Most of your friends and family are generally less savvy about investments and financial products.

They might have some investments, but after a while, they forget how they work. Even if they think they are savvy, they can be relatively optimistic about the range of return outcomes possible with the investments they put their money into. Most importantly, most forget that higher returns usually come with additional risks.

There are no free lunches in this investment world. If you have an excellent element in the investment, there is a tradeoff, perhaps in terms of volatility, an uncommon downside that is catastrophic, and high cost.

In David Blanchett and Michael Finke’s Guaranteed Lifetime Income Isn’t Free, the two retirement experts gave a great question that you should recommend to your friends and family members to ask the person recommending the investment products (note that this example is written from the perspective of a financial adviser):

Imagine a client has saved $500,000 to fund spending in retirement. You tell her she can safely spend about $25,000 each year. She wants to know how confident you are that she won’t run out. You reply that you’re very confident – Monte Carlo simulations show that she has more than a 90% chance of success.

What if the client asked you to guarantee that no matter how long she lived or what happened in the markets, she could continue to receive $25,000 each year from a $500,000 portfolio?

You’d hesitate.

You understand that some clients will live a long time – a healthy 65-year-old woman has a 9% chance of living to 100, according to Society of Actuaries annuity mortality tables (which are appropriate for people with enough money to use an advisor). A 20% drop in a diversified portfolio in the first year would reduce the client’s savings from $500,000 to $400,000, minus the first-year $25,000 withdrawal.

How confident are you that a 66-year-old healthy woman can withdraw $25,000 yearly from a $375,000 portfolio if she lives to age 95? Are you still willing to guarantee that income?

– Guaranteed Lifetime Income Isn’t Free

We had prospects & clients that asked something similar, and we had to explain more about how our returns are derived.

We know that for many investments, returns are not a guarantee. But many financial salespeople market that their products are so good but fail or deliberately leave out the negative trade-offs of the investments to close the client.

Asking for a guarantee can sound ridiculous, but there is a boundary that most financial salespeople would not even dare to go into. If they say they can guarantee the results, you can further ask them to put them into writing or show you where it is stated about this guarantee.

The objective is to uncover why they cannot guarantee you a return.

You Often Have to Give Up Something for Benefits That Are Important to You

Aside from that interesting takeaway, Blanchett and Finke’s article is also excellent because they deconstructed an insurance income product to show us that there are trade-offs for the good features of the insurance income product.

In the United States, there is a lifetime income insurance called the Guaranteed Lifetime Withdrawal Benefit (GLWB), which can preserve a retiree’s ability to spend a minimum amount each year from a risky portfolio for a duration.

If you purchase a GLWB, the value of your investments can grow, and so does the income over time. Your income is consistent, and you will not run out of money for the duration you need.

To our knowledge, there is only one product in Singapore. Here is an illustration of how it will work:

We know that investment returns can be volatile, but the GLWB can “lock” the policy’s value. If the value is locked, the payout can be consistent. So when the investment value grows or “ratchet up”, the value of your policy value also gets fixed to a new level.

If the market has a downturn, don’t worry, the policy value is locked at the current level.

There is an accumulation period and a payout period.

This sounds like an excellent policy that addresses the need of many passive income seekers. Blanchett and Finke explain the trade-offs.

Here is roughly what they said in note form.

What income-seekers want:

- Consistent income

- Income that lasts long enough, or till they pass away

- Achieve #1 and #2 regardless of investment performance

Why income seekers’ requirement is difficult to achieve:

- Some income seekers live a long life while others live a short life. Those who lived a long life need a more significant than expected capital, while those who lived a short life need less.

- Some income seekers will live through a lucky period for extracting income from their portfolios, while others will be unlucky. The former needs less capital while the latter will need more capital.

- Given #1 and #2, how do you know your longevity and luck in the markets?

- You only get to live life once. Would you dare to take the risk?

Why Guaranteed Lifetime Withdrawal Benefit insurance works and the advantages:

- Income seeker transfers the longevity risk to the insurer

- Within the insurance company: If the income seeker’s investment balance runs out, the insurance company pays for it (perhaps through insurance bought with a re-insurer). The insurer makes income payments for life out of their general account rather than through the client’s savings.

- Some clients won’t outlive their savings and end up subsidizing those living longer.

- Income seeker transfers the risk of investments significantly underperforming expectations to the insurer

- If the insurance company has a large cohort of their clients living through a poor sequence AND their investments do not do so well, the insurance company pays a lot out of their pocket.

- If a large cohort of clients lived through a lucky sequence and investments do relatively well, then clients will fund their own income.

- The insurance company can end up collecting far fewer insurance premiums than the amount they paid out.

- Income seekers can spend freely up to the guaranteed income without fear that circumstances beyond his/her control will force him/her to cut back.

We can look at all this from the perspective of the insurance company. How much does the insurer payout from their own pocket versus how much they earn from the policyholder over time depends on the market conditions.

There is a spectrum of investment outcomes.

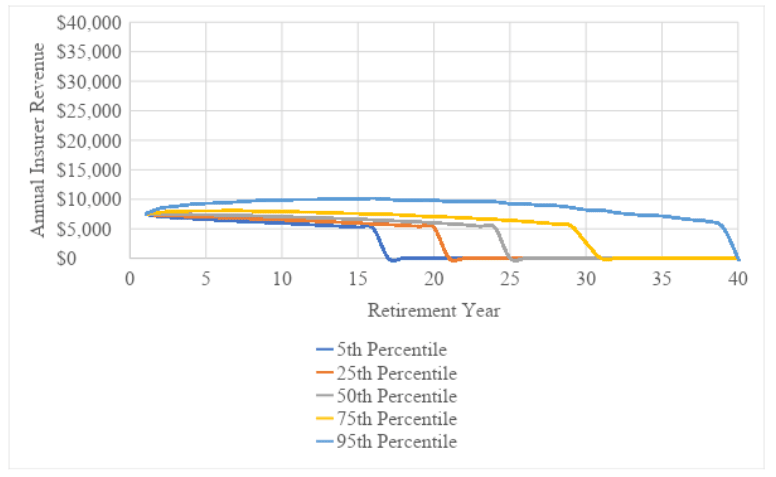

In the chart below, it shows the annual revenue the insurer earns from a single policyholder:

The 5th percentile represents the very lucky income seeker whose policy value becomes depleted after 15.5 years, and the insurance company pays for the rest of the income duration. The 95th percentile represents the very unlucky income seeker whose policy value did not become depleted, and the insurer did not have to pay for the income out of their own pocket.

Of course, lucky or unlucky is quite different, depending on whether you stand on the insurer’s side or the client’s side.

But all these means is that there is no free lunch. Someone needs to pick up the tab for market return uncertainties.

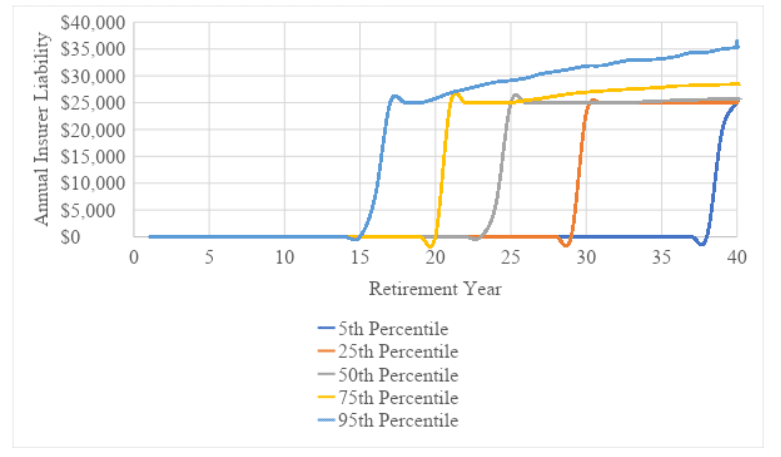

The chart below shows the annual liability of the insurer:

At the 5th percentile, the insurer is very unlucky because their income liability starts after a short while. At the 95th percentile, the insurer is lucky in that the market returns are good and their liability for the policyholder only starts after 35 years.

What are the disadvantages of Guaranteed Lifetime Withdrawal Benefit insurance:

- The insurance cost can be higher than what you pay for an investment portfolio.

- The returns will likely not be as great as a typical investment portfolio. You cannot invest in a portfolio suited to your risk tolerance and time horizon. The ideal investments to work well for GLWB may be investments that traditionally have low expected returns.

If you ask people to guarantee income against challenging conditions, people are either going to:

- Charge you enough to compensate the risks they bear.

- Pay you an income so low they can guarantee without liability.

- Put enough clauses so they can get out of their contractual obligations in case they are unlucky.

Conclusion

There may be a reason why this region’s products that fall into the GLWB category are not offered. The insurer needs to set aside a lot of assets to address the potential liability, taking on many risks.

Given how small the Singapore market is and how much they can capture, they might not be confident that this can be profit-generating for themself.

While the plan can be lower in return, more expensive, or less flexible, some of you might be interested because of your risk-averse nature.

There are trade-offs. You cannot have everything.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024