My experience as a financial blogger and someone trying to accumulate wealth gave me a certain lens about money.

But my experience working in a wealth advisory firm kinda shifted the lens a bit here and there and sometimes, I get a little philosophical about how we all view the concept of wealth.

Nassim Taleb, of Fooled by randomness, antifragile and black swan tries to describe the fine line of how much wealth is optimal:

Money can’t buy happiness, but the absence of money can cause unhappiness.

Money buys freedom: intellectual freedom, freedom to choose who you vote for, to choose what you want to do professionally.

But having what I call “f*ck you” money requires a huge amount of discipline.

The minute you go a penny over, then you lose your freedom again. If money is the cause of your worry, then you have to restructure your life.

Nassim Taleb

Many of us look at it as more wealth equals more freedom.

This can be freedom from many things.

The more money we accumulate, the more freedom from our government and bosses we get and so we think that if we plot our freedom versus our wealth, it is a straight line.

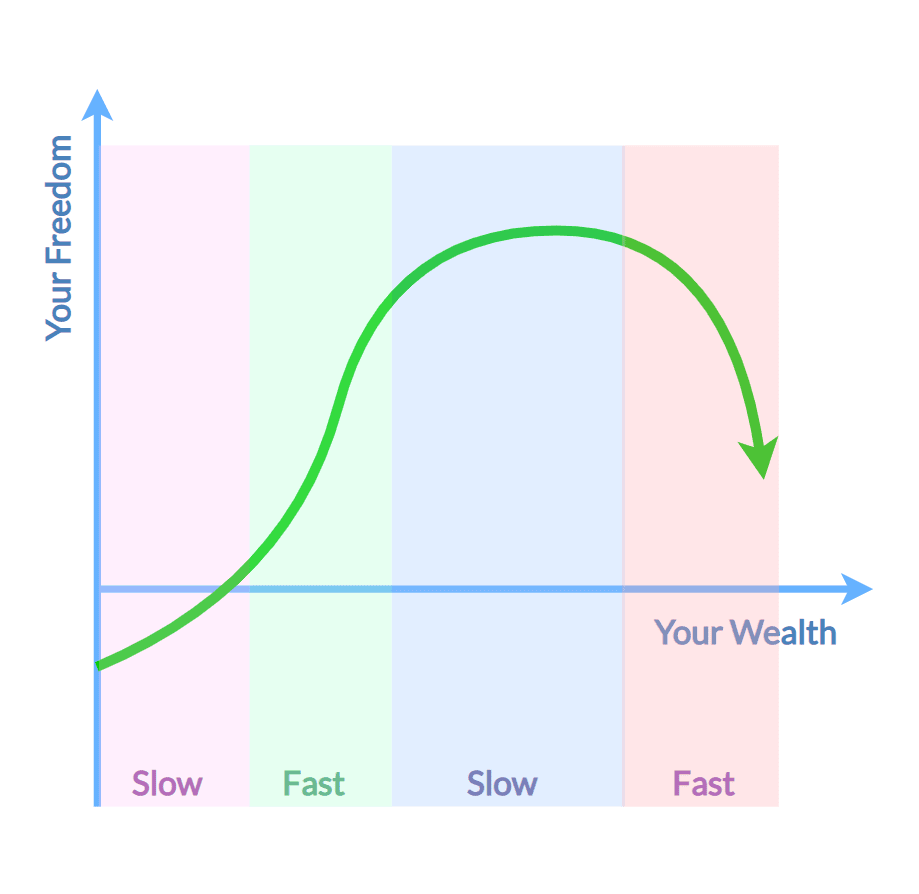

It should look more like a curve.

Initially, when you accumulate more money, it gives you more power over your own life.

It gives you a sense of security.

More money, more optionality in life, and you have more independence over your life decision making.

But why does the freedom curve go down?

If you watch the HBO series Succession, you would realize that the family in the show has a kind of life you want to live and yet at the same time you only want the money they have not the kind of drama and shit in their lives.

When you accumulate money past a certain point, the money may become a real responsibility that you need to steward well.

Or that you need to think about how to distribute it.

Legacy planning or the art of leaving money to the next generation sometimes is a problem that came about for our prospects or clients because… they have too much money and they have this “burden” to steward it and pass it on well.

Some businessmen may have this problem with how to wind down their business, sell it or they could sell it at all because there are complex relationships tied to it.

The Speed of Wealth Accumulation

We should also recognize that initially, compounding our wealth is very slow as it takes capital to do that. Once you have a certain amount of capital, compounding is faster.

How much security, independence and freedom you achieve tend to follow that progression.

Perhaps if you are clearing debt, the pace is slower. But there are also situations where if your income ramps up by $2,000, it buys you a greater amount of security and independence, and that is why with every dollar of wealth, freedom increases by more.

There will be a point where you add more money, it does not give you much more freedom.

And the last phase is more wealth and less freedom.

The Optimal Amount of Wealth that Is Enough is an Art and Science

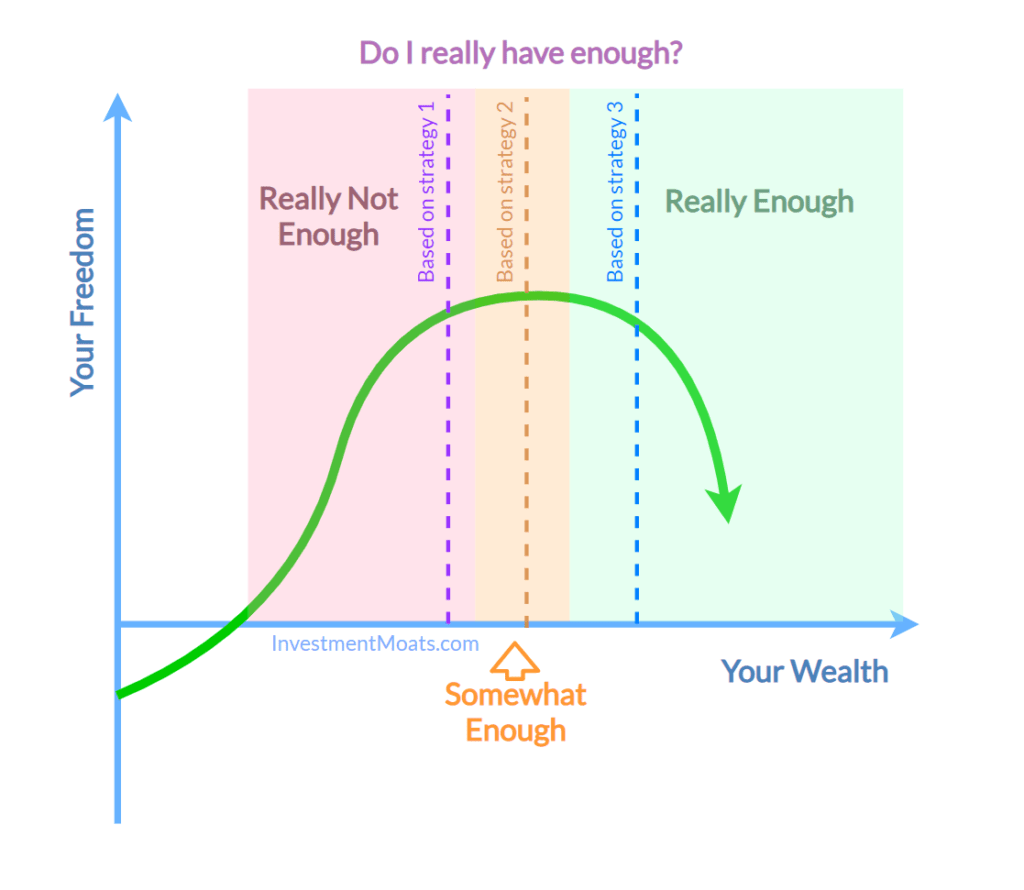

Determining how much will you have enough so that you can be considered to be financially secured, independent or free enough is a subject of constant debate.

If we understand that we are exchanging time for money, then we want to know where is the sweet spot of whether we have accumulated enough.

The layman will be based on some very unsound strategy that leads them to think they need a number that is too high but often too low.

Some strategies will tell us that we really have enough in a fundamentally sound way (the green region in the chart above).

I can safely tell you that if you only spend 1% of your initial wealth on the first year and the majority of your wealth is in a mixture of 55% equities, 40% bonds, and 5% commodities, you really have enough.

Some strategies just tell you that you have enough but perhaps in some reality, you will realize that you do not have enough and when you realize you do not have enough, it is probably too late (the red region in the chart above).

Then of course the orange region is the reality that you will probably have enough but maybe in some unlucky situations, you might eventually need to compromise on some things. Basically, you do not have enough buffer or margin of safety.

Most people come in or find a planner wanting to know if they are in the orange region. But deep down, people would like to know if they are in the green region because if you know you really have enough, then you can don’t worry about money and consider other areas of your life.

You will feel that you are in this state, when money occupies less and less of your consideration.

But they often have this scepticism about what their adviser said or what they read on the internet about whether they have enough that they cannot get some sort of peace of mind. There is probably enough case to be made of advisers letting clients know they have enough, but if we look at it through sound lenses, the client has somewhat enough, but the adviser gives the client the idea that they really have enough.

Usually, those who were scarred by some money traumas in the past will have more anxiety over something like this.

It is sometimes important to recognize that what is considered enough is a function of your family’s unique needs, the asset allocation, the spending strategy and also unique philosophy.

And this is why I feel we should always have a conversation about the nuts and bolts of retirement or financial independence spending (You can read my article How Much Money do You need to be Financial Independent? A Deep Dive)

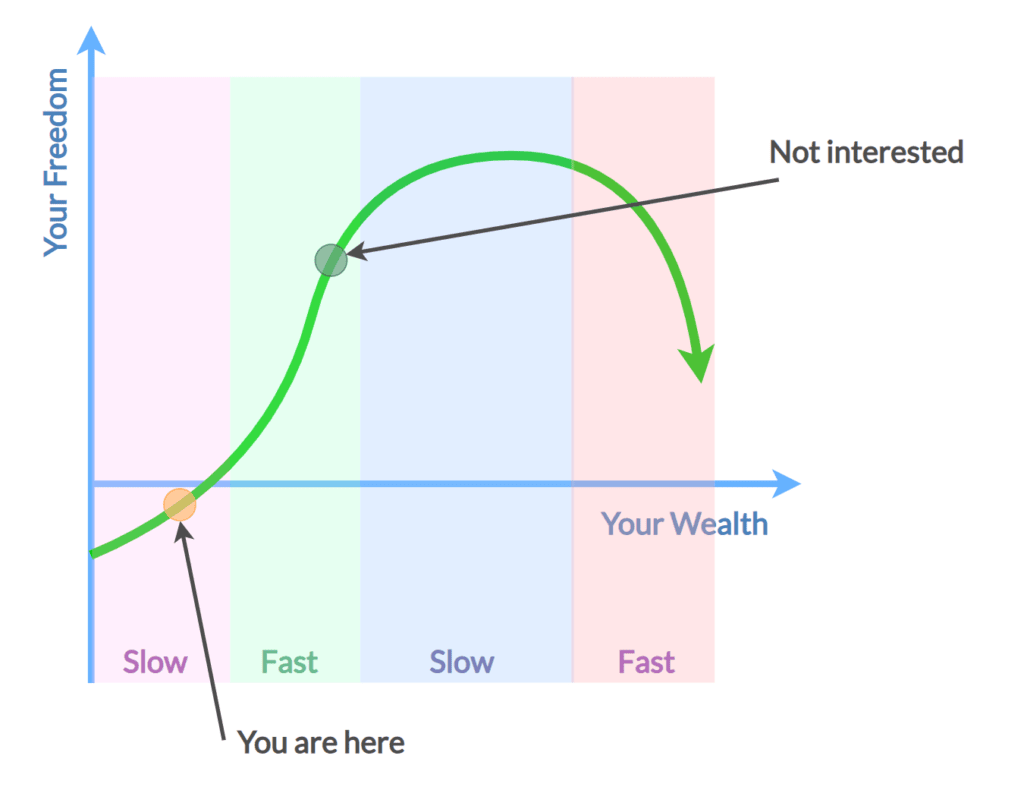

We are just too far to understand some financial topics… until we get there

I recognize that there were some topics written that are bad for business. The majority of the people are trying to accumulate wealth and if they have not reached a certain degree of wealth, they are just not interested in some topics.

This is normal.

We will be more interested if we felt that it will greatly impact our lives soon.

My perception of legacy planning used to be “Wah lan, I am struggling to even accumulate, where got time to think about things like that! If I passed away then, the rest of the folks just live with what I left them with! Already dead liao still has to bother with things of the living world!”

This is the same for maternity insurance.

I mean… asking a single person to write about maternity insurance is like… okay I can do it but it is like my time about writing about my experience doing software and system safety. I can do it but it is a subject that you struggle to wake up and do.

And this is why when you are accumulating your wealth, you may have one eye on how much is enough, but the topic won’t occupy a large part of your headspace.

When you are learning to prospect and identify good stocks, it might take you too long to realize how to have a more balanced portfolio.

In a way, while you may struggle to get up and be interested in some of the topics, they eventually matter and for some, they matter big.

If you like stuff like this, there are more in my building a sound wealth foundation section.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Revhappy

Sunday 10th of April 2022

You are trying to model freedom using money as factor, is just too simplistic in my view. A much bigger factor is our attitude towards our money, the poverty mindset v/s abundance mindset. I know people who spend well on things they love freely and just dont save enough money at the same time, they have this super entitled complex that they are gods gift to this world and deserve all the nice things. They wont even travel my MRT ever, always uber or tax, order food from nice restaurants. They always feel they need to spend a lot and so they also feel they are not getting paid enough and always demand more and more salary and jump companies. The ironic thing, these people actually get everything they want. They get nice hikes, crying baby gets the milk right? They may not even be competent, but they make appearances that they deserve it all and more and somehow that attitude translates into their work also and they do well and just keep climbing the corporate ladder. They dont care about freedom, they dont need it. They will probably keep working and spending and enjoying life. This is called abundance mindset.

The opposite is called as poverty mindset and if I know you Kyith, you belong here and so do I and this is why I can relate with you well. We basically feel we are overpaid. When my salary was 6k a month I used to think, wow so much money what do I do with it. I used to always have this imposter syndrome that I dont belong where I am and it is just sheer luck and I wont last here too long. I was also never really interested in my work, mostly would slack if I got a chance. So my focus was always savings and not income. This attitude leads to very good money management skills and within 13 years I was able to accumulate 1.2million, just like you. But poverty mindset also means, it is very difficult to give up so much money on the table, unless some external force causes it. There is no way someone with poverty mindset walk away and retire early, when they have been penny pinching all their life and trying to save as much as possible. Deep inside, they will be hoping that there is global recession/depression and everyone loses their jobs and we can they justify our early retirement saying that the economy is bad. So, the worry is not going away.

Also your logic of 1% swr doesnt make sense. 1st of all someone with a poverty mindset, will not hit 1% swr kind of corpus. To hit that level, they need to be really be good at what they do and be a high achiever. But then high achievers, dont really need to keep penny pinching, so they would reach 1% either. So I wonder who really reaches 1% swr? Maybe the some one like Piyush Gupta, who reach management levels of companies, or founders of startups who make a windfall. But I am assuming these are not the target audience for your article.