Ben Carlson and Michael Batnick’s Animal Spirits have become a great podcast to listen to. If you are the sort that wants a short 30 minute entertaining take on what are some of the best financial data points out there, and discussion on some of the latest articles that they have read (they read a lot), this is the one.

They have introduced a Talk your book segment where they bring on some interesting financial products that they find, could have a role in your portfolio, and ask the people behind it to talk about it.

You will appreciate the way they context the discussion to a strategic level, thinking about whether you need this financial product in your portfolio.

In last week’s episode, they brought on the folks behind Fundamental Income to talk about their new Net Lease ETF and the index behind it.

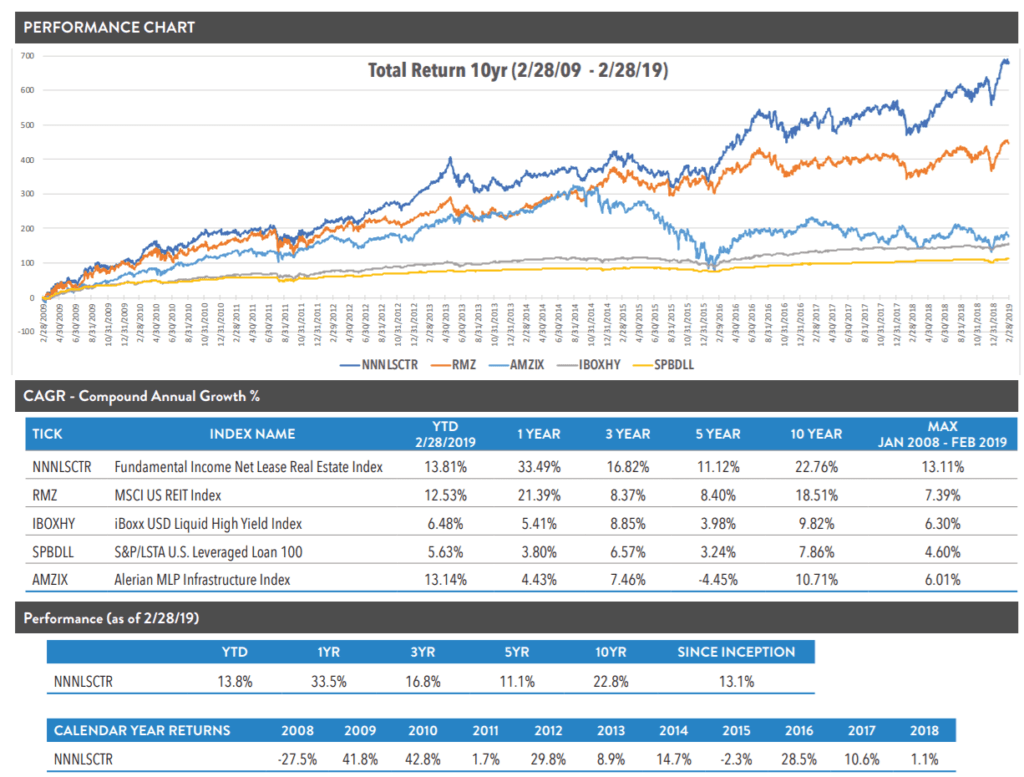

The NETLease Corporate Real Estate ETF (ticker: NETL) seeks to track the performance, before fees and expenses, of the Fundamental Income Net Lease Real Estate Index (NNNLSCTR). The index’s goal is to track the performance of the U.S. listed Net Lease real estate sector in a diversified manner by screening for real estate companies that focus on investments in net lease real estate and assigning only those companies identified to the Index. The Index places constraints on constituents to protect against concentration in any one company or tenant.

This ETF that they are discussing is not listed in Singapore. It is listed in the USA and thus if you are attracted to the dividends, you have to take into consideration a 30% dividend withholding tax. So if the forecast dividend yield is 5% the after tax return is 3.5%.

Still, I think the value of this discussion is to hear from the management why they think this segment has a unique proposition that more investors should know about.

You could also benefit from contrasting this to the other type of REITs you invest in.

You could also benefit form the discussion of portfolio positioning, risk management for the REITs.

The Net Lease segment is interesting. In the past, I wrote an article about the Perfect REIT experienced investors are looking for and the Net Lease like REITs have many of these characteristics.

In Singapore, perhaps Keppel DC, Parkway Life REIT matches that description the most.

You can listen to the podcast here:

Here are some of the notes and discussion from this podcast:

- This is considered a Smart Beta ETF

- It is also considered multi-factor in that they believe a certain segment of the REIT market has the potential to do an absolute return rather than being too cyclical

- The Total REIT Market is $1.1 Trillion Market Cap

Michael asked why didn’t anyone came up with this kind of REIT in the past and they answered that this net lease segment is rather small and young in the first place.

They wanted to create this because they realize that this segment is under-represented in the index. There is less index funds that directly invest in net lease company because based on market capitalization, they are rather under-represented. They want to define the sector.

They also explained the difference of Single tenant versus multi tenant. Why is single tenant preferred.

Currently, these net lease REITs trade at lower multiples compared to the rest of the office REITs.

The main reasons are that people tend to gravitate toward the more attractive office buildings, while the sale and lease back properties tend to look less appealing. Due to their cash flow they trade at a higher CAP rate.

So the management at Fundamental Income believe is that there is a need to accentuate the profitability and cash flow characteristics of these group of REITs to the investor by looking at them more form the fixed income angle than the equity angle.

The characteristics of Net Lease properties

- Single Tenant

- Long term lease (long WALE some 10 to 25 years)

- Sale and leaseback

- Long term stream of cash flow with escalations.

- During past corrections, they crash less than the index

In 2008, Net lease REITs numbered 11 in public. Today, they now total 24.

Technically, there are some companies like casino companies that are not considered as net lease, but they define a few set of characteristics that they look for in their form of net lease companies and these REITs sub-sector exhibit that kind of characteristics.

Some of these are their profitability, above 90% gross margins, above 80% EBITDA margins, which is 30% above other REITs.

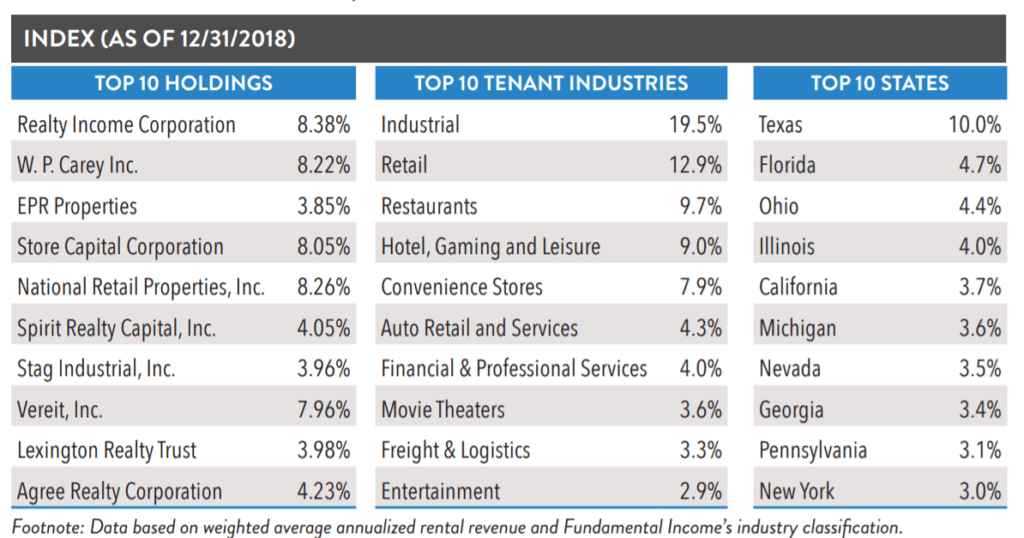

The index is modified capitalization weighted in that the top 5 holdings will not be greater than 8% of the index each.

Motivation of selling these properties to the REIT for the owners. The owners were comfortable with this decision is that they do not see their balance sheet being saddled by so much tangible assets, managing these assets. They would rather subcontract these portion out. Operating business is looking at cost capital comparison. They are also looking to optimize their ROE and not have that reduced to 12% (from an average of 25%) by having these assets on their balance sheet.

Portfolio Positioning of this ETF or this segment of REITs

In terms of whether net lease REITs are more bonds or equity, they say that this segment leans closer to fixed income than equity.

The underlying business is bond like, but the REIT itself is an equity which make it less bond like. And what will freak people out is more of the stock portion of the REIT. It may be why people prefer hard property because they do not see the fluctuation.

By setting up this net lease corporate index and the ETF, they are breaking out a traditional tax strategy, and letting investors see it as an absolute return strategy. The standard S&P 500 index yields 1.9% in dividends while this strategy historically yields 5% in dividends. If both yields 7% in earnings yield, the latter lets you have more of that return total (in current income) versus the S&P 500.

The team at Fundamental Income look at the data and found there are stronger correlation between the REIT’s total return and the growth of their cash flow.

Net lease company should be identified more as financing companies than real estate companies.

Ben Carlson asked whether the Net Lease REITs will be lower in volatility. They replied that they hope that to happen by defining this segment in an index such that people can better appreciate their fixed income characteristics and would price it at higher multiples and also that fund flows would not pull money out so readily.

They believe this net lease ETF is an absolute return strategy that generates long term total return but with a current income component. There is an equity risk premium component in that while there is a current income, this “coupon” on this segment does not stay stagnant but will grow over time.

REIT itself, is a tax classification, not a business model.

Diversified across different tenant segments. There are advantages in this ETF because it is an aggregation of REIT of differing operating environment, different REIT sector (as compared to a pure industrial or office trust)

A big addressable market. There is still like 3 trillion of corporate real estate on balance sheet. So there is a real market for these corporate real estate to be sold to REITs.

The Downside of Net Lease REITs

This is a bet on US Economy because the weakest link is the tenants. So they are betting that the tenants will survive and for that to happen they are betting the economy will go from strength to strength.

Bonds Currently may have too my Negative Asymmetric Risks

Investors usually are more comfortable in owning bonds.

However, the risk versus reward, according to the management, might be better on the net lease REIT front.

There may be a mismatched in the risk you are taking and the returns you are getting in corporate bonds. You may be taking on equity risk for bond like returns. When the loans default the investor gets smoked.

In a traditional income statement, rental expense is paid before EBITDA. Thus, in terms of cash flow seniority, rental income to the REIT holder is paid before interest income to the bond holder.

The high yield bond segment have an average credit rating is a B. The historical average default rate of this segment is 4% (of the total amount of bonds held).

When the bond defaults, the bond holder is able to get back $0.50 on $1.00 of debt. If the high yield bond returns 6%, you will lose 2% of the return to default (4% x 50%) and so you are getting 4% in return.

For net lease REITs, historically the average default rate is 30 to 40 basis points (0.30% to 0.40%) and they trade at yields of 7-8%, that is a better probability based, risk adjusted return compare to high yield bonds.

I write more about REITs in Learning about REITs below.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content via email below.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024