This post is going to be less about markets and the sort, so if you are less interested in these, you can skip it.

The Little Shops Are Going to Suffer

The unique thing about this problem is that commerce came to a screeching halt.

In other crises, the problem was a lack of liquidity. Banks could not lend and small and large firms have to tighten their belt. Those who cannot will default and this ends up as non-performing loans on the balance sheet of banks. There are more unemployed. Providing liquidity to the banks lubricates commerce.

The shit thing about what we are facing now is that you can provide all the liquidity to you to facilitate spending, but if you cannot go out and carry out some services, it is very tough to lubricate.

The world comes to a standstill for a while because the manufacturing base of the world, China, couldn’t function. Your company does not have spare parts, and therefore cannot ship.

Now that they can ship, the demand drops off because other countries are on locked down. Commerce comes to a halt.

What kind of crisis does this other than the great depression?

The toughest folks are the small and medium-sized companies. They usually depend on their peers or the big companies to give them business. A hit in demand on a wide scale hurts them the most.

My friend Caveman said the working capital for these firms is usually very challenging. The government’s main support package’s job is to ensure that these companies do not fire their workers but sometimes you wonder whether they have operated a small business before.

JD Roth over at Get Rich Slowly has a good piece asking how Coronavirus has affected your life. I like that he explores a lot of the impact on his recreational and financial life.

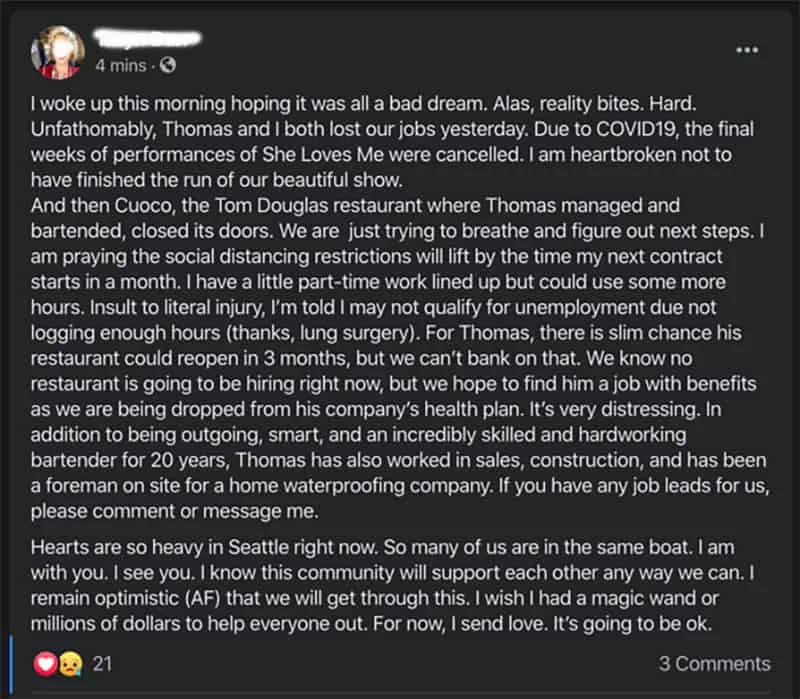

But what captures my attention was his description of his friend’s experience:

To check my hunch, I messaged my friend Kyra Bussanich. Kyra’s the only four-time winner of Cupcake Wars and owns a local gluten-free bakeshop. “Have sales slowed at all?” I asked.

“Oh gosh yes,” Kyra answered. “And if things continue, I don’t know if there’ll be a bakeshop when this blows over.”

Things are so bad, in fact, that she’s taken a part-time job to make ends meet — and is even considering applying for a full-time job. All this while trying to run her business, a business that’s struggling because of the coronavirus.

Get Rich Slowly

Here is another account shared on his blog:

Now imagine this level of stuff happening around the world.

Most People Depend on their Next Paycheck

I am probably going to do OK because I know how to save and have saved up some money. However, the majority out there depends a lot on their paycheck.

Those who are earning a lot, they may still be paying their mortgage. Their paycheck is likely quite a fair bit. However, their liquid cash may only last them for 1 year.

The ones who have the least slack are unfortunately those who did not have enough “financial slack”. Financial slack gives you enough leeway such that if you are forcefully asked to take no-pay leave for an extended period, you can handle it.

I am not sure if there will be higher unemployment but I do think that not having enough business will make companies cut their biggest variable expense, which is manpower.

If there is a bigger wake-up call in the world to do something sensibly with your surplus from your take-home pay, it is this event. Many grandparents were haunted by the Great Depression that they became very frugal even after they have a large monetary margin of safety.

Perception of Risks Gets Re-calibrated

Many have entered the investing world in the past decade experiencing some sort of declines.

Thus, their perception of volatility is programmed by this experience of theirs. When they are assessed their risk tolerance, they will say they are comfortable with it.

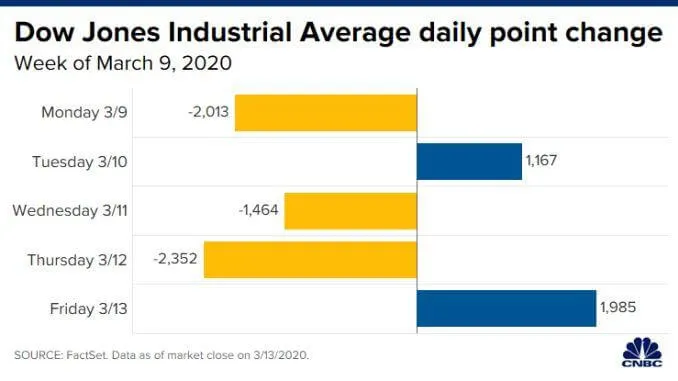

A large decline is a -2% a day on the index.

That is probably our perception if, for the past 7 years, that is our experience.

And we plan our investment strategy based on our knowledge of this. Buy the dip if it comes along…

Usually, the frequency of large decline is few and far between.

Thus, it is to be taken advantage of.

What happens when you have 5 times that and they all happen in 2 weeks?

It became a rare event that has seldom happened before. I seen these crazy moves in 2008, but I cannot remember seeing this kind of frequency + magnitude.

Some usually less flappable, more assured investors got stunned by this.

This is normal.

We get word of panic by traders who trade for their shop.

Risk is not what you can control. Risk is a deviation from the norm. And there are always new things to be added to “the norm”.

Events like this re-calibrate my perception of what is risky. And that is a good thing if you get re-calibrated in the early or mid part of your life. It makes you less gungho and always think of those situations.

Yet at the same time, we have to be aware, these are really like 5 to 9 Sigma events. They do not happen often. Don’t go design a plan thinking these are so frequent (unless this becomes a norm).

What is a Higher Priority in Life?

Some years ago, my boss at Providend shared with some of us bloggers that money is an enabler together with wealth.

I reflected back upon this while we are chasing what could be a very opportune time to accumulate wealth at a good forward rate of return. Have we got complacent by thinking about money making too much and less about another aspect of our lives?

Some of us have pretty high paying career or business. But we exchange that with our time and energy. If we are not careful, we neglect our family and health.

But we need the financial wealth for our goals. With financial wealth, we can buy back some time and health.

These three things are always interchanging.

The Corvid-19 is special because we are not just talking about exchanging wealth with time, but wealth with health.

Nick Maguilli wrote a good section in his latest post reminding us why we are doing this:

Lastly, of all the things I have learned from the Coronavirus crash, it is simply to enjoy life while you can. To illustrate this, let me paint you a picture:

Imagine someone who has been saving money for 40 years. They have been sacrificing day in and day out so they would have enough for retirement. They don’t eat out often. They don’t splurge on themselves. They make all the right financial choices.

Then they hit retirement and decide that they can finally live a little. They take a trip to go skiing in Italy in the winter. Nice time of year. Then it happens.

It starts as a cough, but it gets worse. A fever follows. Then they know they have it.

Some version of this scenario has played out or will play out for seniors across the globe.

We always talk about the case where a person prioritizes saving and when they retire, they kanna some terminal disease and it makes us wonder what is the point of savings so much and not get to enjoy any part of it.

Well, the unique thing about this ordeal is that it increases the possibility of some version of this scenario playing out.

I would like to put it in another way:

You are going to make a lot of money but you are going to lose some of your relatives. Would your life be better?

The opportunity is there for you to take advantage of and if you have, you would have been better off than if you are not financially equipped to profit from it.

But I doubt you would really benefit if you make so much money and your father or mother or grandparents are exposed and didn’t get to enjoy the money with you.

Interesting Observations from the Paid Blogging Space

There is always this Millenial narrative that you should not depend on your main job and you need to have a side hustle.

One of them is to blog for income. Basically, you became a media channel and you take in advertising dollars or you sell your own course.

This is still a very new niche industry and one that has not suffer from any downturn since it only got really popular after the Great Financial Crisis.

But I do wonder if blogging for income is an industry that does not suffer from the usual business dynamics. When commerce has come to a standstill, what happens?

Here are some observations:

- Freezer and Crock-Pot Recipes are up recently.

- Organic search traffic from Google, Pinterest is down for a lot of people. However, there are some who got more traffic than they usually get

- Cost per impression and click are generally holding up

- Travel bloggers focused on Italy saw traffic down 80%. So are theme park bloggers. Since they are used to their traffic having seasonality, they have adjusted well to this severe reduction in traffic.

- Bloggers in the finance space saw their traffic increase greater than usual.

Whichever way you look at it, I think blogging is one media channel and as a blogger, you are not just competing or complementing your peers but also going against other mediums.

I gain this idea in investing that no matter how defensive a business, you are going to suffer if the industry is in a downturn. When the mainstream economy is not doing so well, the advertising budget on aggregate will be smaller.

The difference is that if this is your own business, you can hustle and try to save it. The way this game work is that you might be able to focus on content that will do well during this period in order to try and survive.

If you are a big shot on the right side of the spectrum, then even if you suffer a little, you will be OK. Those in the middle and the left side of the spectrum will feel the pain as in all industries.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

ED360

Monday 16th of March 2020

This post reasonate with me in a certain way.

I am learning an important lesson; the psychology makeup of an investor is pretty much influenced by his or her resources and stages of life.

Currently, I am experiencing a 30-35 percent drawdown. I find that I can simply breath better because 1. My war chest still have some juices to spare. 2. Saving that can last me for a couple of months. 3. A steady cash flow from my job. 4. An IT guy in a sustainability business that is expanding in Singapore. Probably, the only few industries that can weather the storm, I have good confidence that I will keep my job for the next 3 year. 5. Time is still on my side as I just cross 31. 6. Single and no plans to get married for the next 2-3 years... 7. My faith (I generally keep it private but I have to admit my faith really cause me to see and use money in a different way).

I guess people in my situation will have more holding power in this crisis. Given the right plan and right time, I hope I can FI like Chris from TOP.

Though it is still sad that my portfolio got slashed. Tonight is probably the same :(

Kyith

Saturday 21st of March 2020

Hi ED360, that is a good situation to be in. You believe you have a bond like career. I think for many of us, what will kill us more is when we realize we make the biggest mistake of our lives. It is more than the money.

ED360, you are 31 years old. If you compare your capital now to how much capital you have from this point till the next 10 years, what you have now is much smaller. this is probably the most significant thing you need to know. So just invest away diligently the surplus from your work income.

Thanks for sharing with me.

Shaun Tan

Sunday 15th of March 2020

Very good points as always, based on facts and logic. There is one part I don't really agree with:- "If you are a big shot on the right side of the spectrum, then even if you suffer a little, you will be OK. Those in the middle and the left side of the spectrum will feel the pain as in all industries." My own view is everyone has financial planning challenges. Right side of spectrum could be either high income and/or wealth, and each has its own challenges. High earners are very subject to retrenchment risk in MNCs, high wealth in SG often means family biz and some are under pressure to retain employment of old employees etc - you get the drift. But the concepts of planning and resiliency plans apply across the board.

I really like that you've called out 2 points, 1 on what's the whole purpose of financial planning anyway, and second on holistic risk management. Don't think there are easy answers for either but the point is to think through how each of us individually handle it.

Kyith

Sunday 15th of March 2020

Hi Shaun Tan, thanks for your valuable feedback. Ok I think I was not very clear but nevertheless the outcome is still the same. I considered that the high income can be subjected to retrenchment risks. It was the first thing that I thought about. However, I am making some assumptions here. Most of those with higher income may have $100,000 lying somewhere. When retrenchment happens, they have something to work with. Some may have higher expenses but hey with $100,000 it might allow you to survive a little better than if you are barebones.

For those on the lower end, they have the same proportionate of expenses. But because they earn much less, they could not save enough for this kind of situation.

At this point, you may think that I am stereotyping and I am. I am the odd ball that does not earn so well but have buffers. A lot of my friends are. But in general, i felt that with more resources you could survive better.

I think a lot of things are subjective, but we can focus on some of the real shit out there. by real shit, i mean some things that are the truth. for example, if you need this much for something, you cannot double count the money meant for that goal and allocate it to another thing. these are rules.

the subjective part is more like at this point is it better to focus on saving or letting the wife stay at home for a while.

Hope this helps.

Financial Horse

Sunday 15th of March 2020

Great read, really interesting alternative point of view. I think that in the weeks to come, we will slowly start to further unpack the economic damage from this virus, and the steps taken to address it.

China has shown that the damage is big and wide ranging, and even when it eventually reopens, not everything goes back to normal.

Kyith

Sunday 15th of March 2020

I think not everything goes back to normal. But at this point i am more concern about whether people will have jobs.