In the last two years, Providend gradually became more deliberate in our thoughts about environmental, social and governance (ESG) matters.

Like how we looked at most things, we don’t wish to do things just because it is popular. We tried to peel away the layers, and think deeply about what is core behind ESG so that we are more sure that we are doing the right thing.

One of the approaches that will allow us to make a greater impact is to use our skills or influence to positively shape the broader society. When AN LIVING approached us to see whether we are open to helping them solve a unique social problem, we decided to explore further.

This week, AN LIVING, a socially conscious enterprise launched its first product AN LIVING Wealth Access.

I decided to pen down some thoughts about Wealth Access because firstly, some of you might find this solution useful but also secondly, I hope I can help AN LIVING’s founder Jonathan Teoh in some ways.

A socially conscious enterprise are companies which are set up with clear social goals, where resources are channelled to fulfilled clear social objectives. Jonathan feels that if you feel strongly about effecting change, setting up a social enterprise allows you to channel the funds to the areas that get less attention compared to other charities.

Jonathan should know enough.

Jonathan’s mother Julia left a high-flying regional managing director career to set up Malaysia’s first social enterprise Truly Loving Company (TLC) in 2006. Truly Living Company sells environmentally-friendly household and personal care products.

TLC gives all its dividends to charities.

Working in TLC allows Jonathan to see the real impact of doing good and how it shifts society. One of the things he learned from his days in TLC is to listen to those people with problems, which helps drive a large part of TLC’s direction of gifting.

When he listen to the voices on the ground, there was a unique problem that he may be able to solve with his property development and marketing background.

Let me explain to you what AN LIVING Wealth Access is about.

What AN LIVING Wealth Access is Trying to Solve

For most of us planning for our retirement, we want to create a robust, yet sustainable plan to provide enough income for our spending needs.

Our spending needs can be rather subjective. For some of us (myself included), we are concerned about having enough to pay for our essential expenses and then we are rather flexible with our discretionary expenses.

For some others, they wish to have an income that covers them well for much of the discretionary part as well. They desired a richer retirement lifestyle.

A richer retirement lifestyle means that they would need a larger income stream.

For many of us, our income stream is constrained by the amount of investable and pension capital we have.

Put it simply, how much income we have is determined by:

- Our investable assets

- Our CPF

- The structure of the income solution we create around the investable assets and CPF

Many families have their capital locked in a third asset: their residential real estate.

We live in our residential home, and most of us cannot rent it out. While the value of our residential home is valued based on the aggregate value of the discounted rental income, we cannot tap upon this captive capital unless we sell it, live somewhere else and allocate the proceeds from this sale somewhere.

Yet at the same time, some grew attached to their place of residence and are often resistant to the idea of selling their residential property and moving somewhere. Not everyone feels that way but some do and they have difficulty monetizing their residential home by selling and downsizing somewhere else so as to unlock capital to enhance their retirement income.

Sometimes, the problem may not be that we wish for a richer desired retirement lifestyle. Some seniors have a large part of their capital tied to their residential property and aside from that, they do not have many assets that could generate a decent income for their essential needs.

In summary, the main problem is that some of us can unlock our residential property to gain capital to enhance our income stream, yet have adequate control and ownership of the property.

How Does AN LIVING Wealth Access Work?

AN LIVING Wealth Access allows the owner of the freehold/999-year leasehold residential home to be able to secure a 20-year interest-free loan.

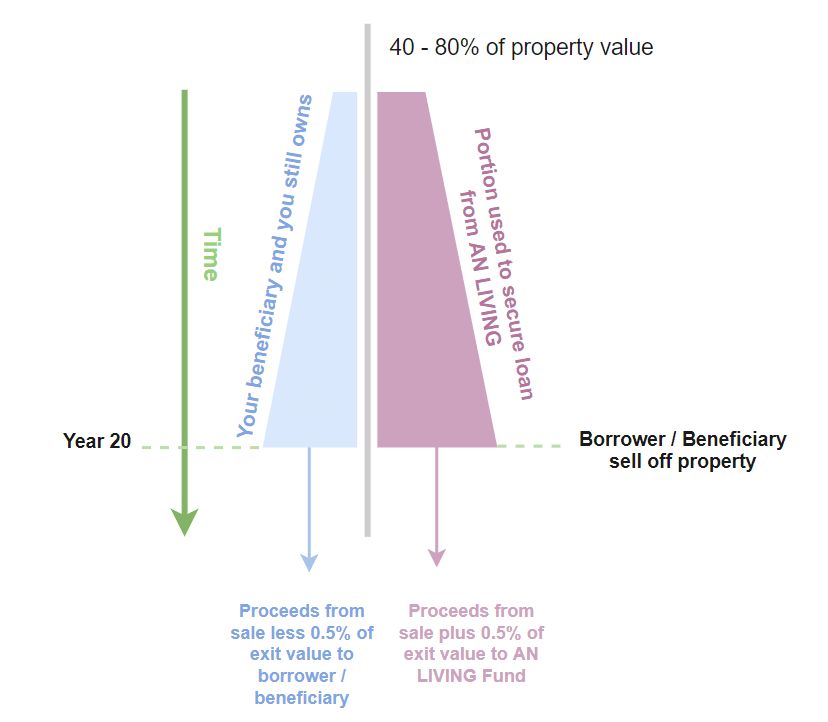

The amount the senior can loan depends on the percentage of the property that you wish to secure against. This can range from 40% to 80% of the value of your investment property less certain costs (we will talk about this later).

This loan act as the capital to provide the senior (“borrower”) with the additional income he or she needs.

AN LIVING Wealth Access has a fixed structure for how you deploy the loan (which is now the capital for income):

- The borrower will be required to top up their CPF Retirement Account to Enhanced Retirement Sum

- The Remaining funds MUST be managed according to a financial plan by AN LIVING Fund’s approved list of financial advisers

The goal is to have a sound financial structure to provide the senior with an income stream that blends well with his or her life goals.

At the end of the loan agreement (e.g. 20 years), the borrower (or the beneficiaries if the borrower passes away) receives a percentage of the value of sales proceeds of the property under the agreement while AN LIVING Fund receives the rest of the value of the sales proceed.

Here is an infographic bringing us through an example of how a senior couple Mr & Mrs Lee may benefit from AN LIVING Wealth Access:

This may be a bit confusing, but let me try to put it in simple words and illustrations (this is my best interpretation after listening to the explanation and trying my best to understand it).

First, let us ignore what we do with the loan or capital part first and focus solely on understanding how the loan works.

How does the loan work?

Suppose you do not do anything with your property and just live like how you live now:

The value of your property will increase over time but because you live in it, you cannot extract capital or income from it (unless you rent out some of the rooms, which is an option.)

With AN LIVING Wealth Access, the borrower will be able to secure a loan based on a certain percentage (in this diagram 40-80%) of their property value. Structuring as a loan, enables the borrower and family to retain the ownership of the home. However, we know that under the agreement, when the property is sold, the proceeds plus a 0.5% exit fee will be returned to AN LIVING Fund.

From AN LIVING’s perspective, they lend the borrow a lump sum upfront (less some costs) and are able to participate in the capital appreciation of the freehold/999-year leasehold property.

The borrower, due to the agreement, gives up the capital appreciation of the property but secures the capital upfront to provide him or her with more income.

What are the costs involved with AN LIVING Wealth Access?

It will be strange if this loan does not have a cost to it.

The cost to the borrower is:

- Upfront fee. This is non-refundable. This is paid upfront. The upfront fee is a fixed 12.5% of the portion of the initial property value.

- Utilization fee. This may be refundable. This is paid upfront.

- The opportunity cost of not participating in the upside for the percentage of the property you use to secure the loan with AN LIVING

- Exit fee. This is a 0.5% fee paid at the end of the loan term.

I think I have explained the opportunity cost of not participating in the upside of the property growth. That should be easier to understand. This could range from [ 0% to 4%] x Percentage of property under the agreement.

The utilization fee can be seen as a rental fee. If AN LIVING Fund owns this portion of your home, they could rent out that portion of the home (in theory) and earn a rental income. But instead, the borrower is living on the property for 20-years.

So the loan quantum needs to deduct this aggregated rental fee when the borrower and his family utilize the home. This utilization fee is computed by multiplying the portion of the home under the agreement times the number of years the borrower and family are living in the home times 1.344%.

You can look upon the 1.344% as the net rental income you be renting from AN LIVING, paid upfront to them, instead of paying it over 20 years. According to AN LIVING’s research, this is much lower than the average net rental yield of condominiums and landed property.

The upfront fee is the discount on the actual value of the property that the investors in the AN LIVING Fund are willing to accept for taking on the investment risk of loaning the money to the borrower.

An Example of How Much Loan You Could Get from Wealth Access

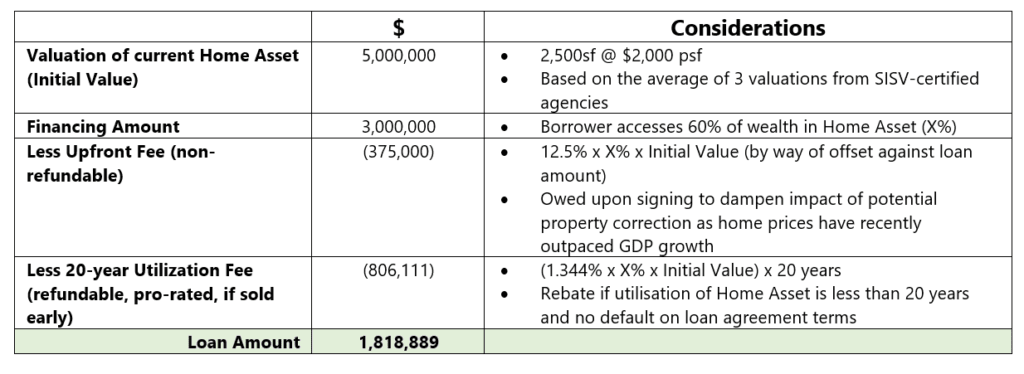

A senior has the intention to free up 60% of her wealth in her freehold residential property so that she can gain a stronger income stream. This is the amount she would be able to secure:

The value of the home, done by 3 valuers is $5 million. 60% of $5 million is $3 million. The upfront fee of 12.5% comes up to $375,000 which is paid upfront to AN LIVING. The utilization fee comes up to $806,111, which you can view as paid upfront to AN LIVING.

The senior would be able to secure $1.8 million to generate income.

At the same time, she is able to retain and live in her home and her future beneficiaries would be able to access the other 40% ownership of the property still under her name.

Why Did AN LIVING Structure the Loan to Work with Approved Financial Advisers?

The main goal of a socially conscious enterprise is to mainly focus on helping seniors achieve greater financial security.

AN LIVING felt that their responsibility to the seniors does not end with just providing the loan but also making sure that the loan allows them to gain a meaningful outcome.

We all heard about horror stories of people (not just seniors) gaining access to a windfall and subsequently channelling them to questionable products or investments and not gaining a sound outcome.

AN LIVING wishes to prevent that by structuring the loan to come with sound financial management.

That is why there are requirements to make sure the seniors use the loan to top up their CPF to the Enhanced Retirement Sum.

Whatever that is left over, a sustainable financial plan will be implemented for them.

The first financial adviser AN LIVING will work with is Providend Ltd.

Providend is an independent wealth adviser and fund management company licensed by MAS. Over the past 20 years, Providend has come to be known as a specialist in retirement planning, whether you are accumulating towards financial independence or planning to draw down your capital in retirement.

For readers who have been reading my stuff for a while, I think you know my affiliation to Providend.

The majority of the prospects and clients approach us to give them a coherent plan to eventually provide them with a sustainable income.

With AN LIVING Wealth Access, some of you would be able to tap upon the latent wealth residing in your residential property. However, you would still need a plan to make sense of the various streams of cash flow that you have, that comes online and goes offline at different junctures of your life.

What Are Type of Properties that Will Qualify for AN LIVING Wealth Access?

Only a selected group of private properties are considered for AN LIVING Wealth Access.

These have to be unencumbered freehold or 999-year leasehold homes.

What is the Range of Loan Quantum You Could Unlock?

In general, you can loan from 40% to 80% of the property value but from what I understand, it is subjected to TDSR rules.

But given this range, it means that this is possibly the highest loan amount that you can tap upon for the age you qualify for.

The Requirements for Homeowners and the Usage of the Home Asset

Homeowners will have to be at least 55 years old and above and have met the criteria of an Accredited Investor.

The homeowner cannot rent or sublet the home asset after the loan agreement is reached. The home should be used in a way that is compliant with URA or relevant government guidelines.

The homeowners are responsible for the service charges, maintenance fees, sinking fund, utilities, property tax and third-party liabilities just like how they are now. If they live on landed property, they would have to keep up with the landscaping. The general idea is that the home should not be in a lesser state than when the Loan Agreement is signed.

The homeowners must set up a Lasting Power of Attorney for themselves and register it with the office of the public guardian.

The home asset must be adequately insured by the homeowners.

There will be an annual inspection of the home asset to ensure that the home asset is compliant with the loan agreement.

How does the AN LIVING Wealth Access Loan Agreement End?

Sometimes, we can never fathom what we should consider until we really sit down and think.

When it involves properties, Jonathan and his team probably thought through enough considerations about what could happen. These are both to safeguard their interest (to prevent people from using this for unintended purposes) and also to ensure you gain enough clarity so that you have reasonable confidence when you sign on the dotted line.

Here are some possible exits that eventually result in the sale of the property:

- End of the loan agreement (default case)

- Death of sole homeowner (a rebate of utilization fee to borrower’s estate applies)

- Death of surviving borrower in joint-tenancy homeownership (a rebate of utilization fee applies)

- Death of any borrower in tenants-in-common homeownership (a rebate of utilization fee applies)

- Surviving borrower admitted into permanent institutional care (a rebate of utilization fee applies)

- En-bloc or compulsory government acquisition (a rebate of utilization fee applies)

There are also some possible exits triggered by the borrower or the courts:

- Voluntary termination by the borrower (a rebate of utilization fee applies)

- Court orders compelling sale of Home Asset (a rebate of utilization fee forfeited)

- Default by Borrower (a rebate of utilization fee forfeited)

In a lot of these situations, if you did not use the full 20-year term, and there are exits, part of the utilization fee can be rebated back to you.

Depending on which kind of exits happen voluntarily or involuntarily, there are various options available to the borrower or beneficiaries which includes:

- Accessing further wealth from the home asset on a subsequent loan agreement with updated terms

- Extend the usage of home assets via a subsequent loan agreement with updated conditions without accessing a further wealth

- Divest home assets at no less than the exit value

- Compensate AN LIVING Fund with a cash amount

- Retain the home asset and compensate AN LIVING Fund with a cash amount

I can only give you a subset of some of your concerns and considerations and this is a section that best takes it up with AN LIVING if you are interested.

The Seniors Who May be Interested in AN LIVING Wealth Access

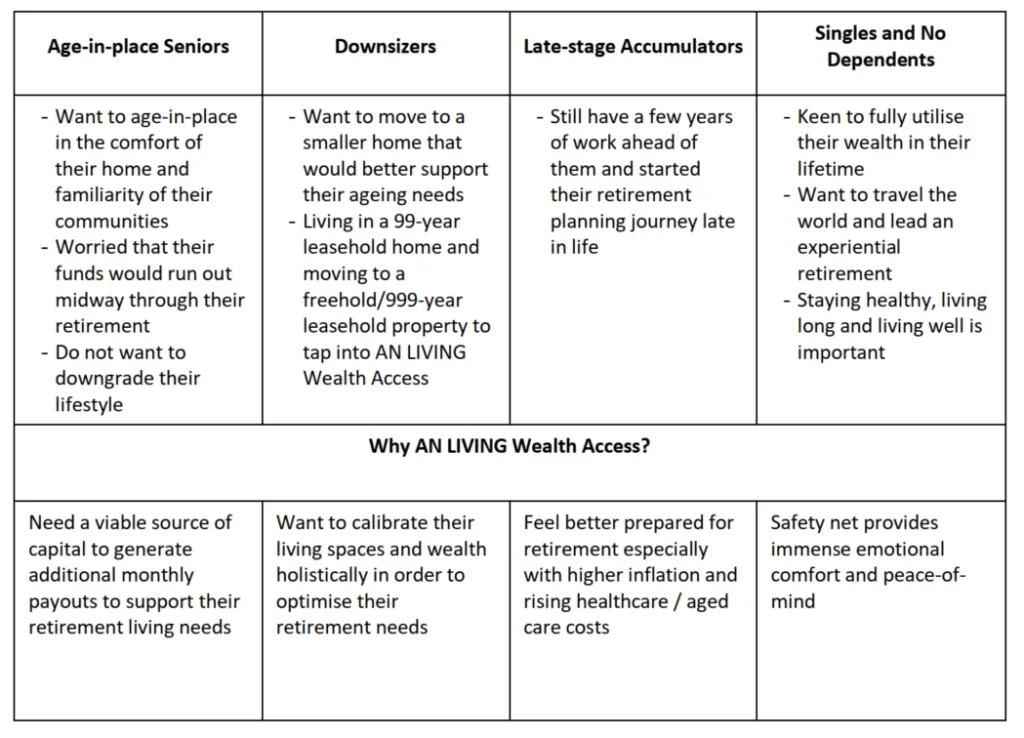

The folks behind AN LIVING believe that the following profiles of people may be interested in their wealth solution:

If you have other investment properties that can tap upon for your retirement income, you might not see the need for AN LIVING Wealth Access but for some, this might present an option for you to reallocate your funds around.

One of the ways to monetize your residential property is to downsize, but some have revealed that if they choose to downsize to freehold or a 999-year leasehold, they can potentially gain capital from the downsize and access to a certain portion of their new residential home.

The Unique Thing About AN LIVING Wealth Access

I think Jonathan and his team have created a rather unique solution for a problem that may affect a part of Singaporeans:

- The age criteria for normal loans are less than 65 to 75 years old. Only selected loan solutions such as reverse mortgages and like allows senior to gain access.

- Existing loans meant to release capital from homes only release up to CPF Full Retirement Sum or CPF Enhanced Retirement Sum. There are not a lot of ways for you to free up such a large amount of capital to gain passive income.

- The utilization fee or the imputed rent that you pay to stay in the property is reasonable.

- The solution tries its best to help the seniors by building sound financial principles behind it (LPA, topping up the government pension scheme, engaging in vetted advisers, don’t allow you to go and gamble)

- It allows you to age in a home that you feel very at ease in

- It allows you the leeway to pay and extend the tenure of the loan should you need to live in it longer.

- It gives you control over the timing and procedures for the sale of the property

The cost is a mixture of the upfront fee and the opportunity cost forgone. A good way to think about the cost is to ask yourself what is the discount rate that you would assign to the value of the property?

I think because of the size of the loan quantum, there were also more considerations on the part of AN LIVING in thinking about what could happen not just for themselves but also for you. After all, what good is a social enterprise if it doesn’t fulfil the social need?

If you feel very strongly about handing down your freehold/999-year leasehold property to your next generation as part of your legacy, AN LIVING Wealth Access is not for you. If you also felt very strongly about making sure you gain the greatest bank for the buck, then this may not be suitable for you as well.

However, if you think deeper and realize you would rather live a greater life or a life with a greater buffer or somewhere in between and that is more important than a lot of other things, then AN LIVING Wealth Access may be something you would wish to explore more.

If you are interested to find out more about AN LIVING Wealth Access, you can fill up and submit an enquiry form here at AN LIVING. Someone will get into contact with you and arrange a Zoom call to find out your needs. That will also be a session for you to clarify any doubts that you have after reading this article.

If you are a client of Providend, you can contact your client adviser to find out more.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

FCY

Sunday 3rd of April 2022

What happen to the arrangement when for example, touch wood...An Living winds down before the maturity of the full duration of the agreement?

Kyith

Monday 4th of April 2022

Hi FCY, I believe Jonathan will answer your question.

Jonathan

Monday 4th of April 2022

@FCY, This is Jonathan from AN LIVING and thank you for your question.

We are currently working with our fund management partner and lawyers to develop the fund documentation that will lay out all the ring fencing mechanisms. As for the fund investors, they do not have the possibility to suddenly call back their capital as their commitment is aligned with the length of the loan agreement.