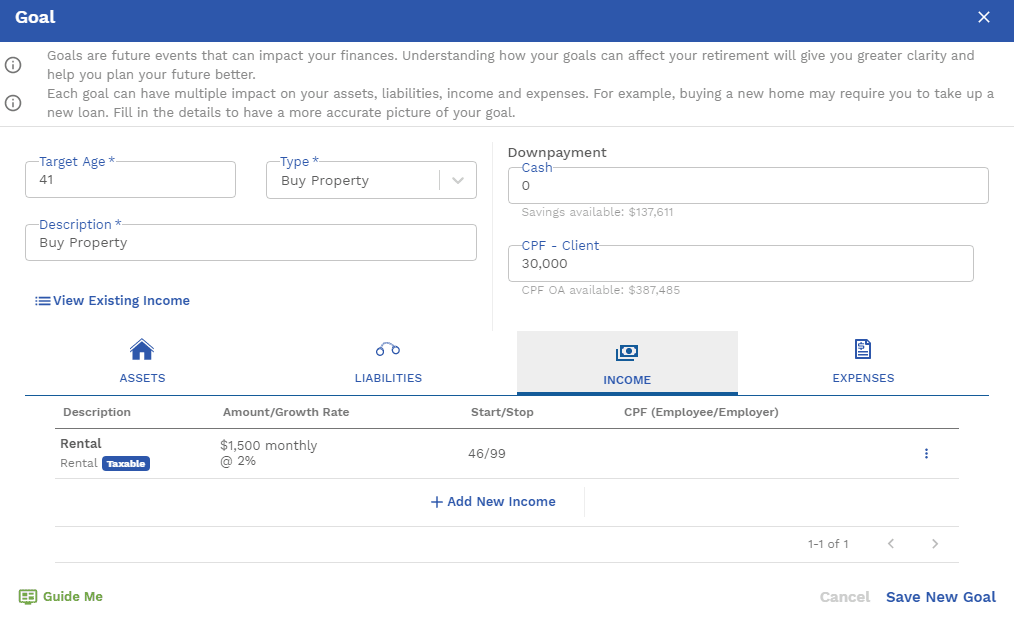

In my example, suppose I am interested to

- thinking of buying a 3 room HDB flat somewhere at 41 years old and renting it out 5 years later

- help fund a relative’s university plan

In the first goal, I specified my intention to purchase a 3 room HDB flat that is around my age. Goalsmapper allows me to specify the “goal balance sheet and cash flow” changes. The nice thing about the way Goalsmapper is built is that we can feel the code base is elegant and favors future expansion and flexibility.

I would only be able to rent out 5 years later at a conservative $1,500/mth estimate.

The other goal is to see whether if I were to help to fund a relative’s future university fee, will it impact my finances. The only peeve here is that I have to manually calculate how much is the annual tuition fee for the young relative 20 years from now and there isn’t a mechanism to do that. That kind of granularity can be refined over time.

The Goalsmapper chart, after factoring the new HDB rental and university spending expense 20 years later

Now, after inputting these two goals, we can see the change to our Goalsmapper chart. Recall that previously, I would have ran out of money at 88 years old. With these two there are no more red bars, which indicates this would improve my plan! I have a better plan going forward.

So you can see at 41 years old, there is a spike up. That is due to the increase in HDB equity. I will not be showing it here but in the cash flow chart, you will observe that we have corresponding cash inflow from rentals only at 46 years old and increase in mortgage expenses at 41 years old. You can see these two reflected here where my passive income (green bars) now start at 46 years old, and grow much more. My cash holdings (black line) start declining at 41 years old.

The $18k per year at 58 years old looks to be sustainable.

Notice that at the Goals there are 2 check boxes. This means that anytime, you can uncheck and check these goals to show your clients how their plan changes.

Throwing Life Scenarios into the Mix

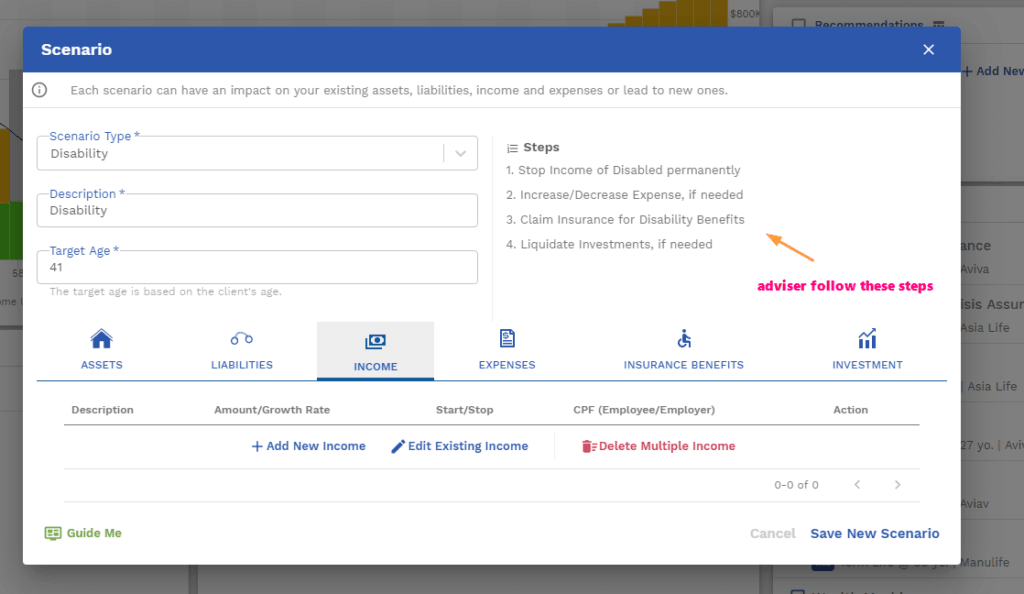

Other than Goals, an adviser can make use of Goalsmapper to model a few life what if scenarios.

For example, one of the spouse passes away at a particular age. With that, there may be

- a loss of income

- a payout from an insurance policy

- a reduction in some expenses.

Or there could be a disability event. That would mean

- loss of income

- increase in expenses

- a payout from a policy for a duration till 65 years old

Here are some of the template scenarios:

- Disability

- Death

- Early stage critical illness

- Advanced stage critical illness

- Change of career

- Promotion

- Sabbatical leave

- Retirement

- Retrenchments

- Liquidating Investments

- Redeem Loans

- Refinance Loans

- Rent out property

- Sell property

With the way Goalsmapper is coded, you can choose not to rely on these custom scenario templates but to key in your own. This is because when one of these scenario hits, it is a modification of your assets, liabilities, cash flow. Goalsmapper is flexible enough to take in a whole list of expenses, income and change in asset that comes with the scenario.

The power lies in the competency of the adviser.

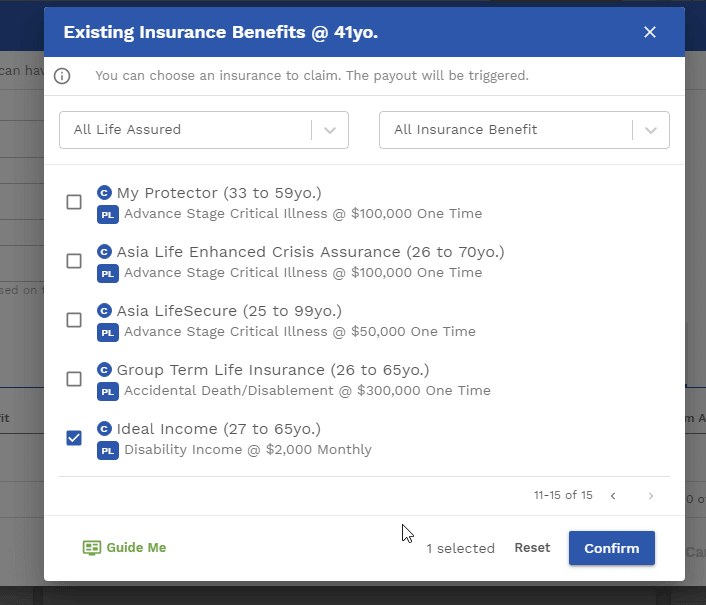

I have coverage for an Aviva Disability Income insurance. I would like to see what if, I cannot work in my profession for an extended period of time. How would my cash flow plan be like at the end of 100 years old?

Each of these template goals will involve different degree of changes to the personal balance sheet and net worth. Thus Goalsmapper provides enough instructions what you need to think about when setting this scenario.

Goalsmapper was able to list out the protection policies I have, so that I can quickly choose ideal protection plan to cash flow from.

What is not shown is that due to the disability, I have stopped the income earned. But the income disruption only took place for a total of 4 years. However, the disability income, if claimable could last till 65 years old. This actually make the future cash flow picture looked much better.

Some Downsides or Areas of Improvement

GoalsMapper is not without its flaws.

The extent of integration with CPF and Government Regulations. I think the team did a tremendous job on the templates to factor in a lot of what if scenarios. If your CPF is not enough it automatically flows to cash for mortgage payment. However, there is still a limit to the current government rules.

The adviser needs to be competent enough to compute them. For example, I tried to put in whether I can purchase a home worth $900,000 and a mortgage of $810,000 (Ok, maybe I cannot have only a 10% downpayment) but this configuration surely will make me burst the TDSR or MSR. Apparently, GoalsMapper still shows that I can purchase the home.

The adviser would need to know the regulations well to spot that.

Not so Robust Drawdown Simulation. As a person that owns a portfolio of mainly self managed stocks and cash, I hope that there are some more realistic simulation of how I can cash flow the portfolio.

You could either

- Liquidate x% of your portfolio for one time

- Drawdown a fixed sum

- Drawdown over a fixed period

The #3 is very weird in that if your portfolio keeps growing, then wouldn’t you be short changing yourself by not spending more?

You can’t have an option to draw down X% of your investment portfolio a year. Or to do some form of flexible spending plan as I have explained in the past.

Overall Thoughts

As a client, I would really feel invigorated if I know that, by taking the financial steps, I would have accumulated enough wealth to fulfill my future goals in life.

This year I went to a retirement presentation together with a co-worker. It was an invite by his friend, who is the adviser. One of the adviser’s client spoke about how the adviser was different from the rest. Instead of scaring him about how inadequate his current situation is, the adviser was able to make him excited about positive future possibilities.

And I think SAAS such as Goalsmapper makes it much easier for the adviser to show these possibilities.

The caveat I feel is that the adviser really needs to know what is going on. Goalsmapper is rather flexible and if you are not too competent you would be overwhelm by what you are suppose to key in.

If you are interested to find out more, do find out more at Goalsmapper>>

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content via email below.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024