I am not sure if everyone is feeling it, but I felt that the energy level to work is at its lowest.

It is as if the most I can do is 9 months of work.

I wonder if the market will behave like how I behave. We had a strong market and it is a market where the biggest correction for the year is only 4%.

More and more, it confirms the theory that this US market is driven by options market dealer’s actions and Federal Reserve’s liquidity action then by fundamentals.

Here are some of the good info points that I came across recently.

The Fifth Person Explains Estate Tax!

My friends at Fifth Person runs courses where they expose their customers to great companies.

Some of these companies are listed in the United States and I think it is good of them to educate their readers about the presence of estate taxes instead of skirting around the subject.

Overall, they did quite a good job covering the topic in a light-hearted manner (If you are interested you can read my more serious, comprehensive estate tax article here)

Can Equities do Badly if Yields Look Like it is Going Up?

Bonds and equities tend to be less correlated.

When bonds do not do well, equities do well. However, there are periods when the correlation is close (this means that equities and bonds move in the same direction).

There were a few chart tweets yesterday on the weakness of bonds:

Yields look like they are going to go above the Ichimoku cloud, which signals a change in trend. Yields up, price of bonds down.

If bonds are this weak, how weak could equities be?

El Salvador’s president is the New Michael Saylor

On the day that El Salvador officially accepted it as legal tender, Bitcoin and the rest of the altcoins went on a correction that is big enough for most of us to take notice.

Every time a notable person does this kind of thing, it seems more like a market turning point instead of being bullish for crypto.

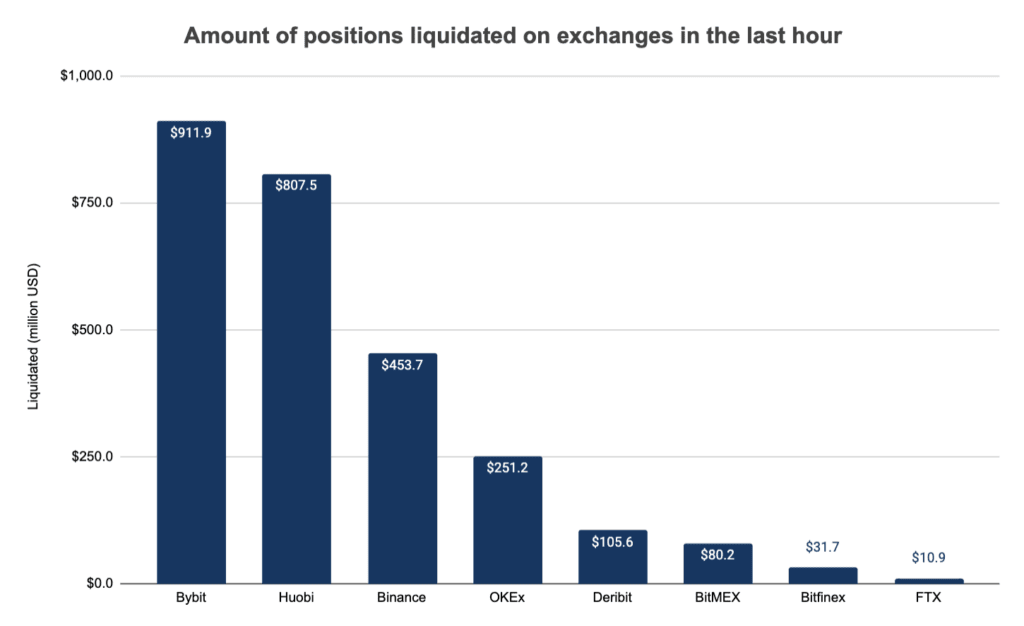

During the crash, $2.65 billion was liquidated in 1 hour according to The Block Research.

In the past, the most notable person who would come out and give Bitcoin the vote of confidence was MicroStrategy’s, Michael Saylor. This time it was El Salvador’s president Nayib Bukele who tweeted that he is buying a further 150 BTC.

Day Time and Night Time Factor Results Show Markets are Less Rational

Klement on Investing profiled interesting factor research done by Austin Hill-Kleespie.

In a previous post, Klement highlighted that there are substantial differences in returns of markets during the day and overnight when the market is closed.

If you have a broker that allows you to trade overnight after trading hours and pre-market like Interactive Brokers, you will be able to take advantage of news flow after hours.

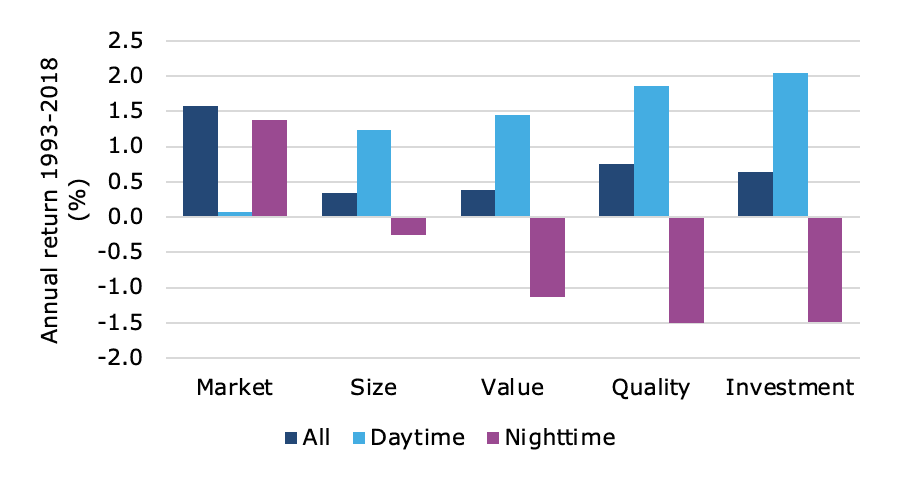

Austin Hill-Kleespie split the performance of US stocks from 1993 to 2018 into day and nighttime returns, and break that up into different Fama-French four-factor model components.

The four-factor are:

- CAPM Market return (market risk over risk-free rate)

- Size (smaller companies do better than larger companies)

- Value (cheaper companies do better)

- Profitability (more profitable companies do better)

- Investment (companies with more investment in assets do worse)

The result is damn befuddling. We can see that there is a distinct difference between daytime and nighttime for the 4 factors.

The returns in day time do much better than in night time. At night, what affect prices tend to be overnight news. So there is a lot of irrationalities there.

The fundamental drivers of factors can largely be attributed to the lack of rationality of investors at particular times, in different magnitudes.

The data here seem to show this. The factors work in the daytime because the factors are rational data screening, which cuts through a lot of the irrationality. At night, there exist mostly irrationality which these factors could not cut through.

Klement concludes that successful investing needs to marry both the fundamental and rational side of the markets with the human and irrational side of the markets.

Aims Apac Looks to Purchase $450 million 10-year leases Sub-urban Office

Singapore industrial REIT Aims APAC are in an exclusive due diligence stage to purchase a suburban office campus in northwest Sydney from Inmark Asset Management.

The sale is believed to be one of the largest for an Australian suburban office.

Aims APAC will be purchasing the office at a Cap rate of 5%. 5 years ago, Inmark paid Australian property company Mirvac at 6.07% in Cap rate.

This property is appealing to Aims APAC (and possibly you the shareholders) because it is on a 10-year net lease to Australia’s largest food retailer Woolworths.

It looks like Aims APAC supporters would be happy with this deal as it will further lengthen the weighted average lease expiry of the REIT.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024