There is always a tale or two to tell revolving around safe withdrawal rates.

When I am dealing with more work and busy personal life during this period, two social media instances temporarily took my attention away, which are sort of related.

Both links back to safe withdrawal rates.

In the first story, Patrick Teo explains that he has some reservations about the safe withdrawal rate:

And he explains his own model.

I do understand that in Patrick’s model, he based his retirement income based on a multi-income strategy on CPF LIFE, CPF interest, dividend income, and property income.

There is something in what he says that leads me to believe there is a gap in his understanding of the safe withdrawal rate study.

Parts of what Patrick says is sound financial planning which I agree with. I felt that if they understand that the safe withdrawal rate is more of a risk management rate, rather than predominately a final spending strategy, then they might look at it differently and see its virtues.

Let me dive into different parts of the comments about his model.

25 x expense = required savings must not include the value of your home, and must not include MA and RA.

The 4% safe withdrawal rate translates to a simple rule of thumb where you can multiply your expenses by 25 to find out the capital you need. This is just shifting parts of the formula around.

If we look at that portion of our money to funnel into something to provide income, then it should not include other objectives such as your home, CPF MA, which is our Medisave meant for healthcare needs.

Plainly, this is the sound separation of the money we have based on the financial goal and strategy we use to tackle it, although many like to put their retirement and living goals together as properties. That would usually mess things up in their head.

Should you not include CPF Retirement Account (RA) in the safe withdrawal rate? I think you should leave it aside, purely because that income stream is unique, just like the money you set aside in this safe withdrawal rate study.

The execution of the SWR can be a nightmare & will be a stressful process

If you look at the safe withdrawal rate less like a risk-management metric but as a sustainable spending strategy, then maybe it is less ideal and more complex.

But it is not as complex as what Patrick is proposing, which is a combination of a dividend-based, property rental income-based income strategy.

The safe withdrawal rate just tells you:

The maximum inflation-adjusted amount you can safely take out, based on deep research, so that you won’t run out of money earlier, for the period you need the income. This is so that you can have income to keep up with inflation for your needs.

How you decide to take it out is another matter altogether.

Even with a dividend + property rental income strategy, you would have to ponder that question and figure out the maximum you can withdraw so that you won’t run out of money yet preserve your real spending.

I think telling someone “this year if you spend $43,500, you can preserve your real spending and still not run out of money”, is easier than telling someone, “last year your income is $53,000, but let us see how much income this year we will get, from all the different sources. They should hit $53,000 and adjust for inflation. If not enough, then we can sell capital to make up for the rest. You can sell a little from this stock because it has appreciated in value, and have more capital gains buffer.”

The difference in the second set of instructions to your spouse, when you are not around, who can be less financially savvy, is that you marry the risk-management limit with the actual spending strategy. Where you draw out the money, how actually you draw out is kind of nuance and perhaps should be separated from the part about whether you will run out of money.

My model is to have a passive income to be greater than my annual expenses

Our income should cover our expenses. Thus, the income we plan for is often called our income requirement, which is based on future expenses.

Passive income should be invariant of market conditions

I looked up the dictionary and invariant means that the income should not change based on market conditions.

I think that is what the safe withdrawal rate is about. It is finding out the recommended amount, based on market returns, and inflation data on a wide variety of market periods.

In a certain sense, if the safe withdrawal rate is flawed, then is his proposed alternative, based on uniquely selected individual stocks and property better in ensuring the income is invariant of market conditions?

The group of stocks was selected from a subset of Singapore stocks, which existed from the 1970s till today. That is almost 50 years. But has the strategy been back-tested against the different time periods for us to confidently say that by just taking out dividend income, and not the capital, for that selected basket of stocks with unique style, we can preserve our real spending needs yet not run out of money?

If that research has been done on the dividend style factor he chooses to adopt, then I think we can say it is at least more robust than just basing our confidence that the income will be invariant of market conditions.

But if its just based on the performance of the last 20 years, that is a short period, and not even long enough for a period that they expect to last (perhaps closer to 30 years).

Many suggested their own strategy, are massively hoping that the market conditions (inflation, unemployment, interest rates, growth, political conditions) and returns they managed to live through, will also be similar for the next 30, 40, 50 years that they need.

Hoping without enough backtested work done.

And to them, that seems more robust than a study with longer financial history, over a wider variety of market conditions. Admittedly, the safe withdrawal rate study is mainly US-market centric, but there are studies done on international, United Kingdom, Australia based on bond and equity total returns.

I am not saying a dividend income plus property rental strategy is less robust than the safe withdrawal rate strategy.

I am saying that those who prefer a dividend income strategy often fail to look at their dividend, or property or dividend plus property income as a spectrum and figure out what is the safe rate. They assume that for thirty years, things will roughly be the same. Most importantly, there is less proving done and more hoping. We move away from hoping if we show more research.

Have cash reserves of up to 3 years of annual expenses to handle life’s curve balls

Having a certain cash allocation, as part of that safe withdrawal income strategy of stocks and bonds, has proven to improve the odds of not running out of money. There is evidence of that over different market conditions. But what Patrick is sharing here may be another goal.

What is unexpected may not be what you have planned for in your income needs.

This might translate to “I don’t know whether there are some spending I have not considered well, or how different inflation would be, so I err on the safe side.”

In that case, then this amount should be viewed together as part of the income strategy.

Adding buffers… is lowering the income as a percentage of your capital… which translates to a lower safe withdrawal rate.

I contend that many who voiced reservations or critique the safe withdrawal rate, didn’t realize that they are also looking for the safe withdrawal rate in their strategy.

There is more “I hope things are similar to the last x number of years so that my plan can work”, then simulating through a wider spectrum of real-life market outcomes.

Because they have not simulated, how do they compensate for it? Often, shifting their asset allocation mix such as having a cash cushion.

Is that sound? Not sure because did they test it or was there research done on it? I am not sure there.

But some account for the cash cushion separately.

Basically, they increase the capital base so that their plan remains safer. But what they didn’t realize is what made their plan safer is that they have much, much more capital in their income plan.

This is sort of linked to a Tweet All-Star Chart’s Willie Delwiche put out yesterday:

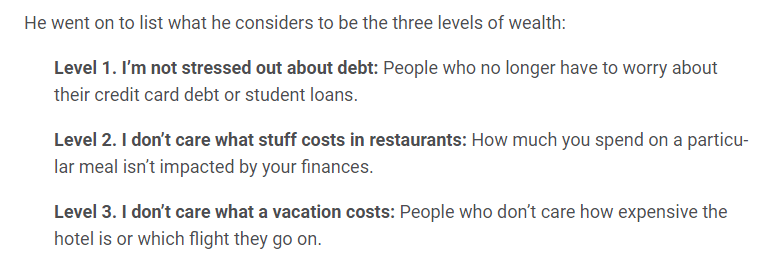

It reminds me of what Slack founder Stewart Butterfield said on a podcast about how he views wealth:

Which I think is quite true.

Wealthy person has so much wealth that they don’t worry so much about the numbers.

Planning-wise, how much is it? Stewart basically tells us feeling wealthy is more of a feeling than the actual numbers.

I agree.

But without numbers, I contend some of us won’t have the conviction we lie closer to being wealthy than thinking-we-are-wealthy-but-mathematically-we-aren’t-wealthy.

If we translate it to numbers it usually means:

Your income is low enough, relative to your capital, that despite what outcome the market throws at you, you wouldn’t worry about it.

Here is how the math work:

Suppose you need $30,000 a year and you have $6 million in your portfolio. That works out to be 0.50% of your portfolio.

Now, if your portfolio tanks 70%, what would happen? If we take $30,000/ $1,800,000 we have a current withdrawal rate of 1.7%.

Technically, your $1.8 million can still last you perpetually, based on all the different kinds of market conditions of the past.

What if inflation is so out of wack that your spending goes up by 200%?

The math would be $90,000/ $6,000,000 = 1.5%.

That current withdrawal rate of 1.5% would still last you perpetually.

Technically, even after absurd portfolio crashes and absurd inflation, your wealth will still last perpetually.

If I tell you that even with these absurd conditions, your money can still safely last forever, would you freely spend that $30,000 inflation-adjusted annually?

I think you probably would.

The rich has a better plan often not because they have more sophisticated product but because their math just work out better.

For most of us, there are tradeoffs to setting aside so much just for retirement income. For most of us, even reaching 3% is a problem!

Conclusion

Stewart Butterfield and Willie Delwiche’s more qualitative take is my benchmark of how a wealthy person should feel like.

You don’t think about the figures and just live life.

But in reality, we all would have our anxious moments. We alleviate that by having a sensible way to know our plan remains sensible and conservative.

How we go about determining that can vary from person to person.

My structured mind tells me that sensible people look for conservatism in their income plan but many didn’t realize they were searching for their strategy’s safe withdrawal rate or a safe way to spend that would meet their income needs.

And yet they critique a stock and bond safe withdrawal rate.

There is too much hope out there and less empirical evidence.

More financial planning stuff in my planning your retirement series is below.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Steveark

Saturday 4th of February 2023

I've been retired for seven years and my average withdrawal rate is right at 1%. When I first realized that would be the case for the rest of my life, my perspective on spending changed. We will never be able to spend down our portfolio, it is going to grow much faster than we are capable of depleting it. At that point money becomes pretty meaningless, as do prices, budgets or taxes. We can just live without money being a factor in our decisions from here on. I think that is how being wealthy feels. You focus on health, purpose, relationships and joy but not on money. Because you are past that phase of your life. There are some money management tasks that are necessary but other than that, money stops mattering.

retirewithfi

Friday 3rd of February 2023

The SWR math has been solved by various people, see https://earlyretirementnow.com/2017/02/01/the-ultimate-guide-to-safe-withdrawal-rates-part-8-technical-appendix/ , https://www.financialwisdomforum.org/gummy-stuff/sensible_withdrawals.htm and https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2551370.

Basically, the returns and inflation series over the entire retirement period will determine the withdrawal rate and final value (legacy).

Kyith

Tuesday 7th of February 2023

Thanks retirewithfi!

Sinkie

Friday 3rd of February 2023

Think is becoz the SWR is trying to solve 1 problem (sustainable adequate retirement income), while Patrick is trying to solve 3 (ditto, capital preservation, legacy to descendants).

Basically his framing can be seen as getting the SWR to below 1%.

That works for people in the top 10% of salary percentile, but not practical for median wage earners.

The unwritten aim of the original SWR besides having some level of certainty for retirement income, is also that it's relatively achievable by most wage earners. Even so, many people already find it very hard to accumulate 25X of their annual living expenses in a balanced portfolio, unless they cut down on their discretionary during retirement.

lim

Friday 3rd of February 2023

"Passive income should be invariant of market conditions" - I doubt that is possible unless the whole portfolio is in AAA sovereign debt.

The better concept to employ is that of 'margin of safety' which would also be linked to the volatility of your portfolio. i.e. the more volatile your portfolio, a larger of margin of safety is required (as one standard deviation is higher).

In 2020 my dividend income fell by 20%. So for a 'safe' financial independence, I would want my passive income to equal my standard of living expenses, and maybe add 20% more for 'margin of safety'.

On the other hand, margin of safety might not be so crucial if you were willing to cut some expenses in the years when your passive income drops (temporarily), eg: by going on fewer overseas holidays.